Securing funding is a critical milestone for startups. Understanding the details of Series A funding is often the first step in this journey. From pre-seed investments to Series C rounds, each stage serves a unique purpose in scaling a business. This blog aims to simplify these funding stages, highlighting their strategic importance for growth and sustainability.

Early funding plays a crucial role in bridging the gap between initial ideas and scalable operations. Entrepreneurs must understand the types of startup funding available to make informed decisions about their capital-raising strategies.

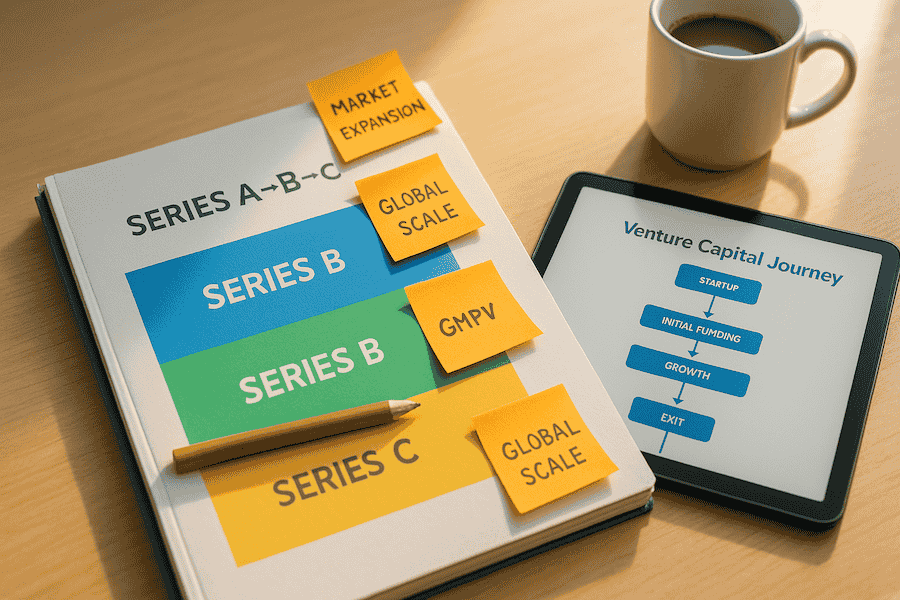

Startup Funding Stages: Seed to Series C Explained

The journey of startup funding unfolds through distinct stages, each tailored to meet the evolving needs of businesses. It begins with the pre-seed phase, where founders rely on personal savings or angel investors. As they progress to the IPO stage, startups face changing capital requirements and investor expectations. In July 2025, the US recorded Series A: $2.03B across 124 deals and Series B: $1.65B across 46 deals, highlighting the significant capital involved in these stages.

Pre-seed and seed funding focus on validating ideas and building prototypes. In contrast, Series A through Series C rounds emphasize scaling operations and expanding market reach. As startups mature, they may explore alternative financing options like venture debt or crowdfunding to complement traditional investment paths.

Building relationships with venture capital firms is crucial for startups aiming to secure Series C funding, ensuring access to strategic guidance and growth capital. Learn more about building relationships with venture capital firms. Understanding this funding series explained helps entrepreneurs align their strategies with investor priorities.

Series A Funding

Series A funding represents a pivotal stage in a startup’s journey, where the focus shifts from proving the concept to scaling operations. At this point, startups aim to validate their business model and demonstrate revenue traction, showcasing their potential for long-term profitability. Typical Series A rounds raise between $2M and $15M, as highlighted by Series A Stats, setting realistic expectations for capital needs during this phase. In Q1 2025, the median Series A funding round was $7.9 million, providing a benchmark for startups aiming to secure this level of investment.

Investors prioritize strong unit economics and scalable business models, ensuring the startup can sustain growth while maintaining profitability. To better understand and define Series A funding, securing venture capital funding is a critical step for startups progressing through Series A, B, and C funding stages. Learn more about this process by exploring our guide on how to secure venture capital funding.

Series B Funding

As illustrated by Strand Therapeutics, Series B funding can drive significant advancements in specialized industries. Strand Therapeutics raised $153M in Series B financing to advance its programmable mRNA therapeutic pipeline, enabling clinical trials with promising RECIST responses and total funding exceeding $250M.

Investors in this round demand clear evidence of growth potential, substantial user adoption, and a well-defined plan for scaling. Compared to Series A, Series B funding often involves higher stakes and larger investments, reflecting the startup’s maturity and readiness to expand. This funding round is crucial for startups aiming to solidify their market presence and drive sustained growth.

Series C Funding

An example of this is Clay, which raised $100M in Series C funding led by CapitalG to scale its AI sales automation platform. With 150+ integrations and AI agents, Clay achieved a valuation of $3.1B, projected to triple its revenue to $100M in 2025.

Series A, B, and C Financing Explained

Securing funding is a critical milestone for startups, and each funding round—Series A, B, and C—serves a unique purpose in a company’s growth journey. In the Series A round of funding, investors focus on validating the startup’s proof of concept and its ability to generate revenue. Founders often exchange equity for capital, which they typically use to refine products and expand market reach. However, only 15.4% of startups that raised seed in early 2022 managed to secure Series A funding within two years, indicating a challenging environment for early-stage companies.

By the time Series B arrives, the emphasis shifts to scaling operations. Venture capitalists and other investors look for startups demonstrating consistent growth and a scalable business model. Equity stakes increase in value as the company gains traction.

Series C funding prioritizes rapid expansion. At this stage, investors look for startups with solid revenue, proven scalability, and a clear path to market leadership or exit opportunities. Startups that succeed in attracting venture capitalists during this phase typically demonstrate strong operational metrics, a dominant market position, and strategic use of capital to fuel growth.

Series Funding Valuation: How to Determine Your Startup's Worth

Determining a startup’s valuation is both an art and a science. Founders often rely on comparables, traction, and market potential to establish their worth. Metrics such as market size, revenue streams, and growth projections play a pivotal role in this process.

For early rounds like Series A funding, meaning revolves around pre-money valuation techniques, which assess the company’s value before investments are made. Later rounds, however, emphasize future projections and scalability. Investors scrutinize these factors to negotiate funding terms that align with the startup’s potential. Balancing these elements ensures a fair valuation that benefits both founders and investors.

Signal shift from proving fit to scaling it. Series a vs series b clarifies how milestones evolve, from sticky cohorts and repeatable acquisition at A to multi-market scale and efficiency at B.

Disadvantages of Series A, B, and C Funding Rounds

Securing venture capital through Series A, B, and C funding rounds can propel startups toward growth, but it comes with notable challenges. Each funding round often requires founders to relinquish more control over their company, leading to equity dilution. As investors gain larger stakes, their influence on decision-making increases, potentially shifting the company’s strategic direction away from the founders’ original vision.

Additionally, stricter investor demands and performance milestones become prevalent in later rounds. These expectations can create pressure to meet aggressive growth targets, sometimes at the expense of long-term sustainability. The venture capital due diligence process plays a vital role in securing Series B and C funding successfully, but it also introduces compliance hurdles that can be time-consuming and resource-intensive.

Understanding these drawbacks is essential for founders weighing the benefits of external funding against its challenges.

Series Funding Example: How Aisles Raised $30M

As demonstrated by Datavations, raising Series A funding in challenging market conditions is achievable with innovative tools. Datavations utilized Flowlie's AI-powered fundraising platform to secure an oversubscribed $17M Series A plus $5M debt, achieving a 3.3x valuation step-up and saving 250 hours for reinvestment in sales and product development.

Alternatives to Series A, B, and C Funding

- Bootstrapping allows founders to retain equity while scaling at their own pace, though it may limit rapid expansion.

- Crowdfunding taps into public interest and provides upfront capital, but success depends heavily on marketing and campaign strategy.

- Debt financing offers immediate resources without diluting ownership, yet it introduces repayment and cash-flow risks.

- Revenue-based financing provides growth capital in exchange for a fixed percentage of future revenue, aligning repayment with business performance.

- Venture debt gives startups supplemental capital alongside equity financing, helping extend runway without significant dilution.

- Grants and incubator/accelerator programs offer non-dilutive funding, mentorship, and resources, though they often involve competitive selection and milestone tracking.

Founders negotiating with venture capitalists must be prepared to address key concerns related to Series B and C stages.

Partner with Us

Securing Series A funding can be a pivotal moment for startups, and having the right support makes all the difference. Our team specializes in guiding businesses through the complexities of venture funding, offering tailored strategies to maximize outcomes. Partnering with us means gaining access to expert insights and professional assistance during critical funding stages. Let us help you turn your vision into reality with confidence and clarity.

Explore our Fundraising Assistance to take the next step toward growth.

Related Resources

Understanding financial metrics is essential for startups aiming to secure Series A funding. To deepen your knowledge, explore resources that cover critical topics like burn rate, cash flow management, and cap table analysis. These materials provide actionable insights into refining your funding strategies and preparing for investor evaluations.

For a comprehensive dive into these metrics, ensure you have a clear grasp of how they influence your financial health and long-term scalability. Use these tools to strengthen your approach and align with investor expectations.

Get Started for Free

Take the first step toward securing your Series A funding with no upfront cost. Sign up today for a free consultation tailored to your unique needs or explore our comprehensive resources designed to help you craft a winning funding strategy. This is your opportunity to access expert guidance and actionable insights without any commitment. Let us help you build a strong foundation for your funding journey, start for free and see the difference expertise can make.

Startup Funding Sources

Securing funding is a critical step for startups, and the options are as diverse as the businesses themselves. Entrepreneurs can explore bootstrapping, which involves using personal savings or reinvesting early profits to maintain control.

Angel investors often provide early-stage funding along with mentorship, while venture capital firms offer significant financial backing for scalable business models, typically during Series A funding rounds. Crowdfunding platforms enable startups to raise capital directly from supporters.

Each option carries unique benefits and risks, making it essential to align the choice with the startup’s goals and growth strategy. How startup rounds work breaks down timelines, runway planning, and why bridges/extensions happen. It covers trade-offs between dilution and speed, plus how to prep a crisp “why now, why this size” narrative.

Conclusion

Understanding the intricacies of each funding stage is vital for startups aiming to secure capital effectively. From seed funding to Series A and beyond, every stage demands careful planning and a clear grasp of investor expectations. By mastering these strategies, founders can position their ventures for sustainable growth and long-term success.

If you’re ready to take the next step in connecting with the right investors, we at Qubit Capital are here to assist. Our Investor Discovery and Mapping service utilizes AI-driven insights to match startups with best-fit investors. Let’s get started today!

Key Takeaways

- Funding rounds follow a structured path—from Series A (early validation) to Series C (rapid expansion)—each requiring different levels of traction and offering varying capital amounts.

- Investor expectations evolve across rounds, with increasing emphasis on revenue growth, scalability, and market dominance, affecting startup valuation and equity negotiations.

- Case studies, such as Aisles, illustrate how startups apply these rounds in real-world growth strategies, highlighting how capital is strategically deployed at each stage.

- Alternative funding sources like bootstrapping, crowdfunding, or revenue-based financing offer startups flexibility, though often with trade-offs in speed, control, or scale.

- A clear understanding of the full funding timeline helps founders anticipate investor demands and align their capital strategy with long-term business goals.

Frequently asked Questions

What are Series A, B, and C funding rounds?

Series A focuses on validating the business model, Series B on scaling operations, and Series C on market dominance or preparing for an IPO.