Building strong connections with venture capital (VC) firms can significantly impact startups aiming for growth. Finding a VC that matches your vision is crucial for gaining the resources and mentorship necessary for success. These relationships offer more than just funding; they open doors for collaboration, strategic guidance, and long-term partnerships.

Understanding what venture capital is lays the foundation for leveraging it as a tool to scale your startup. By fostering proactive engagement with VC firms, startups can position themselves for sustainable growth and innovation.

This blog explores the strategies, insights, and actionable steps to build lasting relationships with venture capital firms.

How to Qualify Your VC Leads with Relationship Intelligence

Finding the right venture capital (VC) partner starts with asking the right questions. Use open-ended inquiries to uncover alignment in philosophy, decision-making, and support capabilities:

- Understand their investment thesis:

Ask how they approach scaling startups to assess alignment with your vision. - Evaluate operational support:

A survey found 44% of founders rated VC support as 1/5—ask:

1-“Can you share examples of how you’ve supported startups in overcoming operational challenges?”

2- “What resources do you provide to help founders scale effectively?” - Explore their decision-making process:

Clarify timelines, criteria, and communication style to ensure compatibility. - Assess focus areas:

Ask about their industry preferences and the startup stages they typically invest in. - Investigate portfolio founder experiences:

Reach out to founders in their portfolio to understand the firm’s level of relational support, networking leverage, and real-world collaboration. - Leverage relationship intelligence:

Use data-driven tools to map shared connections and secure warm introductions before making formal outreach.

Building meaningful VC relationships starts with clear qualification. Focus on partners with a track record of founder support and aligned goals.

Looking for tailored advice on qualifying VC leads? Explore our services at Qubit Capital to connect with investors who align with your goals.

Relationship Intelligence to Build Your VC Pipeline

Establishing a strong venture capital (VC) pipeline requires deliberate planning and foresight. Ideally, this process should begin 6–12 months before you start fundraising. By proactively identifying and engaging with potential investors, you can position your startup for success when it’s time to secure funding.

- Start Broad and Refine Your List: Research firms that have a history of investing in your industry, stage, or business model. Once you have a comprehensive list, narrow it down by evaluating each firm’s portfolio and expertise.

- Evaluate Strategic Fit: Consider what each VC brings beyond funding—mentorship, industry connections, operational support—and ensure alignment with your long-term vision.

- Seek Portfolio Feedback: Reach out to founders who have worked with the VCs on your list to gain insights into the firm’s approach, responsiveness, and value-add.

- Engage Early: Start engaging with your shortlisted firms well before your fundraising round, sharing progress, milestones, and vision to build credibility.

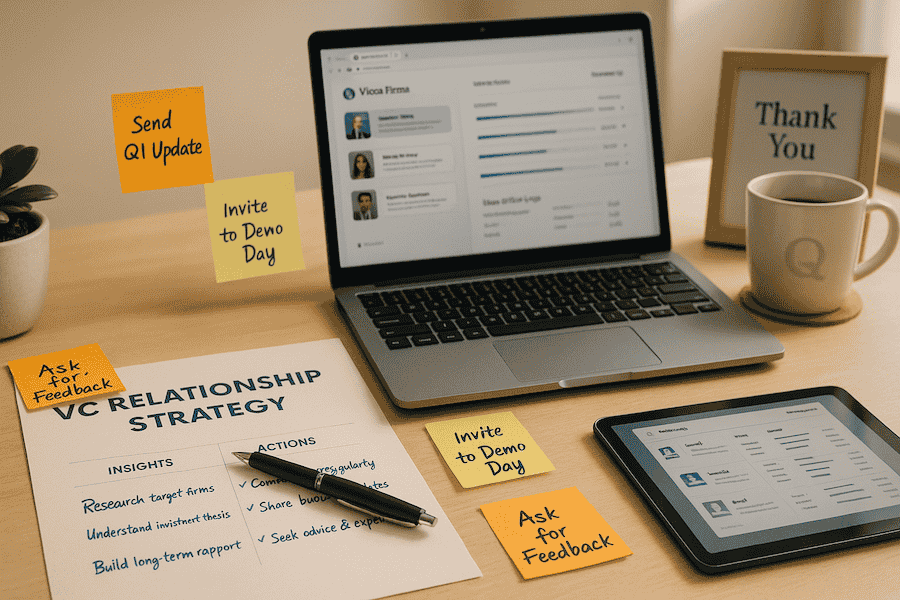

- Leverage Relationship Intelligence Tools: Use platforms that analyze mutual connections, partner networks, and portfolio founder relationships to generate warm intros and prioritize investors with the strongest relational fit.

- Track and Optimize Your Pipeline: Implement a CRM or spreadsheet to log outreach efforts, meeting outcomes, and response rates. Regularly review and refine your list based on engagement metrics and feedback.

1. Start Broad and Refine Your List

The first step is to create an extensive list of potential VC firms. Research firms that have a history of investing in your industry, stage, or business model. This broad approach ensures you don’t overlook any opportunities. Once you have a comprehensive list, narrow it down by evaluating each firm’s portfolio and expertise. Look for VCs who have backed companies similar to yours but avoid those that have invested in direct competitors.

2. Evaluate Strategic Fit

Not all investors are created equal. Beyond funding, consider what each VC brings to the table. Do they offer mentorship, industry connections, or operational support? Assess their track record of helping startups scale, such as the approach used by J-Ventures, which built an internal AI-based platform to improve sourcing and screening. Their 'neural network' connects insights across their community of over 400 professionals, surfacing relevant expertise faster and supporting portfolio companies more effectively.

3. Seek Portfolio Feedback

Reach out to founders who have worked with the VCs on your list. Their firsthand experiences can provide valuable insights into the firm’s approach, responsiveness, and value-add. This feedback can help you further refine your pipeline and focus on investors who align with your goals.

4. Engage Early

Building trust with VCs takes time. Start engaging with your shortlisted firms well in advance of your fundraising round. Share updates about your startup’s progress, milestones, and vision. Early engagement not only builds credibility but also gives investors time to understand your business and its potential.

By following these steps, you can create a robust VC pipeline that positions your startup for a successful fundraising journey.

Effective VC Pipeline Management with Relationship Intelligence

To enhance pipeline management further, startups should focus on presenting themselves as appealing investment opportunities. Affinity's relationship intelligence platform is used by over 3300+ investment firms, highlighting the importance of leveraging technology to streamline investor interactions. By understanding venture capital networking, founders can align their communication strategies with investor expectations. This ensures that every interaction adds value and positions the startup as a compelling choice for funding.

Consistent communication paired with a structured CRM system simplifies the process of tracking investor interactions, ensuring no detail is overlooked. By prioritizing updates and follow-ups, startups can maximize their chances of securing the support they need to grow.

Discover how our Investor Outreach service can connect you seamlessly with potential investors.

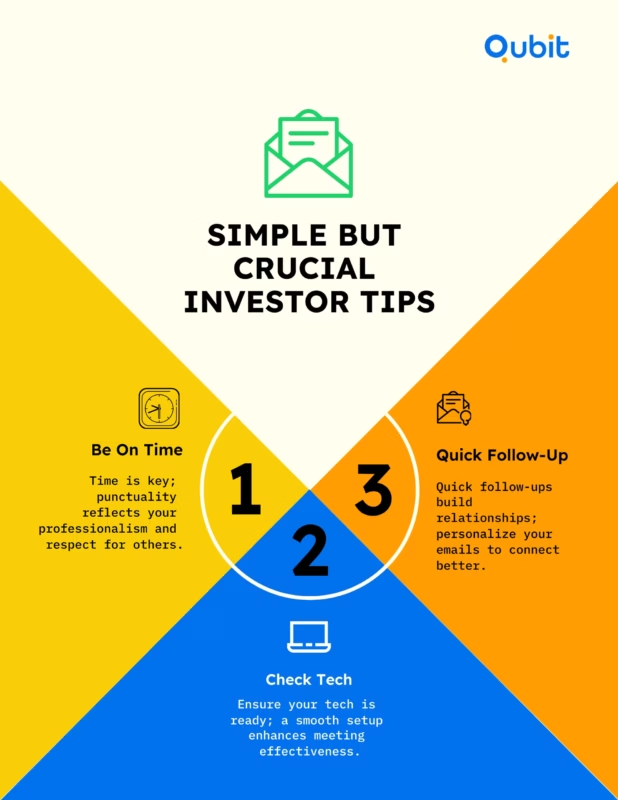

Simple Yet Crucial Investor Tips

Building trust with investors often hinges on small yet impactful actions. These seemingly minor details can make or break your professional image during critical interactions.

- Be Punctual: Timeliness is a direct reflection of your reliability. Arriving on time for scheduled meetings demonstrates respect for the investor’s time and sets a positive tone for the discussion.

- Ensure Technical Readiness: Technical glitches can disrupt the flow of a meeting and leave a negative impression. Test your equipment, software, and internet connection well in advance to ensure a seamless experience. This preparation shows your commitment to professionalism.

- Follow Up Promptly: A personalized email after each meeting is more than just a courtesy—it’s an opportunity to reinforce key points and express gratitude. Prompt follow-ups also help maintain momentum and build authenticity in your relationship with investors.

- Research Their Portfolio & Personalize: Study the VC’s existing investments and portfolio founders. Tailor your discussion to reference relevant successes or challenges, demonstrating you’ve done your homework and value their specific expertise.

Navigating the venture capital stages, such as Series A, B, and C funding, provides a roadmap for scaling your business effectively.

By focusing on these simple yet essential practices, you can create a lasting impression and foster stronger connections within your network VC.

Avoid Missing Golden Opportunities

Every missed investor connection can translate into lost funding potential, especially in a market where early-stage deal value has dropped by 43.5%. Nearly 92% of businesses find CRM systems crucial for achieving their revenue goals, underscoring the need for robust process management. A well-organized CRM ensures no lead or detail slips through the cracks, safeguarding critical opportunities for growth.

Maintaining every vc connection is vital for building a solid foundation of investor relationships. A structured approach to tracking communications, follow-ups, and deal progress can make all the difference. Securing venture capital funding requires a strategic approach, from crafting a compelling pitch to understanding investor expectations. Learn more about this structured approach through our guide on how to secure venture capital funding.

Operational disorganization can derail deal flows, but implementing rigorous CRM practices like those used by TPY Capital allows startups to stay ahead. Their custom AI agents for automated sourcing track and qualify startups meeting investment criteria, resulting in 3-4× more qualified leads each week without increasing headcount.

Nurturing Lasting Investor Relationships

Building enduring connections with investors requires more than initial enthusiasm; it demands consistent engagement and foresight. Advanced technologies like 4Degrees are transforming how relationships are managed, offering tools to identify and monitor at-risk partnerships. Their AI-powered automation maps internal and external networks to identify warm paths to key stakeholders, providing a real-time view of the deal universe without relying on manual updates.

Equally important is the commitment to supporting the founder’s vision. Investors value alignment with the long-term goals of the businesses they back. Demonstrating unwavering support for the founder’s leadership, especially during critical phases like the venture capital due diligence process, reinforces trust and strengthens the partnership. The venture capital due diligence process is a critical step in building investor trust and securing funding.

By combining technological insights with authentic engagement, businesses can foster relationships that withstand challenges and evolve over time.

Accessing VC Insight in Seconds

Time-sensitive decisions often define the success of startup negotiations. Founders juggling multiple investor relationships need tools that deliver crucial insights instantly. AI-driven solutions like omni search are revolutionizing this process, enabling rapid access to investor intelligence without the need for exhaustive manual research.

Imagine entering a negotiation armed with precise data about a venture capitalist’s portfolio, investment history, and preferences—all surfaced in seconds through plain English queries. This capability not only accelerates decision-making but also empowers founders to tailor their pitch effectively. The result? A more strategic and confident approach to securing funding.

Negotiating with venture capitalists requires a mix of preparation, clarity, and strategic thinking to ensure mutually beneficial outcomes. Instant access to data allows founders to make quick, informed decisions during negotiation, enhancing their ability to align with investor priorities.

Instant access to data also minimizes the time spent on preliminary screening, reducing it by up to 30%. This efficiency allows founders to focus on refining their strategy and building meaningful connections with investors. When paired with preparation and clarity, tools like omni search become indispensable for negotiating with venture capitalists, ensuring mutually beneficial outcomes.

By integrating AI into the search process, founders can transform how they approach investor relationships, making every interaction more informed and impactful.

Stay Fundraising-Ready: Expand Your Knowledge in Investor Psychology and Beyond

Expanding your knowledge in fundraising types and investor relations can unlock new strategies and insights. Exploring adjacent topics such as effective pitch creation, investor psychology, or post-funding relationship management can complement the core strategies discussed here. Resources like industry webinars, expert blogs, and case studies provide valuable perspectives to deepen your understanding.

Continuous learning not only enhances your skills but also keeps you adaptable in a rapidly evolving financial landscape. Staying informed empowers you to refine your approach and build stronger connections with investors.

Conclusion: Ongoing education is essential for mastering fundraising and venture capital networking, ensuring long-term success.

Must-Have Tools and Resources for Venture Capital Firms and Portfolio Founders

Accessing the right resources can significantly enhance your venture capital journey. Whether you’re seeking insights into funding strategies or tools to streamline investor relations, leveraging curated materials is key to success. Explore guides, webinars, and case studies tailored to your needs, ensuring you stay informed and prepared for every stage of the fundraising process.

Stay ahead in the competitive venture capital landscape by utilizing these essential resources to refine your approach and build lasting connections.

Venture Capital Trends & Due Diligence: What Founders Need to Know Now

The venture capital sector continues to evolve, presenting both opportunities and challenges for investors and founders alike. AI-related investments accounted for 71% of VC funding in Q1 2025, indicating a significant trend towards technology-driven ventures. Due diligence remains a cornerstone of investment decisions, requiring thorough analysis to mitigate risks and identify potential growth.

Simultaneously, shifting industry norms are reshaping how investors and entrepreneurs engage, emphasizing transparency and shared values. Network referrals play a pivotal role in this ecosystem, often serving as the bridge between promising startups and investors. These dynamics highlight the importance of staying informed about emerging trends and adapting to the changing landscape to foster successful partnerships.

Conclusion

Establishing a proactive venture capital relationship pipeline requires strategic effort and consistent execution. By focusing on qualifying leads effectively, maintaining clear and timely communication, and integrating AI-driven tools, startups can streamline their investor outreach process. These approaches not only enhance efficiency but also foster meaningful connections that drive long-term success.

Sustained engagement with investors ensures that your startup remains top-of-mind, paving the way for future opportunities and partnerships. Building these relationships is not just about securing funding; it’s about creating a network of support that can propel your business forward.

If you’re ready to elevate your VC relationships, we at Qubit Capital offer Fundraising Assistance to guide you every step of the way. Let’s get started.

Key Takeaways

- Proactively engaging VCs months before fundraising builds strong, lasting relationships.

- Effective lead qualification requires asking open-ended questions to align on vision and support.

- Structured CRM processes and regular updates can reduce missed follow-ups significantly.

- Leveraging AI-driven tools speeds up data retrieval and enhances negotiation preparedness.

- Integrating actionable strategies ensures founders secure not just capital, but a committed partnership.

- Harness relationship intelligence to map mutual connections and unlock warm introductions with venture capital firms and portfolio founders.

Frequently asked Questions

What is venture capital and how does it work?

Venture capital (VC) is a form of private equity financing provided by investors to startups and small businesses with high growth potential. These investors, known as venture capitalists, typically receive equity in the company in exchange for their investment. Venture capital funding is often used to scale operations, develop products, or expand into new markets.

Back

Back