An updated investor database is the backbone of effective portfolio management schemes. It ensures that your outreach efforts are targeted, timely, and relevant to the right audience. Without consistent updates, critical opportunities can be missed, and relationships may stagnate. This blog will explore actionable strategies to maintain your investor database, focusing on segmentation, technology integration, and strategic relationship building.

By learning how to build an investor map, startups can better organize their database and ensure they target the right audience. This foundational step complements the importance of keeping investor data current and accessible.

Ready to optimize your investor outreach? Let's go!

Why is Investor Database so Important

An investor database is more than just a collection of names; it’s a strategic tool that can transform a startup’s funding journey. By implementing a well-organized portfolio management scheme, startups can pinpoint investors who are most likely to align with their vision. This targeted approach minimizes wasted effort and ensures that pitches reach those with genuine interest.

Efficiency is another critical benefit. Instead of spending valuable time on uninterested parties, startups can focus on building meaningful connections. Early relationship-building is particularly impactful, as it lays the groundwork for future funding rounds. Engaging with investors ahead of time fosters trust and opens doors to tailored pitches that resonate with their specific interests.

Proactive maintenance of an investor database also helps startups adopt data-driven strategies for superior funding outcomes. Understanding how to find investors for startups is a foundational step toward building a robust investor database.

Ultimately, an updated and strategically managed database doesn’t just enhance alignment; it boosts the likelihood of securing funding.

What to Include in an Investor Database

Building a comprehensive investor database requires attention to detail and strategic organization. First you should be mastering investor mapping techniques for startups.

Then, start by creating detailed investor profiles that include essential criteria such as industry alignment, investment stage, reputation, and geographic location. These elements ensure that the database reflects investors who are compatible with your business goals.

Incorporating vetting criteria is equally important. Analyze prior investments and recent deal activity to gauge an investor’s track record and current interests. This data-driven approach minimizes risks and ensures that potential investors align with your growth trajectory. Additionally, consider the value they can provide beyond funding—such as mentorship, access to networks, or operational expertise.

A robust database also evaluates cultural fit and long-term compatibility. Investors who share your vision and values are more likely to contribute positively to your business journey. To keep your database relevant and updated, explore tools that streamline the process. Using the best investor discovery tools can simplify updates and expand your network with meaningful connections.

How to Build & Grow an Investor Database

Expanding an investor database requires a strategic approach that leverages various channels and tools:

- Utilize online platforms like Qubit Capital to tap into a network of over 20,000 investors—including 7,476 VCs, 4,202 PEs, and 4,807 Corporates—and integrate its API with your CRM for automatic investor profile updates.

- Attend networking events to engage in direct conversations, fostering relationships that can lead to long-term collaborations.

- Leverage social media platforms for targeted campaigns and thought leadership content to connect with potential investors.

- Rely on peer recommendations from other founders to uncover valuable leads that might otherwise remain hidden.

- Segment contacts into distinct groups to ensure tailored and impactful outreach, increasing the likelihood of successful connections.

- Adopt automation tools, such as automated segmentation systems, to refresh investor details regularly and eliminate manual errors.

- Embrace a diverse and precise approach—whether through digital platforms, events, or automation—to continuously build and grow your investor database.

Expanding an investor database requires a strategic approach that combines multiple channels and tools. You can also use online platforms like Investor Hunt, which provides access to over 90,000 angel investors and venture capitalists. Integrating the Investor Hunt API with your CRM ensures automatic updates to investor profiles, saving time and improving accuracy.

To maximize the effectiveness of your database, segmenting contacts into distinct groups is essential. Learn more about how to segment investors to ensure your outreach efforts are tailored and impactful, increasing the likelihood of successful connections.

Steps to Update Your Investor Database

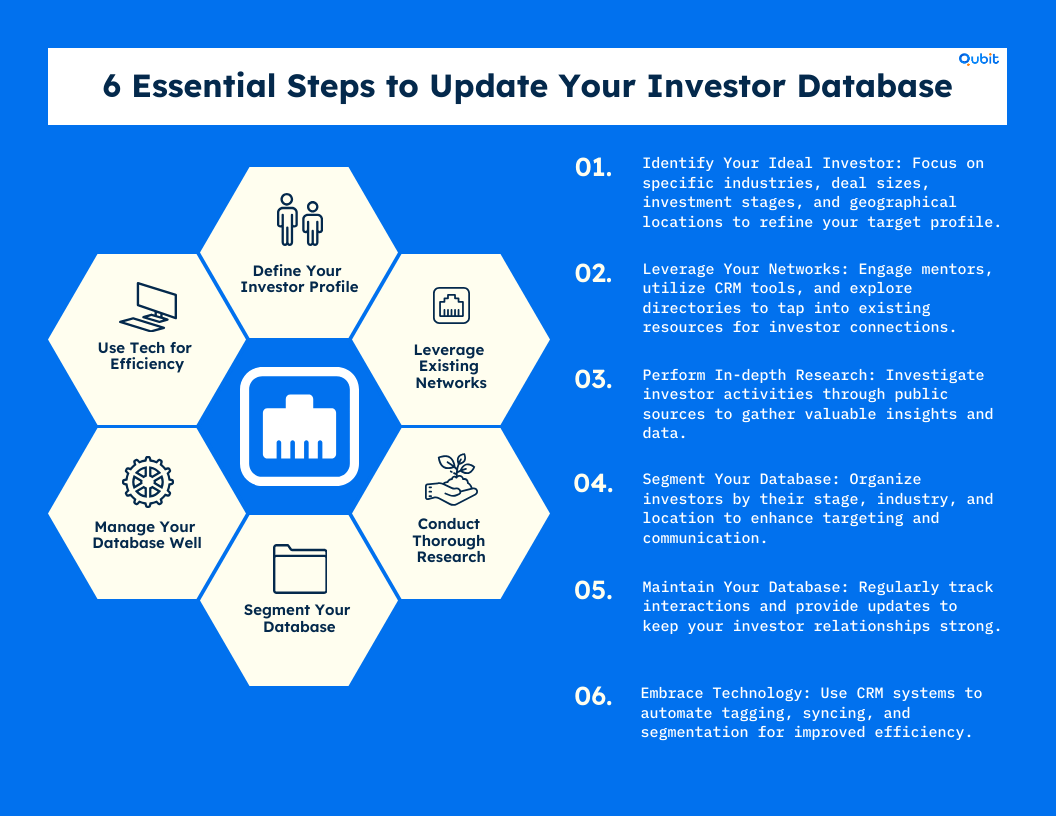

Here are detailed steps to keep your investor database up to date:

Step 1: Define Your Target Investor Profile

Identifying the right investor begins with a clear understanding of your ideal profile. Precision in defining this profile ensures your outreach is both focused and personalized, saving time and increasing the likelihood of meaningful connections. Start by narrowing down key factors such as industry alignment, investment stage, deal size, and geographic preference. For example, if your startup specializes in renewable energy, targeting investors with a history in clean technology portfolios is essential.

Regularly analyzing investor portfolios allows you to update your database with insights on who might be interested in your startup’s vision. This approach not only refines your search but also helps you tailor communication strategies effectively.

By focusing on these criteria, you create a roadmap to connect with investors who share your vision and are likely to support your growth journey.

Step 2: Tap Into Existing Networks and Resources

Building connections starts with what you already have. Personal relationships, industry events, and online directories offer a solid foundation for expanding your reach. Whether it’s colleagues, mentors, or professional acquaintances, these networks can help identify potential investors aligned with your portfolio management scheme.

Modern digital tools can transform legacy contacts into actionable resources. Platforms like CRM systems and investor databases ensure that information remains current and accessible. By maintaining updated profiles and tracking interactions, you can streamline communication and enhance engagement.

Industry events and conferences are also invaluable for meeting new contacts and reconnecting with established ones. Pairing these opportunities with online directories provides a comprehensive approach to identifying prospects.

Integrating technology into your outreach strategy not only simplifies the process but also ensures precision in targeting investors who align with your portfolio management examples.

Step 3: Conduct Thorough Research

Expanding your investment portfolio begins with meticulous research. By systematically analyzing industry publications, company websites, and government resources, you can uncover new investor opportunities while refreshing outdated data. This process of portfolio management ensures your strategy remains dynamic and well-informed.

Thorough research is essential for broadening the investor pool beyond familiar contacts. It allows portfolio managers to identify untapped opportunities, ensuring a diverse and robust network. Furthermore, revisiting older data ensures that your investment portfolio management approach stays accurate and relevant, avoiding reliance on outdated or incomplete information.

A structured approach to research not only enhances decision-making but also strengthens the foundation of your portfolio management process. By prioritizing reliable sources and maintaining consistency, you can uncover valuable insights that drive growth and innovation.

Step 4: Prioritize and Segment Your Database

Efficient outreach starts with a well-organized database. Begin by categorizing investor prospects based on three critical factors: investment stage, industry focus, and geographic location. This segmentation ensures that your communication aligns with the specific interests and priorities of each prospect.

For example, grouping investors by their preferred investment stage—seed, growth, or late-stage—helps tailor your pitch to match their portfolio goals. Similarly, identifying industry focus allows you to connect with investors who are more likely to resonate with your business model. Geographic segmentation further refines your approach, ensuring that time zones, market familiarity, and regional preferences are considered.

Prioritization is equally essential. Focus on high-potential prospects who align closely with your objectives. This not only streamlines follow-up communications but also maximizes the efficiency of your portfolio management scheme. By combining segmentation and prioritization, you create a structured framework for meaningful and productive investor engagement.

Step 5: Nurture and Maintain Your Database

A well-maintained database is the cornerstone of effective portfolio management. To keep your investment portfolio management efforts dynamic, prioritize regular updates to your database. This includes recording new investor details, tracking interactions, and noting any changes in investor activity. These updates ensure your database reflects the latest information, enabling informed decision-making.

Periodic communication with investors is equally vital. Whether through newsletters, personalized emails, or quarterly updates, consistent engagement fosters trust and strengthens long-term relationships. Monitoring investor activity, such as portfolio adjustments or new investments, allows you to anticipate needs and tailor your approach accordingly.

By nurturing these connections, your database evolves into a powerful tool for managing relationships and driving portfolio growth. Remember, a dynamic database isn’t static—it thrives on consistent attention and thoughtful interaction.

Step 6: Amplify Efficiency with Technology and Automation

Streamlining your investor database begins with adopting the right tools. A robust CRM Software like HubSpot or Salesforce can transform how you manage investor data. For instance, these platforms can automatically update investor profiles after every interaction, eliminating the need for manual data entry. This ensures that your portfolio management scheme operates with accurate, real-time information.

Automation doesn’t stop at data updates. Features like automated tagging and segmentation allow your database to become self-sustaining. These tools categorize investors based on their preferences, behaviors, or engagement levels, making it easier to tailor your communication strategies. This process not only saves time but also enhances the overall efficiency of your portfolio management service.

By integrating technology into your workflow, you reduce the risk of human error and ensure that investor information remains consistently up-to-date. Whether you're managing a small investor pool or a large-scale portfolio, automation tools provide the scalability needed to handle growing demands.

Investing in the right technology today can simplify the complex process of portfolio management, leaving you more time to focus on building meaningful investor relationships.

Conclusion

Maintaining a dynamic and updated investor database is an essential strategy for startups seeking sustainable growth. Throughout this blog, we’ve explored key approaches to refining investor outreach, emphasizing the importance of tailored communication and consistent updates to foster meaningful connections. These strategies not only streamline the investment process but also enhance your startup’s credibility and appeal.

By prioritizing an organized and proactive approach, you position your business to attract the right investors who align with your vision and goals. If you’re ready to engage with the right investors, let’s connect. Our Investor Outreach service can help secure the best investment opportunities for your startup.

Key Takeaways

- A well-maintained investor database is vital for targeted outreach and improved funding efficiency.

- Include comprehensive criteria such as industry alignment, investment stage, reputation, and geographic location.

- Utilize multiple channels—online tools, newsletters, social media, and networking events—to build your database.

- Automation and CRM integration are essential for keeping investor information current.

- Regular nurturing and segmentation foster long-term relationships with invest

Frequently asked Questions

What is an investor database?

An investor database is a structured collection of investor profiles designed to assist startups in identifying suitable investors. It provides detailed insights into investment history, industry preferences, and engagement levels, allowing businesses to streamline outreach efforts and increase funding efficiency.