Quantum startup funding scaled dramatically in recent years. Global quantum technology funding reached nearly USD 2.0 billion in 2024, up 50% from USD 1.3 billion in 2023. This surge underscores rapidly growing investor appetite and sector maturation, setting the context for expanding capital pathways and unique funding strategies in quantum innovation.

The quantum technology sector represents one of the most promising frontiers in modern science and commerce, with applications spanning quantum computing, quantum sensing, quantum communications, and quantum cryptography. However, the capital-intensive nature of quantum research and the extended timeline to commercialization create unique challenges for entrepreneurs seeking seed funding.

This comprehensive guide explores the full spectrum of seed funding options available to quantum startups, providing practical insights for this complex but opportunity-rich funding.

Understanding the Quantum Funding Challenge

Quantum startups face a distinctive set of hurdles compared to traditional technology ventures. The development of quantum technologies requires specialized equipment, highly trained personnel with advanced degrees, and lengthy research and development cycles before achieving market-ready products. These factors mean that quantum startups often need more substantial seed capital and longer runways than conventional software or hardware companies.

Government Grants and Research Programs

Government funding represents one of the most accessible and substantial sources of seed capital for quantum startups. Many nations recognize quantum technology as strategically important and have established dedicated funding programs.

The primary advantage of government grants is that they provide non-dilutive capital, allowing founders to retain full ownership while validating their technology. However, these programs often come with administrative overhead, reporting requirements, and restrictions on intellectual property rights.

1. National Quantum Mission (India)

India's National Quantum Mission launched in 2023 with a $750 million budget represents one of the world's most comprehensive quantum funding initiatives. QpiAI is one of eight startups selected by the National Quantum Mission, each receiving an initial grant of up to $3.5 million.

The mission targets development of intermediate-scale quantum computers with 50-1,000 physical qubits within 8 years, while supporting startups across the quantum technology stack. QpiAI raised $32 million in Series A funding co-led by the Indian government's National Quantum Mission, demonstrating the program's commitment to substantial startup investments.

Key Benefits:

- Initial grants up to $3.5 million for selected startups

- Co-investment in larger funding rounds

- Access to government research facilities and expertise

- Market validation through government backing

2. Startup India Seed Fund Scheme

The Startup India Seed Fund Scheme is a major source of seed funding for quantum startups seeking early-stage financial support.

- Up to ₹20 lakhs as grants for validation of proof of concept or prototype development

- Up to ₹50 lakhs investment for market entry and commercialization through convertible debentures or debt

A startup applicant can avail seed support in the form of grants and debt/convertible debentures each once as per the guidelines of the scheme, providing quantum startups with substantial non-dilutive funding opportunities.

3. I-HUB Quantum Technology Foundation Programs

The I-HUB QTF provides seed support system (SSS) to provide early-stage investment to startups in development of quantum devices. This specialized quantum incubator offers:

- Sector-specific expertise in quantum technology development

- Maximum funding support decided case-to-case based on technical promise and resource requirements

- Physical and virtual incubation programs for quantum startups

- Bridge funding between development and commercialization phases

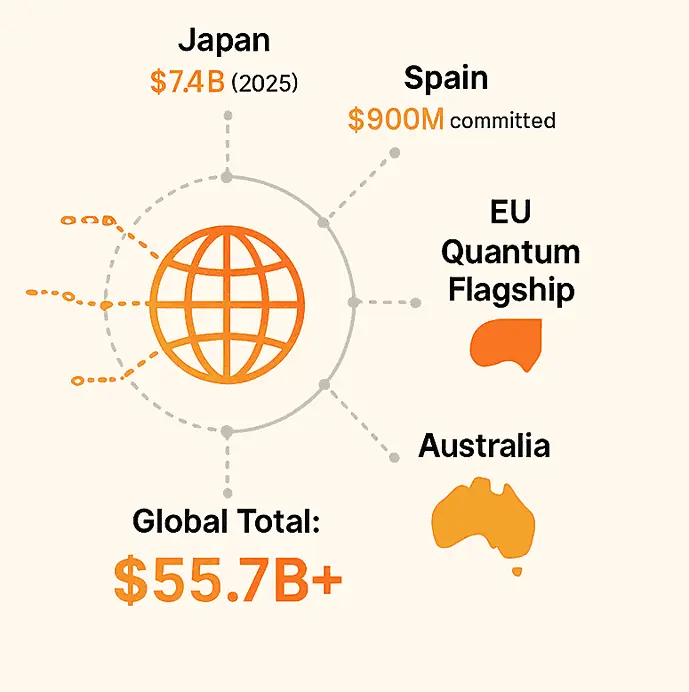

4. International Government Programs

Government investment in quantum technology goes beyond individual national allocations. Global quantum initiatives have collectively surpassed $55.7 billion, reflecting a worldwide commitment to R&D and commercialization. For startups, this global funding surge expands opportunities for international partnerships and multi-country support.

- Japan announced a $7.4 billion investment in quantum technology in early 2025, while Spain committed $900 million, creating opportunities for international quantum startups seeking government backing.

- European Quantum Technologies Flagship provides substantial funding through Horizon Europe programs, while Australia announced a $620 million financial package for PsiQuantum to build a utility-scale quantum computer.

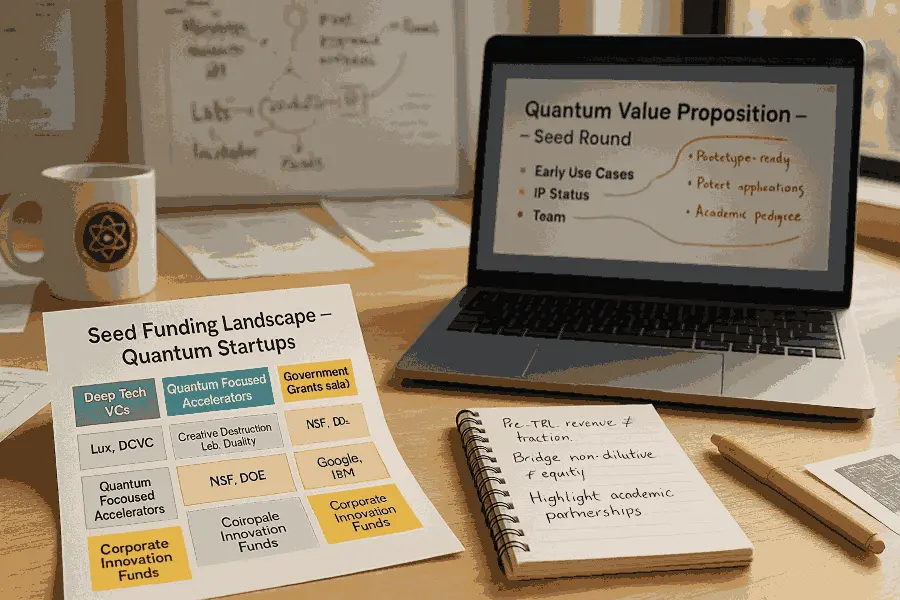

Private Venture Capital

Quantum-specialized venture capital funds are increasingly important sources of seed funding for quantum startups. Quantonation is the first early-stage VC fund dedicated to deep physics and quantum technologies, representing a new category of quantum-focused investors. EIF invests €30 million in Quantum technologies and Deep physics with Quantonation II, demonstrating institutional confidence in quantum-specific venture funds.

These specialized funds offer:

- Deep technical expertise in quantum technology evaluation

- Industry networks connecting startups with potential customers and partners

- Longer investment timelines appropriate for quantum technology development

- Follow-on funding capabilities for later-stage rounds

Corporate Venture Capital

Major technology companies have established venture arms specifically targeting quantum investments:

Investment Focus Areas:

- Quantum computing hardware development and manufacturing

- Quantum software and algorithm development

- Quantum networking and communication systems

- Quantum sensing and measurement applications

Typical Investment Ranges:

- Seed stage: $1-5 million for proof-of-concept and early development

- Series A: $5-20 million for product development and market validation

- Follow-on rounds: Up to $50 million for scaling and commercialization

Generalist VC Interest in Quantum

The annual funding mark in the early stage DeepTech ecosystem has grown from $1.2B to $2B, with quantum technologies representing a significant portion of this growth. Generalist VCs increasingly recognize quantum computing's potential, though they typically require:

- Clear commercialization timelines within 5-7 years

- Experienced technical teams with quantum expertise

- Addressable market validation for quantum solutions

- Intellectual property protection through patents and trade secrets

This momentum is clear in recent market activity. Venture capital invested $1.9 billion in quantum startups across 62 funding rounds in 2024, a 138 percent increase from 2023. For VCs, this surge reflects growing confidence and expanding deal flow in the quantum arena.

Corporate Strategic Partnerships

Strategic partnerships with established technology companies provide quantum startups with both funding and market access through complementary relationships.

Technology Giants' Quantum Initiatives

Major corporations have established quantum research divisions and partnership programs:

- IBM Quantum Network provides cloud access and collaboration opportunities

- Google Quantum Computing partnerships for algorithm development

- Microsoft Azure Quantum cloud platform integration opportunities

- Amazon Braket quantum computing service partnerships

Partnership Benefits Beyond Capital

Strategic partnerships offer quantum startups more than funding:

- Technical expertise from established quantum research teams

- Customer access through existing enterprise relationships

- Manufacturing capabilities for quantum hardware scaling

- Regulatory guidance for commercialization requirements

Typical Partnership Structures

- Joint Development Agreements enable startups to collaborate on specific quantum applications while sharing development costs and intellectual property rights.

- Licensing Deals provide upfront payments and ongoing royalties in exchange for quantum technology access, offering revenue without equity dilution.

- Strategic Investments combine funding with commercial partnerships, typically involving minority equity stakes and board representation.

Accelerators and Incubators

Accelerators and incubators often provide seed funding for quantum startups alongside mentorship and technical resources. Quantum-focused accelerators and incubators provide specialized support, funding, and networks specifically designed for quantum technology startups.

Quantum Technology Accelerators

Starburst Accelerator operates quantum-focused programs across multiple locations, providing startups with industry connections and commercial opportunities without taking equity stakes.

Key Program Benefits:

- Mentorship from quantum industry veterans

- Customer introductions to potential enterprise clients

- Technical resources including quantum computing access

- Funding preparation for subsequent venture capital rounds

University-Based Quantum Incubators

GUSEC Seed provides funding support up to ₹50,00,000 through investment against equity, debt, or mix of both for quantum and other technology startups.

University incubator advantages:

- Research collaboration with quantum physics departments

- Talent pipeline access to quantum-trained graduates

- Laboratory facilities for prototype development and testing

- Academic partnerships for joint research and publication

Competition and Pitch Programs

Quantum and Photonic Startup Pitch Competition 2025 offers $100,000 investment for startups with less than $10M in prior funding. These competitions provide:

- Investor exposure to quantum-specialized venture capital

- Market validation through expert panel evaluation

- Media attention for marketing and recruitment purposes

- Network building with other quantum entrepreneurs

Exploring corporate venture capital in quantum tech reveals funding patterns that closely align with your strategic positioning goals in the quantum space.

Recent Funding Success Stories

Analyzing recent quantum startup funding rounds provides insights into investor preferences, valuation trends, and successful fundraising strategies.

Hardware-Focused Success Stories

Finnish quantum computing startup QMill secured €4M in seed funding from Maki.vc, Antler, and Kvanted. The company focuses on developing quantum algorithms to solve complex optimization problems for industrial applications using near-future quantum hardware.

Universal Quantum raised $14.9M in seed funding with backing from Village Global, supported by Bill Gates, Mark Zuckerberg, and Jeff Bezos. The UK-based company aims to build a million-qubit quantum computer using microwave technology instead of lasers.

Key Success Factors:

- Experienced technical teams with quantum physics backgrounds

- Clear commercial applications in finance, telecommunications, and optimization

- Differentiated technology approaches distinguishing from competitors

- Strong intellectual property portfolios protecting core innovations

Qolab, Inc. secured over $16 million led by Octave Ventures, backed by DBJ, WARF, and Phoenix Venture Partners. This international co-investment approach highlights the cross-border appeal and strategic depth required to scale advanced quantum systems.

Software and Application Success Stories

QpiAI raised $32 million in Series A at a $162 million post-money valuation, demonstrating strong investor appetite for quantum software applications. The company integrates AI and quantum computing for enterprise use cases.

Recent quantum computing investment trends:

- Two late-stage startups, PsiQuantum and Quantinuum, received half of total investment in 2024

- Most new startups launched in 2024 are developing equipment and components or application software

- Value shift expected with quantum startups moving from hardware toward software in the next five to ten years

Industry-Specific Funding Opportunities

Quantum technology applications span multiple industries, each offering specialized funding opportunities and investor networks.

Financial Services Applications

Quantum computing's potential for optimization, cryptography, and risk analysis attracts significant investment from financial services firms and their corporate venture arms.

Application Areas:

- Portfolio optimization using quantum algorithms

- Risk modeling and Monte Carlo simulations

- Cryptographic security and quantum-safe protocols

- High-frequency trading algorithm development

Healthcare and Pharmaceuticals

Drug discovery acceleration through quantum molecular simulation attracts pharmaceutical industry investment and government health agency funding.

Quantum applications in healthcare:

- Molecular modeling for drug discovery

- Protein folding simulation and analysis

- Medical imaging enhancement and analysis

- Personalized medicine optimization

Defense and Security

Government defense agencies provide substantial funding for quantum technologies with national security applications.

Defense quantum applications:

- Quantum radar and sensing systems

- Secure quantum communication networks

- Electronic warfare countermeasures

- Navigation systems independent of GPS

Energy and Materials

Quantum simulation for materials discovery and energy system optimization attracts investment from energy companies and government sustainability programs.

Energy sector applications:

- Battery technology development and optimization

- Solar cell efficiency improvements

- Grid optimization and load balancing

- Carbon capture material development

Funding Strategy Framework

Developing an effective funding strategy requires understanding the unique characteristics of quantum technology investment and aligning startup needs with appropriate funding sources.

Best Practices for Stage-Aligned Quantum Funding

- Apply for non-dilutive government grants and incubator support during early development to minimize equity loss and validate technology.

- Target venture capital and strategic partnerships as your quantum startup approaches commercialization and scaling milestones for larger funding rounds.

- Tailor investor pitches to funding stage, emphasizing clear technical milestones for angels and accelerators, and strategic value for VCs and government funds.

- Leverage accelerator programs to gain mentorship, technical validation, and early capital without immediate dilution or complex equity terms.

- Combine multiple funding sources strategically to balance risk and support commercialization across different phases of quantum technology development.

Stage-Appropriate Funding Selection

Early-stage quantum startups should prioritize funding sources that provide technical validation and development support:

- Government grants for non-dilutive early development funding

- University partnerships for research collaboration and talent access

- Accelerator programs for mentorship and network building

- Angel investors with quantum industry experience

Growth-stage quantum companies can access larger funding sources focused on commercialization:

- Venture capital for scaling and market entry

- Corporate partnerships for customer development and revenue generation

- Strategic investors for industry expertise and market access

- International expansion funding for global market penetration

A discussion of fundraising strategies for deep tech startups situates your understanding of the broader funding mechanisms that also inform quantum computing innovation, emphasizing contextual parallels in capital acquisition.

Geographic Considerations

- Quantum innovation clusters are emerging globally, each with distinct funding characteristics:

- United States: Strong venture capital presence and government R&D funding through agencies like NSF, DOE, and DARPA.

- Europe: Significant EU Quantum Technologies Flagship funding and strong government support in UK, Germany, and Netherlands.

- Asia-Pacific: Rapidly growing government investment led by China, Japan, and Australia, with emerging private investor interest.

- Canada: Strong academic research base with government support through quantum-focused programs and tax incentives.

Funding Mix Optimization

Successful quantum startups often combine multiple funding sources:

- Government grants (20-30%) for non-dilutive early development

- Venture capital (40-50%) for growth and scaling capital

- Strategic partnerships (20-30%) for market access and validation

- Revenue financing (5-10%) from early customer contracts

Building a Diversified Quantum Investor Consortium

This funding mix strategy requires founders to actively build a consortium of investors across government, venture capital, and corporate sectors. By engaging sovereign funds, strategic partners, and traditional VCs, startups can spread risk and access specialized resources. A diversified investor base supports longer development timelines and enables access to technical expertise, market channels, and regulatory guidance. Founders should prioritize investor alignment with their technology domain and commercialization goals to maximize funding impact.

Conclusion

Seed funding for quantum startups remains a foundational step in building successful quantum technology companies. Quantum startups demands a tailored, multi-channel strategy. This approach reflects the sector’s deep-tech complexity and long-term development horizons.

As the industry shifts from hardware to applications, startups must demonstrate clear commercial pathways, strong IP, and technically experienced teams to attract attention. Ultimately, combining grants, VC, partnerships, and international programs allows quantum startups to de-risk development, validate markets, and scale efficiently.

For founders, the right funding mix is not just about raising capital, it’s about accelerating quantum innovation with strategic alignment. Building an investor list shouldn’t be random. Connect with our Investor Discovery and Mapping experts and learn how data-driven mapping changes the game.

Key Takeaways

- Government funding programs provide substantial non-dilutive capital, with India's National Quantum Mission offering up to $3.5 million grants and major international programs investing billions

- Private venture capital interest has grown significantly, with quantum startup funding increasing 50% to $2 billion in 2024 and average seed rounds growing from $2M to $10M since 2018

- Corporate strategic partnerships offer both funding and market access, with major tech companies establishing quantum-focused venture arms and collaboration programs

- Specialized quantum accelerators and university incubators provide sector-specific expertise, mentorship, and networks that generic programs cannot offer

- Recent success stories demonstrate investor appetite for both hardware and software applications, with companies like QpiAI raising $32M and Universal Quantum securing $14.9M in seed funding

- Industry-specific opportunities exist across financial services, healthcare, defense, and energy sectors, each offering specialized funding sources and investor networks

Frequently asked Questions

What government grants are available for quantum startups in India?

Quantum startups in India can access up to $3.5 million via the National Quantum Mission and additional support through the Startup India Seed Fund Scheme.