When it comes to securing funding, the right platform can make all the difference. Qubit Capital has facilitated an impressive $215M in funding since 2020, setting a benchmark for success. Unlike traditional methods, Qubit delivers 2x faster fundraising outcomes, helping startups cut months off their timelines. This efficiency is backed by real-world results, such as Swiipr Technologies, which raised approximately $7.6M in Series A funding through Qubit’s platform.

For founders exploring their options, understanding the advantages of outsourced fundraising for startups can provide valuable context. Insights into outsourced fundraising for startups contribute an alternative perspective that complements your comparison of in-house and external solutions without deviating from the broader strategic narrative.

Let’s explore why Qubit Capital stands out as the top choice for fundraising success.

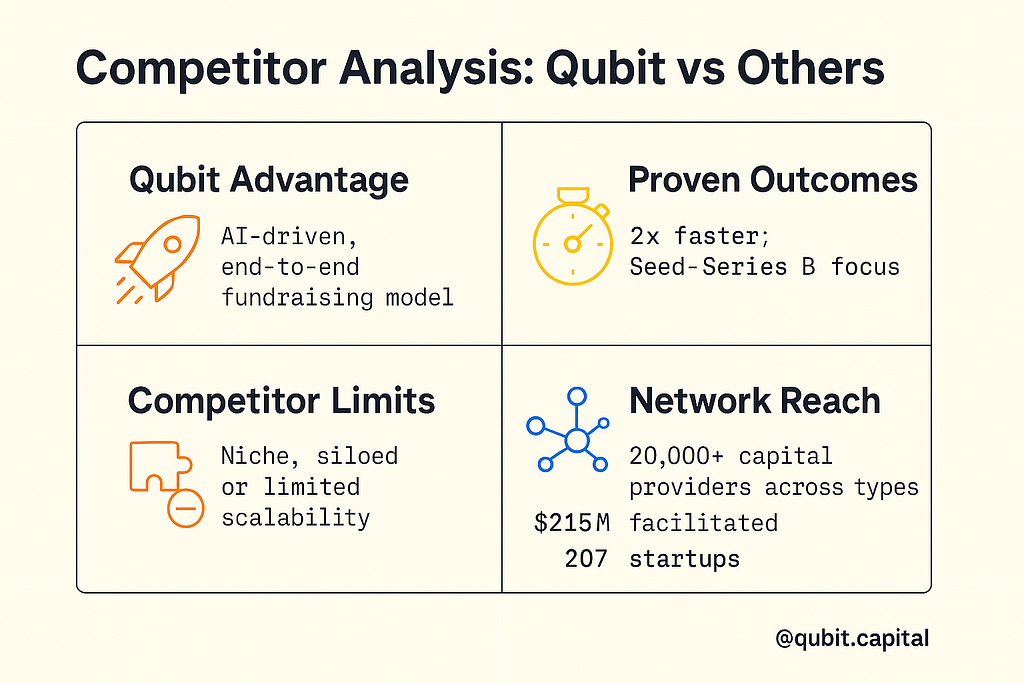

Competitor Analysis

Understanding the competitive landscape is essential for positioning any business effectively. Qubit Capital operates in a dynamic space alongside notable players like SuperWarm, LVX, Fundacity, LvlUp Ventures, OpenVC, Monaco Foundry, Impact Guru, NACO, Google Assistant Investments, and Rice AI Venture Accelerator Program. Each of these competitors brings unique strengths to the table, yet their approaches differ significantly from Qubit Capital’s integrated, AI-driven methodology. We begin with Qubit Capital’s integrated model, then review alternative platforms.

1. Qubit Capital: AI-Driven, End-to-End Fundraising

Qubit Capital blends advanced AI with hands-on expertise to compress fundraising timelines and elevate outcomes. Since 2020, the platform has facilitated over $215M for 64+ startups and routinely delivers 2x faster fundraising outcomes. Recent wins include Swiipr Technologies (~$7.6M Series A), alongside cross-border rounds that showcase the platform’s global reach and institutional investor access.

AI-Powered Matchmaking

At the core is an AI engine that evaluates sector focus, stage fit, check size, geography, and historical activity to surface high-relevancy investors. With a network of 20,000+ capital providers, including 7,476 VCs, 4,202 PE firms, and 4,807 corporates, the system assigns relevancy scores and automates personalized outreach at scale, lifting response rates and accelerating first meetings.

End-to-End Fundraising Support

Beyond introductions, Qubit provides start-to-finish support: strategy, investor mapping, data room preparation, and process management through diligence. Dedicated pitch work, spanning pitch deck development and live review sessions, replaces fragmented advisors and traditional fundraising consultants with a cohesive, investor-centric workflow.

Who It’s Best For

Early to mid-stage companies raising Seed to Series B (roughly $150K–$30M) that want precision targeting and streamlined execution. The platform is sector-agnostic, fintech, deep tech, SaaS, healthcare, climate, and more, and is built for US, UK, and European founders pursuing cross-border capital or strategic corporate investors.

Results and Social Proof

Performance continues to compound: 3,000+ startup–investor meetings facilitated; 207 startups connected with 6,300+ investors; and $9M+ in Q2 2024 alone. Notable outcomes include Swiipr’s round led by Octopus Ventures and TX Ventures, Spottitt’s financing with Right Side Capital and angels, and additional institutional matches across SaaS and enterprise. Founders consistently cite high-caliber investor conversations, meaningful time savings, and a steadier pipeline, crediting Qubit’s rigorous targeting and disciplined follow-through.

2. SuperWarm and LVX: Contrasting Market Entry Timelines

SuperWarm, founded in 2023 in New York, represents a relatively new entrant in the market. Its focus on early-stage funding solutions highlights its niche, but its recent establishment may limit its operational maturity and scalability. On the other hand, LVX, founded in 2013 in Bengaluru, has had a decade to refine its offerings. This earlier market presence allows LVX to build a robust network, but its traditional approach may lack the technological innovation that Qubit Capital prioritizes.

3. Fundacity and LvlUp Ventures: Startup-Centric Models

Fundacity and LvlUp Ventures cater specifically to startups, offering tailored funding and mentorship programs. While these models provide value to early-stage companies, they often operate in silos, focusing on either funding or mentorship. Qubit Capital, in contrast, integrates these elements seamlessly with AI-driven insights, enabling startups to access both financial and strategic support through a unified platform.

4. OpenVC and Monaco Foundry: Niche Expertise

OpenVC and Monaco Foundry emphasize niche expertise, with OpenVC focusing on connecting startups with venture capitalists and Monaco Foundry specializing in scaling businesses. While these targeted approaches are effective within their domains, they lack the holistic framework that Qubit Capital offers. By combining AI analytics with end-to-end support, Qubit Capital ensures that businesses receive comprehensive guidance at every growth stage.

5. Impact Guru, NACO, and Google Assistant Investments: Diverse Offerings

Impact Guru and NACO bring unique value propositions, with Impact Guru excelling in crowdfunding for social enterprises and NACO supporting angel investors. Meanwhile, Google Assistant Investments leverages its tech ecosystem to back AI-driven startups. However, these players often cater to specific sectors or investment types, limiting their adaptability. Qubit Capital’s AI-driven platform transcends these limitations, offering tailored solutions across industries and investment stages.

6. Rice AI Venture Accelerator Program: Academic Roots

The Rice AI Venture Accelerator Program stands out for its academic foundation, providing startups with resources and mentorship rooted in research. While this model fosters innovation, it may lack the agility and scalability of a dedicated investment platform like Qubit Capital.

For founders exploring agencies instead of platform-based guidance, an examination of fundraising agencies startups supplies a comparative framework that highlights differences between external agency support and the integrated model described in your content, offering a broader view of available expertise.

Platform Features and Brand Overview

Qubit Capital stands out by offering a suite of innovative tools and services tailored to the unique needs of startups and investors. Designed to support early to mid-stage funding efforts, the platform combines cutting-edge technology with strategic human insights to create a seamless experience for both parties.

AI-Powered Matchmaking

At the heart of Qubit Capital’s platform is its AI-powered matchmaking feature. This advanced system analyzes key metrics, such as industry focus, funding stage, and growth potential, to connect startups with the most relevant investors. By automating this process, the platform saves valuable time and ensures that connections are not only timely but also highly strategic. Whether a startup is seeking seed funding or preparing for a Series B round, this feature ensures that every match is meaningful and aligned with long-term goals.

Pitch Review Sessions

Crafting the perfect pitch can make or break a funding opportunity. Qubit Capital offers dedicated pitch review sessions where startups receive actionable feedback from experienced mentors and industry experts. These sessions are designed to refine messaging, enhance presentation skills, and ensure that pitches resonate with potential investors. Unlike traditional approaches, where startups often rely on external fundraising consultants, Qubit Capital integrates this service directly into its platform.

Strategic Mentorship

Mentorship is a cornerstone of Qubit Capital’s approach. The platform connects startups with seasoned professionals who provide guidance on scaling operations, navigating market challenges, and optimizing business models. These mentors bring a wealth of experience across diverse industries, ensuring that startups receive tailored advice that aligns with their specific needs. This strategic support is particularly valuable for early-stage companies looking to establish a strong foundation for growth.

Comprehensive Tools for Investors and Startups

Qubit Capital goes beyond matchmaking and mentorship by offering a robust suite of tools designed to simplify the funding process. For startups, the platform provides resources to track investor engagement, manage due diligence, and prepare for funding rounds. Investors, on the other hand, gain access to detailed analytics and insights that help them identify high-potential opportunities.

A Focus on Early to Mid-Stage Funding

While many platforms cater to a broad range of funding stages, Qubit Capital specializes in early to mid-stage funding, from Seed to Series B. This targeted approach allows the platform to address the unique challenges and opportunities faced by startups in these critical growth phases. By focusing on this niche, Qubit Capital ensures that its services are not only relevant but also highly impactful.

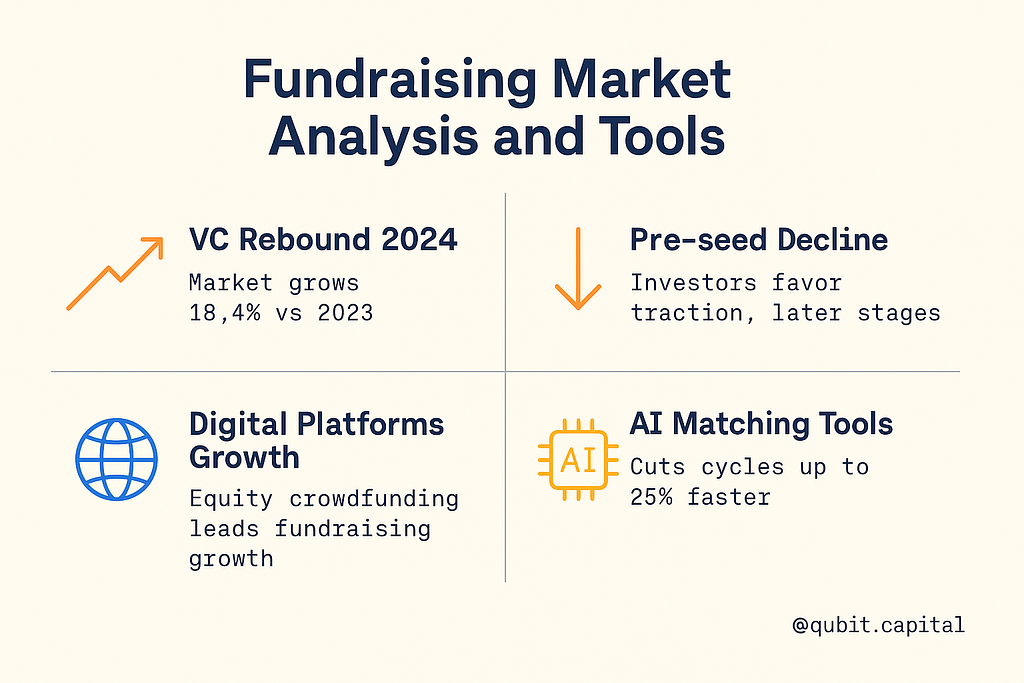

Fundraising Market Analysis and Tools

The startup fundraising landscape is undergoing significant shifts, shaped by evolving market trends and innovative tools. While venture capital (VC) funding shows signs of recovery, other areas, such as pre-seed funding, are experiencing notable declines. At the same time, digital platforms and AI-driven solutions are transforming how startups connect with investors, streamlining processes and improving outcomes.

Market Trends Shaping Fundraising

1. VC Funding Rebounds in 2024

After a challenging period, VC funding is showing signs of optimism. According to VC funding rebound data for 2024, the market is expected to experience an 18.4% increase in total funding compared to 2023. This rebound reflects growing investor confidence and a renewed focus on scaling innovative startups. Such upward trends highlight the resilience of the startup ecosystem and the potential for growth in the coming years.

2. Decline in Pre-Seed Funding

While VC funding is on the rise, pre-seed funding has taken a different trajectory. Recent data reveals a 36% drop in pre-seed funding volume, signaling a shift in investor priorities. This decline suggests that investors are focusing more on startups with proven traction or those in later funding stages, leaving early-stage founders to explore alternative financing options.

The Role of Digital Platforms and AI

1. Growth of Digital Fundraising Platforms

Digital platforms are becoming indispensable for startups seeking funding. Among these, equity crowdfunding is leading the charge, offering founders a way to connect directly with a broad base of investors. As these platforms continue to grow, they are democratizing access to capital, enabling startups to reach investors beyond traditional networks.

2. AI-Driven Investor Matching Tools

Artificial intelligence is revolutionizing the fundraising process. Tools that use AI to match startups with investors are reducing fundraising cycles by up to 25% faster, allowing founders to focus more on building their businesses. Additionally, platforms with AI-powered matching features report up to a 40% higher investor response rate, fostering deeper engagement between startups and potential backers.

Overcoming Challenges with Technology

The challenges of securing funding, especially in a competitive market, are being addressed through technology. By adopting integrated tools and platforms, startups can streamline their fundraising efforts, improve investor outreach, and adapt to shifting market dynamics.

As the fundraising landscape evolves, staying informed about these trends and tools is essential for startups aiming to secure the capital they need to thrive. Before you open the data room, skim how to choose startup funding for when to use grants, venture debt, or SAFE notes.

Conclusion

Choosing the right platform for your startup’s growth is no small task. Throughout this article, we’ve explored how Qubit Capital’s holistic approach stands apart by combining AI-driven matching with strategic mentorship. This dual focus ensures startups not only find the right investors but also gain the guidance needed to scale effectively.

A clear, narrative-driven platform is essential for building trust and fostering meaningful connections. Qubit Capital’s emphasis on integrating advanced technology with personalized support creates a seamless experience for founders seeking to elevate their fundraising strategies.

If you're ready to transform your fundraising strategy, explore our Fundraising Assistance service at Qubit Capital. Let us help you unlock new opportunities and achieve your growth goals.

Key Takeaways

- Qubit Capital has facilitated over $215M in funding driven by its AI-powered investor matching.

- Competitor analysis reveals niche strengths, but Qubit stands out with its holistic, integrated approach.

- Platform features like tailored matchmaking, mentorship, and targeted investor support enhance overall value.

- Market trends indicate a significant shift towards digital, AI-driven fundraising platforms.

- Qubit Capital’s comprehensive strategy significantly accelerates fundraising cycles while offering unmatched support.

Frequently asked Questions

What makes Qubit Capital different from other fundraising platforms?

Qubit Capital stands out by combining advanced AI-driven matching with a comprehensive mentorship program. This unique approach ensures startups are paired with the right investors, accelerating fundraising cycles significantly. Unlike traditional platforms, Qubit Capital offers a holistic ecosystem that supports entrepreneurs beyond funding, fostering long-term growth and success.