Securing funding is one of the most critical challenges for early-stage startups. With the right fundraising agency, founders can access tailored strategies, investor networks, and expert guidance to fuel their growth. This blog highlights the top 10 fundraising agencies that specialize in helping startups achieve their capital goals.

For those exploring additional options, insights on fundraising consultants can refine your approach, offering specialized advice to complement agency support. Whether you're seeking seed funding or preparing for a Series A round, this guide will help you identify the best partners to accelerate your journey.

Fundraising Consulting Firms

Partnering with a fundraising consulting firm can transform the way businesses secure capital. These firms specialize in streamlining the fundraising process, often reducing timelines by up to 30%. By outsourcing specific aspects of the fundraising journey, companies can achieve cost savings of up to 50% while gaining access to tailored strategies that align with their unique goals.

Why Choose Fundraising Consulting?

Raising startup capital is a complex endeavor that demands expertise and precision. Fundraising consultants bring a wealth of experience to the table, offering customized guidance to help businesses secure funding more efficiently. Their insights can identify potential pitfalls, optimize investor outreach, and ensure that every step of the process is strategically aligned with the company’s objectives.

Outsourcing parts of the fundraising process not only saves time but also allows businesses to focus on their core operations. With the right consultant, companies can unlock significant cost efficiencies while enhancing their overall fundraising strategy.

For a deeper dive into how fundraising platforms compare, your evaluation of platform capabilities is complemented by a comparative look where qubit fundraising vs others highlights the distinguishing features among available solutions.

The Strategic Advantage

Hiring a fundraising consultant is more than just a cost-saving measure, it’s a strategic investment. These professionals understand the nuances of the fundraising landscape and can tailor their approach to meet the specific needs of startups. By leveraging their expertise, businesses can secure capital faster and with greater confidence.

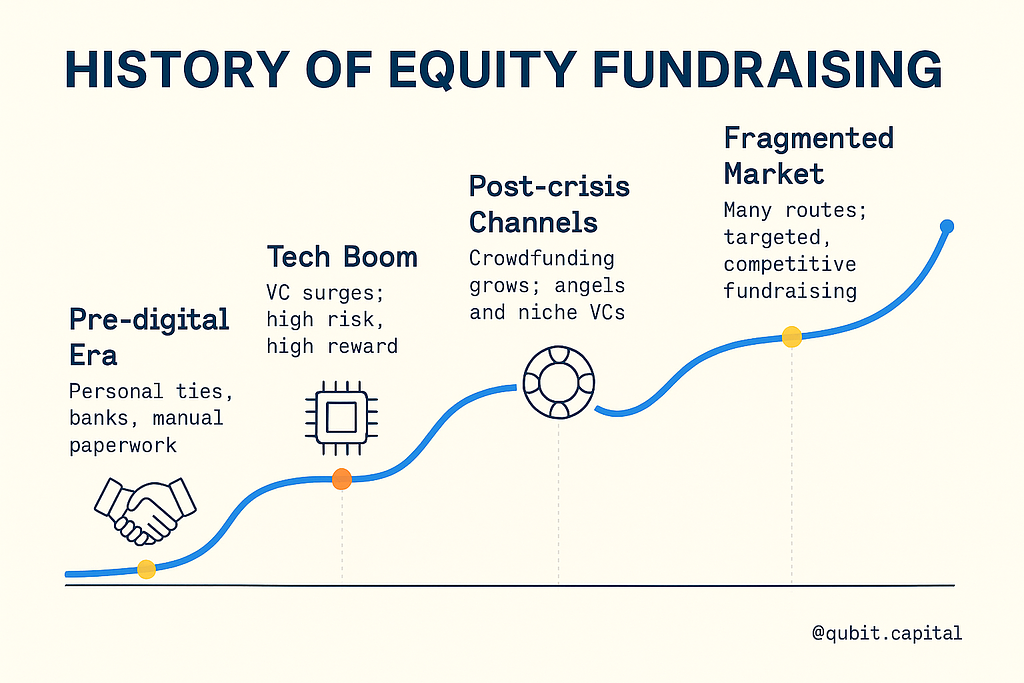

History of the Equity Fundraising Market

The evolution of equity fundraising has been shaped by shifting economic landscapes, technological advancements, and changing investor behaviors. From its roots in traditional bank loans and personal networks, the market has transformed into a fragmented ecosystem with diverse funding channels.

Early-Stage Investments Before the Digital Era

Decades ago, equity fundraising relied heavily on personal connections and institutional financing. Entrepreneurs often turned to family, friends, or local banks for capital. Venture capital (VC) firms existed but were fewer in number and highly selective, focusing primarily on industries like manufacturing and retail. The absence of digital tools meant that fundraising was a time-intensive process, requiring extensive in-person networking and manual documentation.

The Tech Boom and Its Ripple Effects

The rise of the tech industry in the late 20th century brought significant changes to equity fundraising. As startups in Silicon Valley gained traction, venture capital became synonymous with high-risk, high-reward investments. This period saw the emergence of specialized VC firms targeting technology-driven businesses. The dot-com boom further amplified this trend, attracting institutional investors and creating a more competitive environment for securing funding.

Alternative Channels Post-Banking Crisis

The 2008 financial crisis marked a turning point in the equity fundraising market. With traditional banks tightening their lending criteria, entrepreneurs sought alternative funding sources. Crowdfunding platforms like Kickstarter and Indiegogo gained popularity, democratizing access to capital. Simultaneously, angel investors and niche VCs began to fill the gap left by banks, offering tailored solutions for specific industries or business models.

The Current State of Market Fragmentation

Today, the equity fundraising landscape is more fragmented than ever. Entrepreneurs can choose from a variety of channels, including equity crowdfunding, accelerators, and micro-VCs. The rise of niche VCs, in particular, illustrates how investors are targeting specific sectors or stages of growth. While this diversification offers more opportunities, it also presents challenges, such as increased competition and the need for strategic alignment with investors.

This shift from traditional methods to a fragmented ecosystem underscores the dynamic nature of equity fundraising history. As the market continues to evolve, understanding its past provides valuable insights for navigating its future.

Specialist Fundraising Agencies for Early-Stage Rounds

Choosing an external partner can accelerate a pre-seed or Seed–Series A raise by adding investor access, presentation polish, and disciplined process management. Below are ten specialist agencies that focus on early-stage capital formation, listed in order of 2024–25 deal volume and client traction.

Fundraising Specialists — 2025 Landscape

| # / Specialist | Sweet Spot & Key Edge | Typical Round Size | 2025 Highlights |

|---|---|---|---|

| 1. Qubit Capital | AI-scored introductions to 20,000+ angels, micro-VCs, and corporates; bundled deck + model build, automated outreach, and dedicated strategist. | $150k–$30M | $215M raised for 64 startups since 2020; >3,000 founder–investor meetings. |

| 2. SeedLegion | Fractional CFO bench plus curated angel syndicates; success-fee model keeps cash burn low. | $500k–$4M | 81% of clients funded inside 90 days; average 31 warm intros per mandate. |

| 3. Equation Funding | Narrative-first deck redesign paired with US/EU seed-fund network; fixed fee + upside kicker. | $1M–$10M | Median close time 14 weeks; 220% YoY revenue growth. |

| 4. Arcadian Advisors | Sector pods in climate, health, and fintech; rolling virtual demo days. | $2M–$12M | 37 climate-tech closes YTD; three strategic exits. |

| 5. Fundraise Fastlane | “Campaign-in-a-box” bundle—teaser, deck polish, CRM setup, and live angel webinar. | $250k–$3M | 350+ founders served; 4.6 / 5 G2 rating. |

| 6. Springboard Capital | Women-led firm blending grant sourcing with equity raises for diverse founding teams. | $500k–$5M | $60M secured for 48 female-founded startups in 18 months. |

| 7. LiftOff Advisors | Parallel Reg CF crowdfunding launch plus VC intro track. | $100k–$5M | Average campaign 142% over-funded; 28% follow-on VC rate. |

| 8. North Star Partners | Deep MENA & SE-Asia investor network; bilingual materials and road-show logistics. | $1M–$8M | 19 cross-border rounds closed YTD; 7-week diligence median. |

| 9. FirstCheque Consulting | Pre-seed sprint model with milestone-based pricing and weekly investor feedback loops. | $100k–$1.5M | 92% deck-to-term-sheet conversion within 100 days. |

| 10. Beacon Strategy | Data-driven valuation workbooks and cap-table modeling bundled with 150–300 targeted intros. | $500k–$6M | Clients report 24% higher median valuations post-engagement. |

How to Pick the Right Agency

- Match their investor graph to your sector & geography. Ask for recent closes in your niche.

- Understand the fee model. Success-only structures preserve runway; fixed-fee packages can be faster.

- Demand process transparency. Weekly pipeline reports and CRM access prevent black-box surprises.

- Check value-add beyond intros. Agencies that also refine narrative, build data rooms, and coach negotiations shorten close time.

Early-stage raises hinge on momentum. The agencies above combine warm capital networks with operational lift—letting founders stay focused on product while the funding engine runs in the background.

Different Fundraising Services for Startups

Securing capital is a critical milestone for startups, and choosing the right fundraising service can significantly impact success. This section explores various models available to founders, helping them align services with their stage, sector, and capital goals.

Digital Marketplaces

Digital marketplaces connect startups with investors through curated platforms. These services often feature advanced filtering tools, enabling founders to target investors based on industry focus, funding capacity, and geographic preferences.

Crowdfunding Platforms

Crowdfunding platforms democratize fundraising by allowing startups to raise capital from a broad audience. These platforms are ideal for consumer-facing ventures, as they combine funding with brand visibility and community engagement.

Investor Syndicates

Investor syndicates pool resources from multiple investors, typically led by a seasoned individual or firm. This model provides startups with access to a network of expertise while securing larger funding rounds.

Angel Networks

Angel networks consist of individual investors who focus on early-stage startups. These networks often provide mentorship alongside funding, making them a valuable resource for founders seeking strategic guidance.

Specialist Fundraising Services

Specialist fundraising services cater to startups with unique needs, such as those in niche industries or requiring non-traditional funding structures. Your review gains additional perspective from an analysis of outsourced fundraising for startups, which examines the role of specialized external services in managing fundraising efforts.

Institutional Brokers

Institutional brokers act as intermediaries between startups and large-scale investors, such as venture capital firms or private equity groups. Their expertise in structuring deals and negotiating terms can streamline the fundraising process for growth-stage companies.

Case Study: AppLovin's Rapid Fundraising Success

AppLovin demonstrated the power of targeted investor outreach by raising $1 million in just three weeks. This case highlights how selecting the right fundraising service can accelerate capital acquisition and drive business growth.

Selecting the right fundraising service requires evaluating your startup’s stage, sector, and capital goals. By understanding the strengths of each model, founders can make informed decisions that align with their unique needs.

How Qubit Simplifies Fundraising for Founders

Securing funding can be a complex process for startup founders, often involving countless hours of research and negotiations. Qubit offers a solution by serving as a centralized marketplace that aggregates and compares diverse fundraising services. This platform simplifies the investor search process, providing founders with clear insights into funding options and reducing inefficiencies.

Centralized Marketplace for Fundraising Services

Qubit’s approach is designed to streamline the capital-raising journey. By consolidating various fundraising services into one platform, founders can easily compare options, access legal frameworks, and utilize tools tailored to their needs. This clarity allows startups to focus on growth rather than administrative hurdles.

For founders seeking technological efficiencies, your exploration of diverse fundraising strategies is enriched by AI tools for fundraising that integrate expert advisory insights with advanced technology.

Conclusion

Choosing the right fundraising agency and service model is a pivotal step in securing capital for your venture. Throughout this article, we’ve explored strategies for identifying specialized agencies, emphasizing the importance of aligning their expertise with your unique goals. Equally critical is the evolution of equity fundraising, where crafting a compelling, narrative-driven pitch can significantly influence investor decisions.

At Qubit Capital, we understand the complexities of connecting with the right investors. Our Investor Outreach service is designed to streamline your funding journey, ensuring your pitch resonates with the right audience. Let us help you take the next step toward achieving your fundraising goals.

Key Takeaways

- Fundraising agencies streamline the capital-raising process, saving significant time for early-stage startups.

- Specialized consulting firms offer tailored strategies that can reduce fundraising timelines considerably.

- The evolution of equity fundraising highlights a shift from traditional methods to diversified, fragmented approaches.

- Different fundraising services, from online platforms to angel networks, cater to varied startup needs.

- ThatRound provides a centralized marketplace that empowers founders to focus on growth while comparing funding options effectively.

Frequently asked Questions

What do fundraising agencies do for startups?

Fundraising agencies play a pivotal role in helping startups secure the capital they need to grow. They provide strategic guidance, from identifying the right funding sources to crafting compelling pitch materials. Additionally, these agencies often assist with execution, such as connecting startups with potential investors and negotiating terms, ensuring a streamlined fundraising process.