Creating a financial roadmap is essential for achieving long-term business success. Whether you're a startup founder or an established entrepreneur, a well-structured financial plan example can help you make informed decisions, manage risks, and seize growth opportunities. This blog explores the key steps to building a robust financial strategy that aligns with your goals.

From forecasting revenue to budgeting expenses, each component plays a critical role in shaping your financial future. For startups, understanding how to create a financial model for investors is particularly crucial. Creating a financial model that aligns with investor expectations is a pivotal step in the roadmap to success.

Let’s dive into the actionable steps that will guide you toward financial clarity and sustainable growth.

Why a Financial Plan is Critical for Your Startup's Success

Launching a startup is exhilarating, but without a solid financial plan, success can quickly slip out of reach. It is one of the financial modeling basics for startups. A financial plan example serves as a blueprint for setting realistic goals, making informed decisions, and ensuring your business stays financially healthy.

Establishing Clear Financial Goals

A well-crafted financial plan provides clarity by defining both short-term and long-term objectives. For instance, it can outline revenue targets for the first year while projecting growth over the next five years. This roadmap helps founders stay focused and measure progress effectively.

Data-Driven Decision Making

Guesswork can be costly for startups. A financial plan for startups enables data-driven decisions, ensuring resources are allocated efficiently. By analyzing financial metrics, founders can identify areas to cut costs or invest more, ultimately improving operational efficiency.

Building Investor Confidence

Securing funding often hinges on demonstrating a strong financial trajectory. Investors are more likely to back businesses with comprehensive financial plans that showcase profitability and sustainability. Research from CB Insights underscores the importance of financial planning, noting that cash flow challenges are a leading cause of startup failures.

Managing Cash Flow Effectively

Cash flow management is vital for survival. According to Forbes, 82% of businesses fail due to poor cash flow management, highlighting the importance of tracking income and expenses meticulously. Furthermore, a CNBC study revealed that 44% of startup failures in 2022 were attributed to running out of cash, emphasizing the need for proactive financial planning.

A robust financial plan not only mitigates risks but also positions your startup for long-term success. By setting clear goals, relying on data, and managing cash flow effectively, you can build a solid foundation for growth.

Core Components of a Startup Financial Plan

A well-structured financial plan is the backbone of any successful startup, offering clarity and direction in the often unpredictable world of business. A comprehensive financial plan includes essential elements such as sales forecasts, expense budgets, cash flow statements, profit and loss statements, and balance sheets. These components work together to provide a clear picture of financial health and sustainability.

Revenue Projections: The Starting Point

The importance of financial forecasting for startups cannot be stressed enough. Realistic revenue projections are crucial for understanding potential income streams. Differentiating between fixed and variable costs while employing forecasting methods ensures accuracy. This step helps startups anticipate market demands and allocate resources effectively. To learn more about .

Cost Management and Profitability Analysis

Tracking expenses and categorizing them into fixed and variable costs is vital for managing budgets. Profitability analysis, which compares revenue against expenses, allows startups to identify areas for improvement and optimize operations.

Cash Flow Monitoring and Balance Sheets

Cash flow statements highlight the movement of money in and out of the business, ensuring liquidity for daily operations. Balance sheets, on the other hand, provide a snapshot of assets, liabilities, and equity, offering insights into the company’s financial position.

Break-Even Analysis: Measuring Success

Break-even analysis helps startups determine the point at which revenue equals expenses, signaling financial stability. This tool is invaluable for setting realistic goals and planning for growth.

Step-by-Step Guide to Craft Your Financial Roadmap

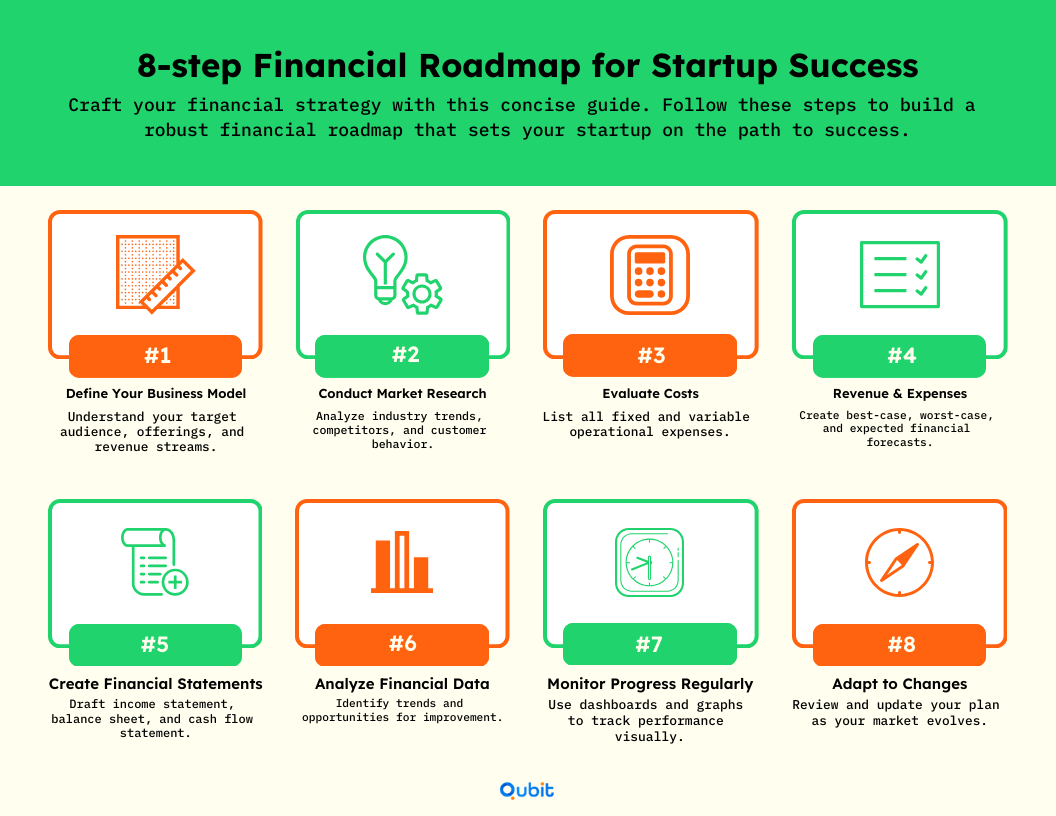

Creating a financial plan for a business involves more than just crunching numbers. It’s about crafting a dynamic strategy that adapts to market shifts and ensures long-term sustainability. This eight-step process will help you build a comprehensive financial roadmap tailored to your goals.

1. Define Your Business Model

Start by outlining your business model. Identify your target audience, core offerings, and revenue streams. A clear understanding of your model lays the groundwork for accurate financial planning.

2. Conduct Market Research

Gather data on industry trends, competitors, and customer behavior. Market research helps you anticipate demand and refine your pricing strategy, ensuring your financial plan aligns with market realities.

3. Evaluate Costs

List all fixed and variable costs associated with your operations. From production expenses to marketing budgets, understanding your cost structure is essential for creating realistic projections.

4. Project Revenue and Expenses

Develop detailed forecasts for revenue and expenses over a specific timeframe. Incorporate scenario analysis—best-case, worst-case, and expected outcomes—to prepare for uncertainties.

5. Create Financial Statements

Draft key financial statements, including income statements, balance sheets, and cash flow statements. These documents provide a snapshot of your business’s financial health. For guidance on this step, explore our resource on financial statements for startup founders.

6. Analyze Financial Data

Examine your financial statements to identify trends, strengths, and areas for improvement. This analysis will inform strategic decisions and highlight opportunities to optimize your financial plan.

7. Monitor Progress Regularly

Track your financial performance using visual dashboards and graphs. These tools make it easier to spot deviations from your plan and take corrective action promptly.

8. Adapt to Changes

Markets evolve, and so should your financial plan. Regularly review and update your roadmap to reflect changes in your business environment, ensuring it remains relevant and effective.

By following these steps, you’ll create a financial roadmap that not only supports your business goals but also prepares you for unexpected challenges.

Essential Financial Metrics for Startup Health

Understanding financial metrics is crucial for maintaining the health of any startup business financial plan. Startups often operate in dynamic environments, making it essential to track key indicators such as burn rate, customer acquisition cost (CAC), customer lifetime value (CLTV), CAC payback period, gross margin, contribution margin, and unit economics. These metrics provide actionable insights that drive data-informed decision-making and effective resource allocation.

1. Burn Rate: Keeping Expenses in Check

Burn rate measures how quickly a startup spends its capital. Monitoring this metric ensures that founders can anticipate funding needs and avoid running out of cash prematurely.

2. Customer Acquisition Cost (CAC) and Lifetime Value (CLTV): Balancing Costs and Revenue

CAC reflects the cost of acquiring a new customer, while CLTV estimates the revenue generated by a customer over their lifetime. A healthy financial plan for startups ensures that CLTV significantly exceeds CAC, signaling sustainable growth.

3. CAC Payback Period: Time to Profitability

The CAC payback period calculates how long it takes to recover the cost of acquiring a customer. Shorter payback periods indicate efficient operations and faster profitability.

4. Gross and Contribution Margins: Measuring Profitability

Gross margin evaluates the percentage of revenue left after subtracting the cost of goods sold, while contribution margin focuses on the profitability of individual units. Together, they highlight areas for cost optimization.

5. Unit Economics: The Foundation of Scalability

Unit economics assesses the profitability of a single unit of product or service. Positive unit economics indicate that scaling operations will lead to sustainable growth.

Consistent monitoring of these metrics is vital for startups aiming to optimize operations and ensure long-term success. For actionable strategies, explore finance management best practices for startups.

Advanced Strategies to Enhance Your Financial Plan

Refining your startup business financial plan requires a deeper dive into advanced techniques. Dynamic cash flow forecasting, for instance, allows businesses to predict and adapt to fluctuating revenue streams and expenses, ensuring liquidity remains intact during critical periods. Sensitivity analysis further complements this by evaluating how changes in key variables—such as market demand or operational costs—impact overall financial outcomes.

1. Optimize Working Capital

Efficient working capital management is essential for startups aiming to scale sustainably. By analyzing receivables, payables, and inventory cycles, businesses can free up cash for reinvestment or operational needs. This strategy not only improves liquidity but also minimizes the risk of financial bottlenecks during growth phases.

2. Master Valuation and Dilution

Understanding pre-money versus post-money valuation is crucial during funding rounds. Pre-money valuation refers to the company’s worth before external investment, while post-money valuation includes the added capital. Dilution modeling helps founders visualize how equity distribution changes as new investors come on board, ensuring they retain control over their vision while attracting necessary funding.

3. Scenario Planning with Tax Considerations

Comprehensive scenario planning prepares startups for various financial outcomes, from rapid growth to unexpected downturns. Incorporating tax forecasting into this process adds another layer of precision, enabling businesses to anticipate tax liabilities and optimize deductions. This approach ensures that financial plans remain robust and adaptable, even in complex regulatory environments.

Compelling financial models to attract investors demonstrate growth potential and instill investor confidence.

Tools and Resources to Streamline Financial Planning

Efficient financial planning is essential for businesses aiming to thrive in competitive markets. Fortunately, modern tools and resources make this process more accessible than ever.

Cloud-Based Accounting Software

Platforms such as Xero, QuickBooks Online, and FreshBooks simplify the management of income and expenses. These cloud-based solutions offer real-time tracking, automated reporting, and seamless integration with other business systems. Their user-friendly interfaces reduce the complexity of financial management, allowing businesses to focus on growth.

Financial Plan Templates

Access to a financial plan template for business plan can save time and provide clarity. Free downloadable templates and specialized software tools are available to streamline forecasting and budgeting processes. These templates offer structured formats for projecting cash flow, estimating expenses, and setting financial goals, ensuring businesses have a solid foundation for their plans.

Mentorship and Startup Communities

Expert mentorship and participation in vibrant startup communities can significantly enhance the quality of financial planning. Mentors provide valuable insights, while startup networks offer opportunities to exchange ideas and learn from peers. These resources foster collaboration and innovation, helping businesses refine their strategies.

Reliable Benchmarking Data

Accurate benchmarking data is another critical resource. By comparing financial performance against industry standards, businesses can identify areas for improvement and set realistic targets. Access to reliable data ensures that financial plans are both practical and achievable.

Whether it’s utilizing cloud-based tools or tapping into community expertise, these resources simplify financial planning and empower businesses to make informed decisions.

A Practical Financial Plan Example

Imagine you’re opening a cozy coffee shop. A clear plan can help you keep things on track.

- Sales Projections:

- Expect 5% growth in Year 2 and 10% in Year 3.

- Keep your targets realistic.

Your plan includes a barista salary of $36,000 a year. Fixed expenses like this make budgeting easier.

- Profit Margins:

- Aim for an 85% gross profit margin.

- Plan for a 3% net profit margin, typical for the food service industry.

You should also include key financial statements. A balance sheet, cash-flow statement, profit & loss statement, and break-even analysis give you a full picture.

This sample plan shows how conservative assumptions and careful tracking can work together. It’s a smart, simple framework for any food service entrepreneur.

Conclusion

Crafting a dynamic financial roadmap is more than just a strategy—it’s an essential step for startups aiming to thrive in competitive markets. Throughout this blog, we’ve explored actionable insights and strategies to help startups build a data-driven approach to funding and growth. From understanding the importance of adaptability to implementing tools that enhance decision-making, the emphasis has been on creating a roadmap that aligns with long-term goals.

The significance of a well-planned financial roadmap cannot be overstated. It empowers startups to make informed decisions, attract the right investors, and sustain growth amid uncertainties. If your startup is ready to take the next step, we’re here to help.

Explore our Fundraising Assistance service and discover how we can turn your financial roadmap into a funding success story. Let us partner with you to secure the resources your startup needs to succeed.

Key Takeaways

- Developing a financial roadmap is essential for startup success.

- Realistic forecasting and budgeting are critical to avoiding cash flow pitfalls.

- Advanced techniques like dynamic forecasting and sensitivity analysis add strategic value.

- Access to the right tools, mentorship, and resources can streamline financial planning.

- A data-driven financial plan inspires investor confidence and secures funding.

Frequently asked Questions

How to create a financial roadmap?

A financial roadmap begins with a clear understanding of your business model. Conduct thorough market research to identify opportunities and challenges. Evaluate costs and project potential revenues. Finally, compile detailed financial statements, including balance sheets, income statements, and cash flow projections, to guide your decision-making.

Back

Back