Recent data shows only 34.7 percent of businesses survive ten years, so resilience is not a nice to have. In this market, investors demand evidence you can execute, adapt, and stay alive long enough to win.

Raising capital is still one of the most important steps if you want to scale. It can also become a time sink if you pick the wrong support.

This guide helps you choose the best fundraising services for startups without getting lost in hype. You will see which service types fit each stage, what each one actually does, and how to vet them fast. We will also cover common pricing models, red flags to avoid, and the tools that make fundraising smoother, from data rooms to investor outreach platforms.

Step-by-Step Guide to the Best Fundraising Services for Startups

The best fundraising services for startups help you move faster with the right investor reach, flexible fees, CRM support, and hands-on advisory. The goal is not more conversations. The goal is better conversations that convert.

For early stage founders, structure matters because it sets momentum. In Q1 2025, SAFEs comprised 90% of all deals on Carta. That is why many pre-seed rounds move faster and stay simpler on paperwork.

1. Initial Call with an Investment Analyst

The process begins with a discovery call. During this step, an investment analyst evaluates your business model, market potential, and financial needs. This is your opportunity to present a concise overview of your vision and establish credibility.

2. Crafting a Tailored Investor Pitch

A compelling pitch is essential to capture investor interest. This involves creating a presentation that highlights your unique value proposition, financial projections, and growth strategy. Personalized support from experts, such as fundraising consultants, can refine your pitch to align with your startup’s financial strategy.

3. Preparing Thorough Documentation

Investors expect detailed documentation to assess the viability of your business. This includes financial statements, market analysis, and a clear business plan. Ensuring these materials are accurate and well-organized demonstrates professionalism and builds trust.

4. Identifying and Reaching Out to Potential Investors

The next step is identifying investors whose interests align with your business. This involves researching venture capital firms, angel investors, or other funding sources. Personalized outreach, tailored to each investor’s focus, increases the likelihood of securing a meeting.

5. Hosting Investor Calls and Meetings

Investor calls are your chance to dive deeper into your business model and address specific questions. These discussions often determine whether an investor will move forward, so preparation is key. Anticipate potential concerns and be ready to provide clear, confident answers.

6. Maintain Proactive Investor Communication

Consistent communication with investors is essential after initial meetings and throughout the fundraising process. Regular updates on business progress, milestones, and challenges help build trust and keep investors engaged. Transparent commuMomentum dies in silence. Set a regular update cadence, like biweekly or monthly, and keep it focused on measurable progress and next milestones.

- Send updates to active prospects and existing investors with wins, risks, and upcoming milestones.

- Respond quickly to questions and document requests to keep the round moving.

- Use secure, organized platforms to share files and track conversations, so nothing slips.

With the right service and a structured process, fundraising becomes a system you can run, not chaos you survive.

Expert Strategies for Effective Investor Engagement

The best fundraising services for startups provide tailored support for connecting with investors.

Leveraging broader investor networks has tangible results. In Q3 2025, global VC investment rose to $120 billion, up from $112 billion in Q2. These increases reflect the effectiveness of expanding outreach and tailoring engagement. Founders using robust strategies tap directly into this growth.

Connecting with investors requires more than just a compelling pitch, it demands a tailored approach that resonates with their unique priorities.

1. Personal Investor Sessions for Tailored Communication

One-on-one investor sessions offer startups the opportunity to craft personalized narratives that align with individual investor goals. These sessions go beyond generic presentations, enabling founders to address specific concerns, highlight relevant metrics, and build genuine rapport. By focusing on tailored communication, startups can foster trust and demonstrate their understanding of an investor's vision.

2. Iteration-Based Documentation Support

Iteration-based documentation support, where drafts are continually improved based on feedback—ensures every investor document is refined to perfection.

With expert guidance, founders can present data and projections in a way that is both compelling and easy to digest. This increases the likelihood of securing funding.

3. Expanding Investor Networks

Building connections with the right investors is often the key to successful fundraising. Expert services can help startups access extensive networks, including direct links to family offices and angel investors. These connections open doors to funding opportunities that might otherwise remain out of reach. Observations on outsourced fundraising for startups highlight how delegation of fundraising responsibilities can optimize your operational focus, allowing founders to concentrate on scaling their businesses while professionals handle investor outreach.

Integrating AI Tools with Human Expertise

Building on network expansion, integrating AI-driven platforms with human expertise enhances investor targeting and outreach. AI tools can quickly analyze large datasets to identify ideal investor matches, while human judgment refines these results for alignment and relationship-building. This blended approach increases efficiency and ensures outreach efforts are both data-informed and personally resonant.

For those seeking cutting-edge solutions, discussions involving AI fundraising tools offer insights into how innovative technology supports a modern approach to startup financing.

Leading Fundraising Services: Comprehensive Analysis

1. Qubit Capital — Premier Comprehensive Matchmaking Platform

Qubit Capital excels across two critical evaluation criteria: investor network breadth and feature comprehensiveness. The platform maintains a proprietary database of over 20,000 active investors, enhanced by an AI-driven scoring system that analyzes investment thesis alignment, check size preferences, geographic focus, and portfolio adjacency. This infrastructure earns a perfect network strength rating of 10/10.

The platform's comprehensive feature set includes in-house pitch deck development, financial model creation, automated outreach campaigns, and real-time response analytics, positioning it ahead of competitors in capability depth.

Value Proposition: The integrated workflow spanning research, introductions, and secure data room management—an online space for sharing confidential documents—reduces dependency on multiple third-party tools. Additionally, dedicated strategist support significantly de-risks first-time fundraising efforts.

Considerations: The onboarding process requires more time investment compared to self-service platforms. Optimal value realization typically requires full-stack engagement for a minimum of one quarter.

For a deeper dive into how platforms like Qubit Capital outperform competitors in enabling such results, explore our comparison on qubit fundraising vs others. This resource highlights unique advantages through real-world comparisons, offering insights into why Qubit ranks as a top choice for startups aiming to accelerate investor engagement.

2. Dealroom — Advanced Market Intelligence Platform

Dealroom's competitive advantage lies in its comprehensive data infrastructure, featuring over two million organization profiles continuously updated with hiring trends, web traffic analytics, and funding signals. This extensive database earns strong ratings for network depth (8/10) and features (8/10), particularly due to its predictive valuation models and sophisticated Signal Search filtering capabilities.

Optimal Use Case: Organizations requiring comprehensive market trend analysis, sector heat mapping, and exportable datasets to complement existing outreach tools.

3. SeedInvest — Regulated Equity Crowdfunding for US Markets

SeedInvest operates as an SEC-regulated equity crowdfunding marketplace with rigorous internal due diligence processes, accepting approximately 2% of applicants. This curated approach, combined with a substantial accredited investor base, results in strong network and suitability scores (7-8/10). However, the platform requires mandatory success fees.

Target Market: US-based companies seeking both capital and brand advocacy without developing extensive angel investor networks independently.

4. Republic — Multi-Asset Class Crowdfunding Platform

Republic's primary strength is market reach, serving over 2 million retail investors across equity, revenue-sharing, and cryptocurrency transactions. This broad accessibility translates to excellent cost efficiency (8/10) with success-only fee structures, though investor strength ratings are moderate (6/10) due to smaller average contribution sizes. Feature depth ranks mid-tier (7/10) due to limited back-office functionality. Overall Score: 7.05/10

Strategic Fit: Companies prioritizing community building alongside capital formation, with internal capabilities for data room management and investor communications.

5. Visible — Investor Relations Management System

Visible specializes in post-funding transparency and relationship management through automated KPI reporting, investor portals, and streamlined fundraising pipelines. The platform achieves exceptional user experience (8/10) and cost efficiency ratings (9/10) thanks to comprehensive free tier offerings. However, the absence of an integrated investor directory limits network strength (5/10), resulting in a weighted average of 6.85/10.

Strategic Application: Founders with established warm networks (or those utilizing Qubit/Dealroom for investor discovery) seeking professional investor communication and commitment conversion tools.

The Right Moment: It’s Time To Raise Capital

Opportunities don’t wait, and neither should you. For startups, timing is everything, especially when it comes to raising capital. The right moment to act is often fleeting, and hesitation can mean missing out on critical funding that could propel your business forward.

A well-planned capital raise can unlock resources to scale your operations, expand your team, and refine your product offerings. It’s not just about securing funds; it’s about positioning your startup to thrive in a competitive market. Investors are always on the lookout for businesses that demonstrate readiness and a clear vision, so acting decisively can set you apart.

If the market conditions align with your goals, now is the time to take action. Waiting for the “perfect” moment might leave you behind. Instead, seize the opportunities available today and give your startup the financial boost it needs to grow.

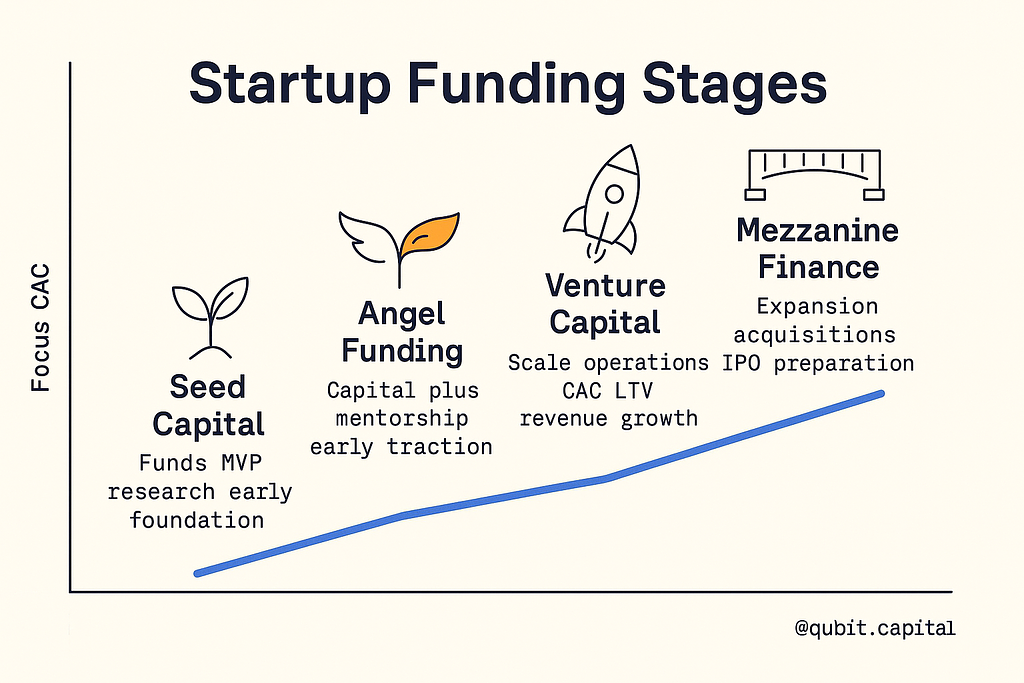

Understanding the Stages of Startup Funding

Securing funding is a critical milestone for startups, and understanding the distinct stages of startup funding can make all the difference in achieving sustainable growth. Each stage comes with its own set of opportunities, challenges, and strategic considerations.

1. Seed Capital: Laying the Foundation

The journey begins with seed capital, often sourced from personal savings, friends, family, or early-stage investors. This funding is typically used to develop a minimum viable product (MVP), conduct market research, and establish the initial business framework. Startups at this stage must focus on presenting a compelling vision and demonstrating the potential for scalability.

2. Angel Investor Funding: Early-Stage Support

Angel investors step in after the seed stage, offering not just financial support but also mentorship and industry connections. These investors are often drawn to startups with a clear value proposition and early traction. To attract angel funding, startups should emphasize their unique market positioning and the problem their product or service solves.

3. Venture Capital Financing: Scaling Operations

Venture capital (VC) funding marks a significant leap, providing the resources needed to scale operations, expand teams, and enhance product offerings. VCs typically invest in startups with proven market demand and a scalable business model. At this stage, startups must focus on metrics like customer acquisition cost (CAC), lifetime value (LTV), and revenue growth to appeal to potential investors.

For Series A, recent data provides clear benchmarks. In Q1 2025, median Series A funding round was $7.9 million. This standard helps startups set realistic targets when mapping their growth trajectory. Understanding round typicals ensures fundraising plans are grounded in today's market realities.

4. Mezzanine Financing and Bridge Loans: Preparing for Expansion

As startups mature, mezzanine financing and bridge loans serve as transitional funding to prepare for larger milestones, such as acquisitions or public offerings. These funding options are often used to stabilize cash flow, fund marketing campaigns, or finalize product development. Startups must demonstrate financial stability and a clear plan for utilizing these funds effectively.

5. Initial Public Offering (IPO): Going Public

The IPO represents the pinnacle of startup funding, allowing companies to raise significant capital by offering shares to the public. This stage requires rigorous financial audits, compliance with regulatory standards, and a strong market presence. Startups must ensure they have the operational capacity and governance structures to thrive as a public company.

Understanding these funding stages equips startups with the knowledge to approach investors strategically and transition smoothly between phases. By aligning their goals with the expectations of each funding stage, startups can maximize their chances of long-term success.

The Evolution of the Equity Fundraising Market

Equity fundraising has undergone a remarkable transformation, shaped by historical milestones, technological advancements, and economic shifts. From its origins in traditional investment practices to the dynamic and fragmented market we see today, the journey of equity-based fundraising reflects the broader evolution of global finance.

Market evolution has produced major fluctuations. Global VC investment dropped from $128.4 billion in Q1 2025 to $101.05 billion, per StartUs Insights. This downswing demonstrates how market fragmentation and new channels reshape fundraising cycles. Recognizing these patterns is key for founders adapting to change.

Modern equity fundraising is driven by the best fundraising services for startups, reflecting ongoing transformation.

1. Early-Stage Investments: A Pre-Digital Landscape

Before the digital era, equity fundraising was a highly localized and relationship-driven process. Entrepreneurs relied heavily on personal networks, angel investors, and venture capital firms to secure funding. These early-stage investments were often limited in scope, with minimal access to broader markets. The absence of digital tools meant that raising capital required significant time and effort, often constrained by geographical boundaries.

2. The Tech Boom and Its Ripple Effects

The late 1990s and early 2000s marked a pivotal moment with the rise of the tech boom. This period saw an unprecedented surge in venture capital activity, as investors sought to capitalize on the rapid growth of technology startups. Companies like Amazon and Google became emblematic of this era, demonstrating the potential for exponential returns. The tech boom not only expanded the scale of equity fundraising but also introduced new players to the market, including institutional investors and private equity firms.

3. Post-Banking Crisis: The Rise of Alternative Channels

The 2008 global financial crisis reshaped the equity fundraising landscape, prompting the emergence of alternative funding channels. Traditional banks, burdened by regulatory constraints, reduced their lending activities, creating a gap that was quickly filled by innovative platforms. Crowdfunding, for instance, democratized access to capital, enabling startups to connect directly with a global pool of investors. Similarly, the rise of online marketplaces and blockchain-based fundraising methods, such as Initial Coin Offerings (ICOs), further diversified the options available to entrepreneurs.

A Fragmented Yet Dynamic Market

Today, the equity fundraising market is more dynamic than ever, characterized by a blend of traditional and modern approaches. While venture capital and private equity remain dominant, the proliferation of digital platforms has made it easier for startups to access funding. This fragmentation has created a competitive environment, encouraging innovation and fostering growth across industries.

The evolution of equity fundraising underscores the importance of adaptability in a constantly changing financial ecosystem. As technology continues to advance, the market will likely witness even more transformative shifts in the years to come.

Factors to Consider When Comparing Platforms

Conclusion

Securing funding is a critical milestone for startups, and success begins with a clear, narrative-driven plan. From choosing the right fundraising platforms to implementing a structured process, each step plays a vital role in attracting investors. Actionable insights and proven case studies further empower startups to refine their strategies and accelerate growth.

Fundraising services offer invaluable support, ensuring startups can confidently pitch their vision and secure the capital needed to thrive.

If you want hands-on fundraising support, pick our fundraising assistance service to get a structured roadmap, pitch refinement, and investor targeting support that helps you run a cleaner, faster raise.

Key Takeaways

- A comprehensive guide that centralizes multiple fundraising platforms and solutions.

- Step-by-step instructions clarify the complete startup fundraising process.

- Real-world case studies validate the effectiveness of robust investor engagement strategies.

- Historical insights enhance understanding of the evolution of equity fundraising.

Frequently asked Questions

Which fundraising platform is best for early-stage startups?

Platforms like SeedInvest and Republic are ideal for early-stage startups, offering regulated crowdfunding and broad investor access.