Unlike traditional venture capitalists who often enter at later stages, consumer tech angels engage with founders at the earliest phases of development, when passion and vision matter as much as metrics and traction. These investors bring a unique combination of financial resources, industry expertise, and strategic networks that can accelerate a startup's journey from concept to market leader.

This comprehensive guide explores the landscape of angel investing in consumer technology, providing founders with the knowledge and strategies needed to secure the right investment partners for their ventures.

What Are Consumer Tech Angel Investors?

Consumer tech angel investors are high-net-worth individuals who provide early-stage funding specifically to startups developing products and services for end consumers. These investors typically possess deep understanding of consumer behavior, market dynamics, and the unique challenges facing consumer-focused businesses.

Key Characteristics:

- Investment Range: Typically $25,000 to $500,000 per deal

- Stage Focus: Pre-seed and seed stage companies

- Sector Expertise: Deep knowledge of consumer markets and user behavior

- Value Addition: Strategic guidance beyond capital provision

- Network Access: Connections to customers, partners, and follow-on investors

- Timeline: Quick decision-making compared to institutional investors

What Sets Them Apart:

Consumer tech angels differ from generalist investors through their specialized understanding of consumer markets. They recognize the importance of user experience, brand building, viral growth mechanics, and the unique monetization challenges facing consumer-focused startups.

Consumer Tech Investment Focus Areas

| Category | Examples | Key Success Factors | Typical Investment Size |

|---|---|---|---|

| Mobile Apps | Social media, productivity, gaming | User engagement, viral growth | $50K - $250K |

| E-commerce Platforms | Marketplaces, D2C brands | Customer acquisition cost, retention | $100K - $500K |

| Entertainment & Media | Streaming, content platforms | Content quality, audience building | $75K - $300K |

| Health & Wellness | Fitness apps, mental health | User outcomes, regulatory compliance | $100K - $400K |

| Fintech Consumer | Payment apps, personal finance | Security, user trust, adoption | $150K - $500K |

| Food & Lifestyle | Delivery apps, lifestyle brands | Market size, operational efficiency | $100K - $350K |

Leading Consumer Tech Angel Investors

Naval Ravikant

Co-founder of AngelList

Investment Philosophy: Focuses on companies with strong network effects and viral potential

Notable Consumer Investments: Twitter, Uber, Stack Overflow

What He Brings: Deep understanding of platform businesses and network effects

Investment Range: $50K - $200K per deal

Marc Andreessen

Co-founder of Andreessen Horowitz

Investment Philosophy: "Software is eating the world" - focuses on tech-enabled consumer services

Notable Consumer Investments: Skype, Oculus VR, GitHub

What He Brings: Technical expertise and scaling insights

Investment Range: $100K - $500K per deal

Chris Sacca

Former Lowercase Capital

Investment Philosophy: Invests in consumer products with mass market appeal

Notable Consumer Investments: Twitter, Uber, Instagram

What He Brings: Consumer marketing expertise and media relationships

Investment Range: $75K - $250K per deal

What Consumer Tech Angels Look For: The Investment Criteria

- Strong Product-Market Fit Signals

- Early user traction and engagement metrics

- Evidence of organic user growth

- Clear value proposition for target consumers

- Scalable Business Model

- Path to monetization clearly defined

- Unit economics that improve with scale

- Defensible competitive advantages

- Experienced Team

- Prior experience in consumer markets

- Technical capabilities to execute vision

- Ability to attract and retain talent

- Large Market Opportunity

- Total addressable market exceeding $1 billion

- Growing market trends supporting expansion

- Multiple monetization pathways

- Traction and Validation

- Prototype or minimum viable product

- Early customer feedback and adoption

- Revenue generation or clear path to revenue

It’s easy to overlook how differently marketplace and consumer business models perform under funding pressure, the funding guide for consumer & marketplace startups helps clarify the trade-offs.

Advantages vs. Challenges of Angel Investment

Advantages for Startups

Speed and Flexibility

Angel investors can make decisions quickly, often within weeks rather than months required by institutional investors.

Industry Expertise

Consumer tech angels bring deep sector knowledge and can provide strategic guidance on product development, marketing, and scaling.

Network Access

Angels often provide introductions to customers, partners, and follow-on investors that can accelerate growth.

Mentorship Value

Beyond capital, angels offer ongoing mentorship and support throughout the startup journey. Even in the earliest stages, knowing how consumer behavior data impacts investor confidence is critical, especially in this guide on early-stage funding for consumer startups.

Challenges to Consider

- Limited Capital

Individual angel checks are typically smaller than VC investments, potentially requiring multiple investors. - Equity Dilution

Angel rounds can involve giving up 15-25% equity, impacting founder ownership. - Varying Involvement

Some angels are highly involved while others are passive, creating uncertainty about ongoing support. - Due Diligence Complexity

Managing relationships with multiple angel investors can be administratively complex.

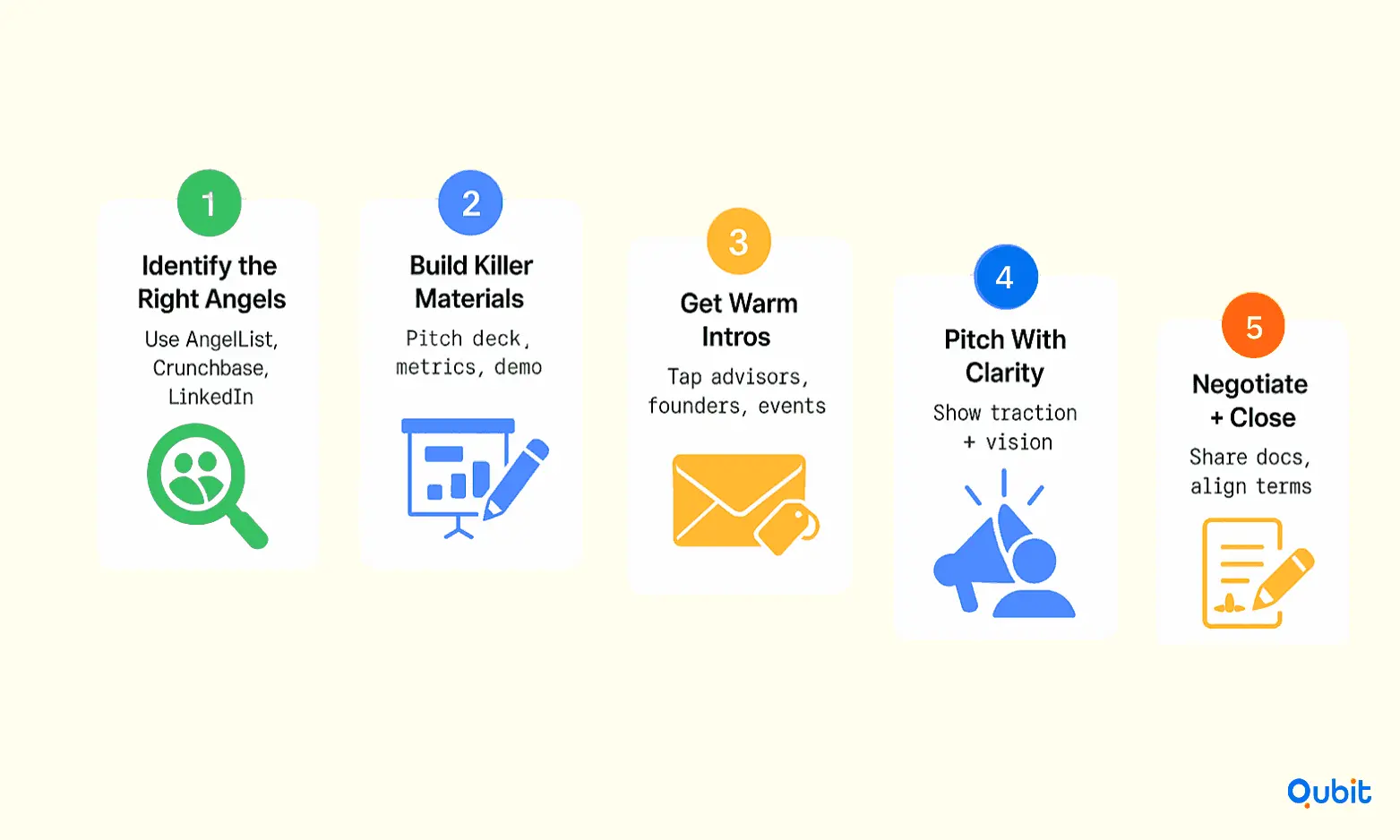

How to Approach Consumer Tech Angels: A Step-by-Step Process

Step 1: Research and Identification

Build your target investor list by researching angels who have invested in companies similar to yours

- Use platforms like AngelList, Crunchbase, and LinkedIn

- Attend industry events and startup meetups

- Leverage warm introductions through mutual connections

Step 2: Prepare Your Materials

Create compelling pitch materials that clearly communicate your value proposition

- Executive summary (1-2 pages)

- Pitch deck (10-12 slides maximum)

- Financial projections and key metrics

- Product demonstration or prototype

Step 3: Secure Warm Introductions

Leverage your network to get introduced to potential angels

- Ask advisors, mentors, and other entrepreneurs for introductions

- Participate in accelerator programs that provide investor access

- Attend pitch events and demo days

Step 4: Initial Outreach

Craft personalized messages that demonstrate knowledge of the investor's background

- Reference their previous investments

- Explain why your startup fits their investment thesis

- Request a brief meeting rather than immediate investment

Step 5: The Pitch Meeting

Present your vision clearly and concisely

- Focus on the problem you're solving and market opportunity

- Demonstrate early traction and user validation

- Be prepared to answer detailed questions about your business model

Step 6: Due Diligence and Terms

Navigate the investment process professionally

- Provide requested financial and legal documentation

- Negotiate terms that protect both parties' interests

- Maintain communication throughout the process

If you’re at the “too early for Series A, too big for angels” stage, exploring all seed funding options for consumer startups becomes a survival strategy.

Success Stories: Learning from Consumer Tech Wins

The consumer tech angel investment landscape is filled with remarkable success stories that demonstrate the transformative power of early-stage funding. Instagram's journey from concept to $1 billion Facebook acquisition in just two years exemplifies how angel investment can accelerate consumer product development. Early angels who believed in the photo-sharing concept when it was just an idea saw extraordinary returns while helping shape one of the most influential consumer platforms ever created.

Similarly, Uber's early angel investors recognized the massive market opportunity in transforming urban transportation long before traditional VCs understood the potential. These prescient angels provided not just capital but strategic guidance that helped Uber navigate regulatory challenges and scale globally.

Spotify's angel investors demonstrated the importance of patient capital in consumer markets where network effects take time to develop. Early backers understood that music streaming required building both user base and content relationships simultaneously, requiring sustained investment before achieving profitability.

These success stories share common themes: visionary angels who understood consumer behavior, patient capital that allowed for proper market development, and strategic guidance that helped founders navigate complex scaling challenges. For today's consumer tech entrepreneurs, these examples illustrate the transformative potential of finding the right angel investment partners.

Conclusion

The consumer technology sector continues evolving rapidly, with new categories like augmented reality, artificial intelligence applications, and sustainable technology creating fresh opportunities for angel investment. The most successful consumer tech angels are those who combine financial resources with deep market understanding, helping entrepreneurs build products that genuinely improve consumers' lives while creating sustainable, scalable businesses.

For founders seeking angel investment in consumer technology, success depends on thorough preparation, strategic targeting of appropriate investors, and building relationships that extend far beyond simple financial transactions.

The right angel investors become true partners in the entrepreneurial journey, providing guidance, connections, and support. Our Investor Outreach helps your message cut through the noise and helps to connect with the investors who actually “get” you. Connect Now!

Key Takeaways

- Consumer tech angels invest early, betting on vision, not just traction, and move faster than VCs.

- They bring more than money, think product advice, brand instincts, and intros that actually matter.

- Top angels like Naval and Sacca win by spotting viral potential and user obsession before the hype.

- Startups need real user love, a killer market, and scalable models to catch angel interest.

- Getting funded is part hustle, part homework, targeted outreach, warm intros, and pitch clarity are non-negotiable.

Frequently asked Questions

How do I know if an angel investor is right for my consumer tech startup?

Look for investors who have experience in your specific consumer category and can provide strategic value beyond capital. Check their portfolio for similar companies and ask for references from their existing investments.