Securing investor interest often hinges on presenting a well-organized set of investment documents. These materials provide clarity, instill confidence, and demonstrate your business's readiness for funding. From detailed financial models to pitch decks, each document plays a vital role in painting a comprehensive picture of your venture’s potential.

Investor requirements have evolved in recent years. Series A funding benchmarks show rounds between $6M and $30M, while post‐money valuations range $20M-$50M. These structured deals demand precise documentation. It demonstrates that startups must meet new standards for funding success.

Hiring a financial modeling consultant can help refine your projections and improve investor presentations. Explore the benefits of working with consultants to maximize value for your business. Whether you're seeking seed capital or preparing for a major funding round, understanding what investors look for is crucial.

This guide will help you understand the importance of financial documents to the investors and how to present these documents to them to get a desired funding. Let’s dive into the essential components investors expect, ensuring your documentation stands out and meets their expectations.

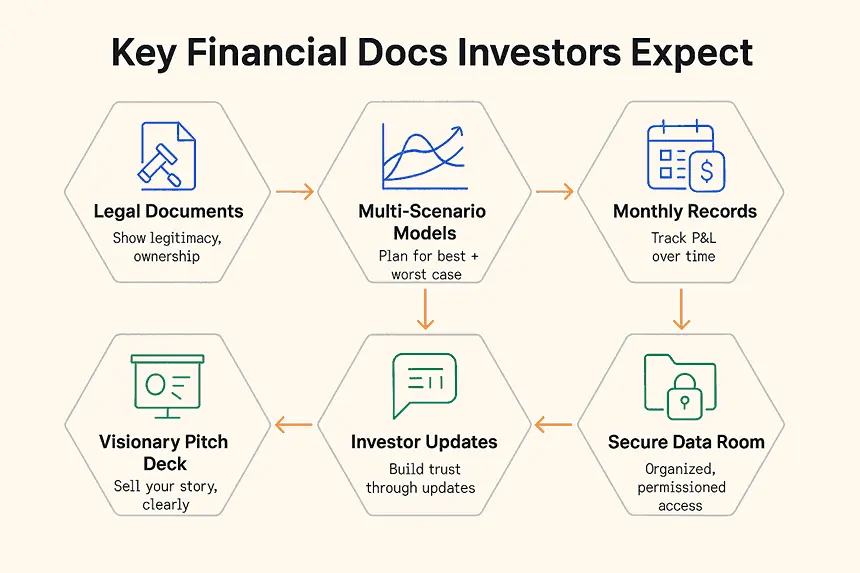

6 Key Investment Documents for Investors

Securing investor confidence requires more than just a great idea, it demands thorough preparation and documentation. Investors rely on specific investment documents. These documents help them evaluate operational performance and predict future growth.

For startups at the earliest stages in 2025, pre-seed round size averages $700K, with valuations near $17M and typical equity dilution from 10–15%. These figures set clear expectations for founders' document preparation. Below, we outline the five essential investment documents every startup needs to present a compelling case.

1. Legal and Administrative Documents

Before diving into financials, ensure your legal and administrative paperwork is in order. Investors will scrutinize these documents during the due diligence process to confirm your business’s legitimacy and compliance. From incorporation certificates to intellectual property agreements, these documents establish trust and credibility.

2. Multi-Scenario Financial Models

A dynamic financial model is indispensable for demonstrating your startup’s revenue potential and operational sustainability. Investors expect projections that account for various scenarios, including optimistic, realistic, and conservative outcomes. Financial models that include top-line growth metrics offer a clearer view of scalability, aligning with principles in how to create a financial model for investors. Accurate projections enhance strategic planning and investor appeal.

3. Monthly Financial Records

Transparency in financial performance is crucial. Providing detailed monthly financial records, including profit and loss statements, allows investors to track your startup’s progress over time. For example, including income statements can showcase profitability trends and operational efficiency. These records not only build confidence but also demonstrate your commitment to accountability.

4. A Visionary Pitch Deck

Your pitch deck is your opportunity to tell a compelling story about your startup. It should combine data-driven insights with a clear vision for the future. Highlighting metrics like customer retention can emphasize the long-term value of your business model. A well-crafted pitch deck should be concise, visually engaging, and tailored to your audience.

5. Regular Investor Updates

Investor scrutiny has intensified. due diligence timelines now range from 4 to 8 weeks for financial and legal document review. This increased review window emphasizes the necessity of complete and accurate documents, helping founders avoid costly delays.

Maintaining transparency doesn’t end after securing funding. Regular updates keep investors informed about your progress and any challenges you may face. Incorporating metrics like net burn in these updates can show how efficiently you’re using funds to sustain operations. Consistent communication fosters trust and strengthens investor relationships over time.

6. Set Up a Secure Investor Data Room

A secure investor data room is essential for organizing and sharing sensitive documents during fundraising. This digital repository allows founders to control access, ensuring only authorized investors can review confidential materials.

By centralizing legal, financial, and operational records, data rooms streamline the due diligence process and reduce administrative friction. Investors appreciate the transparency and efficiency this structure provides, which can accelerate decision-making and build trust.

Founders should tailor the data room contents to their funding stage, including incorporation papers, cap tables, financial models, contracts, and team credentials. Maintaining up-to-date files and clear folder organization demonstrates professionalism and readiness for investment.

By assembling these key documents, startups can confidently approach investors, demonstrating both operational readiness and growth potential.

A Detailed Look at Financial Statements

Financial statements are essential investment documents, offering a detailed snapshot of a company’s fiscal health. The global impact is unmistakable. Q1 2025 venture funding reached $115B, with mega deals driving 61.2% of all VC investments. This underscores how meticulous documentation positions startups for capital in a competitive market.

There are three primary financial statements: balance sheet, income statement, and cash flow statement. Each gives unique insights into a company’s operations and stability.

- The balance sheet outlines a company's assets, liabilities, and equity at a specific point in time. This document helps investors evaluate the organization’s financial position, including its ability to meet short-term and long-term obligations.

- The income statement highlights profitability by detailing revenues, expenses, and net income over a given period. It’s a critical tool for understanding how effectively a company generates profit from its operations.

- The cash flow statement tracks the inflow and outflow of cash, offering clarity on liquidity and operational efficiency. This statement is particularly useful for assessing whether a company has sufficient cash reserves to sustain its operations or fund future growth.

Together, these financial statements form the backbone of an investment dossier, providing investors with the data needed for informed decision-making. Whether evaluating a funding document or conducting due diligence, understanding these reports is key to identifying opportunities and risks.

Essential Legal Documents

Establishing a startup requires more than just a groundbreaking idea; it demands a solid legal foundation. Investment legal documents, such as articles of incorporation, intellectual property protections, and formal contracts, play a pivotal role in ensuring compliance and safeguarding your business. These documents validate your startup’s credibility, defining its structure and operational guidelines while protecting its innovative assets.

- Articles of Incorporation:

Articles of incorporation formalize the existence of your company, outlining its purpose, governance, and ownership. - Intellectual Property Protections:

Intellectual property protections, including trademarks and patents, shield your unique ideas and products from unauthorized use. This helps secure your competitive edge. - Formal Contracts:

Formal contracts are indispensable for defining partnerships, employee agreements, and vendor relationships. They ensure clarity and minimize disputes.

Comprehensive legal documentation not only fosters regulatory compliance but also instills confidence in investors. A well-prepared investment dossier demonstrates professionalism, making your startup more attractive for funding opportunities.

Tax Documentation Essentials

Clear and accurate tax documentation is a cornerstone of financial transparency for any startup. Investment documents, such as detailed tax returns and compliance records, serve as proof of your company’s adherence to fiscal regulations. These records not only validate your startup’s financial health but also demonstrate its commitment to regulatory compliance.

Maintaining these documents reassures potential investors that your business operates with integrity and accountability. From annual tax filings to quarterly compliance updates, having organized and accessible tax paperwork ensures your startup is prepared for due diligence processes. Ensuring legal compliance with financial docs strengthens investor confidence and supports your journey toward securing funding.

Additional Supporting Documents for Investors

Providing supplementary materials such as customer metrics, employee records, and industry-specific reports can significantly enhance an investment report to potential investors. These documents offer a deeper understanding of your startup’s market position and operational performance, complementing the core financial data with valuable context.

By including quantitative validation and detailed market insights, you strengthen your narrative and demonstrate a well-rounded approach to securing funding. For instance, customer retention rates or employee satisfaction scores can highlight operational stability, while industry-specific analyses showcase your adaptability market. Together, these elements create a compelling funding document that instills confidence in investors.

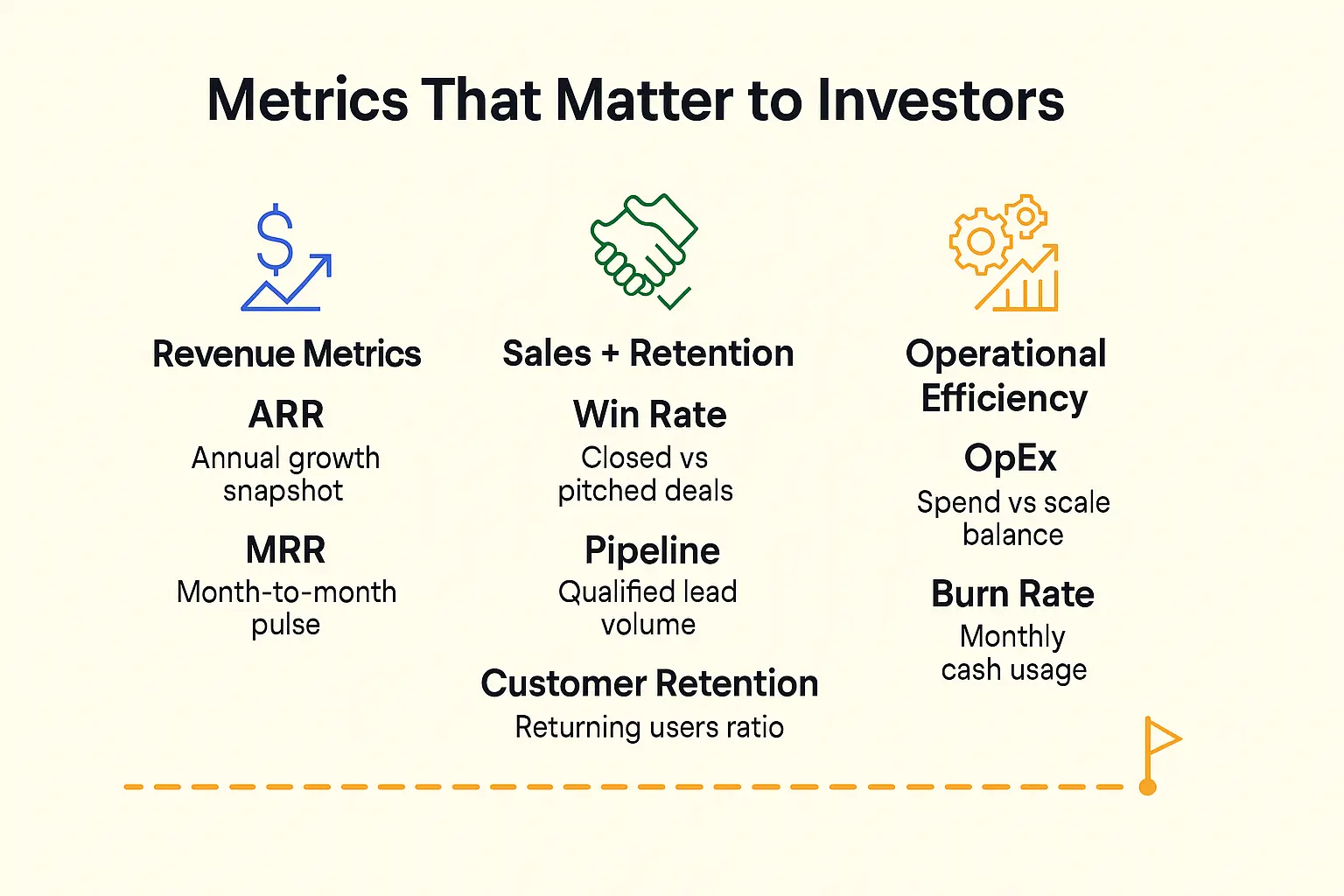

Important Metrics to Share With Investors

Funding timelines and investor caution have shifted. Median wait time between rounds now stands at 696 days as of Q2 2025, with check sizes falling by 3–9%. This trend makes demonstrating strong growth metrics essential to secure meaningful investment.

Showcasing key metrics, startups can provide investors with a clear picture of their growth trajectory and operational efficiency. Metrics such as Annual Recurring Revenue (ARR), Monthly Recurring Revenue (MRR), customer retention rates, and operational expenses are essential for building credibility and demonstrating potential.

1. Revenue Metrics: ARR and MRR

Revenue trends are among the most critical indicators of a company’s performance. Annual Recurring Revenue (ARR), which represents the total revenue generated from customer contracts annually, offers a long-term view of financial stability. Including ARR in revenue metrics to show growth potential is a powerful way to highlight consistent progress. Similarly, Monthly Recurring Revenue (MRR) provides a granular perspective on monthly revenue trends, enabling investors to understand short-term fluctuations and predict future growth.

2. Sales and Retention Insights

Sales performance and customer retention are equally vital. Metrics such as win rates and pipeline generation help quantify sales efficiency, while retention measures indicate customer loyalty and satisfaction. During periods of economic volatility, showcasing sales resilience can further strengthen investor confidence. For example, narratives about maintaining steady sales during downturns can illustrate adaptability and market strength.

3. Operational Expenses

Operational expenses provide insight into how efficiently resources are managed. Transparent reporting on cost structures and spending patterns can reassure investors that the company is optimizing its budget while scaling operations.

Effective financial due diligence preparation helps align metrics with investor expectations, a critical component of how to prepare for financial due diligence.

Business Plan for Investment in Startup Companies

A well-crafted business plan is essential for securing investment for startup companies. A recent example, Morgan Stanley Expansion Capital funding resulted in $18 million raised using a five-point pitch deck. Their method streamlined pitching and proved the importance of document clarity and strategic presentation for attracting major investors.

Key Components of a Business Plan

- Executive Summary

The executive summary encapsulates the essence of the business. It highlights the mission, objectives, and key strategies, offering a snapshot of the company’s potential. This section is often the first impression for investors, making clarity and precision essential. - Market Analysis

A thorough market analysis demonstrates an understanding of industry trends, target demographics, and competitive positioning. By showcasing data-driven insights, businesses can validate their market opportunity and establish credibility. - Financial Projections

Financial projections provide a roadmap for profitability and growth. This section includes revenue forecasts, expense estimates, and funding requirements, reassuring investors of the startup’s financial viability.

A robust business plan not only acts as an investment report to potential investors but also lays the foundation for sustainable growth.

Conclusion

Organizing essential financial documents is more than a task—it's a strategic move that can define your startup's success. By implementing the strategies outlined, you ensure your records are not only accessible but also impactful in building investor trust. Each document plays a vital role in showcasing transparency, credibility, and preparedness, which are critical in securing funding.

Now is the time to act. Whether you're refining your pitch or preparing for investor meetings, having a solid foundation of well-organized financial documents can make all the difference.

If you’re ready to elevate your investor communications and secure the right funding, our Investor Outreach service can help you connect with the ideal investors. Let us support you in turning your vision into reality.

Key Takeaways

- Comprehensive investment documents build investor confidence.

- Key documents include administrative basics, robust financial models, detailed historical data, persuasive pitch decks, and regular investor updates.

- Advanced metrics such as ARR, MRR, and retention rates are essential for demonstrating growth potential.

- Automated platforms like Mosaic boost accuracy and efficiency in reporting.

- A clear narrative supported by detailed documentation is crucial for attracting the right investors.

Frequently asked Questions

What are examples of financial documents investors need?

Examples of financial documents include balance sheets, income statements, cash flow statements, tax records, and business financial models. These help showcase fiscal health and growth potential.