The e-commerce sector is entering a hyper-growth phase, not a slow climb. By 2030, the global e-commerce market is projected to reach USD 73.52 trillion, compounding at roughly 19.2% CAGR. That kind of scale and speed is reshaping how capital flows into the space, and which startups actually get backed.

For founders, this means two things: the opportunity set is massive, and so is the competition. Understanding who is investing and what they’re looking for is now a core part of your strategy, not an afterthought.

This blog breaks down the top e-commerce VC firms actively backing startups in 2025 and the key investment trends shaping the category.

Let’s jump right in!

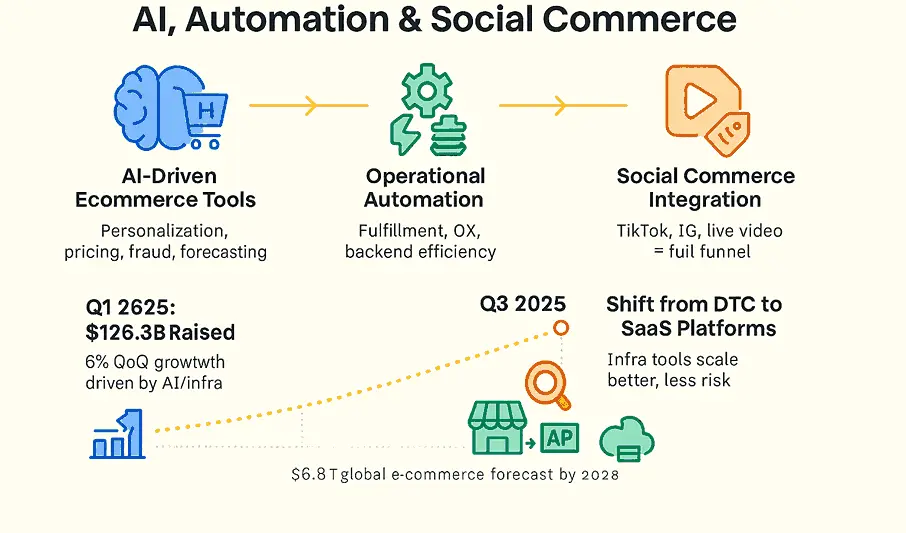

Ecommerce Venture Capital Growth Driven by AI, Automation & Social Commerce

The e-commerce funding landscape has snapped back with force. After a reset period, capital rebounded in 2024 and picked up even more momentum in 2025 as investors doubled down on tech-led models rather than pure branding plays.

The shift shows up clearly in the numbers. In Q1 2025, global venture funding reached USD 126.3 billion, a 6% increase from the previous quarter, momentum largely powered by AI-driven and automation-focused platforms. Later in the year, Q3 2025 global VC deal value jumped nearly 45% year-on-year to USD 120.7 billion, underscoring just how strong appetite has become for scalable, technology-first models.

Three forces are driving this surge:

- AI-powered ecommerce tools – from personalization engines and dynamic pricing to fraud detection and inventory optimization.

- Automation technologies – streamlining fulfillment, customer service, and backend operations to improve margins.

- Social commerce trends – turning platforms like TikTok, Instagram, and live shopping into full-funnel sales channels instead of just top-of-funnel marketing.

As a result, investors are shifting away from traditional DTC-only brands and toward infrastructure, platforms, and SaaS-style tools that can plug into many merchants and markets. These models scale faster, have better unit economics, and create more defensible moats, hence the disproportionate flow of capital into them.

For founders, the message is clear: you’re far more likely to attract serious investment if you’re building tech that powers ecommerce, not just another store competing on ad spend and aesthetics. Gain deeper insights into funding approaches with the ecommerce startup fundraising strategies.

The Shift from DTC Brands to Scalable Platforms

A significant pivot in retail investment priorities has been the move away from traditional DTC models toward scalable e-commerce platforms. Early data indicates that this shift is driving larger check sizes in 2025, as investors prioritize businesses with robust technological foundations. According to insights, the decline in DTC funding highlights an investor pivot toward more scalable e-commerce platforms. This trend reflects a growing preference for platforms capable of adapting to market demands and leveraging AI-driven tools to optimize operations.

AI Innovations Reshaping E-commerce Retail

Artificial intelligence has emerged as a cornerstone of e-commerce innovation. Platforms adopting AI solutions, such as Graas.ai, are gaining a competitive edge by automating inventory forecasting, optimizing pricing, and managing inventory across 100+ platforms. Graas.ai supports over 2,000 brands, has processed $1+ billion in GMV, and operates across 7 countries in Asia. Shopify’s launch of ‘Magic’ in 2024 marked a significant milestone in AI-driven automation, influencing broader industry trends. By streamlining forecasting and improving customer acquisition costs, AI-powered retail tech is enabling startups to achieve operational excellence and scale faster.

The Maturation of Social Commerce

Social commerce has evolved from a niche strategy to a mainstream driver of e-commerce growth. In 2025, social platforms are not just facilitating transactions but are actively shaping consumer behavior and brand loyalty. This maturation is prompting investors to prioritize businesses that integrate social commerce seamlessly into their operations.

With global online retail sales expected to reach $6.8 trillion by 2028, social commerce plays a crucial role in this growth. Experts forecast a CAGR of 8.9% from 2023 to 2028, underscoring the sustained rise in digital adoption.

Top Ecommerce Venture Capital Firms in 2025

Explore the leading ecommerce venture capital firms driving innovation and growth in 2025.

Active engagement often distinguishes leading firms. TELUS Ventures exemplifies this with over 200 investments in Vancouver, showcasing continual support for e-commerce and technology startups. Their dynamic approach reflects the performance expected from top-tier venture capital organizations in 2025.

1. Sequoia Capital

- Focus: Marketplaces, logistics, social commerce, SaaS (Software-as-a-Service) for retail

- Why Top: Sequoia is one of the world’s most respected VC firms, with a history of backing category-defining e-commerce and tech companies such as Instacart, DoorDash, and Shopify. In 2025, Sequoia continues to invest in AI-driven retail tech and omnichannel commerce platforms.

- Notable Portfolio: Instacart, DoorDash, Shopify

- Stage & Check Size: Series A to Growth rounds, typically investing $10M–$100M

2. Andreessen Horowitz (a16z)

- Focus: AI/automation in retail, marketplaces, creator economy

- Why Top: a16z is highly active in e-commerce, investing in platforms that leverage automation, personalization, and creator monetization. Their portfolio includes marketplace disruptors and social commerce tools.

3. Accel

- Focus: E-commerce infrastructure, SaaS (Software-as-a-Service) for retail, global marketplaces

- Why Top: Accel has backed major e-commerce successes and is known for supporting startups that scale internationally from day one. They are active in funding logistics, fulfillment, and customer retention platforms.

4. Forerunner Ventures

- Focus: Consumer brands, Direct-to-Consumer (DTC), digital commerce, customer engagement

- Why Top: Forerunner is a specialist in consumer and e-commerce, with a track record of investing in iconic DTC brands like Warby Parker, Dollar Shave Club, and Glossier. The firm is known for deep operational guidance in brand-building and digital growth.

5. L Catterton

- Focus: Consumer lifestyle, health, retail, global brand expansion

- Why Top: L Catterton is one of the largest consumer-focused VC and PE firms, investing in high-growth e-commerce and lifestyle brands such as Peloton and Oatly. Their expertise in scaling global brands makes them a preferred choice for ambitious e-commerce startups.

6. Bessemer Venture Partners

- Focus: SaaS (Software-as-a-Service), marketplaces, verticalized commerce

- Why Top: Bessemer is a global VC powerhouse with a strong e-commerce track record, investing in infrastructure, SaaS for online retail, and vertical marketplaces.

7. Index Ventures

- Focus: Marketplaces, SaaS (Software-as-a-Service), social commerce

- Why Top: Index has ramped up e-commerce investments, backing companies like Faire, Whatnot, and Swap. They are known for supporting startups at the intersection of tech and retail innovation.

8. Lightspeed Venture Partners

- Focus: Enterprise tech, consumer, e-commerce, global reach

- Why Top: Lightspeed invests across sectors, including e-commerce, with a hands-on approach and global presence. Their portfolio includes Snap, AppDynamics, and many fast-scaling retail tech startups.

9. Shopify Ventures

- Focus: E-commerce enablement, automation, retail SaaS

- Why Top: Shopify’s corporate VC arm invests in startups that enhance the Shopify ecosystem, including automation, logistics, and personalization tools.

10. Amazon and Walmart Corporate VC

- Focus: Ecosystem expansion, retail tech, logistics

- Why Top: Both giants deploy strategic capital into startups that complement their platforms, from logistics optimization to AI-driven retail analytics.

11. ICONIQ Growth

- Focus: Marketplaces, SaaS (Software-as-a-Service), data-driven commerce

- Why Top: ICONIQ has increased its e-commerce investments, supporting high-growth companies in the retail tech and marketplace space.

12. General Catalyst

- Focus: Consumer tech, marketplaces, SaaS (Software-as-a-Service)

- Why Top: General Catalyst is recognized for backing innovative e-commerce and retail tech startups, with a focus on scalable, data-driven business models.

13. Techstars

- Focus: Early-stage, pre-seed, e-commerce accelerators

- Why Top: Techstars is a leading accelerator, supporting early-stage e-commerce startups with funding, mentorship, and global networks.

14. Global Founders Capital

- Focus: Global e-commerce, SaaS (Software-as-a-Service), marketplaces

- Why Top: GFC is active in e-commerce investments worldwide, backing startups across the value chain.

15. Mayfield Fund, DCM Ventures, Peak XV Partners, Bain Capital Ventures

- Focus: Diverse e-commerce and consumer tech investments

- Why Top: These firms round out the top tier with notable investments in high-growth e-commerce platforms and supporting technologies.

Aligning Startup Profile With VC Firm Selection

Building on the profiles above, founders should match their startup’s funding stage, sector, and geographic focus with each VC firm’s investment criteria. This alignment increases the likelihood of securing investment and fosters stronger partnerships. Carefully researching firm portfolios and stated preferences helps avoid wasted outreach and improves funding outcomes. Prioritizing fit ensures your pitch resonates with investors and accelerates the fundraising process.

Key Trends Driving Venture Capital Investment in E-commerce

Industry impact is clear from sector benchmarks. In Q2 2025, e-commerce contributed 15.5% of total U.S. retail sales, reaching USD 292.9 billion in transactions. This share shows how digital transformation and investment trends convert into tangible, rapid retail growth. Several key trends are reshaping ecommerce venture capital investment strategies:

- AI-Powered Retail Tech: Startups leveraging AI are streamlining forecasting and reducing customer acquisition costs, making them attractive to investors.

- Automation Tools: Solutions like Shopify Magic are transforming inventory management and personalization, setting new benchmarks for operational efficiency.

- Scalable Platforms: The shift from Direct-to-Consumer (DTC) brands to scalable platforms is leading to larger investment rounds and higher growth potential.

- Social Commerce Integration: Businesses that effectively incorporate social commerce into their models are capturing consumer attention and driving sales.

- Cross-Border Expansion: Investors are backing startups that simplify global payments, localization, and logistics.

- Sustainable & Ethical Commerce: Eco-friendly practices and transparent supply chains are drawing impact-focused funds.

- Live Commerce & Interactive Shopping: Real-time selling via live streams and AR/VR experiences is emerging as a high-growth investment area.

As these trends continue to evolve, they are redefining the priorities of investors and reshaping the future of e-commerce.

VC Evaluation and Due Diligence Process

- Deal sourcing begins with investor networks, curated platforms, and inbound founder pitches relevant to e-commerce trends.

- Rigorous due diligence follows, examining market opportunity, financials, team strength, and product scalability for risk assessment.

- Investment committee review weighs strategic fit, growth potential, and defensible moats before approving funding decisions.

- Term negotiation establishes investment terms, equity stakes, and post-investment support expectations for both parties.

- Ongoing strategic support includes mentorship, operational guidance, and network access to accelerate startup growth after funding.

Risks of Weak Unit Economics in VC Pitches

Emphasizing strong unit economics is crucial when pitching to e-commerce VCs. Failing to present clear metrics like CAC payback periods or retention rates can undermine investor confidence. Without a demonstrated path to profitability, founders risk rejection even if their product is innovative. Preparing robust financial data ensures your startup stands out and meets investor expectations.

Future Outlook: Ecommerce Venture Capital Funding Trends for 2025

Ecommerce is heading into 2025 with a strong tailwind. In H1 2025, global venture capital funding was up 25%, a clear signal that investors are leaning back into growth, especially where technology, data, and scalability intersect.

Within that broader surge, ecommerce capital is flowing toward platforms and tools, not just storefronts. Investors are prioritizing businesses that use AI, automation, blockchain, and advanced analytics to drive personalization, conversion, and operational efficiency at scale. Think infrastructure, enablement, and intelligence layers rather than another DTC brand fighting over ad spend.

For founders, the implication is simple: the best-funded ecommerce plays in 2025 will be those that look and behave like tech companies, built on defensible IP, leverage, and efficiency, not just digital retailers.

Emerging Technologies Shaping E-commerce Venture Capital

Artificial intelligence is revolutionizing e-commerce by enabling hyper-personalized customer experiences and predictive analytics. This shift is attracting funding toward platforms that integrate AI-driven solutions to optimize operations and enhance user engagement. Similarly, blockchain technology is paving the way for decentralized funding mechanisms.

For instance, Uzum, backed by $70M equity financing led by Tencent and VR Capital, highlights how integrated fintech and e-commerce ecosystems can scale rapidly. Uzum reached a $1.5B valuation, serves 17+ million monthly users, and issued 2+ million Visa debit cards in Uzbekistan.

E-commerce Market Trends and Venture Capital Strategies

The rebound in venture capital activity is evident in the 14.5% quarter-over-quarter growth in Q1 2025 e-commerce enablement deals, totaling 134 transactions. 36% of total VC deal value involved corporates and Corporate Venture Capital (CVC) firms, highlighting their strategic role in the investment landscape.

As the ecosystem evolves, platforms like Parafin are becoming essential tools for connecting SMBs with tailored financial services. Parafin's ML-based underwriting has driven a 400% growth in transaction volumes since Series B, serving 700,000 SMBs and forecasting profitability within six months of its $100M Series C.

Conclusion

E-commerce isn’t just growing, it’s compounding into a different beast. Capital is flowing back in, but it’s not chasing “nice brand, nice Instagram” anymore. It’s chasing infrastructure, AI-native tools, automation, social commerce rails, and platforms that can plug into hundreds of merchants, not just one.

For founders, that rewrites the playbook. If you want serious VC attention in 2025, you’re positioning yourself as a tech company that happens to sit in e-commerce, not as a store with some tooling bolted on. That means sharp unit economics, clear platform leverage, and a story that fits where the smartest capital is actually going: enablement, intelligence, and global scale.

If you’re preparing to pitch your startup and need a compelling deck, we at Qubit Capital can help with our ecommerce fundraising assistance. Let us assist you in crafting a presentation that captures your vision and secures the funding you need.

Key Takeaways

- Capital is shifting from DTC brands to scalable ecommerce infrastructure, platforms, and SaaS.

- AI, automation, and social commerce are now the core filters for how VCs prioritize deals.

- The strongest firms in this space (Sequoia, a16z, Accel, Forerunner, etc.) want tech leverage, not just GMV screenshots.

- Clean unit economics and a clear platform moat matter more than aesthetics or ad-spend-driven growth.

- You raise faster when your pitch says “we power ecommerce at scale,” not “we’re another online store.”

Frequently asked Questions

How are AI advancements impacting venture capital trends in e-commerce?

AI is driving VC interest by improving operational efficiency and personalization in e-commerce startups. Many firms now prioritize investments in AI-powered platforms.