Securing the right investors isn’t just about finding financial backers—it’s about aligning with partners who share your vision, understand your objectives, and can contribute meaningfully to your journey.

With countless businesses vying for attention, how do you ensure that you’re not only noticed but also chosen by investors who truly resonate with your mission?

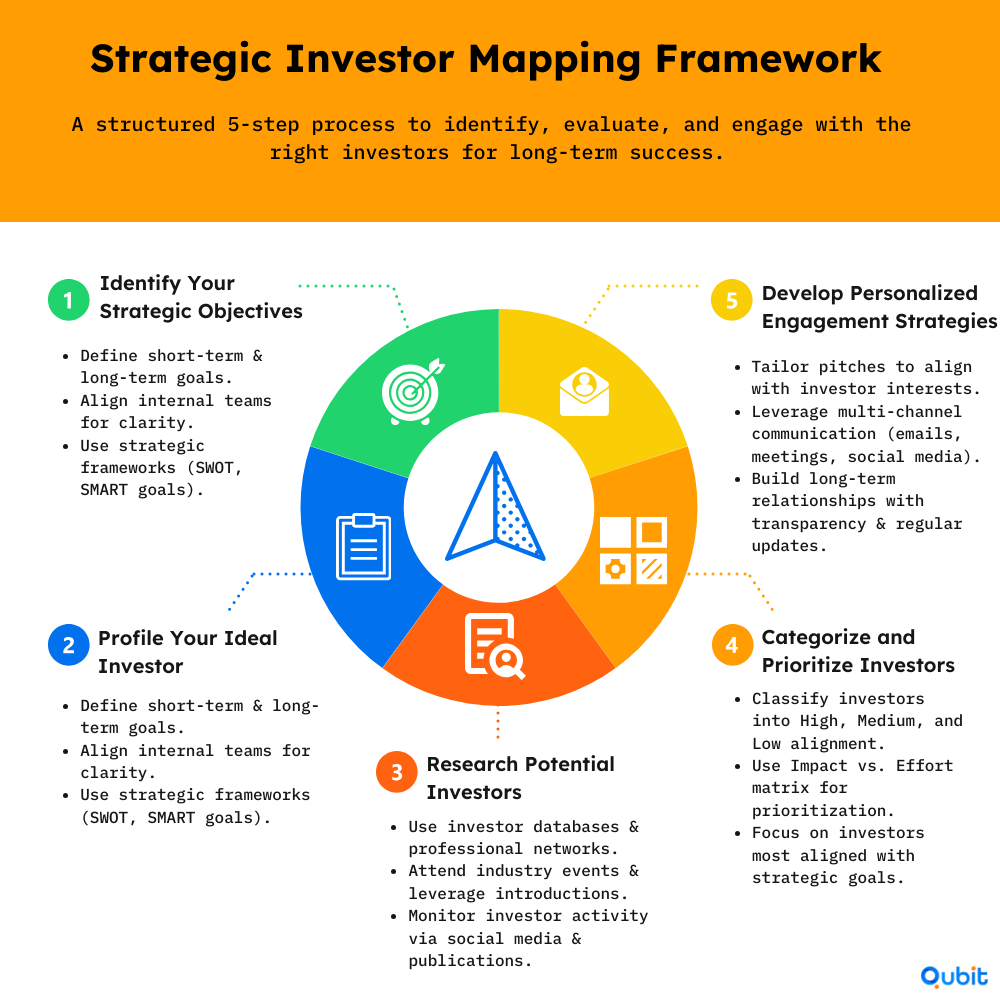

Welcome to the world of strategic investor mapping. This systematic process enables organizations to methodically identify, evaluate, and engage with potential investors who align perfectly with their strategic goals.

We’ll explore the intricacies of strategic investor mapping in this comprehensive guide. You’ll discover detailed methodologies, practical tools like templates and checklists, and actionable strategies that demystify the process.

Understanding Strategic Investor Mapping

What Is Strategic Investor Mapping?

Strategic investor mapping is a critical process that can define the trajectory of your organization’s growth. At its core, it involves systematically identifying and evaluating potential investors who not only are interested in funding your business but also align with your strategic objectives. This involves:- Profiling Your Ideal Investor: Understanding the characteristics, preferences, and goals of investors who would be the best fit for your organization.

- Researching Their Interests and Investment Patterns: Delving into their investment history, focus areas, and previous collaborations.

- Developing Personalized Engagement Strategies: Crafting tailored approaches to connect with investors in a way that resonates with them.

Why Aligning with Investors Matters

Aligning with the right investors supports strategic investment success for several reasons:- Shared Vision and Goals: When investors and organizations share a common vision, it fosters a collaborative environment where both parties work toward the same objectives.

- Value-Added Contributions: Aligned investors often bring more than capital—they offer industry expertise, strategic guidance, networks, and resources that can accelerate growth.

- Mitigated Risks: Misaligned investors may push for strategies that conflict with your long-term goals, leading to internal conflicts and potential derailment of your strategic plans.

- Enhanced Trust and Communication: Alignment builds trust, facilitating open communication and more effective problem-solving.

The Impact on Long-Term Success

Organizations that effectively employ strategic investor mapping reap significant benefits:- Accelerated Growth: Partnering with investors who provide strategic support leads to more effective scaling.

- Market Expansion: Aligned investors may have networks and resources that facilitate entry into new markets.

- Innovative Advancements: Investors with a shared vision support creative projects that others might deem too risky.

The Benefits of Strategic Investor Mapping

Enhanced Investor Alignment

Ensuring your investors share your vision and objectives brings numerous advantages:- Unified Direction: With shared goals, the organization and investors move in the same direction, reducing conflicts and misaligned expectations.

- Strategic Support: Aligned investors are more likely to back strategic decisions, even during challenging times, because they believe in the long-term vision.

- Synergistic Collaboration: Joint efforts become more productive when both parties share common ground, leading to creative solutions and improved outcomes.

Improved Fundraising Efficiency

- Targeted Outreach: Understanding your ideal investors allows you to tailor your pitches and communications, increasing the likelihood of a positive response.

- Resource Optimization: By concentrating on promising leads, you avoid wasting time and resources on unlikely prospects.

- Shortened Fundraising Cycles: An efficient process helps secure necessary funding more quickly, allowing you to focus on execution.

Stronger Investor Relationships

Building lasting partnerships founded on mutual goals enhances organizational health:- Long-Term Commitment: Investors who are aligned are more likely to support the company through various growth stages.

- Open Communication: Trust fosters transparency, enabling honest discussions about challenges and opportunities.

- Collaborative Growth: As the company grows, investors benefit, reinforcing their commitment to the organization.

Better Strategic Decision-Making

Aligned investors contribute to more informed and effective decisions:- Expertise and Insight: Investors bring valuable industry experience and knowledge that inform strategic choices.

- Aligned Risk Appetite: Sharing perspectives on risk leads to support for bold initiatives aligning with long-term goals.

- Collective Problem-Solving: Challenges become collaborative efforts, with investors actively contributing to solutions.

Steps to Perform Strategic Investor Mapping

Step 1: Identify Your Strategic Objectives

Before finding investors who align with your organization, you must clearly understand your own strategic objectives. Define Clear Short-Term and Long-Term Goals- Short-Term Goals: Objectives to achieve within the next 12–24 months, such as launching a new product line or entering a new market.

- Long-Term Goals: Goals extending beyond two years that shape your organization’s future direction, like becoming a market leader or establishing a global presence.

- Collaborative Planning: Engage key stakeholders to ensure a unified understanding of the organization’s direction.

- Documentation: Create a strategic plan outlining goals, strategies, and success metrics.

- Communication: Regularly update the organization on progress to maintain alignment.

- Use Strategic Frameworks: Tools like SWOT analysis or the Balanced Scorecard help define and align objectives.

- Set SMART Goals: Ensure objectives are Specific, Measurable, Achievable, Relevant, and Time-bound.

Step 2: Profile Your Ideal Investor

Creating a detailed profile of your ideal investor helps focus efforts on the most promising prospects. Determine Characteristics That Match Your Objectives- Industry Focus: Investors with a track record in your industry are more likely to understand and support your vision.

- Investment Size and Stage: Match your funding needs with investors’ typical investment amounts and stages.

- Geographical Preferences: Consider investors’ regional preferences or limitations.

- Value-Added Services: Identify investors who provide guidance, mentorship, or access to networks.

- Investment Philosophy: Are they long-term investors or looking for quick exits?

- Risk Tolerance: Understanding their risk appetite helps align expectations.

- Cultural Fit: Shared values and business practices lead to smoother relationships.

- Develop Investor Personas: Similar to customer personas, create profiles that encapsulate your ideal investors’ traits.

- Use Templates: Utilize templates to ensure consistency in profiling.

Step 3: Research Potential Investors

With your ideal investor profile in hand, identify real-world investors who fit the criteria. Utilize Databases- Professional Platforms: Use platforms that offer extensive data on investors, including past investments and contact information.

- Company Websites and LinkedIn: Review investors’ focus areas and investment criteria.

- Professional Networks: Leverage industry connections for introductions and recommendations.

- Conferences and Seminars: Attend events where investors participate, offering opportunities for engagement.

- Incubators and Accelerators: These organizations often have investor networks and can facilitate introductions.

- LinkedIn: Engage with investors by interacting with their posts and joining relevant groups.

- Twitter and Blogs: Follow investors’ thought leadership to gain insights into their interests.

- Create a Master List: Compile a list of potential investors with relevant details and notes.

- Monitor News and Publications: Stay informed about recent deals and shifts in investor focus.

Step 4: Categorize and Prioritize Investors

Organizing your list allows you to focus on prospects most likely to align with your goals. Create Categories Based on Alignment Levels- High Alignment: Investors closely matching your ideal profile.

- Medium Alignment: Investors meeting several criteria but with some differences.

- Low Alignment: Investors meeting minimal criteria.

- Impact vs. Effort Matrix: Focus on investors requiring reasonable effort for high potential impact.

- Scoring System: Assign values to criteria like industry focus and alignment with values to calculate a total score.

- Visual Tools: Use spreadsheets, CRM systems, or software to organize and visualize data.

- Regular Updates: Adjust categorizations as you gather more information.

Step 5: Develop Engagement Strategies

Crafting personalized engagement plans increases the likelihood of successful interactions. Craft Personalized Communication Plans- Initial Outreach: Tailor pitches to highlight how your objectives align with the investor’s interests.

- Ongoing Communication: Provide regular updates and share relevant progress or insights.

- Understand Motivations: Identify what drives each investor—financial returns, social impact, new ideas.

- Appeal to Interests: Align communication to resonate with their motivations.

- International Investors: Be aware of cultural differences in business practices and communication styles.

- Language and Etiquette: Adapt materials and observe proper business etiquette when engaging globally.

- Direct Meetings: Whenever possible, meet in person or via video conferencing to build rapport.

- Thought Leadership: Share articles or insights demonstrating your expertise.

- Social Engagement: Interact with investors on social media professionally.

- Create an Engagement Calendar: Schedule touchpoints and ensure consistent follow-up.

- Use Storytelling: Make pitches more compelling and relatable through stories.

Tools and Resources for Strategic Investor Mapping

Using the right tools effectively streamlines your strategic investor mapping process.Essential Software and Platforms

- CRM Software (e.g., Salesforce, HubSpot)

Manage Investor Relationships and Track Interactions

- Centralized Database: Store all investor information and communications in one place.

- Segmentation: Categorize investors based on alignment, stage, or other criteria.

- Automation: Set up reminders for follow-ups or important events.

- Analytics: Track engagement metrics to assess communication effectiveness.

- Actionable Tips

- Customize Your CRM: Tailor fields and workflows to suit your process.

- Integrate with Other Tools: Sync with email platforms and calendars for seamless operations.

- Investor Databases

Access Comprehensive Investor Profiles

- Investment History: Review past investments to gauge interests.

- Contact Information: Obtain details or mutual connections.

- Industry Trends: Analyze funding flows within your industry.

- Actionable Tips

- Set Alerts: Receive notifications about investor activities.

- Export Data: Use data exports for offline analysis or integration.

- Mapping Software (e.g., MindManager, XMind)

Visualize Connections and Strategize Outreach

- Mind Maps: Create visual representations of investor relationships.

- Flowcharts: Map out your engagement process.

- Collaboration: Share maps with your team for alignment.

- Actionable Tips

- Use Templates: Utilize or create templates for consistent mapping.

- Interactive Elements: Embed links or notes within your maps.

Utilize Templates and Checklists

Offer Downloadable Templates- Investor Profile Template: Include sections for contact details, investment criteria, and notes.

- Prioritization Checklist: Ensure consistent assessment across criteria.

- Objective Setting Checklist: Confirm all objectives are defined.

- Research Checklist: Outline steps for researching investors.

- Engagement Strategy Checklist: Ensure communication plans are personalized.

- Customize Templates: Adjust to fit your organization’s needs.

Access Reliable Data Sources

Emphasize Accurate Data- Decision-Making: Base decisions on facts, not assumptions.

- Credibility: Accurate information enhances your reputation.

- Financial Reports: Access public companies’ financial statements.

- Industry Reports: Utilize reports from reputable firms for insights.

- Government Databases: Refer to resources like the World Bank for data.

- Cross-Reference Data: Verify information across multiple sources.

- Stay Current: Use the most recent data available.

Case Studies of Successful Strategic Investor Mapping

Case Study 1: Achieving Market Expansion Through Strategic Alignment

Background XYZ Tech Solutions, a growing software company specializing in cloud-based solutions for the education sector, aimed to expand into international markets in Asia and Europe. Recognizing the complexities of global expansion, they sought investors offering strategic support beyond funding. Mapping Process- Strategic Objectives: Expand globally while maintaining product localization.

- Ideal Investor Profile: Investors with international presence and education sector experience.

- Research: Identified firms with a track record in international expansion.

- Categorization: Prioritized investors with operations in target regions.

- Personalized Pitches: Highlighted how their platform could adapt to different markets.

- Cultural Nuances: Engaged local experts to understand cultural expectations.

- Secured Funding: Partnered with Global Ventures, a firm with international experience.

- Strategic Partnerships: Leveraged the investor’s network to establish local partnerships.

- Successful Market Entry: Launched in five new countries within 18 months.

Case Study 2: Forming Strategic Partnerships via Investor Mapping

Background GreenInnovate, a renewable energy startup focused on advanced biofuel technology, needed capital and industry expertise to bring their product to market. Mapping Process- Strategic Objectives: Accelerate product development and scale production.

- Ideal Investor Profile: Investors committed to environmental sustainability with biofuel expertise.

- Research: Identified impact investment funds specializing in clean energy.

- Categorization: Prioritized investors involved in policy advocacy.

- Aligning with Investor Goals: Demonstrated how their technology reduces carbon emissions.

- Impact Documentation: Provided projections of environmental benefits.

- Established Partnership: Secured investment from EcoFund Capital.

- Accelerated Development: Received funding and technical expertise.

- Policy Influence: Collaborated to advocate for supportive biofuel policies.

Maintaining and Managing Investor Relationships

Building relationships doesn’t end once investment is secured; ongoing management is crucial for long-term success.Importance of Ongoing Relationship Management

- Continuous Alignment: Regular communication ensures both parties remain aligned as objectives evolve.

- Trust Building: Transparency deepens trust, encouraging continued support.

- Access to Opportunities: Strong relationships open doors to new partnerships and resources.

Best Practices

- Regular Updates: Provide consistent reports on performance and milestones.

- Engagement Opportunities: Invite investors to events or strategy sessions.

- Feedback Mechanisms: Encourage investors to share insights.

Using Technology

- CRM Systems: Use features tailored for investor relations.

- Investor Portals: Offer secure access to key documents and updates.

Using Social Media for Investor Engagement

In the digital age, social media platforms offer valuable channels for engaging with investors.The Role of Social Media

- Visibility: Showcase achievements and thought leadership.

- Engagement: Interact directly with investors and stakeholders.

- Research: Gain insights into investor opinions and activities.

Effective Strategies

- Professional Presence: Maintain active profiles on platforms like LinkedIn.

- Content Sharing: Post updates and insights relevant to your industry.

- Direct Interaction: Comment on and share investors’ content.

Considerations

- Consistency: Align messaging with your brand.

- Compliance: Be mindful of regulations regarding disclosures.

Bringing It All Together

Aligning with the right investors through strategic investor mapping is a strategic investment that propels your organization toward its goals.Key Takeaways

- Aligning with Investors Is Essential: Shared vision leads to productive partnerships.

- Structured Processes Enhance Efficiency: A systematic approach saves time and resources.

- Tools and Resources Are Indispensable: Effective use of technology streamlines the process.

- Personalization and Cultural Awareness Are Critical: Tailored strategies resonate more effectively.

- Examples Demonstrate Benefits: Case studies show tangible applications of these strategies.

Conclusion

By applying the methodologies outlined in this guide, your organization can confidently steer through investor relations. Strategic investor mapping can make the difference between securing capital and forging partnerships that drive lasting success, whether seeking seed funding or aiming for expansion. Ready to improve your strategic investment journey? Contact the experts at Qubit Capital to optimize your investor mapping process and align with partners who share your vision.Key Takeaways

- Strategic investor mapping positions your organization to align with investors who support and enhance your goals.

- A structured, step-by-step process improves the efficiency and effectiveness of your investor outreach.

- Utilizing the right tools and resources streamlines mapping and engagement efforts, saving time and resources.

- Personalization, understanding investor psychology, and considering cultural nuances are critical for successful engagement.

- Examples demonstrate the tangible benefits and applications of these strategies, emphasizing their importance.

Frequently asked Questions

What is strategic investor mapping?

Strategic investor mapping is the process of systematically identifying and evaluating potential investors who align with your organization’s strategic objectives. It involves profiling ideal investors, researching their interests, and developing personalized engagement strategies to connect effectively.

Back

Back