Securing venture debt for asset-heavy PropTech businesses can be a game-changer, offering growth capital without diluting equity. As PropTech companies increasingly rely on physical assets—such as smart building technologies or IoT-enabled infrastructure—venture debt provides a tailored solution to fund expansion while preserving ownership.

Exploring venture debt complements insights from proptech crowdfunding platforms, where equity-based funding options provide alternative strategies for PropTech businesses. This blog will guide you through the essentials of venture debt, focusing on how asset-heavy models can utilize this financing method effectively.

Expect actionable insights, expert quotes, and case studies to help you understand funding strategies and risk mitigation. By the end, you'll be equipped to secure venture debt without compromising your company’s future growth potential.

Understanding Venture Debt for PropTech

What Makes Asset-Heavy Models Attractive

Venture debt lenders love predictable assets. Your property management platform with contracted revenue streams looks appealing. Your real estate lending business with loan portfolios provides tangible collateral. Your PropTech infrastructure investments create measurable value.

Asset-heavy models offer something pure software plays can't – real collateral. Property portfolios, equipment, and contractual cash flows create security for lenders. This reduces their risk and improves your terms.

The Venture Capital Prerequisite

Here's the first rule: venture debt follows equity, never replaces it. Lenders want to see institutional venture capital backing before they'll consider your application. This VC validation serves as their primary underwriting criterion.

Your Series A or later funding rounds signal market confidence. VCs have already done deep due diligence on your business model. Lenders leverage this validation rather than starting their assessment from scratch.

Minimum VC Requirements:

- At least one institutional funding round completed

- Recognizable VC investors with strong track records

- Recent funding (typically within 12-18 months)

- Clear path to next equity round

Preparing Your Asset-Heavy Model for Venture Debt

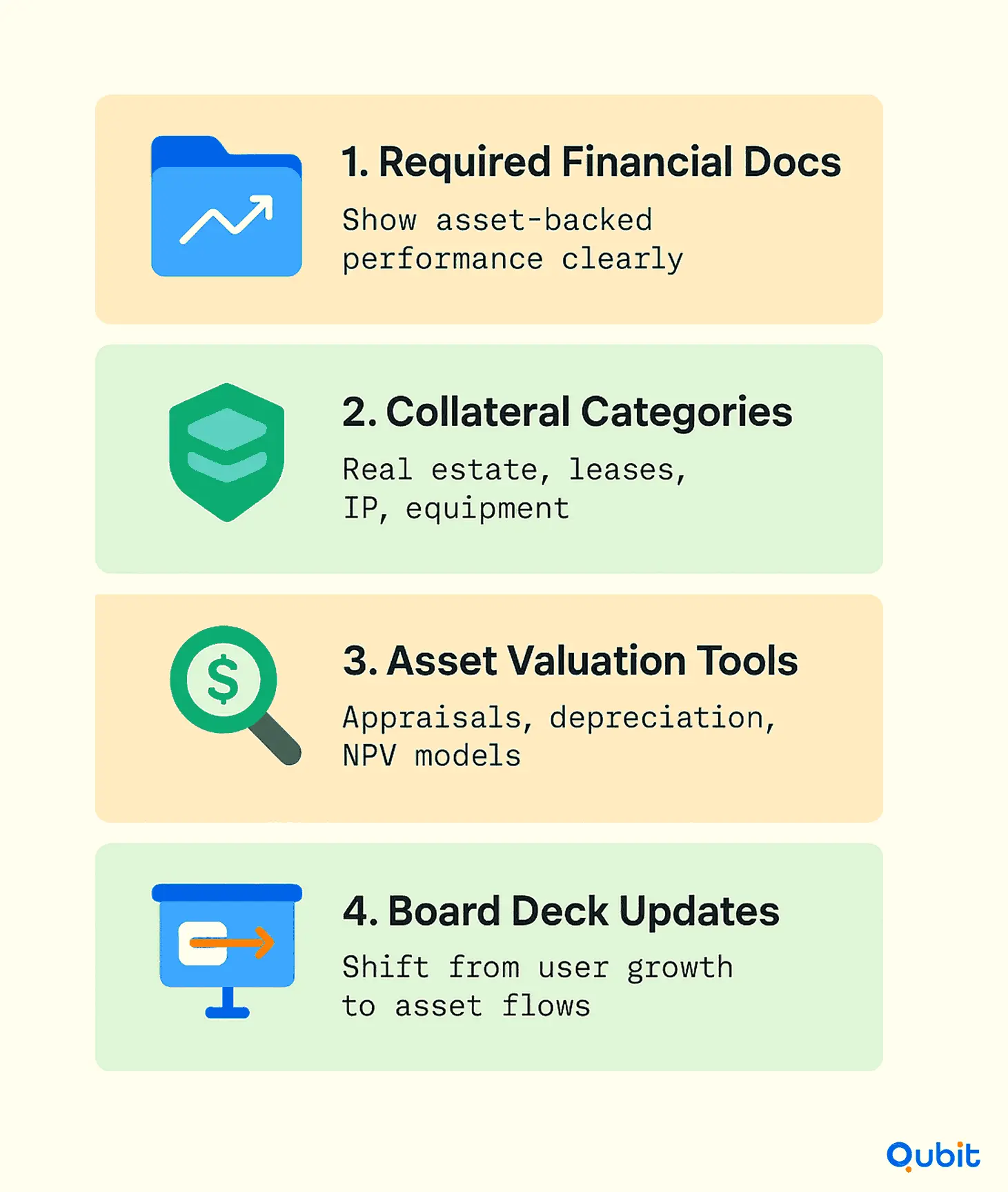

Financial Documentation That Matters

Lenders scrutinize different metrics for asset-heavy PropTech companies. Pure software metrics don't tell your story. You need documentation that highlights your asset performance and operational efficiency.

Essential Financial Documents:

- Monthly recurring revenue broken down by asset class

- Asset utilization rates and performance metrics

- Historical cash flows from property operations

- Loan portfolio performance (if applicable)

- Capital expenditure schedules and ROI analysis

- Accounts receivable aging by tenant or client type

Your board deck needs modification for venture debt presentations. Emphasize asset performance over user growth metrics. Show how your assets generate predictable cash flows.

Asset Valuation and Collateral Strategy

Asset-heavy models require detailed collateral analysis. Property portfolios, equipment, and contractual rights all factor into lender calculations. Professional appraisals strengthen your position significantly.

Document your asset base comprehensively. Real estate holdings need current market valuations. Equipment requires depreciation schedules and replacement costs. Intellectual property merits separate valuation analysis.

Collateral Categories for PropTech:

| Asset Type | Valuation Method | Lender Appeal |

|---|---|---|

| Real Estate Portfolio | Professional appraisal | Very High |

| PropTech Equipment | Depreciated replacement cost | High |

| Lease Contracts | NPV of cash flows | High |

| Loan Portfolios | Mark-to-market | Very High |

| IP and Patents | Expert valuation | Medium |

The Venture Debt Application Process

Building Your Lender Target List

Not all venture debt providers understand PropTech models. Asset-heavy businesses require specialized lenders with real estate experience. Traditional tech-focused lenders might undervalue your collateral.

Research lenders who've funded similar PropTech companies. Look for those with real estate lending backgrounds. Banks with commercial real estate divisions often understand asset-heavy models better.

Lender Categories to Consider:

- Specialized venture debt funds with PropTech experience

- Banks with real estate and technology lending divisions

- Alternative lenders focused on asset-backed businesses

- Family offices investing in real estate technology

Crafting Your Venture Debt Pitch

Your venture debt presentation differs from equity pitches. Focus on cash flow predictability over growth potential. Emphasize asset quality over market size. Demonstrate operational efficiency rather than just innovation.

Start with your asset base and cash flow generation. Show how properties, loans, or infrastructure create steady income streams. Prove that your technology enhances rather than replaces traditional real estate economics.

Key Presentation Elements:

- Asset portfolio overview with performance metrics

- Revenue predictability from contracted cash flows

- Operational leverage from technology platforms

- Risk mitigation through diversification

- Clear repayment capacity from asset cash flows

Due Diligence Expectations

Venture debt due diligence resembles commercial real estate lending more than traditional startup financing. Expect property inspections, lease audits, and detailed asset analysis. Lenders want to verify your collateral value independently.

Prepare for operational due diligence beyond financials. Lenders examine property management systems, tenant retention rates, and maintenance records. Your technology should demonstrate clear operational advantages.

Due Diligence Areas:

- Property inspections and appraisals

- Lease agreement analysis

- Technology platform demonstrations

- Management team interviews

- Market competition assessment

- Regulatory compliance review

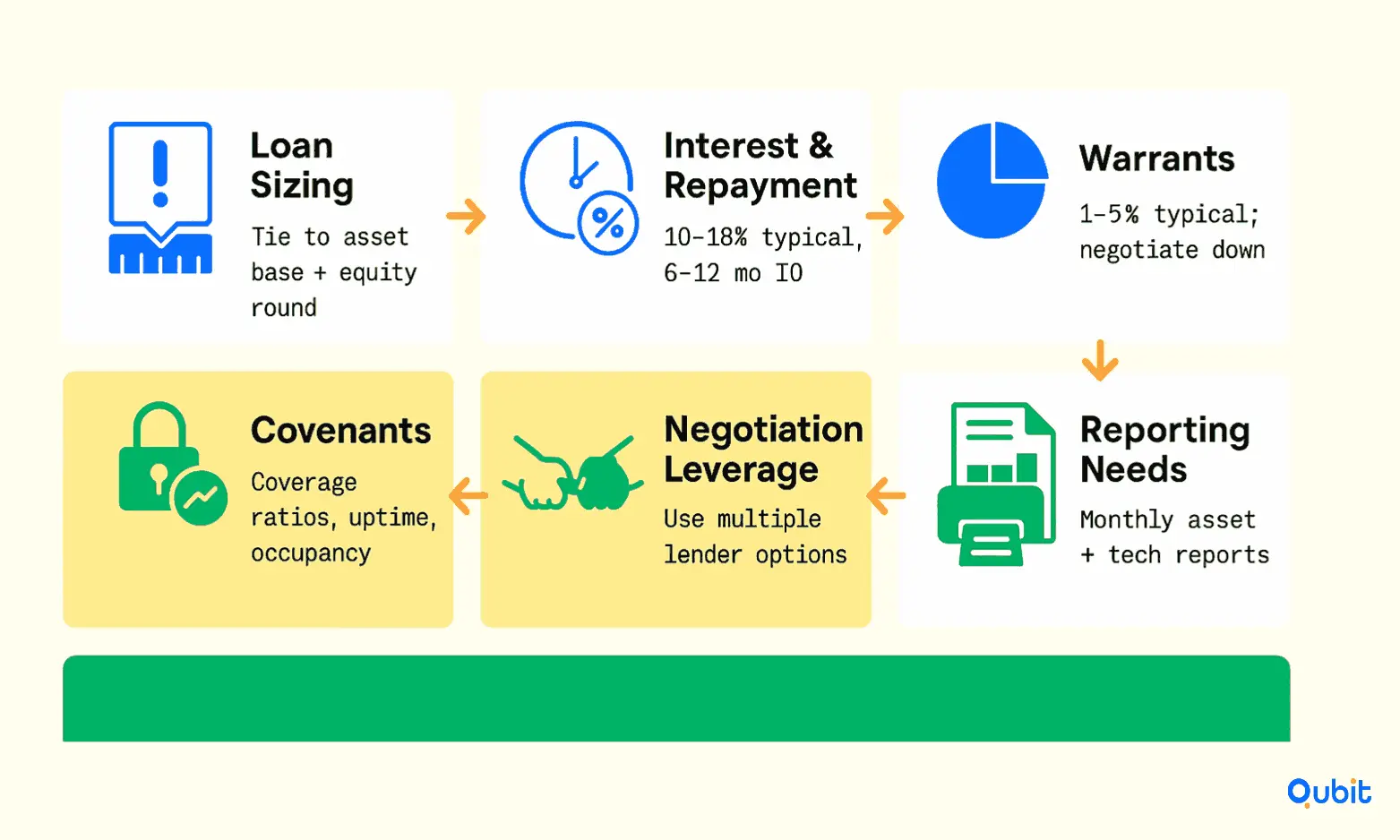

Structuring Venture Debt for Maximum Benefit

Optimal Loan Sizing for Asset-Heavy Models

Venture debt amounts typically range from 25% to 35% of your last equity round. Asset-heavy models can often secure larger amounts due to collateral security. Some PropTech companies obtain debt equal to 50% or more of recent equity raises.

Consider your asset base when determining loan size. Property-backed businesses can support higher debt levels than pure software companies. Revenue-generating assets justify larger credit facilities.

Sizing Considerations:

- Loan-to-value ratios on property assets

- Debt service coverage from operating cash flows

- Growth capital requirements for asset expansion

- Buffer for market volatility or vacancy periods

Interest Rates and Terms Structure

PropTech venture debt rates typically range from 10% to 18% annually, depending on risk profile and collateral quality. Asset-heavy models often secure better rates due to tangible security. Strong property portfolios can drive rates toward the lower end.

Interest-only periods provide breathing room during growth phases. Most lenders offer 6-12 months of interest-only payments before principal repayment begins. This structure helps asset-heavy companies manage cash flow during expansion.

Term Structure Components:

- Base interest rates tied to prime or SOFR

- Warrant coverage (typically 1-5% of loan amount)

- Origination fees and closing costs

- Financial covenants and reporting requirements

- Early repayment options and penalties

Covenant Design for PropTech Assets

Financial covenants for asset-heavy models focus on operational metrics rather than just growth rates. Lenders want assurance that your assets continue generating cash flows. Property performance metrics often replace traditional SaaS covenants.

Common PropTech Covenants:

- Minimum cash balance requirements

- Debt service coverage ratios

- Property occupancy rate minimums

- Loan portfolio quality metrics

- Technology system uptime requirements

- Insurance coverage maintenance

Common Mistakes to Avoid

Undervaluing Your Asset Base

Many PropTech founders underestimate their collateral value. Property portfolios, long-term contracts, and specialized equipment create significant security for lenders. Professional valuations often exceed internal estimates.

Don't rely on book values for venture debt applications. Market valuations for real estate, replacement costs for equipment, and NPV calculations for contracts provide stronger foundations for negotiations.

Timing the Application Incorrectly

Asset-heavy businesses have natural funding cycles. Apply for venture debt when your assets are performing well and occupancy rates are high. Market timing affects both your collateral values and lender appetite.

Avoid applying during major transitions like management changes or asset dispositions. Lenders prefer stability when evaluating asset-backed businesses. Complete major operational changes before starting the debt process.

Optimal Application Timing:

- Strong quarterly performance metrics

- High asset utilization rates

- Stable management team

- Clear growth capital deployment plan

- 12-18 months from last equity round

Neglecting Operational Due Diligence

Asset-heavy due diligence extends beyond financial metrics. Lenders examine property conditions, tenant relationships, and operational systems. Poor property management or deferred maintenance can derail applications.

Invest in operational excellence before approaching lenders. Property inspections, system upgrades, and process documentation strengthen your position. Well-managed assets command better terms and higher valuations.

Negotiation Strategies for Better Terms

Multiple Lender Competition

Asset-heavy PropTech companies often attract multiple lenders. Real estate backing creates broader appeal than pure software models. Use this competition to improve terms and reduce costs.

Share term sheets strategically with competing lenders. Asset-backed deals create more negotiation leverage than traditional venture debt. Property collateral gives lenders confidence to compete aggressively.

Structuring Warrants Appropriately

Venture debt typically includes warrant coverage allowing lenders to purchase equity at predetermined prices. Asset-heavy models can often negotiate lower warrant percentages due to collateral security. Aim for warrant coverage below 3% of the loan amount.

Negotiate warrant exercise prices carefully. Use recent 409A valuations as starting points but consider future funding round impacts. Structure warrants to minimize dilution during high-growth periods.

Warrant Negotiation Points:

- Coverage percentage (1-5% of loan amount)

- Exercise price determination method

- Anti-dilution protection provisions

- Exercise timing and expiration dates

- Cashless exercise options

Financial Reporting Requirements

Asset-heavy models require specialized reporting beyond traditional venture debt metrics. Property performance, tenant metrics, and asset utilization rates matter more than pure software KPIs. Negotiate reporting that reflects your business model.

Monthly reporting should emphasize asset performance and cash flow generation. Quarterly reports can include detailed property metrics and portfolio analysis. Annual reports might require third-party asset appraisals.

Reporting Categories:

- Property performance and occupancy metrics

- Revenue per asset or per square foot

- Maintenance and capital expenditure tracking

- Tenant retention and lease renewal rates

- Technology platform performance metrics

Deployment Strategies for Growth

Capital Allocation for Maximum Impact

Asset-heavy PropTech companies must deploy venture debt capital efficiently. Property acquisitions, equipment purchases, and infrastructure investments require careful planning. Lenders want clear capital deployment strategies.

Prioritize investments with measurable returns. Property acquisitions should target specific cap rates or cash-on-cash returns. Equipment purchases need clear productivity improvements. Infrastructure investments require usage projections and revenue impacts.

Scaling Operations with Debt Capital

Venture debt enables asset expansion without equity dilution. Use debt capital to acquire properties, purchase equipment, or build infrastructure that generates immediate cash flows. This approach preserves equity for higher-value uses.

Create asset expansion pipelines before securing debt. Identified properties, equipment suppliers, and infrastructure projects demonstrate clear capital needs. Lenders prefer funding specific growth initiatives over general corporate purposes.

Strategic Deployment Options:

- Property portfolio expansion

- Technology infrastructure scaling

- Equipment purchases for operational efficiency

- Working capital for seasonal fluctuations

- Bridge financing for major transactions

The Path to Venture Debt Success

Asset-heavy PropTech models have unique advantages in venture debt markets. Your properties, equipment, and contractual cash flows create security that pure software companies can't offer. This collateral opens doors to larger debt facilities at better terms.

Success requires understanding how venture debt lenders evaluate asset-backed businesses. They focus on cash flow predictability, asset quality, and operational efficiency. Your technology enhances these fundamentals rather than replacing them.

Prepare thoroughly before approaching lenders. Professional asset valuations, detailed financial documentation, and operational excellence create competitive advantages. Multiple lender relationships provide negotiation leverage and better terms.

The PropTech industry is maturing. Venture debt is becoming a standard tool for scaling asset-heavy businesses. Companies that master this financing option will capture market opportunities while preserving equity for maximum value creation.

Conclusion

The strategies discussed throughout this article emphasize the importance of aligning innovative funding methods with solid risk management practices. From exploring venture debt as a viable option for asset-heavy PropTech models to balancing creative financing approaches, the actionable insights provided aim to empower businesses to make informed decisions. Key statistics and expert opinions reinforce the credibility of these approaches, ensuring readers have a clear understanding of their potential impact.

If you're ready to secure the funding for your PropTech model, contact us and let our Investor Outreach service guide you through the process.

Key Takeaways

- Venture debt enables non-dilutive funding for asset-heavy PropTech models.

- Aligning asset strength with lender requirements is critical to secure favorable debt terms.

- Innovative funding strategies, including convertible debt, can reduce overall financing costs.

- Robust risk mitigation measures are essential to manage potential financial exposures.

Frequently asked Questions

What is venture debt in proptech?

Venture debt in proptech refers to a financing method that allows companies to secure funding without issuing equity. This type of non-dilutive capital is typically backed by tangible assets, enabling businesses to maintain ownership control while accessing growth capital.