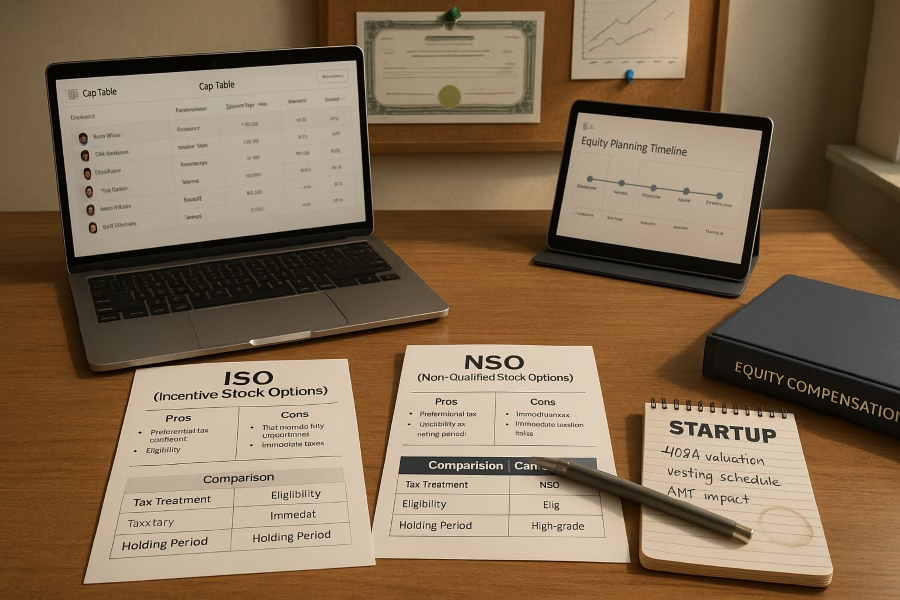

Equity incentives are a cornerstone of startup compensation strategies, offering employees a stake in the company’s future success. Among the most popular types of stock options are Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs).

While both provide opportunities for ownership, they differ significantly in terms of tax implications, eligibility, and strategic planning. Understanding these distinctions is crucial for founders and employees alike, as the choice between ISO and NSO options can impact long-term financial outcomes.

Let’s dive deeper into the key differences between ISOs and NSOs and how to make the right choice for your equity incentive strategy.

How to Decide: ISO vs NSO Options for Your Grant Strategy

ISOs and NSOs mostly differ in when taxes show up. ISOs can delay taxes if you meet specific rules. NSOs are generally taxed when you exercise. The right choice depends on who is receiving the grant and what outcomes you want.

Strategic Allocation of ISOs and NSOs by Recipient Type

Many startups grant ISOs only to eligible employees, then use NSOs for everyone else. That usually includes contractors, advisors, and international team members. ISOs can be more tax efficient, but the rules are strict and eligibility is limited. NSOs are more flexible and work for a wider range of contributors. Splitting grants this way helps you stay compliant and still align incentives across roles.

Risk Watchouts That Change the Math

If you leave the company unexpectedly, the exercise window can shrink fast. If the stock price drops after you exercise, you could lose the upside you expected. ISOs can also trigger AMT in some cases, which can create a tax bill without cash proceeds. Talk to a tax advisor before exercising, especially if timing is uncertain.

What Market Data Suggests

Recent surveys shed light on industry practice. In 2021, median ISO grant size was 15,000 options, while NSOs typically reached 10,000. These figures reflect how startups balance tax benefits with flexibility in compensation.

Tax Timing Basics, in Plain English

ISOs can offer tax advantages, but only if you follow the holding rules and other requirements. ISOs are not typically taxed at exercise for regular income tax purposes. Taxes are usually recognized when you sell the shares, not when you exercise. If you qualify, gains may be treated as long-term capital gains instead of ordinary income.

NSOs are taxed when exercised in most cases. The spread between exercise price and fair market value is treated as ordinary income. That creates an immediate tax obligation, even if you do not sell shares right away. Employers often like NSOs because they have fewer regulatory constraints than ISOs.

How to Apply This to Your Plan

Start with eligibility and compliance, then map grants to the role mix in your company. Use ISOs where they fit and where employees can realistically benefit. Use NSOs where flexibility matters more than preferential tax treatment. This creates a grant strategy that is practical, compliant, and aligned with your compensation goals.

In your exploration of financing options, the discussion on alternative funding for startups offers insights into unconventional methods like crowdfunding and peer-to-peer lending that diversify capital sources.

What You Need to Know About ISO Constraints and Limitations

Incentive Stock Options (ISOs) come with stringent rules that must be followed to retain their favorable tax treatment. First and foremost, ISOs are exclusively available to employees, meaning contractors and other non-employee stakeholders are not eligible.

Across startups in 2024, 60% of companies offer ISOs for their tax advantages. This wide adoption underscores their key role in equity planning and highlights why industry attention remains focused on these option types. Additionally, if an employee leaves the company, they must exercise their options within three months of termination to maintain ISO status.

Consequences of Failing ISO Qualification

Beyond these limitations, failing to meet ISO requirements can cause options to lose their favorable tax status. When this occurs, the affected options are reclassified as NSOs and become subject to ordinary income tax at exercise. This reclassification can lead to higher tax liabilities and unexpected financial consequences for employees. Careful adherence to ISO rules is essential to preserve intended tax benefits.

Understanding these constraints is essential for employees to maximize the benefits of ISOs while avoiding costly tax consequences.

Stock Options Made Simple: The Basics of Equity

Stock options are a popular form of equity compensation, offering employees the opportunity to purchase company shares at a fixed price, known as the strike price. This predetermined price allows employees to benefit from potential increases in the company’s stock value over time.

When granted stock options, employees receive the right, not the obligation, to buy shares, which can be a valuable incentive tied to the company’s performance. These options typically vest over time, meaning employees gain access to them gradually as they remain with the company.

Tax implications are an essential consideration when exercising stock options. Depending on the type of option, Incentive Stock Options (ISOs) or Non-Qualified Stock Options (NSOs), employees may face different tax treatments. ISOs often provide favorable tax benefits but come with specific requirements, while NSOs are taxed as ordinary income upon exercise. Understanding these nuances is crucial for maximizing the benefits of stock options while minimizing tax liabilities.

To demonstrate the power of equity, consider a common scenario. If a startup goes public in 2025 and you exercise 10,000 options at $1/share (costing $10,000), shares could be worth $500,000 at a $50 trading price.

When and How Stock Options Are Taxed: Key Insights

Stock options are subject to taxation at two critical points: when they are exercised and when they are sold. Understanding these events is essential for managing tax liabilities effectively.

Taxation at Exercise: Key Differences Between ISOs and NSOs

When exercising stock options, the type of option—Incentive Stock Options (ISOs) or Non-Qualified Stock Options (NSOs), determines the tax treatment. For NSOs, the difference between the strike price and the fair market value (FMV) at exercise, known as the spread, is taxed as ordinary income. For example, if the FMV is $10 and the strike price is $9, the spread is $0.90, which becomes taxable income. ISOs, on the other hand, are not taxed at exercise under regular tax rules but may trigger Alternative Minimum Tax (AMT) based on the spread.

Taxation at Sale: Capital Gains

The second taxable event occurs when the shares are sold. For NSOs, any appreciation beyond the FMV at exercise is taxed as a capital gain. ISOs, if held for the required period (more than one year after exercise and two years after grant), qualify for long-term capital gains treatment, which typically results in lower tax rates. However, selling ISOs before meeting these holding periods results in disqualifying dispositions, converting gains into ordinary income.

A 'disqualifying disposition' occurs when ISOs are sold before meeting holding requirements, causing gains to be taxed as ordinary income.

Why Timing Matters

The timing of exercise and sale can significantly impact tax liability. For instance, exercising options when the FMV is low minimizes the spread and, consequently, the tax burden. Similarly, holding ISOs for the required period can reduce taxes through long-term capital gains rates.

Understanding these nuances ensures that individuals can make informed decisions about their stock options while optimizing their tax outcomes.

Early Exercise and 83(b) Election for NSOs

Building on the importance of timing, early exercise of NSOs paired with a timely 83(b) election can significantly impact tax outcomes. By exercising options before they vest and filing the 83(b) election within 30 days, recipients recognize ordinary income at the time of exercise, often when the share value is low. This approach can reduce the total tax burden if the stock appreciates later, as future gains may qualify for capital gains treatment. Understanding this process helps option holders make informed decisions about when to exercise and how to plan for taxes.

Detailed Insights Into ISO Tax Rules

Understanding the tax implications of Incentive Stock Options (ISOs) is crucial for employees aiming to maximize their financial benefits. ISOs offer preferential tax treatment, but only if specific conditions are met regarding the timing of exercise and holding periods.

Preferential Tax Treatment for ISOs

ISOs can qualify for favorable tax treatment, allowing employees to defer taxation until the shares are sold. To benefit, the shares must be held for at least one year after exercise and two years from the grant date. Meeting these holding periods ensures that any profit is taxed as long-term capital gains, which typically have lower rates compared to ordinary income.

Risks of the Alternative Minimum Tax (AMT)

Failing to meet the required conditions can lead to unexpected tax consequences, particularly due to the Alternative Minimum Tax (AMT). When ISOs are exercised, the difference between the exercise price and the fair market value of the shares is considered for AMT purposes. This can result in a significant tax liability, even if the shares are not sold.

To mitigate this risk, employees can use tools like the AMT Calculator to estimate their potential AMT liability before exercising their options. The AMT Tool allows employees to approximate AMT liability at exercise, helping them make informed decisions about whether to hold or sell shares.

Understanding the interplay between preferential tax treatment and AMT risks is essential for optimizing ISO benefits. By carefully planning the timing of exercise and holding periods, employees can avoid costly tax surprises while maximizing their financial gains.

NSO Tax Rules Explained

Non-qualified stock options (NSOs) come with distinct tax implications that every recipient should understand. Upon exercising NSOs, the difference between the exercise price and the fair market value of the stock is taxed as ordinary income. This means the income is subject to standard federal, state, and payroll taxes, potentially resulting in a significant tax liability at the time of exercise.

However, the tax treatment changes when the stock is sold. Any subsequent appreciation in the stock’s value after the exercise is classified as a capital gain. Depending on the holding period, this gain may qualify for favorable long-term capital gains tax rates, which are typically lower than ordinary income rates.

Timing plays a crucial role in minimizing the overall tax burden. Exercising NSOs and holding the stock for over a year before selling can reduce taxes significantly. Conversely, selling the stock shortly after exercising may result in higher short-term capital gains taxes.

Understanding these nuances can help recipients make informed decisions about when to exercise and sell their NSOs, optimizing their financial outcomes.

Capital Gains vs Ordinary Income: What Your Stock Options Mean for Taxes

Understanding how stock options are taxed can significantly impact your financial planning. The key distinction lies between capital gains tax and ordinary income tax. Capital gains tax applies to profits from the sale of assets like stocks, while ordinary income tax covers wages, bonuses, and other earned income.

When stock options are exercised and sold, the tax treatment depends on how long you've held the shares. If held for over a year, the profit qualifies for long-term capital gains tax, which typically has lower rates than ordinary income tax. This can result in substantial savings compared to the higher rates applied to short-term gains or ordinary income.

Smart Strategies to Plan Taxes on Stock Options

Effective tax planning for stock options requires a proactive approach and a clear understanding of the tax implications tied to Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). Consulting with tax advisors is essential to craft a personalized strategy that minimizes liabilities and maximizes financial outcomes.

For ISOs, timing plays a critical role. Exercising options strategically, such as during a year with lower income, can reduce exposure to the Alternative Minimum Tax (AMT). Meanwhile, NSOs are taxed as ordinary income upon exercise, making it crucial to calculate the potential tax impact before proceeding.

Additionally, evolving trends like equity compensation democratization are making stock options accessible to a broader range of employees, encouraging creative plan structures that align with individual tax goals.

Managing taxes for equity compensation can be overwhelming, but it doesn’t have to be. Our free guide is designed to simplify tax reporting for stock options, including ISOs, NSOs, RSUs, and RSAs. Whether you're an employee or employer, this resource breaks down complex tax rules into easy-to-follow steps, ensuring you stay compliant while maximizing your benefits.

Conclusion

Understanding the intricacies of ISO vs NSO Options, including tax timing, eligibility, and strategic planning, can significantly impact your financial outcomes. Taking actionable steps based on these insights is essential. Whether it’s aligning your equity strategy with long-term goals or refining your approach to maximize benefits, the right plan can make all the difference.

We at Qubit Capital are here to support your journey. If you’re looking to enhance your equity strategy, our Pitch Deck Creation service can help you craft a compelling financial narrative tailored to your needs. Let us help you turn insights into impactful results.

Key Takeaways

- ISOs and NSOs differ primarily in tax timing and eligibility criteria.

- Adherence to holding periods and exercise guidelines is crucial for optimal tax treatment.

- Real-world examples, like those from late-stage startups, highlight strategic differences.

- Effective tax planning and professional guidance can optimize stock option benefits.

- Understanding the nuances of each option is key to making informed equity decisions.

Frequently asked Questions

What are the holding period requirements for ISO stock options?

To qualify for favorable tax treatment, ISO shares must be held for at least one year after exercise and two years after the grant date.