Social media has reshaped how you discover and evaluate startups, and LinkedIn sits at the center of that shift. As the leading platform for professional networking and investor outreach, LinkedIn gives startups a place to signal traction and gives investors a way to spot promising teams early. Its features help you build relevant networks, follow markets, and surface opportunities that match your focus areas.

LinkedIn’s influence is measurable. A 2024 survey found that 68% of financial advisors invest in LinkedIn as their primary marketing channel, underlining how central it has become for outreach and professional engagement.

At the same time, how to do startup outreach for investors offers a broader view of strategic outreach, covering structured ways to connect with startups beyond a single platform. While LinkedIn remains a dominant force, other social channels are gaining ground and create new paths to engage with emerging businesses.

This article explores how investors are using LinkedIn and other social platforms to uncover the next wave of standout startups.

LinkedIn Outreach Strategy: Avoid Ineffective Cold Messaging

Investors mostly rely on mutual connections, targeted searches, and group engagement to discover startups on LinkedIn. Cold messaging has very low conversion, so network driven, tailored outreach works best.

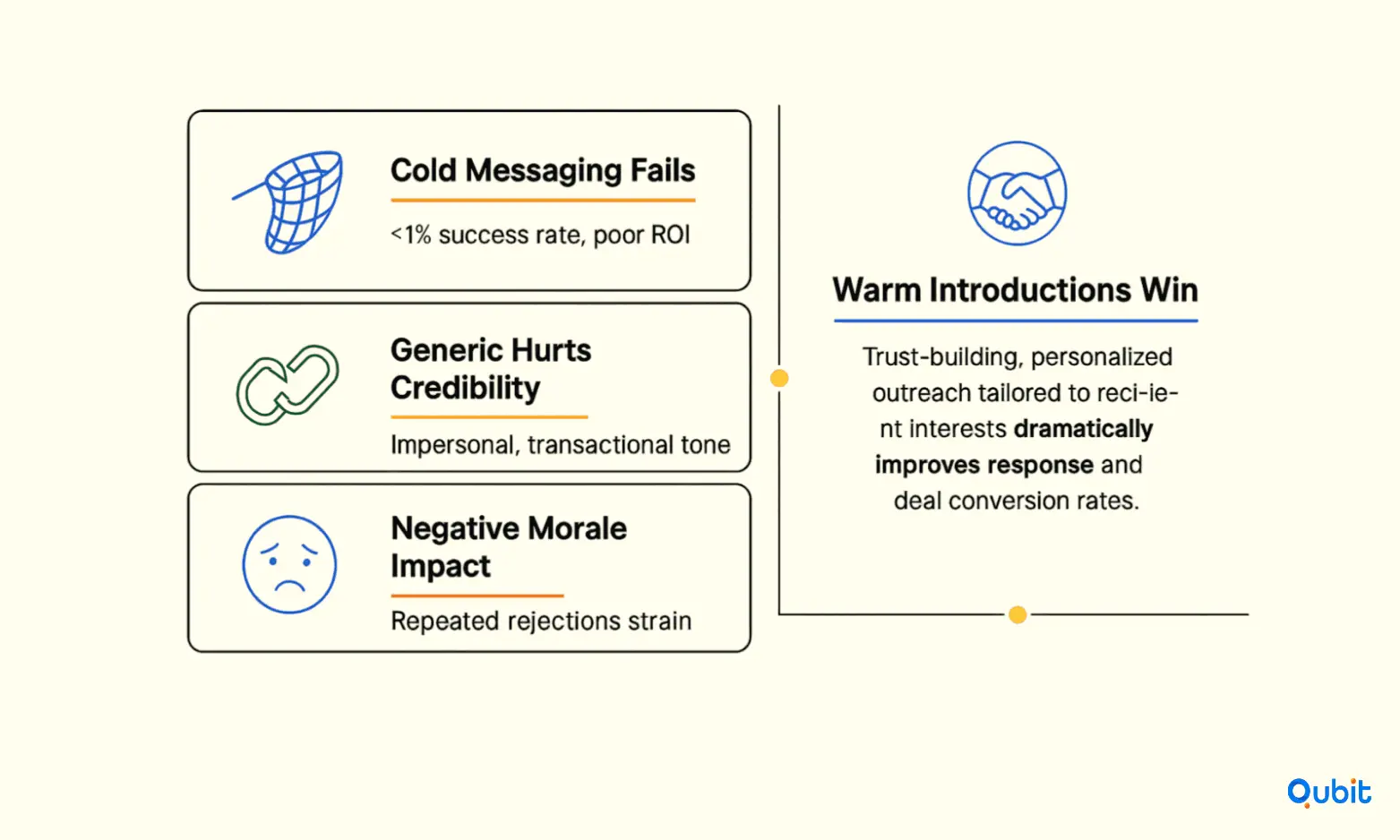

Cold messaging on LinkedIn is often like casting a wide net into an empty sea. With a success rate of less than 1%, it rarely delivers meaningful deal flow. Flybridge Venture, for example, reported that only 1 in 60 deals came from a cold introduction, which highlights how inefficient this route is for investors.

Recent LinkedIn outreach data shows a 38% acceptance rate on connection requests when messages are well targeted. Personalized outreach dramatically outperforms impersonal cold messaging, which still averages below 1% response. For investors, this reinforces a simple rule: use focused, tailored engagement strategies instead of high volume cold messages if you want to reach the right founders.

Venture capitalists (VCs) like those at M8 Ventures have openly expressed their aversion to unsolicited LinkedIn pitches. These messages often come across as impersonal.

Instead of relying on cold messaging, consider the value of warm introductions. As highlighted by Del Johnson, warm connections are far more effective in building trust and opening doors. Personalized outreach, tailored to the recipient’s interests and needs, can significantly improve your chances of success.

For a broader perspective on outreach strategies that work, explore insights into effective outreach channels for investors, which offer actionable approaches to attract quality startups.

Cold messaging may seem like a quick fix, but its inefficiency and potential downsides make it a strategy worth reconsidering. Focus on building genuine connections and leveraging proven methods to maximize your impact.

- Update your headline with relevant keywords

- Add recent traction and results

- Join investor-focused LinkedIn groups

- Seek warm introductions through mutual connections

Targeting the Right Investors

Understanding the interests and behaviors of potential investors is essential for building meaningful connections. Tailored outreach begins with segmenting investors based on their profiles, preferences, and engagement habits. This approach ensures your efforts resonate with the right audience, maximizing the chances of a productive relationship.

Use LinkedIn Groups for Investor Access

Building on segmentation strategies, joining relevant LinkedIn groups exposes founders to concentrated investor audiences. These groups often host discussions, share opportunities, and facilitate direct engagement with active investors. Participating thoughtfully in group conversations can establish credibility and foster valuable relationships. This approach complements targeted outreach by increasing visibility among investors interested in your sector.

A key insight to remember is that many venture capitalists maintain a passive presence on platforms like LinkedIn. For instance, Brad Feld’s LinkedIn activity reference illustrates how certain VCs prefer minimal LinkedIn engagement. This highlights the importance of researching an investor’s activity level before initiating contact. Passive users may require a different strategy, such as email or direct introductions, to capture their attention effectively.

To refine your targeting, consider using filters to identify investors who actively engage on LinkedIn. These individuals are more likely to respond to personalized messages and content. For a deeper understanding of how to position yourself as a resource for investors, explore the strategies outlined in content marketing for investors, which emphasizes the value of creating tailored digital content.

Effective Engagement with Investors

Establishing meaningful connections with investors requires more than just sending out generic pitches. It’s about fostering genuine relationships through thoughtful interactions and consistent communication. Investors are more likely to engage when they feel valued and understood, rather than being treated as mere recipients of a sales pitch.

1. Prioritize Authentic Interactions

Instead of focusing solely on your startup’s needs, take the time to understand an investor’s interests, portfolio, and long-term goals. Tailor your outreach to reflect this understanding. For example, referencing their recent investments or public statements can demonstrate that you’ve done your homework. This approach not only builds rapport but also sets the stage for a mutually beneficial relationship.

2. Engage Through Value-Driven Content

Sharing insights, industry trends, or thought leadership pieces can position you as a credible and informed founder. Engaging with investor content, such as commenting on their posts or sharing relevant articles—can also help you stay on their radar. Additionally, alternative methods like investor outreach podcasts offer unique opportunities to connect. These podcasts explore how virtual events can broaden the scope of your startup’s visibility, providing a platform to showcase your expertise.

3. Maintain Consistent Communication

Building trust takes time, and consistency is key. Regular updates about your startup’s progress, milestones, or challenges can keep investors informed and engaged. However, ensure that your communication remains concise and relevant to avoid overwhelming them with unnecessary details.

Focusing on relationship-building rather than transactional interactions can significantly enhance your chances of securing investor interest. By adopting a thoughtful and consistent approach, you not only increase your visibility but also create a foundation for long-term collaboration.

Ultimately, aligning your outreach with an investor’s interests and activity level is a strategic move. It not only improves engagement but also demonstrates your commitment to building a mutually beneficial partnership. Start with how to run a startup challenge to set themes, prizes, timelines, and judging without chaos.

Optimizing Your LinkedIn Profile

A well-optimized LinkedIn profile can be a game-changer when it comes to attracting investors. It serves as a digital handshake, inspiring confidence and showcasing your professional achievements. By focusing on measurable outcomes and strategic visibility, your profile can become a powerful tool for building trust and credibility.

1. Highlight Measurable Achievements

Investors are drawn to tangible results. Including specific metrics in your profile, such as “300% revenue growth,” demonstrates significant traction and underscores your ability to deliver results. This example metric showcased in profile achievements illustrates a powerful way to display success. Use your headline or summary to emphasize these accomplishments, ensuring they stand out at first glance.

Showcasing quantitative success makes an impact. In 2024, average startup founder's salary rose to $142,000, reflecting market recognition of strong performance. Highlighting such financial achievements on LinkedIn can enhance credibility with potential investors.

2. Optimize for Search Visibility

Incorporating relevant industry keywords into your profile can significantly improve its visibility. Tools like Google Keyword Planner can help you identify effective terms to include in your headline, summary, and experience sections. For instance, if your industry focuses on SaaS, integrating keywords like “SaaS growth strategies” or “cloud-based solutions” can make your profile more discoverable to potential investors.

3. Align with Broader PR Strategies

Your LinkedIn profile doesn’t exist in isolation. It works in tandem with other efforts, such as investor PR strategies, to enhance your startup’s visibility. By ensuring consistency in messaging across platforms, you create a cohesive narrative that resonates with your audience.

A compelling LinkedIn profile is more than just a digital resume, it’s a strategic asset. By showcasing measurable achievements, optimizing for search visibility, and aligning with broader PR efforts, you can position yourself as a credible and attractive investment opportunity.

Building a Strong Company Page

A well-crafted Company Page can be the cornerstone of your startup’s online presence, offering a centralized platform for updates and fostering investor confidence. To make your page stand out, focus on these essential strategies.

1. Complete Your Profile with Precision

Start by ensuring every section of your Company Page is filled out. Include a compelling description, your startup’s mission, and key achievements. Highlighting milestones, such as AI Innovations onboarding its 10,000th user and reducing diagnostic errors by 20%, can demonstrate tangible success. Sharing these accomplishments not only builds credibility but also captures investor attention, as seen in the example of AI Innovations.

2. Share Regular Updates

Consistency is key to keeping your audience engaged. Post updates about product launches, partnerships, or industry insights. These updates not only showcase your progress but also position your startup as active and innovative.

3. Showcase Your Team

Investors often look for the people behind the product. Highlighting your team’s expertise and achievements can humanize your brand and build trust. Share team spotlights or behind-the-scenes content to create a personal connection with your audience.

4. Connect to Broader Strategies

Your Company Page should integrate seamlessly with your overall marketing efforts. A complete and engaging Company Page not only boosts your startup’s legitimacy but also signals professionalism to potential investors.

Sharing Engaging Content

Crafting content that resonates with your audience is more than just a marketing tactic, it’s a way to position your startup as a thought leader in your industry. By sharing insights that are both thoughtful and targeted, you can capture the attention of investors and establish credibility within your niche.

Dropbox’s viral growth strategy demonstrates the impact of value-driven content. Their referral incentive approach increased users from 100,000 to 4 million in just 15 months. This shows how targeted campaigns can transform audience engagement and deliver measurable results.

- One effective approach is to focus on creating content that addresses the specific challenges and opportunities within your sector. For instance, sharing case studies, industry trends, or actionable advice can demonstrate your expertise while providing value to your audience.

- Consistency is another critical factor. Regularly publishing high-quality content not only keeps your audience engaged but also signals to investors that your startup is active, informed, and forward-thinking. Whether it’s through blog posts, videos, or social media updates, maintaining a steady stream of relevant content can help you build a loyal following over time.

- Finally, don’t underestimate the power of storytelling. Sharing your startup’s journey, including milestones and lessons learned, can humanize your brand and foster a deeper connection with your audience. Investors are often drawn to companies with a compelling narrative, as it reflects passion and a clear vision for the future.

Attracting Investors with Public Product Launches

Sharing public product launches and key milestones on LinkedIn can generate organic investor interest. These updates signal traction and progress, attracting attention from venture capitalists seeking promising opportunities. Consistently highlighting achievements demonstrates momentum and positions your startup as a credible, investable business. This strategy can lead to inbound investor inquiries without direct outreach.

Engaging with Your Network

Building a strong network is only the first step. Maintaining it as an investor requires consistent and meaningful engagement. Responding to comments and messages promptly shows attentiveness and builds trust. Even a short, thoughtful reply can leave a lasting impression.

Personalized connection requests are just as important. Generic requests are easy to ignore, but a tailored message stands out. Mention a shared experience, mutual connection, or specific reason for reaching out to increase your chances of a positive response.

Active participation keeps you visible in the feeds of founders and other investors. Commenting on posts, asking smart questions, or sharing short insights helps you stay relevant. Over time, this steady engagement builds a reputation for reliability and approachability.

Networking is not only about meeting new people. It is also about deepening existing relationships. Simple gestures, like congratulating someone on a milestone or sharing a useful resource that matches their interests, can strengthen connections and open doors to future deals.

Sponsored Content and Strategic Ad Targeting on LinkedIn

Reaching the right audience is crucial when promoting your brand or services, and LinkedIn Ads offer a powerful way to achieve this. With its professional user base, LinkedIn allows businesses to connect with decision-makers and investors who are often difficult to reach through other platforms.

1. Sponsored Content: Amplify Your Message

Sponsored content on LinkedIn enables businesses to showcase their expertise and offerings directly in the feeds of targeted users. This format blends seamlessly with organic posts, ensuring higher engagement rates. For instance, promoting thought leadership articles or case studies can position your brand as an industry authority while subtly attracting investor attention.

2. Strategic Ad Targeting: Precision at Scale

LinkedIn’s advanced targeting options allow businesses to focus on specific demographics, industries, job titles, and even company sizes. This precision ensures that your ads are seen by the most relevant audience. With the platform allowing up to 30,000 direct connections per account, scaling sponsored content becomes a strategic advantage. By tying this figure into your ad campaigns, you can maximize reach and visibility among key investor demographics.

Combining these tools creates a dual advantage: increased visibility and meaningful engagement. Sponsored content builds trust, while targeted ads ensure your message reaches the right people at the right time.

To further enhance your LinkedIn strategy, consider integrating these ad campaigns with your broader marketing efforts. This approach ensures consistency and reinforces your brand’s credibility across multiple touchpoints.

Building Credibility and Social Proof

Establishing trust is a cornerstone for any startup aiming to thrive in a competitive market. One of the most effective ways to build credibility is through strategic media mentions. Securing coverage in reputable publications not only amplifies your brand’s visibility but also positions your startup as a trustworthy player in the industry. Highlighting these mentions on your website or marketing materials can significantly enhance your reputation.

Recommendations from satisfied customers or industry peers further solidify your credibility. Collecting testimonials, case studies, or even video endorsements can provide tangible proof of your startup’s value. These endorsements act as a bridge, connecting potential clients or investors with the assurance they need to engage with your business.

Collaborations with thought leaders and industry influencers can also elevate your startup’s standing. Partnering with respected figures in your niche lends authority to your brand and expands your reach to their established audiences. Whether through co-branded content, webinars, or joint ventures, these collaborations demonstrate that your startup is recognized and trusted by experts.

Building credibility is not a one-time effort but an ongoing process. By showcasing media mentions, gathering endorsements, and forming strategic partnerships, your startup can create a solid foundation of trust that resonates with both customers and investors alike.

Digital Resources for Startup Funding

Finding the right investors is a critical step for startups, and digital tools have become indispensable in this process. Online platforms and resources not only simplify investor research but also enhance the efficiency of due diligence. For instance, reviewing

The shift towards digital networking and investor sourcing has also transformed how startups connect with potential backers. As highlighted by the broader Trend Example, online platforms now play a pivotal role in modern fundraising. These tools allow entrepreneurs to identify and engage with investors who align with their vision, streamlining the entire funding process.

Steps to Validate Investor Contacts on LinkedIn

- Review the investor’s LinkedIn profile for consistent professional history and credible endorsements from industry peers.

- Check for mutual connections or group memberships that confirm the investor’s active participation in relevant sectors.

- Search for recent activity, such as posts or comments, to assess engagement and authenticity on the platform.

If your target investor isn't accessible via LinkedIn, consider alternative channels like mutual introductions, email, or events.

Integrating such resources into your fundraising strategy can save time and improve outcomes. Whether it’s through comprehensive due diligence guides or digital networking platforms, startups can now access a wealth of information to make smarter funding decisions.

Tips for Finding Startup Investors

Securing the right investors can be a game-changer for startups, often determining the trajectory of their growth. A well-planned approach that combines profile optimization, strategic networking, and consistent content sharing can significantly improve your chances of attracting the right backers.

1. Optimize Your Profiles for Credibility

Your online presence is often the first impression for potential investors. Ensure both your personal and company profiles are polished and professional. Highlight your startup’s mission, achievements, and growth potential. A strong profile serves as a credibility checkpoint, reassuring investors about your seriousness and capability.

2. Build Strategic Connections

Networking is not just about attending events; it’s about building meaningful relationships. Research investor profiles to identify those who align with your industry and vision. Attend startup-focused events, pitch competitions, and industry meetups to connect with potential investors. For example, Peter Thiel’s early $500K investment in Facebook eventually turned into over $1 billion, showcasing the transformative impact of early investments. This underscores the importance of finding the right investor who believes in your vision.

3. Share Consistent, Value-Driven Content

Regularly sharing updates about your startup’s progress, milestones, and industry insights can keep you on an investor’s radar. Use platforms like LinkedIn or Medium to publish thought leadership pieces that demonstrate your expertise and commitment. Consistency in content sharing not only builds visibility but also fosters trust over time.

The journey to finding startup investors requires persistence and a strategic approach. By optimizing your profiles, building the right connections, and maintaining a consistent presence, you can position your startup for success.

Conclusion

Building meaningful connections with investors requires a blend of strategy and precision. Throughout this article, we’ve explored key approaches to optimizing your LinkedIn profile, crafting personalized outreach messages, and engaging with potential investors in a targeted manner. These strategies not only enhance your visibility but also establish credibility, making it easier to foster trust with your audience.

Taking proactive steps to refine your LinkedIn presence and engagement tactics can significantly improve your investor outreach efforts. A well-optimized profile and thoughtful communication can set you apart in a competitive landscape, opening doors to impactful opportunities.

If you're looking to secure impactful investor connections, we at Qubit Capital can assist with our Investor Outreach service. Let us help you connect with the right investors and elevate your startup’s potential.

Key takeaways

- Cold messaging on LinkedIn is largely ineffective and may harm credibility.

- Targeted and personalized engagement builds stronger investor relationships.

- Optimized LinkedIn profiles and complete company pages enhance trust.

- Consistent content sharing and proactive networking are crucial for ongoing success.

- Leveraging digital resources and group participation can expand your investor reach.

Frequently asked Questions

How can startups optimize their LinkedIn Company Page for investors?

Startups should complete all sections, add compelling descriptions, showcase key achievements, and share updates to attract investors using LinkedIn.