The logistics and fleet technology space is in a new growth cycle, driven by AI, IoT, and rising pressure to make last-mile delivery faster, cheaper, and more reliable. As logistics demand expands, startups are leaning on more specialized funding routes to scale operations and meet tougher customer expectations.

In 2024, 1,800 logistics transactions totaled over $3.8 trillion globally, which signals strong investor confidence and an active deal environment for the sector.

This guide is for logistics and fleet tech founders, operators, and finance leads who want to understand what funding options fit their stage, and how to position the business to raise capital faster.

Logistics And Fleet Tech Funding: What Investors Want Now

Logistics and fleet tech is getting funded when the pitch proves one thing fast: measurable ROI in a messy, real-world operating environment.

Key investor filters:

- Tailwinds: Last-mile pressure, e-commerce complexity, compliance, and cost reduction, with AI and IoT making operations more trackable and optimizable.

- Buyers: Shippers, 3PLs, carriers, and enterprise fleets that will only adopt if value is clear and implementation is low-friction.

- Metrics: Payback period, retention, gross margin impact, utilization gains, safety reductions, and time saved per route, driver, or dispatch cycle.

- Red Flags: Long sales cycles with no pilots, vague ICP, heavy integration with unclear ROI, and “platform” positioning without a wedge.

- Outcome: A funding story that links product to ROI, ROI to adoption, and adoption to scalable unit economics.

Aligning Investor Outreach by Stage and Location

Building on this landscape, founders should align their fundraising outreach with investors’ preferred funding stages and geographic focus. This approach increases the likelihood of finding capital partners who understand local market dynamics and sector-specific challenges. Targeted outreach also streamlines the funding process, reducing wasted effort on mismatched investors. By prioritizing fit, startups can accelerate growth and foster stronger, more supportive investor relationships.

Key Industry Trends and Lender Priorities

- Urban delivery trends

- Green logistics priorities

- Key lender focus areas

Invoice finance converts unpaid invoices to working capital.

Your exploration of funding methodologies is broadened by the detailed insights found in mobility startup fundraising strategies, which examines various investor profiles and financial frameworks for mobility ventures. This blog delves into the diverse financing strategies available for logistics and fleet tech startups, highlighting how technology adoption and market trends are shaping investment opportunities.

Unsecured Loans for Quick Access Funding

When financial needs arise unexpectedly, unsecured loans can be a practical solution for obtaining quick access to funds. Startups in logistics and fleet tech can consider unsecured loans, asset finance, invoice finance, and R&D tax credits. Each type offers cash flow and growth advantages.

Unlike secured loans, these loans do not require collateral. This makes them an attractive option for those seeking immediate capital. The primary factor lenders assess is creditworthiness, which plays a pivotal role in determining eligibility and loan terms.

What Makes Unsecured Loans Stand Out?

Unsecured loans are designed to provide flexibility and speed, two critical factors for borrowers who need funds without delay. Here’s what sets them apart:

- No Collateral Required: Borrowers don’t need to pledge assets such as property or vehicles, reducing the risk of losing valuable possessions.

- Faster Approval Process: Since there’s no need to evaluate collateral, lenders can process applications and disburse funds more quickly.

- Flexible Usage: These loans can be used for various purposes, including debt consolidation, medical emergencies, or business expansion.

Creditworthiness: The Key to Approval

Lenders rely heavily on credit scores and financial history to evaluate the risk of lending. A strong credit profile not only increases the chances of approval but also secures better interest rates and terms. Borrowers with lower credit scores may still qualify, but they might face higher interest rates or stricter repayment conditions.

Comparing Unsecured and Secured Loans

While both options provide access to funds, unsecured loans offer distinct advantages over their secured counterparts:

- Speed: Secured loans often involve lengthy processes to appraise collateral, whereas unsecured loans eliminate this step.

- Risk: With no collateral at stake, borrowers face less personal financial risk.

- Accessibility: Unsecured loans are accessible to a broader range of borrowers, especially those without significant assets.

However, it’s essential to note that unsecured loans may come with higher interest rates due to the increased risk for lenders. Borrowers should carefully evaluate their financial situation and repayment capacity before committing.

Unsecured loans are a reliable option for those who value speed, flexibility, and simplicity. By focusing on creditworthiness, lenders ensure that borrowers can access the funds they need without the added burden of collateral.

Startup Business Loans: Funding for Early Logistics Ventures

Securing funding is often the first hurdle for logistics startups aiming to establish themselves in a competitive market. Startup business loans offer a practical solution, providing amounts ranging from £1,000 to £25,000 with lower interest rates and flexible repayment terms. These loans are tailored to meet the unique needs of early-stage ventures, enabling entrepreneurs to cover essential costs like fleet acquisition, technology integration, and operational setup.

Why Startup Business Loans Are Ideal for Logistics Ventures

Startup business loans stand out due to their accessibility and adaptability. Unlike traditional financing options, these loans cater specifically to new businesses, offering manageable funding ranges that align with the scale of logistics startups. The flexibility in loan amounts allows founders to secure just enough capital to kickstart operations without overextending their financial commitments.

- Funding Range: With amounts between £1,000 and £25,000, these loans are designed to support businesses at the earliest stages. Whether you need to purchase delivery vehicles or invest in route optimization software, the funding range accommodates diverse needs.

- Lower Interest Rates: Competitive interest rates make these loans more affordable compared to other financing methods, ensuring that startups can focus on growth without being burdened by excessive repayment costs.

- Tailored Repayment Plans: Flexible repayment terms allow businesses to align their loan schedules with projected revenue streams, reducing financial strain during the initial growth phase.

The Role of a Robust Business Plan

A well-crafted business plan is crucial for securing startup business loans. Lenders assess the viability of your logistics venture by examining your business model, growth projections, and operational strategies. A strong plan not only demonstrates your preparedness but also increases your chances of approval.

Key components of a compelling business plan include:

- Market Analysis: Highlighting demand trends and competition within the logistics sector.

- Revenue Projections: Providing realistic financial forecasts based on industry benchmarks.

- Operational Strategy: Outlining how you plan to optimize logistics processes and manage costs effectively.

For additional insights on presenting your business vision, a nuanced discussion in pitch investors logistics startups outlines methods for articulating your goals and engaging potential investors.

Importance of Enterprise System Integration

Beyond a strong business plan, founders should demonstrate their startup’s ability to integrate with common enterprise systems like TMS or ERP. This capability reassures lenders and investors that the business can scale efficiently and meet industry standards. Seamless integration also reduces operational friction, making the venture more attractive for long-term partnerships. Highlighting this readiness can strengthen funding applications and investor confidence.

Regional Trends in Logistics Funding

Funding trends for logistics startups vary across regions, influenced by local economic conditions and industry demands. In the UK, for instance, urban delivery services and green logistics initiatives are gaining traction, prompting lenders to prioritize ventures in these areas. Understanding regional preferences can help you tailor your loan application to align with lender expectations.

Startup business loans provide a vital lifeline for logistics entrepreneurs, offering accessible funding and manageable repayment terms. With a strong business plan and awareness of regional funding trends, you can position your venture for success in this dynamic industry.

Asset Finance: Scaling Fleet Operations for Growth

Expanding fleet operations often requires significant investment in equipment and technology. Asset finance offers a practical solution by breaking down these costs into manageable monthly payments, enabling businesses to scale without the burden of upfront capital expenditure. This approach ensures operational continuity while supporting growth ambitions.

Understanding Asset Finance

Asset finance is a funding method that allows businesses to acquire high-value assets, such as vehicles, machinery, or technology, without the need for immediate full payment. Instead, costs are distributed over a set period, making it easier to manage cash flow while accessing essential resources. This financial strategy is particularly beneficial for companies aiming to expand their fleet operations, as it minimizes financial strain and maximizes scalability.

For businesses in logistics or transportation, asset finance solutions can be transformative.

Case Study: Siemens Financial Services Fleet Expansion

A real-world example of asset finance in action is the Siemens Financial Services Fleet Expansion. Faced with the need to acquire 20 trailers for a new contract within six months, Siemens utilized operating leases through a flexible financing facility. This enabled them to secure modern equipment without upfront capital, ensuring they met contractual obligations while maintaining financial stability

Benefits of Asset Finance for Fleet Growth

Asset finance provides several advantages for businesses looking to expand their fleet operations:

- Preservation of Capital: By spreading costs over time, companies can retain cash reserves for other strategic investments.

- Operational Continuity: Businesses can acquire essential assets without disrupting day-to-day operations due to financial constraints.

- Flexibility: Financing options, such as operating leases, allow companies to adapt to changing needs and market conditions.

- Access to Modern Equipment: Asset finance enables businesses to invest in the latest technology and equipment, enhancing efficiency and competitiveness.

Strategic Considerations

Asset finance is not just a funding mechanism; it’s a strategic tool for growth. By enabling businesses to scale operations without immediate financial strain, it empowers them to focus on long-term success.

Large operators demonstrate these gains at scale. UPS has used AI analytics to optimize delivery routes, saving $400 million each year in fuel and labor. Their predictive models continuously refine routes, maximizing asset productivity and reducing fleet costs.

When exploring asset finance, it’s important to evaluate potential partnerships and investment strategies. A clear comparison in strategic vs financial investors logistics delineates the differences between investor types, offering you a contextual basis for evaluating partnerships in the logistics technology space.

Utilize Industry Expertise for Growth

Building on these strategic considerations, founders can enhance their funding prospects by engaging logistics industry veterans. Experienced professionals bring valuable insights into fleet operations and regulatory requirements. Their involvement signals operational credibility to investors and lenders, reducing perceived risk. This strategy also helps startups navigate complex industry challenges more effectively as they scale.

Invoice Finance: Optimizing Cash Flow and Growth

Invoice finance offers businesses a practical way to address cash flow challenges by converting unpaid invoices into immediate funds. This financial tool is particularly beneficial for companies that experience delayed customer payments, enabling them to maintain operations and pursue growth opportunities without waiting for invoice settlements. From logistics startups to large-scale enterprises, invoice finance has proven to be a versatile solution for managing short-term capital constraints.

Understanding Invoice Finance Methods

Several approaches to invoice finance cater to different business needs. Below, we explore three key methods:

1. Invoice Factoring

Invoice factoring, selling unpaid invoices to another company for fast cash—is a common finance option.

- Advantages:

- Immediate access to funds.

- Outsourced payment collection reduces administrative workload.

- Suitable for businesses with consistent invoice volumes.

Considerations:

- Factoring fees can vary based on invoice value and customer creditworthiness.

- Customers are aware of the factoring arrangement, which may impact relationships.

2. Confidential Invoice Discounting

Confidential invoice discounting allows businesses to raise funds against unpaid invoices while retaining control over customer payment collection. Unlike factoring, this method keeps the arrangement private, ensuring that customers remain unaware of the financing.

- Advantages:

- Maintains customer relationships by keeping financing discreet.

- Provides flexibility for businesses that prefer to manage their own collections.

- Ideal for companies with strong credit control processes.

- Considerations:

- Requires robust internal systems to manage collections effectively.

- May involve higher fees compared to factoring due to the confidentiality aspect.

3. Selective Invoice Discounting

Selective invoice discounting offers businesses the flexibility to choose specific invoices for financing. This method is particularly useful for companies that need occasional cash flow boosts rather than ongoing financing.

- Advantages:

- Tailored financing based on immediate needs.

- Allows businesses to retain control over most invoices.

- Cost-effective for companies with sporadic cash flow challenges.

- Considerations

- Limited to selected invoices, which may not address broader cash flow issues.

- Requires careful planning to maximize benefits.

Case Study: eCapital Trucking Fleet Growth

The transformative power of invoice finance is evident in the success story of eCapital Trucking Fleet Growth. Facing bankruptcy risks due to cash flow issues, the company turned to receivables factoring as a solution. By factoring their invoices and integrating modern technology, eCapital expanded its fleet from three to eleven trucks within six months. This rapid growth highlights how invoice finance can unlock opportunities for businesses in capital-intensive industries.

Real-world innovation is changing how firms tackle disruption risks. Otonomi raised $5 million to scale its insurtech, targeting faster cargo disruption payouts. This capital empowers logistics companies to protect cash flow and recover quicker from operational shocks.

Invoice finance is more than a financial tool; it’s a gateway to sustained growth and operational stability. Whether through factoring, confidential discounting, or selective discounting, businesses can optimize their cash flow and focus on scaling their operations.

For businesses exploring advanced financing strategies, an analytical perspective in structure large rounds mobility startups reviews the structuring of sizable funding rounds, adding an advanced layer of strategy to your examination of capital-intensive scenarios.

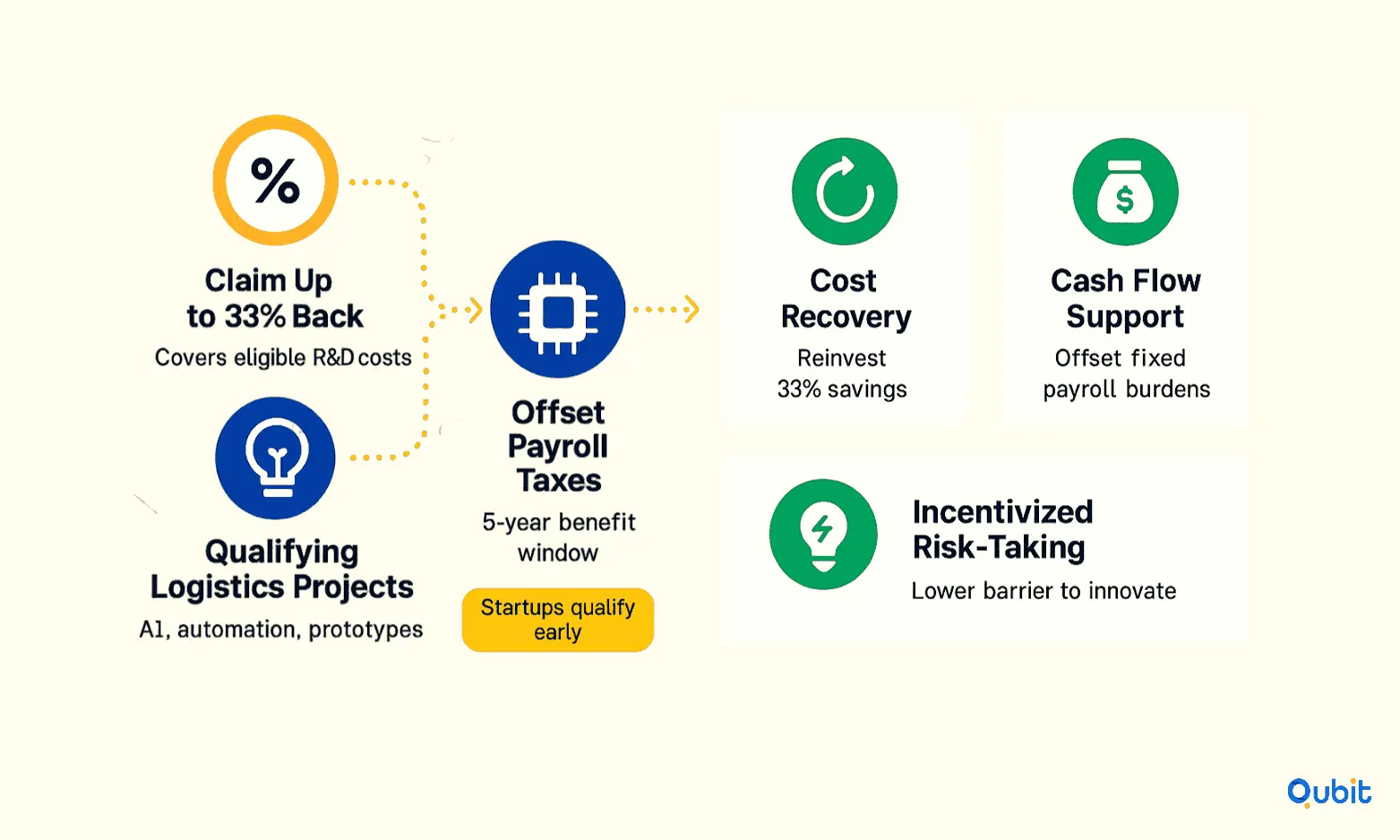

R&D Tax Credits: Funding Innovation in Logistics

Research and development (R&D) tax credits have become a vital tool for logistics startups aiming to innovate while managing costs. These government incentives allow businesses to recoup up to 33% of their R&D expenses, providing a financial cushion that fosters growth and experimentation in specialized logistics technologies.

How R&D Tax Credits Work

R&D tax credits are designed to reward companies for investing in innovation. For small startups, the credit can be as high as 33% of eligible R&D costs, offering substantial savings. These credits can also offset payroll taxes for up to five years, making them particularly valuable for early-stage companies with limited revenue streams.

Qualifying research activities typically include developing new technologies, improving existing systems, or creating prototypes that advance logistics operations. For instance, startups working on automated warehouse solutions or AI-driven supply chain optimization may qualify for these credits.

Benefits of R&D Tax Credits

The advantages of R&D tax credits extend beyond cost recovery. Here’s how they benefit logistics startups:

- Financial Relief: Recouping up to 33% of R&D expenses allows startups to reinvest in innovation without straining their budgets.

- Payroll Tax Offset: For startups in their initial stages, these credits can be applied to payroll taxes, providing additional financial flexibility.

- Encouraging Innovation: By reducing the financial risk associated with R&D, these incentives encourage companies to pursue groundbreaking solutions in logistics.

Why Logistics Startups Should Prioritize R&D Tax Credits

Specialized logistics technologies often require significant investment in research and development. R&D tax credits serve as an essential route for cost recovery, enabling startups to focus on creating innovative solutions without being deterred by high upfront costs.

By taking advantage of R&D tax credits, logistics startups can offset innovation costs while driving progress in their industry. A detailed overview in project financing vs venture capital mobility contrasts distinct financial models, providing you with a balanced look at the alternatives available for funding mobility initiatives.

Conclusion

Securing the right financing for your startup requires a clear strategy and a compelling pitch. Throughout this blog, we’ve explored various financing options, including unsecured loans, startup business loans, asset finance, invoice finance, and R&D tax credits. Each of these strategies offers unique benefits, and understanding how to align them with your business goals is key to success.

We’ve also highlighted actionable steps and real-world case studies to inspire innovative approaches. Whether it’s structuring your financial plan or presenting your business to investors, preparation is everything. A well-thought-out financing strategy not only ensures smoother operations but also builds confidence among potential backers.

If you’re looking to secure the right capital for your startup, we at Qubit Capital can help. Our Fundraising Assistance service connects you with the funding you need. Let’s work together to turn your vision into reality.

Key Takeaways

- Diverse financing options, unsecured loans, business loans, asset finance, invoice finance, and R&D tax credits, are critical for logistics and fleet tech startups.

- Unsecured loans offer rapid access to capital without requiring collateral, but demand strong credit profiles.

- Startup business loans provide flexible, low-interest funding designed for early-stage ventures.

- Asset and invoice financing are essential for managing expensive equipment and ensuring smooth cash flow.

- R&D tax credits enable startups to recoup significant innovation costs and support long-term growth.

Frequently asked Questions

How can R&D tax credits benefit logistics startups?

R&D tax credits can help logistics startups offset up to 33% of eligible research and development expenses, supporting innovation and growth.