The journey of consumer and marketplace investing ultimately leads to one critical milestone: the exit. Exit strategies represent the culmination of years of investment, growth, and value creation, determining whether investors achieve their target returns and founders realize their entrepreneurial ambitions. In an ecosystem where approximately 90% of startups fail, having a well-defined exit strategy becomes essential for protecting investments and maximizing returns.

This comprehensive guide explores the various exit strategies available in consumer and marketplace investing, providing frameworks for evaluation, timing, and execution that maximize value for all stakeholders involved.

Understanding Exit Strategies in Consumer & Marketplace Context

An exit strategy is a contingency plan executed by investors, venture capitalists, or business owners to liquidate their position in a financial asset or business. In the context of consumer and marketplace investing, exit strategies serve multiple purposes: providing liquidity to investors, enabling founders to realize returns on their efforts, and allowing successful businesses to access larger markets or resources through strategic partnerships.

The fundamental goal of any exit strategy is converting illiquid equity positions into cash or liquid securities while maximizing returns on investment. For consumer and marketplace companies, this process is complicated by factors such as brand valuation, network effects, customer data value, and market positioning that may not be easily quantifiable but significantly impact exit valuations.

Unique Characteristics of Consumer & Marketplace Exits

Consumer and marketplace companies present distinct considerations that differentiate their exit strategies from other technology or service-based businesses. These characteristics directly influence exit timing, valuation methods, and potential buyer interest.

Consumer Brand Considerations:

- Brand equity and customer loyalty as intangible assets

- Customer acquisition costs and lifetime value metrics

- Market penetration and geographic expansion potential

- Supply chain relationships and distribution networks

- Seasonal or cyclical business patterns affecting timing

Marketplace Platform Dynamics:

- Network effects and platform liquidity

- Multi-sided market dynamics and growth potential

- Data assets and customer insights value

- Competitive moats and switching costs

- Scalability across different verticals or geographies

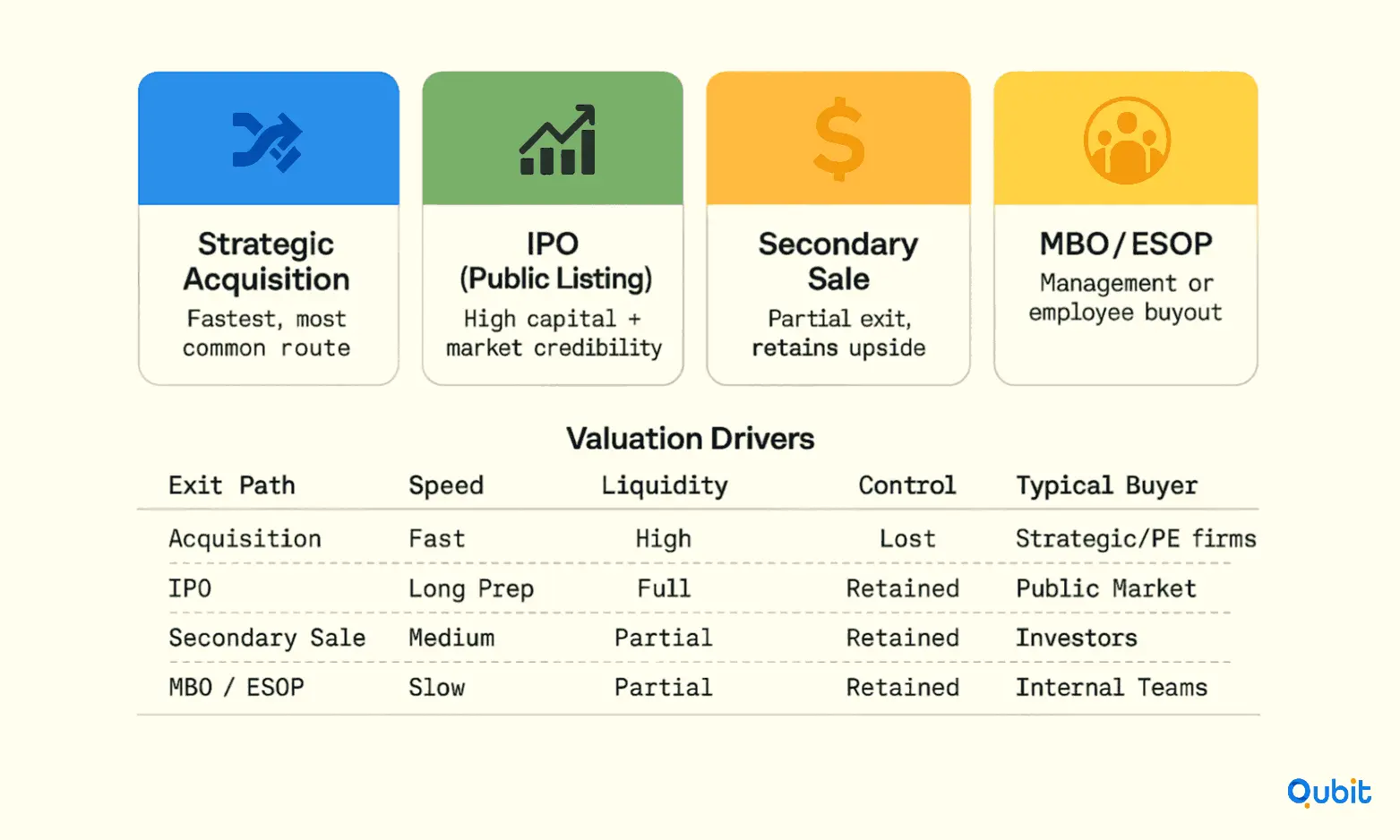

Primary Exit Strategy Options

Acquisitions: The Most Common Path

Acquisitions represent the most frequent exit route for consumer and marketplace startups, typically occurring when larger companies purchase startups to access their technology, talent, customer base, or market position. This exit strategy offers several advantages including faster execution compared to IPOs, more predictable outcomes through negotiated terms, and the potential for strategic synergies between the startup and acquiring company.

Types of Strategic Acquisitions:

| Acquisition Type | Buyer Motivation | Typical Timeline | Valuation Factors |

|---|---|---|---|

| Technology Acquisition | Access to proprietary technology or IP | 3-6 months | Technology differentiation, patent portfolio |

| Talent Acquisition | Acquire skilled teams and expertise | 2-4 months | Team quality, retention agreements |

| Market Expansion | Enter new markets or customer segments | 6-12 months | Market size, customer base quality |

| Competitive Elimination | Remove potential competition | 3-9 months | Market share, competitive threats |

| Vertical Integration | Control supply chain or distribution | 6-18 months | Strategic value, operational synergies |

Acquisition advantages include the ability to provide immediate liquidity to investors and founders, often at premium valuations when strategic value is clear. However, acquisitions may result in loss of company independence, potential restructuring, and founders having limited control over the acquired company's future direction.

Initial Public Offerings (IPOs): The Gold Standard

Going public through an IPO is often considered the gold standard of exits, providing access to significant capital, enhanced company visibility, and the ability for early investors to achieve substantial returns. IPOs enable companies to sell shares to public investors, creating a liquid market for equity positions while maintaining company independence.

IPO Advantages:

- Access to large-scale capital markets for continued growth

- Enhanced company credibility and market visibility

- Liquidity for early investors and employees through public trading

- Currency for future acquisitions through publicly traded stock

- Potential for higher valuations compared to private transactions

IPO Challenges:

- Substantial legal, accounting, and regulatory costs (often $3-5 million minimum)

- Extensive regulatory compliance and ongoing reporting requirements

- Market volatility affecting timing and final valuation

- Lock-up periods preventing immediate liquidity for insiders

- Public scrutiny and quarterly earnings pressure

For consumer and marketplace companies, IPOs typically require annual revenues of $100+ million, strong growth trajectories, and proven business models that can withstand public market scrutiny.

Secondary Sales: Partial Liquidity Solutions

Secondary sales allow existing shareholders to sell portions of their equity to new investors without requiring full company exit. This strategy provides interim liquidity while maintaining involvement in the company's continued growth, making it particularly attractive for early investors seeking to reduce risk exposure or diversify their portfolios.

Secondary Sale Benefits:

- Partial liquidity without complete exit from investment

- Opportunity to reduce risk while maintaining upside potential

- No disruption to company operations or management

- Flexibility to sell additional shares in future transactions

- Validation of company valuation through market transactions

Secondary sales work best for companies that don't require additional capital from the transaction and can attract motivated buyers interested in private market exposure. These transactions often occur during later funding rounds when institutional investors provide liquidity to earlier backers.

Management Buyouts (MBOs) and Employee Ownership

Management buyouts allow leadership teams to acquire controlling stakes in their companies, ensuring business continuity while providing exit opportunities for existing investors. This approach works particularly well for profitable consumer and marketplace companies where management teams have deep operational knowledge and established customer relationships.

MBO Financing Components:

- Management team personal investment

- Debt financing from banks or lending institutions

- Private equity partnership for additional capital

- Seller financing with flexible payment terms

Employee Stock Ownership Plans (ESOPs) represent an alternative approach that transfers ownership to employees while providing tax advantages and preserving company culture. ESOPs typically cost $50,000-$400,000 to establish with ongoing annual costs of approximately one-third of setup expenses.

Consumer & Marketplace Specific Considerations

Network Effects and Platform Value

Marketplace companies possess unique characteristics that significantly impact exit strategies and valuations. Network effects, where platform value increases with user growth, create powerful competitive advantages but require careful evaluation during exit processes.

Key Marketplace Valuation Factors:

- Liquidity and Transaction Volume: Active buyer-seller matching and transaction frequency

- Market Share and Competitive Positioning: Dominance in specific verticals or geographies

- Unit Economics and Take Rates: Revenue per transaction and margin sustainability

- Customer Acquisition and Retention: Cost efficiency and user stickiness

- Data Assets and Analytics: Customer insights and predictive capabilities

Marketplace exits often attract strategic buyers seeking to expand their platform capabilities or enter new markets. Technology companies, traditional retailers, and financial services firms frequently acquire marketplace platforms to access new customer bases or enhance their digital capabilities.

Consumer Brand Equity and Valuation

Consumer brand companies present distinct valuation challenges during exit processes, as brand equity, customer loyalty, and market positioning represent significant but intangible assets that require sophisticated evaluation methods.

Consumer Brand Value Drivers:

- Brand Recognition and Customer Loyalty: Market research and customer lifetime value analysis

- Distribution Relationships: Retail partnerships and channel access

- Intellectual Property: Trademarks, trade secrets, and proprietary formulations

- Supply Chain Advantages: Manufacturing relationships and cost structures

- Geographic Expansion Potential: International market opportunities

Potential acquirers for consumer brands include large consumer goods companies seeking portfolio expansion, private equity firms focused on consumer investments, and strategic buyers looking to enter new product categories or markets.

Investor Evaluation and Decision-Making

Investors typically expect returns within 5-10 years of initial investment, making exit strategy alignment crucial for successful outcomes. Different investor types have varying expectations and timelines that influence exit planning and execution.

Investor Type Expectations:

| Investor Category | Typical Hold Period | Target Returns | Exit Preferences |

|---|---|---|---|

| Angel Investors | 3-7 years | 10-20x returns | Acquisitions, secondary sales |

| Venture Capital | 5-10 years | 5-15x returns | IPOs, strategic acquisitions |

| Private Equity | 3-7 years | 3-5x returns | Management buyouts, acquisitions |

| Strategic Investors | Variable | Strategic value + returns | Acquisitions, partnerships |

Due Diligence and Exit Preparation

Successful exits require extensive preparation and due diligence to maximize valuation and minimize transaction risks. This process often begins years before the actual exit transaction, involving systematic improvements to financial systems, operational efficiency, and market positioning.

Exit Preparation Checklist:

- Financial Systems: Clean accounting records, audited statements, and predictable revenue streams

- Legal Structure: Proper corporate governance, intellectual property protection, and compliance records

- Operational Efficiency: Documented processes, key person risk mitigation, and scalable systems

- Market Position: Competitive analysis, customer concentration assessment, and growth strategy validation

- Team Stability: Management retention agreements and succession planning

Timing and Market Considerations

Market Conditions and Exit Timing

Exit timing significantly impacts transaction outcomes, with market conditions, industry trends, and company-specific factors all influencing optimal exit windows. Understanding these dynamics enables better strategic decision-making and value maximization.

Optimal Exit Timing Factors:

- Market Conditions: Strong M&A activity and favorable valuations in relevant sectors

- Company Performance: Consistent growth, strong financial metrics, and positive momentum

- Industry Trends: Sector consolidation, regulatory changes, or technology disruptions

- Competitive Landscape: Market positioning relative to competitors and potential threats

- Internal Readiness: Management team stability and operational preparedness

Regulatory and Compliance Considerations

Consumer and marketplace companies often face sector-specific regulatory considerations that impact exit processes and valuations. Understanding these requirements early in the investment lifecycle enables better exit planning and risk mitigation.

Common Regulatory Considerations:

- Data Privacy and Security: GDPR, CCPA, and other data protection regulations

- Financial Services: Payment processing, lending, or financial product regulations

- Consumer Protection: Advertising standards, product safety, and disclosure requirements

- Marketplace Regulations: Platform liability, seller verification, and transaction oversight

- Antitrust Considerations: Market concentration and competitive impact assessments

Exit Strategy Planning and Implementation

Developing Exit Roadmaps

Successful exit strategies require systematic planning that begins during the initial investment phase rather than waiting until exit timing becomes urgent. This approach enables value optimization and reduces execution risks when exit opportunities arise.

5-Year Exit Planning Timeline:

Years 1-2: Foundation Building

- Establish robust financial systems and reporting capabilities

- Build strong market position and competitive advantages

- Develop scalable operational infrastructure

- Recruit experienced management team with relevant expertise

Years 3-4: Value Enhancement

- Optimize business model and unit economics

- Expand market reach and customer base

- Strengthen intellectual property portfolio

- Build strategic partnerships and distribution channels

Year 5+: Exit Preparation

- Conduct management presentations and market positioning

- Engage investment banks or exit advisors

- Complete due diligence preparation and documentation

- Execute chosen exit strategy with professional support

Professional Support and Advisory Services

Engaging experienced professionals significantly improves exit outcomes through specialized expertise in valuation, negotiation, and transaction management. The complexity of modern exit transactions makes professional support essential for maximizing value and minimizing risks.

Key Advisory Roles:

- Investment Banks: Transaction execution, buyer identification, and negotiation management

- Legal Counsel: Contract negotiation, regulatory compliance, and risk mitigation

- Tax Advisors: Tax optimization strategies and structure recommendations

- Valuation Experts: Business valuation and financial analysis support

- Industry Specialists: Sector expertise and market intelligence

Common Challenges and Risk Mitigation

Valuation Disputes and Expectations Management

Disagreements between buyers and sellers regarding company valuation represent one of the most common challenges in exit transactions. These disputes often arise from differing perspectives on growth potential, market conditions, and competitive positioning.

Valuation Risk Mitigation Strategies:

- Independent Valuations: Third-party valuation analysis to establish baseline expectations

- Comparable Transaction Analysis: Research similar transactions for benchmark pricing

- Multiple Valuation Methods: DCF analysis, market multiples, and asset-based approaches

- Earnout Structures: Performance-based payments to bridge valuation gaps

- Regular Valuation Updates: Periodic assessments to track value creation progress

Cap Table Complexity and Exit Waterfalls

Complex capitalization structures can significantly complicate exit processes, potentially causing deals to fail even when adequate buyer interest exist. Clean cap tables and clear exit waterfalls become essential for successful transaction completion.

Common Cap Table Issues:

- Stacked Liquidation Preferences: Multiple layers of preferred rights affecting distributions

- Fragmented Ownership: Numerous small investors complicating decision-making

- SAFE Conversion Complications: Uncertain conversion terms creating valuation disputes

- Inadequate Employee Equity: Insufficient stock option pools affecting retention

- Unclear Governance Rights: Ambiguous voting and consent requirements

Exit waterfall analysis reveals how transaction proceeds flow through the cap table, helping identify potential issues before they impact transaction success. Running these scenarios early enables structural improvements that enhance exit prospects.

Case Studies and Market Examples

Successful Consumer Brand Exits

Consumer brand exits demonstrate the importance of building strong market positions and brand equity that translate into premium valuations during exit processes. Companies that successfully develop loyal customer bases and defensible market positions often achieve favorable exit outcomes.

Key Success Factors in Consumer Brand Exits:

- Strong brand recognition and customer loyalty metrics

- Diversified product portfolio and revenue streams

- Scalable operational infrastructure and supply chain

- Clear growth opportunities and expansion potential

- Experienced management teams with proven track records

Marketplace Platform Exit Examples

Marketplace platform exits typically focus on network effects, user engagement, and platform scalability as primary value drivers. Successful marketplace exits often involve strategic buyers seeking to expand their digital capabilities or enter new market verticals.

Marketplace Exit Value Drivers:

- Active user growth and engagement metrics

- Transaction volume and revenue per user trends

- Market share in target verticals or geographies

- Technology infrastructure and scalability capabilities

- Data assets and customer insights value

Conclusion

Exit strategies are a critical component of successful consumer and marketplace investing, guiding founders and investors toward liquidity events that maximize returns and sustain growth momentum. Acquisitions dominate as the preferred exit mechanism due to their relative speed, predictability, and strategic value alignment, while IPOs offer substantial capital and visibility for market leaders.

Entrepreneurs and investors who proactively plan and execute thoughtful exit strategies position themselves to reap the full rewards of their investments while laying a foundation for continued success in the evolving consumer and marketplace sectors.

The right acquisition is about timing and fit. Discover Strategic Acquisition and let’s talk about what’s possible for your next chapter.

Key Takeaways

- Acquisitions remain the most common exit route for consumer and marketplace startups, offering faster execution and predictable outcomes compared to IPOs.

- Consumer brands require evaluation of intangible assets like brand equity and customer loyalty, while marketplaces focus on network effects and platform scalability.

- Exit planning should begin during initial investment phases with systematic value enhancement over 3-5 year periods before transaction execution.

- Professional advisory support from investment banks, legal counsel, and valuation experts significantly improves exit outcomes and transaction success rates.

- Clean cap tables and clear exit waterfalls are essential for successful transactions, requiring early attention to ownership structure and governance rights.

Frequently asked Questions

When should consumer and marketplace companies begin planning their exit strategy?

Exit planning should begin within 1-2 years of initial investment, with systematic preparation occurring 3-5 years before anticipated exit.

Back

Back