Securing funding is a critical milestone for startups, yet the odds are often stacked against them. According to Startup Stats, only 10%-20% of startups succeed, while nearly 45% fail within five years. These sobering statistics highlight the importance of understanding what angel investors look for when deciding to back a venture.

Angel investors, individuals who provide capital to startups in exchange for equity, play a pivotal role in early-stage funding. To define angel investors, they are typically high-net-worth individuals who invest in startups with promising growth potential. Their expectations go beyond financial returns; they seek innovative ideas, strong leadership, and scalable business models.

Let’s explore how startups can meet and exceed these expectations to stand out in a competitive market.

Understanding What Angel Investors Expect

Angel investors play a pivotal role in the startup ecosystem, offering more than just financial backing. These individuals or groups often step in during the early stages of a business, providing critical funding to help startups scale. Angels expect a strong team, growth market, early traction, and a realistic path to 20-25% annual ROI. However, their contributions extend far beyond capital. Provide content that matches the heading but not fluff

The scale of angel investing is expanding rapidly. In 2023, active US angel investors reached 63,000, up 8% year-over-year, with $420,000 as the average deal size, a 15% jump. These figures illustrate both increasing investor engagement and larger commitments, confirming their substantial influence in early-stage funding.

- Strong team

- Scalable plan

- Early traction

- Clear ROI projections

Beyond Financial Support

Beyond funding, understanding what angel investors expect is crucial for startups seeking strategic support and mentorship. Angel investors are known for their strategic involvement in startups. They frequently offer mentorship, guiding founders through the complexities of business operations and growth strategies.

Their industry expertise can be invaluable. It helps startups avoid common pitfalls and make informed decisions. Additionally, angel investors often open doors to key industry networks, connecting startups with potential partners, customers, or additional investors.

For entrepreneurs wondering what are angel investors, they are typically high-net-worth individuals who invest their own money in startups in exchange for equity. Historically, angel investors have been instrumental in nurturing early-stage companies, often taking risks that traditional financial institutions avoid.

Ownership Equity and Due Diligence

In exchange for their investment, angel investors typically acquire ownership equity in the business. This arrangement aligns their interests with the startup’s success, as their returns depend on the company’s growth and profitability. To ensure their investment is sound, angel investors rely on rigorous due diligence processes. Increasingly, they are adopting tech-enabled tools to assess opportunities, streamlining the evaluation of business models, market potential, and financial projections.

For startups looking to secure angel funding, understanding the multifaceted role of these investors is crucial.

Angel investors are more than financial backers—they are strategic partners who contribute to a startup’s success through mentorship, connections, and expertise. Their involvement can be transformative, especially for early-stage businesses seeking to establish themselves in competitive markets.

The scale of angel commitment is notable worldwide. As of March 31, 2025, registered Angel Funds in India reached 103, with total commitments of Rs. 10,138 crores. This level of participation emphasizes the expanding global role of angel investors.

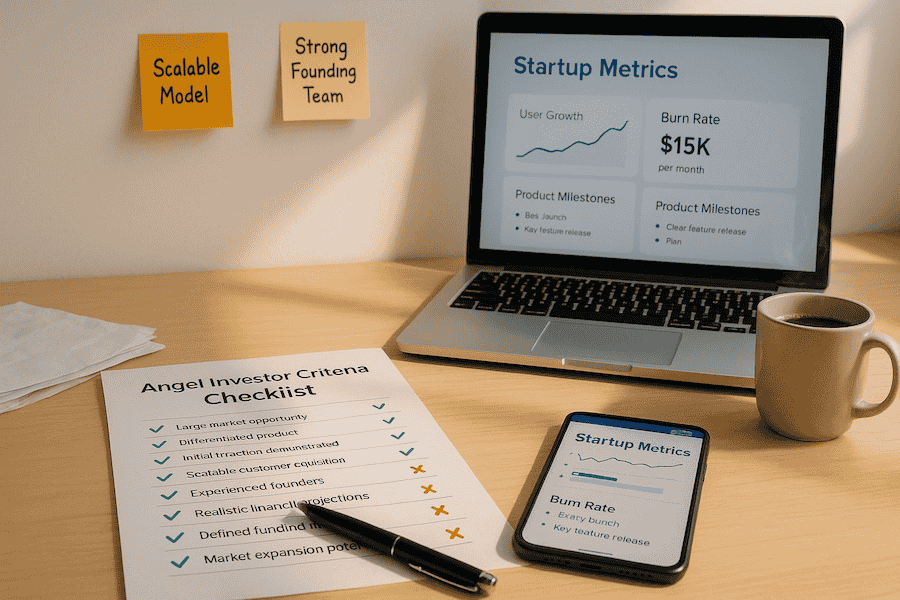

Investor Criteria: Meeting & Exceeding Expectations

Startups must understand what angel investors expect to meet and exceed their criteria.

To attract high-net-worth individuals, startups must understand what drives their decision-making process and how to stand out from the competition.

Competition for angel funding is intense. In 2024, only 2 out of 100 companies applying to angel groups succeeded in reaching an investor’s portfolio. This statistic demonstrates just how discerning angels are and underscores the critical need to stand out.

Angel investors want to see real progress early. Highlight your team's unique strengths. Prepare a plan that withstands tough investor questions.

How Can You Go Above and Beyond Angel Investor Expectations?

While meeting basic criteria is a good starting point, startups that go above and beyond often secure funding faster and build stronger relationships with investors. Here’s how:

- Detailed Market Insights: Presenting well-researched market projections can make a compelling case for your startup’s growth potential. For instance, citing the projected growth of the Angel Funds Market can reinforce your argument about the long-term viability of angel funding.

- Understanding Investor Demographics: The landscape of angel investing is evolving. In 2023, 46.7% of U.S. angel investors were women, reflecting a significant trend toward gender diversity. This demographic shift can influence the type of startups funded and the industries that gain traction. Highlighting how your startup aligns with these trends can set you apart.

- Proactive Communication: Investors appreciate transparency and regular updates. By providing detailed reports on milestones, challenges, and future plans, startups can build trust and demonstrate accountability.

- Social Impact: Increasingly, investors are drawn to ventures that combine profitability with social responsibility. Showcasing how your startup contributes to societal or environmental goals can resonate with angel investors who prioritize purpose-driven investments.

- Exceeding Angel Investor Criteria: Startups that not only meet but also surpass standard expectations often gain a competitive edge. By showcasing advanced strategies, such as leveraging innovative technologies or aligning with emerging market trends, entrepreneurs can demonstrate their commitment to long-term success.

Aligning Expectations for Investor Involvement

Building on these insights, founders should proactively discuss the level of involvement and control expected by angel investors. Establishing clear boundaries around decision-making authority and strategic guidance helps prevent misunderstandings. This approach fosters trust and ensures both parties share a common vision for the startup’s growth. Early alignment on roles and expectations can significantly strengthen long-term investor relationships.

Steps for Transparent Investor Communication

- Clearly outline investment terms, including equity offered and anticipated control arrangements before negotiations begin.

- Disclose key business risks and mitigation strategies to foster trust and demonstrate preparedness to potential investors.

- Set expectations for investor involvement, such as mentorship, board participation, or passive support, early in discussions.

The international opportunity is expanding. In India, recognized startups surged from 20,000 in 2015 to over 1,59,000 by early 2025. This explosive growth underscores why founders should position their ventures for scalable success in dynamic markets.

Metrics That Matter

To exceed expectations, startups must present measurable data that validates their claims. Key metrics include:

Emphasizing revenue is not just for optics, it’s a proven differentiator. In 2023, companies with early revenue streams attracted 50% more angel funding than pre-revenue startups. This data highlights why clearly demonstrating traction can substantially improve funding outcomes.

- Revenue Growth: Demonstrating consistent revenue growth over time signals stability and scalability.

- Customer Acquisition Costs (CAC): A low CAC compared to lifetime customer value (LTV) indicates a sustainable business model.

- Market Share: Highlighting your startup’s position within the industry can reinforce its competitive edge.

Active Involvement of Angel Investors

Angel investors’ active participation often transforms them into key partners in a startup’s journey, making their contributions far more impactful than financial backing alone. For startups wondering how to find a business angel, understanding their engagement strategies and aligning with their expectations can make all the difference.

The Angel investors often contribute more than capital to the startups they support. Many choose to take an active role, offering mentorship, strategic guidance, or even joining the board of directors. This hands-on involvement can be invaluable for founders navigating the complexities of early-stage growth. By sharing their expertise, angel investors help startups refine their business models, expand networks, and tackle unforeseen challenges.

Before committing to a venture, angel investors typically conduct a rigorous due diligence process, dedicating 20 to 40 hours to evaluate the startup’s potential. This thorough examination ensures informed decision-making and enhances the likelihood of favorable returns. For startups, understanding this process is crucial, as it highlights areas requiring improvement and builds trust with investors.

Analyzing Risks: Key Factors by Angel Investors

A key part of what angel investors expect is strong risk mitigation strategies from startups. Angel investors take a meticulous approach to risk evaluation, prioritizing startups that demonstrate robust mitigation strategies. Their assessments extend beyond financial uncertainties, delving into market dynamics, technological viability, and regulatory compliance.

Market risks often involve analyzing demand trends and competitive landscapes, while financial risks focus on revenue models and cash flow stability. Technological risks are scrutinized for scalability and innovation, ensuring the startup’s solutions can adapt to evolving industry needs. Regulatory risks, meanwhile, require a clear understanding of compliance requirements to avoid legal complications.

Startups that proactively address these concerns stand out. Additionally, sector-specific angel networks, such as those focused on climate tech or agritech, refine due diligence by offering domain expertise.

Startups lacking compliance structures or facing high competitive risk often lose investors during due diligence. By presenting clear strategies for risk mitigation, startups can build confidence and secure angel investment effectively.

Portfolio Diversification and Angel Risk Management

Beyond individual startup risks, angel investors often diversify their portfolios across multiple ventures to manage overall exposure. This strategy allows them to balance potential losses with the chance of outsized returns from a few successful investments. Understanding this approach helps founders appreciate why investors may seek a range of opportunities rather than relying on a single outcome.

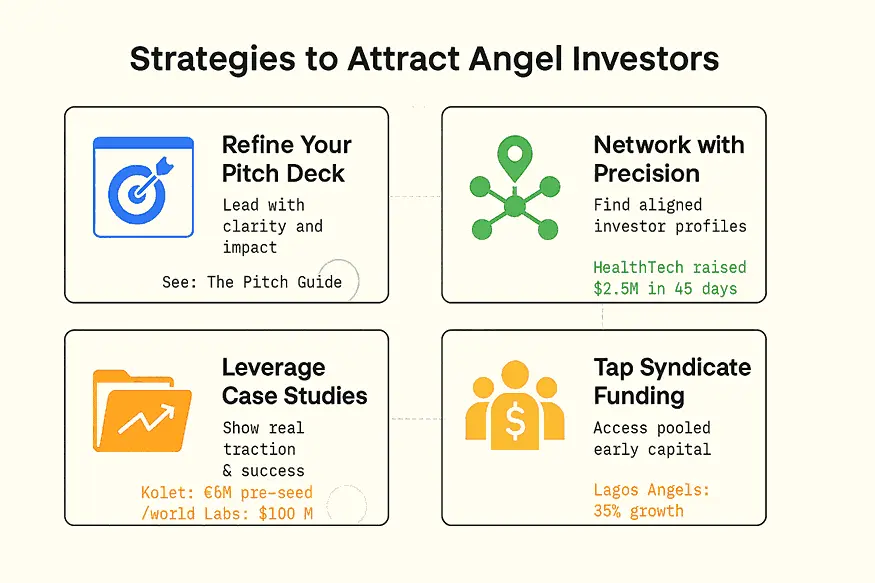

Strategies to Attract Angel Investors Effectively

Securing angel investment requires a combination of strategic planning, compelling storytelling, and targeted outreach. To stand out, startups must focus on refining their pitch deck, showcasing engaging product demonstrations, and building connections with the right investors.

1. Build a Compelling Pitch Deck

A well-crafted pitch deck is your first opportunity to capture an investor’s attention. Highlight your unique value proposition, market potential, and financial projections in a clear, visually appealing format. For practical guidance on creating a pitch deck that meets investor expectations, refer to The pitch Guide, which offers actionable steps for refining your pitch.

2. Conduct Targeted Networking

Connecting with investors who align with your industry and vision is crucial. For example, a HealthTech startup successfully closed a $2.5M seed round in just 45 days by focusing on angel investors with portfolios in healthcare AI. Tailoring your outreach to investors with relevant expertise increases your chances of securing funding.

3. Use Real-Life Case Studies

Demonstrating success through case studies can build trust and credibility. The Kolet Case, for instance, raised €5 million in pre-seed funding by involving 40 international angel investors through a coordinated pitch campaign. Similarly, World Labs attracted $100M at the pre-seed stage by showcasing founder expertise and a robust technical roadmap.

4. Explore Syndicate-Led Funding

Angel groups are increasingly pooling resources for mega rounds, offering startups access to larger capital at earlier stages. The Lagos Angels Network’s sector-focused syndication model is a prime example, achieving 35% portfolio growth despite market challenges.

Employing effective strategies for how to attract angel investors can significantly enhance your ability to meet their criteria.

Conclusion

Meeting what angel investors expect is essential for securing the right funding and building lasting partnerships. Throughout this blog, we’ve emphasized the importance of aligning with investor criteria, reducing risks, and crafting a compelling pitch that resonates. These elements not only build trust but also set the foundation for successful funding partnerships.

A clear, narrative-driven pitch paired with actionable insights ensures your startup stands out in competitive markets. By exceeding expectations and addressing potential concerns upfront, you position your business as a reliable and innovative investment opportunity.

If you're ready to take the next step in finding the perfect investor match, our Investor Discovery and Mapping service is designed to help you achieve your funding goals. Let us guide you in identifying and connecting with investors who align with your vision.

Key Takeaways

- Angel investors evaluate startups based on leadership strength, market potential, early traction, and potential return on investment (ROI).

- While meeting basic investment criteria is necessary, exceeding expectations can greatly improve funding chances.

- Investors often bring more than money, active mentorship and access to strategic networks add significant value.

- Startups must present clear risk mitigation strategies and well-prepared financial projections to build investor confidence.

- Learning from real-life case studies and using data-backed insights helps startups craft more compelling and effective pitches.

Frequently asked Questions

What metrics should startups present to angel investors?

Key metrics for angel investors include revenue growth, market share, and customer acquisition cost. Present data-backed projections and clear traction to build confidence.