Retail startups will see major changes in 2025. Venture capital investments are fueling this transformation. The Q1 2025 Global VC First Look reports global venture funding at $126.3 billion. This marks a 6% increase from the previous quarter. The growth highlights more opportunities for retail startups seeking funding from top venture capital funds.

This blog highlights the top venture capital firms driving retail innovation. It also offers practical tips for startups seeking funding. For more advanced strategies, see retail startup fundraising strategies. This guide covers e-commerce and retail VC funds in detail.

Let’s get started!

Retail VC Investors

Retail venture capital is changing fast. Funding trends show shifting investor priorities in the retail industry. Rezolve AI is a strong example. Citadel Global Equities led a $50 million investment to expand Rezolve AI’s retail platform. This funding helped Rezolve AI reach $70 million in Annual Recurring Revenue. The company also secured a $10 million annual contract with Liverpool retailer.

According to retail tech deals worldwide, this surge shows the sector’s ability to attract capital. Innovations in AI-powered customer experiences, inventory management, and omnichannel solutions drive this growth.

However, retail FinTech faces challenges. Macroeconomic pressures like tariffs and inflation caused a 37.8% drop in funding in Q1 2025. Outside fintech, founders in e-commerce and consumer packaged goods (CPG) still attract top seed investors for retail startups.

As recent market reports note, these factors have lowered investor confidence in retail FinTech. Payment processing platforms and financing tools are especially affected.

VC investors in retail support startups at every stage, from seed to later series. This range lets founders find seed VCs or later-stage partners as they grow. It also helps firms foster innovation and manage risk.

For more on how private equity works with venture capital in retail, see top retail PE firm investors.

What Leading Retail-Focused Venture Capital Firms Do Differently

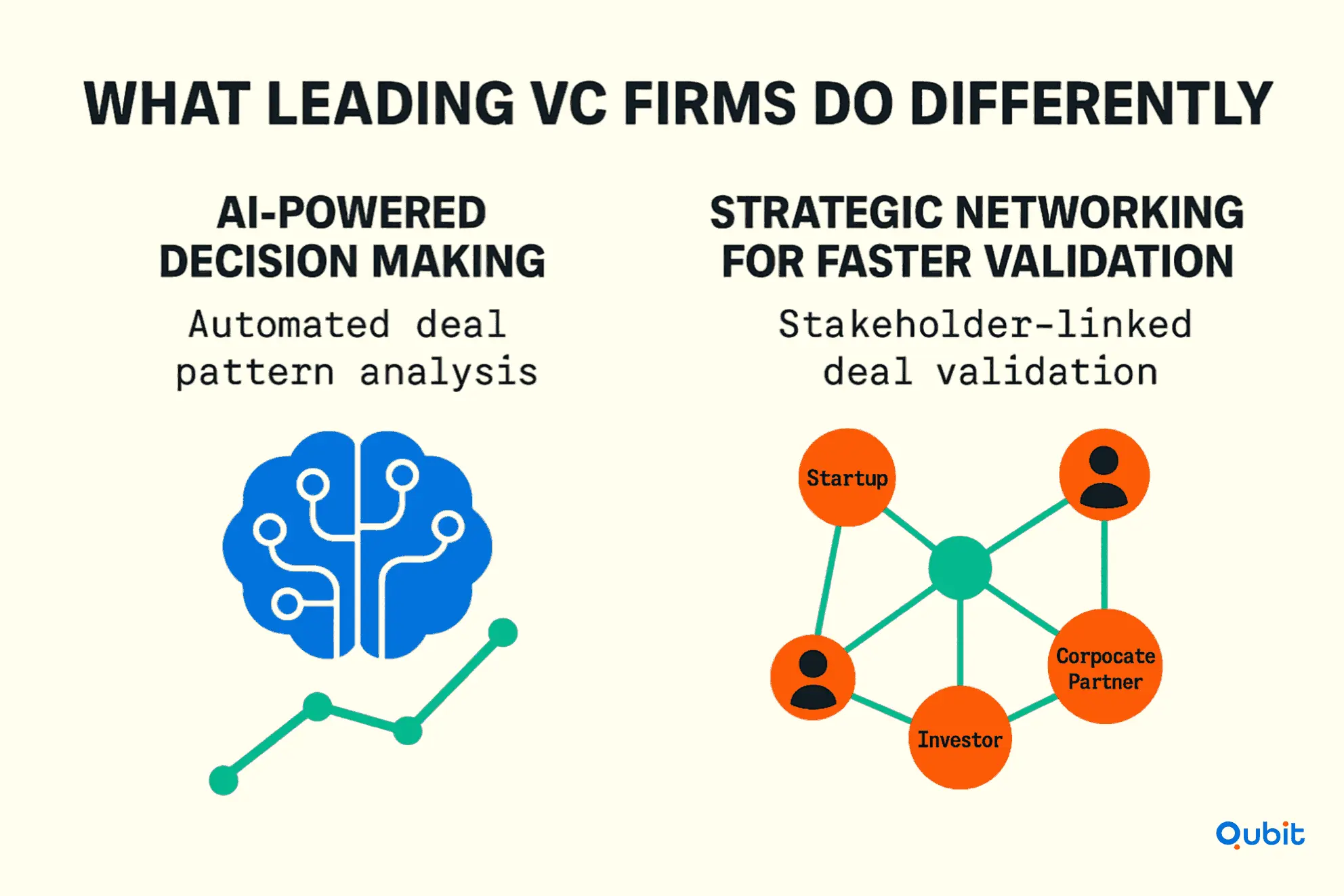

Top venture capital firms stand out by using advanced technology, building strong networks, and being selective. These strategies drive growth and improve portfolio performance in retail.

AI-Powered Decision Making for Retail Venture Capitalists

Artificial intelligence (AI) is changing how VC firms find and manage investments. Nearly 64% of firms now use AI tools for deal sourcing and portfolio tracking.

TechScout, Quid, and Caena are specialized tools for deal discovery. Caena particularly excels at automating the identification of potential investments that align with a firm's investment thesis, auto-filtering inbound deals based on specific criteria so VCs don't have to manually review hundreds of pitch decks.

Eilla AI provides AI analysts that support VC teams with research across over 8 million companies, using sources like Capital IQ to streamline workflow and deliver data-driven insights.

These tools scan large datasets to find hidden patterns. This helps firms spot high-potential investments more accurately.

Strategic Networking for Commerce Tech VC

Building strong networks is key for successful VC firms. Founders often ask where to meet retail-focused investors. These networks help validate deals faster and connect startups with corporate partners and industry experts.

- Start with clear goals: Define which commerce-tech subsectors, geographies, and ticket sizes you want connections in; a focused target list yields warmer intros and higher-quality deal flow.

- Map relationship capital: Use a simple CRM (e.g., Affinity or Airtable) to log founders, execs, and co-investors, then set 30-day touch-points so each contact hears from you before the next round opens.

- Share, don’t hoard, deals: Circulate 1–2 vetted commerce-tech decks weekly to trusted syndicate partners; reciprocity expands scouting reach while preserving proprietary edge.

- Anchor on expertise hubs: Speak or mentor at Shopify, BigCommerce, or retail-tech accelerators; positioning as a niche expert attracts founders before competitive processes begin.

- Blend online & IRL: Post one insight thread per week on LinkedIn + X, then schedule coffee at flagship events (Shoptalk, NRF) to convert digital engagement into durable ties.

For example, corporate venture retail investments explains how corporate venture arms support retail financing. This approach speeds up decisions and helps startups reach product-market fit.

Focused Portfolio Support for Brand-Focused Venture Capital

Leading firms now focus on high-quality opportunities instead of spreading resources thin. AI analytics guide this selectivity. Firms can then give more attention to their portfolio companies.

By concentrating capital and operational resources on a smaller, data-validated set of companies, brand-focused VCs can deploy deep-dive playbooks, covering growth marketing, distribution partnerships, and strategic hiring, that simply aren’t feasible with a scatter-shot portfolio.

This focused support leads to faster growth and better product-market fit. It also improves long-term performance.

Top 7 Retail Venture Capital Firms

Here are the seven most active VC firms in retail startups from June 2024 to May 2025. They are ranked by deal count:

- Forerunner Ventures (36 investments)

Forerunner backs e-commerce, retail, and healthcare companies at Seed to Series B stages. They invest across the US, Canada, and Israel. - FJ Labs (36 investments)

FJ Labs invests in marketplaces and consumer startups from Seed to Series B. They support teams in the United States, Brazil, and the United Kingdom. - Global Founders Capital (29 investments)

GFC has backed over 500 founders worldwide. They invest in financial services, software, and fintech at Pre-Seed to Series A stages in the US, Germany, and the UK. - Accel (23 investments)

Accel targets software, SaaS, and IT companies at Series A to C. They invest in the US, India, and the UK. - SOSV (21 investments)

SOSV runs deep-tech accelerators like HAX and IndieBio. They fund biotech, health-tech, and software startups in the US, India, and the UK. - Index Ventures (20 investments)

Index Ventures has offices in London and San Francisco. They back tech-enabled e-commerce and internet startups from Seed to Series B. Their focus includes fintech, AI infrastructure, and mobility in the US, UK, and France. - District Ventures Capital (20 investments)

District Ventures, led by Arlene Dickinson, invests in Pre-Seed and Seed food, beverage, manufacturing, and retail startups in Canada and the US.

These firms offer deep retail expertise and strong networks. They are top partners for startups aiming to scale in consumer markets. If you seek VCs focused on e-commerce and retail, this list shows the range of specialization available.

Maximize Retail VC Dealmaking with Affinity

Relationship intelligence tools are changing how venture capitalists make deals. Affinity is a leading platform in this space. It helps firms optimize strategies with advanced analytics and automation.

By using Affinity Relationship Intelligence, users see real-time connections and opportunities. This enables smarter investment decisions tailored to portfolio needs.

Affinity tracks and analyzes relationships to make networking more strategic. For example, its real-time monitoring helps firms find high-potential startups and hidden opportunities. This data-driven approach streamlines workflows and improves decision-making. It ensures investments match long-term goals.

By adopting tools like Affinity, venture capitalists can unlock their network’s full potential. Every connection becomes more valuable.

Conclusion

Securing funding in retail, fintech, SaaS, and healthcare requires a tailored strategy. Each industry has unique dynamics. This blog shared actionable strategies for startups. Understanding market trends and telling a clear story are key to attracting investors.

Retail startups should align their pitch with data-driven storytelling. This approach increases appeal to venture capitalists. At Qubit Capital, we help startups refine funding strategies and connect with the right investors.

If you are ready to grow, our Fundraising Assistance service can help you secure needed resources. Let us guide you in building a strong funding foundation.

Key Takeaways

- Top retail VC firms focus on selectivity and network-driven deal sourcing.

- Strong retail tech funding and strategic investments in SaaS and healthcare show market confidence.

- Macroeconomic challenges affect retail FinTech funding, so adaptive strategies are needed.

- AI and analytics are changing investment decision-making.

- Relationship intelligence tools boost dealmaking and investor outreach.

- Data-driven storytelling in pitches increases startup appeal to investors.

Frequently asked Questions

How to find retail venture capital firms

Start by mapping firms that have recently backed commerce, e-commerce, CPG, and omnichannel startups. Use databases like Crunchbase and PitchBook, review accelerator alumni lists, and scan recent deal news. Shortlist partners who have invested at your stage and in your subcategory.

Back

Back