Data-driven organisations are 23× more likely to acquire customers, 6× more likely to retain them, and 19× more likely to be profitable. Advanced analytics has become a genuine game-changer for startup fundraising. Used well, it helps founders make data-driven decisions, uncover investor behavior patterns, and fine-tune their fundraising strategy instead of guessing what will work.

The shift toward data-driven fundraising is no longer theory. As of 2024, 94% of enterprises recognise analytics as essential for business growth and digital transformation, sending a clear signal that using data analytics for startups is now fundamental, not optional, if you want to stand out and attract the right investors.

This guide breaks down what advanced analytics actually means in a fundraising context and gives you practical strategies, tools, and step-by-step guidance you can apply immediately.

Why Advanced Analytics Matters in Startup Fundraising

Advanced analytics involves the use of sophisticated techniques like machine learning, predictive modeling (building models that predict future outcomes from historical data), and statistical analysis to interpret complex datasets.

Unlike traditional analytics, which focuses on analyzing historical data, advanced analytics predicts future trends, behaviors, and outcomes.

By embracing startup data analytics, you can:

- Predict Investor Behavior: Identify which investors are most likely to be interested in your venture.

- Optimize Fundraising Strategies: Tailor your approach based on data-driven insights.

- Enhance Decision-Making: Make informed choices grounded in quantitative evidence.

Incorporating data science for startups allows you to gain a deeper understanding of investor preferences, market dynamics, and fundraising outcomes.

This proactive approach sets you apart, showcasing your commitment to innovation and strategic planning.

Quantifying predictive analytics impact underscores its strategic value. Organizations using predictive analytics reported their top prioritized prospects donated seven times more than others. This result demonstrates how smarter prospect selection amplifies fundraising outcomes far beyond intuition.

Moving Beyond Traditional Analytics

Traditional analytics centers on descriptive statistics, summarizing past data to explain what has happened. Advanced analytics, on the other hand:

- Predicts Future Outcomes: Uses algorithms to forecast trends and investor behaviors.

- Identifies Hidden Patterns: Uncovers insights not apparent through basic analysis.

- Offers Prescriptive Solutions: Recommends actionable steps based on predictive insights.

When you adopt advanced analytics, you transition from reactive to proactive fundraising strategies. It allows you to stay ahead of the curve.

The Impact of Data-Driven Decision-Making

Data-driven decisions are transforming how startups approach fundraising. By utilizing advanced analytics, you can:

- Target Ideal Investors: Analyze investment patterns to focus on investors aligned with your industry and stage.

- Personalize Outreach: Customize communications based on investor interests and behaviors.

- Optimize Timing: Determine the best times and channels to engage with potential investors.

Example: Slack leveraged user engagement analytics to demonstrate significant traction to investors, securing substantial funding and propelling its growth.

How to Use Predictive Analytics for Fundraising Success

1. Discover the Potential of Predictive Analytics

Predictive analytics uses historical data and algorithms. These insights help anticipate future events.

- Investor Interest: Identify which investors are likely to engage.

- Market Movements: Stay ahead of industry trends that impact fundraising.

- Funding Timelines: Estimate how long fundraising efforts may take.

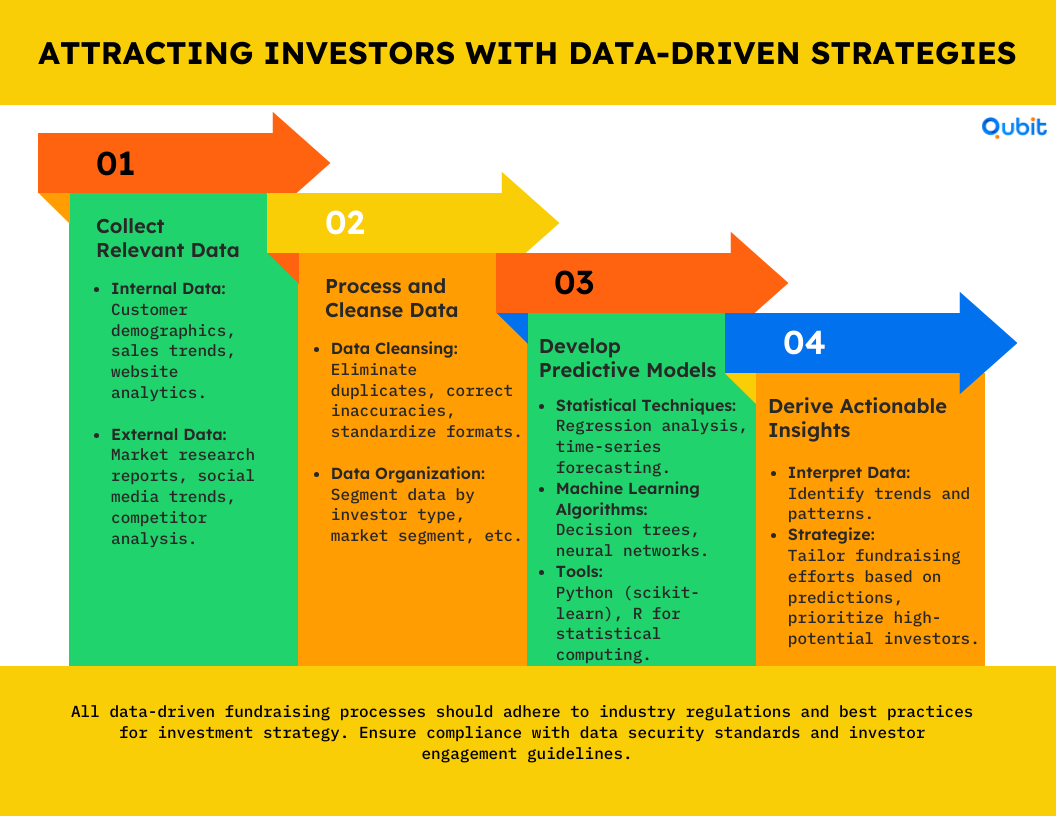

2. Attracting Investors with Data-Driven Strategies

Harnessing predictive analytics may seem difficult, but breaking it down into manageable steps makes it accessible.

3. Embedding Predictive Insights into CRM Workflows

This foundation enables startups to embed predictive analytics outputs directly into CRM and marketing platforms. Integrating insights with these systems streamlines segmentation, targeting, and campaign execution. By operationalizing predictions within daily workflows, teams can act quickly on data-driven opportunities. This approach enhances fundraising efficiency and supports scalable growth.

Step 1: Collect Relevant Data

- Internal Data:

- Customer demographics

- Sales trends

- Website analytics

- External Data:

- Market research reports

- Social media trends

- Competitor analysis

Step 2: Process and Cleanse Data

- Data Cleansing:

- Eliminate duplicates

- Correct inaccuracies

- Standardize formats

- Data Organization:

- Segment data by investor type, market segment, etc.

Step 3: Develop Predictive Models

- Statistical Techniques:

- Regression analysis (a way to find relationships among variables)...

- Time-series forecasting

- Machine Learning Algorithms:

- Decision trees

- Neural networks

- Tools:

- Python with libraries like scikit-learn

- R for statistical computing

Step 4: Extract Actionable Insights

- Interpret Data:

- Identify trends and patterns

- Strategize:

- Tailor fundraising efforts based on predictions

- Prioritize high-potential investors

Real-World Success Stories

Netflix's Data-Driven Fundraising

Netflix utilized predictive analytics to:

- Understand Viewer Preferences: Leveraged data to predict content success.

- Demonstrate Growth Potential: Showed investors data-backed projections.

- Result: Secured funding that fueled its expansion.

Airbnb's Market Prediction

Airbnb harnessed data analytics to:

- Identify Market Gaps: Analyzed travel trends and preferences.

- Forecast Demand: Predicted areas with high rental potential.

- Result: Attracted investors by showcasing a data-driven growth strategy.

Actionable Tips for Implementation

- Define Clear Objectives: Know what you want to predict.

- Invest in User-Friendly Tools: Platforms like Tableau and Power BI simplify analytics.

- Collaborate with Experts: Consider partnering with data scientists.

- Iterate Continuously: Refine models as new data emerges.

Why Regular Model Updates Sustain Predictive Value

Building on these implementation tips, startups must regularly update predictive models to reflect new data and market changes. As investor behaviors and fundraising conditions shift, outdated models can lead to inaccurate forecasts. By refreshing models when significant data changes occur, you ensure predictions remain relevant and actionable. This ongoing process helps maintain the reliability of your fundraising analytics over time.

Tracking and Enhancing Investor Engagement with Advanced Tools

If you’re not measuring which slide types get time and tweaking accordingly, you’re guessing while your competitors are A/B-testing. Advanced analytics tells you exactly where those 180 seconds go. You should utilize tools to get a better result

The Importance of Monitoring Investor Interactions

Understanding how investors engage with your materials helps you:

- Identify High-Interest Investors: Focus on those showing strong engagement.

- Refine Your Messaging: Adjust content to better resonate.

- Increase Conversion Rates: Allocate resources to the most promising leads.

Essential Tools for Fundraising Analytics

DocSend

- Features:

- Tracks document views, time spent, and forwarding

- Benefits:

- Provides insights into investor interest

- Helps tailor follow-ups based on engagement

Crunchbase

- Features:

- Database of investor and company information

- Benefits:

- Identifies potential investors

- Keeps track of industry trends

HubSpot

- Features:

- CRM with email tracking and analytics

- Benefits:

- Personalizes investor communication

- Automates outreach processes

Interpreting Investor Behavior

Use data from these tools to:

- Prioritize Outreach: Focus on investors with the highest engagement.

- Customize Content: Address specific interests or concerns.

- Optimize Timing: Schedule communications when they are most effective.

Personalizing Your Approach

- Tailor Emails: Reference specific interactions or interests.

- Schedule Strategic Follow-Ups: Reach out when engagement peaks.

- Provide Value: Share relevant updates or insights aligned with investor goals.

Data-Driven Pitch Decks That Impress Investors

In their 2023 seed report, DocSend found investors spent 20% less time reviewing decks year-over-year, but still raised the bar on what they wanted to see. In other words: you’re getting less attention and tougher judgment. That’s exactly why data-driven, sharp pitch decks matter more than eve

1. Why Make an Engaging Pitch Deck

Your pitch deck is usually the first real impression an investor has of your startup. In a few minutes, it needs to:

- Clearly communicate your vision

- Prove there’s a real market opportunity

- Show credible traction and growth potential with data

An engaging, well-structured, data-backed deck doesn’t just look good—it makes it easy for investors to say, “This is worth a deeper look.”

2. Including the Right Metrics and Data

Investors look for:

- Market Analysis: Size, growth projections, and trends.

- Competitive Landscape: Your unique advantages.

- Financial Forecasts: Revenue, expenses, and profitability timelines.

- Customer Metrics:

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (LTV)

- User Engagement: Retention rates, active users, and growth trends.

3. Advanced Data Visualization Techniques

Present data in a way that is:

- Clear and Compelling: Use charts and graphs for clarity.

- Interactive: Incorporate dynamic elements with tools like Power BI.

- Visually Appealing: Design infographics that simplify complex data.

Mastering data visualization can significantly enhance your pitch effectiveness.

Personalizing Pitches for Impact

- Align with Investor Interests: Highlight aspects that resonate with their focus areas.

- Address Potential Concerns: Proactively tackle questions or objections.

- Demonstrate Fit: Show how your startup complements their portfolio.

Tailoring Fundraising Strategies to Different Funding Stages

As your startup moves from idea to scale-up, your fundraising strategy can’t stay static. Investor expectations, proof points, and deal dynamics all change with each round.

1. Navigating Funding Stages

Each fundraising stage requires a unique approach:

Seed Stage

- Goal: Validate your concept and gain initial traction.

- Investors: Angel investors, seed funds.

- Focus:

- Product-market fit

- Team strengths

Series A

- Goal: Scale operations and expand reach.

- Investors: Early-stage venture capital firms.

- Focus:

- Revenue models

- Growth strategies

Series B and Beyond

- Goal: Accelerate growth and prepare for exit strategies.

- Investors: Larger VC firms, private equity.

- Focus:

- Market leadership

- Financial performance

2. Adjusting Your Strategy Accordingly

- Seed Stage:

- Highlight Vision: Emphasize the problem-solving aspect.

- Build Relationships: Engage with investors who offer mentorship.

- Series A and Beyond:

- Provide Detailed Financials: Share in-depth metrics and projections.

- Demonstrate Scalability: Show plans for rapid growth.

- Showcase Achievements: Present milestones and successes.

Impress investors by effectively presenting your startup's milestones and achievements.

Addressing and Overcoming Demographic Biases in Fundraising

Demographic bias still shapes who gets meetings, who gets term sheets, and who gets written off too early. Founders can’t fix the system alone, but they can learn to spot these patterns, counter them with evidence, and build investor pipelines that don’t rely on biased gatekeepers.

1. Recognizing the Impact of Biases

Demographic biases can limit opportunities for underrepresented founders.

- Statistics:

- Women-founded startups receive a small fraction of VC funding.

- Minority founders face similar disparities.

- Challenges:

- Limited access to networks

- Unconscious bias during evaluations

2. Strategies to Mitigate Bias

Promote Diversity Within Your Team

- Build a Diverse Team: Reflect a range of perspectives.

- Highlight Diversity: Showcase it as a strength in pitches.

Craft Inclusive Narratives

- Focus on Impact: Emphasize how your solution benefits diverse groups.

- Use Inclusive Language: Avoid terms that might alienate or exclude.

Engage with Diverse Investors

- Seek Like-Minded Investors: Find those committed to diversity.

- Utilize Specialized Platforms: Platforms like Backstage Capital support underrepresented founders.

Benefits of Embracing Diversity

- Innovation Boost: Diverse teams foster creativity.

- Market Appeal: Inclusive products reach wider audiences.

- Positive Branding: Attract investors supportive of diversity.

Success Stories

Blendoor's Mission for Inclusivity

- Challenge: Combat bias in hiring practices.

- Solution: Created a platform anonymizing candidate data.

- Outcome: Attracted investors by addressing a significant market need.

Benchmark your progress using industry standards to showcase your startup's value.

Selecting the Right Advanced Analytics Tools for Your Startup

The right analytics stack should fit your stage, data maturity, and team skills, not just look impressive on a slide. Start by choosing tools that help you track core fundraising and growth metrics reliably, then layer in more advanced platforms only when you’re actually ready to use them.

Tableau

- Pros:

- Sophisticated data visualization

- User-friendly interface

- Integrates with multiple data sources

- Cons:

- Higher cost

- Learning curve for advanced features

Power BI

- Pros:

- Affordable with a free version

- Integrates seamlessly with Microsoft products

- Real-time analytics capabilities

- Cons:

- Less customization

- May be challenging for non-Microsoft users

Mixpanel

- Pros:

- Focused on user behavior analytics

- Real-time insights

- Cons:

- Costs can escalate with data volume

- Requires technical proficiency

Criteria for Tool Selection

- Scalability: Can the tool grow with your startup?

- Budget: Does it fit within your financial constraints?

- Usability: Is it accessible for your team?

- Features: Does it meet your specific needs?

- Support: Are resources available for troubleshooting?

Integrating Tools Smoothly

- Compatibility: Ensure tools work with existing systems.

- APIs: Utilize to connect different platforms.

- Security: Prioritize data protection and compliance.

Staying Ahead with Emerging Trends in Fundraising Analytics

Fundraising analytics is evolving fast, from AI-driven investor targeting to real-time benchmarking against comparable startups. Staying on top of these trends helps you refine your story, spot investor shifts early, and make sharper, faster decisions than founders still flying blind.

Artificial Intelligence (AI) and Machine Learning

- Automation: Streamlines data processing.

- Enhanced Predictive Capabilities: Improves over time with learning.

Real-Time Analytics

- Immediate Feedback: Enables swift decision-making.

- Dynamic Adjustments: Adapts strategies on the fly.

Blockchain Technology

- Transparency: Builds trust with immutable records.

- Smart Contracts: Automates agreements with set conditions.

Looking Forward

- Personalization at Scale: Deliver tailored interactions to numerous investors.

- Accessibility of Advanced Tools: Technological advancements lower barriers.

- Data Privacy Focus: Compliance becomes increasingly vital.

Overcoming Implementation Challenges

Even the best analytics strategy falls apart if your data is messy, fragmented, or nobody actually uses the dashboards. Focus on small, high-impact use cases first, prove value, build trust internally, then expand your fundraising analytics stack instead of trying to “do it all” on day one.

1. Common Obstacles

Data Privacy Concerns

- Regulation Compliance: Navigating laws like GDPR.

- Investor Trust: Maintaining confidentiality.

Resource and Expertise Limitations

- Budget Constraints: Affording advanced tools and talent.

- Skill Gaps: Lacking in-house analytics expertise.

2. Practical Solutions

Partner with Experts

- Consultants: Bring in specialized knowledge.

- Advisory Boards: Gain strategic guidance.

Invest in Team Development

- Training Programs: Enhance staff skills.

- Certifications: Encourage professional growth.

Start Small

- Pilot Projects: Test strategies before full-scale implementation.

- Incremental Growth: Expand capabilities over time.

Commit to Continuous Learning

- Stay Informed: Keep up with industry changes.

- Networking: Engage with peers and thought leaders.

Prioritizing Ethical Data Governance in Fundraising Analytics

Beyond technical challenges, startups must prioritize ethical data governance when implementing fundraising analytics. Transparent data practices and strict compliance with regulations like GDPR build investor trust and safeguard sensitive information. Establishing clear policies for data collection, usage, and protection reduces legal risks and supports responsible innovation. This commitment is essential for sustainable fundraising success.

Conclusion

Advanced analytics offers a transformative approach to startup fundraising. By integrating advanced analytics into your strategies, you position your venture as innovative and forward-thinking—a compelling proposition for investors.

Implementing these strategies may require effort, but the rewards are significant. From personalizing investor engagements to selecting the right tools and staying ahead of trends, you're equipping your startup for success.

Looking to boost your fundraising strategy? Discover how Qubit Capital can support your journey with expert guidance through our fundraising assistance.

Key Takeaways

- Utilize Advanced Analytics: Embrace data-driven strategies to outperform competitors.

- Personalize Investor Engagement: Tailor interactions based on data insights for better results.

- Choose Appropriate Tools: Select analytics tools that suit your startup's needs and growth plans.

- Promote Diversity: Address biases to broaden your appeal and foster innovation.

- Stay Informed on Trends: Keep up with technology advancements to maintain a competitive edge.

Frequently asked Questions

How does predictive analytics improve startup fundraising outcomes?

Predictive analytics uses data trends and machine learning to forecast investor interest and market shifts, helping startups target efforts and increase their fundraising success.