Securing funding is a pivotal moment in a startup’s journey, but understanding the nuances between Series A and Series B rounds is essential for long-term success. These funding stages mark distinct milestones, each with unique metrics and investor expectations.

Series A focuses on scaling a validated business model, while Series B emphasizes expansion and market dominance. To grasp the broader context of venture capital and other financial methods a review of types of startup funding offers you a broader perspective. The review will help in contextualizing the role of venture capital in a diverse funding landscape. Let’s jump right in!

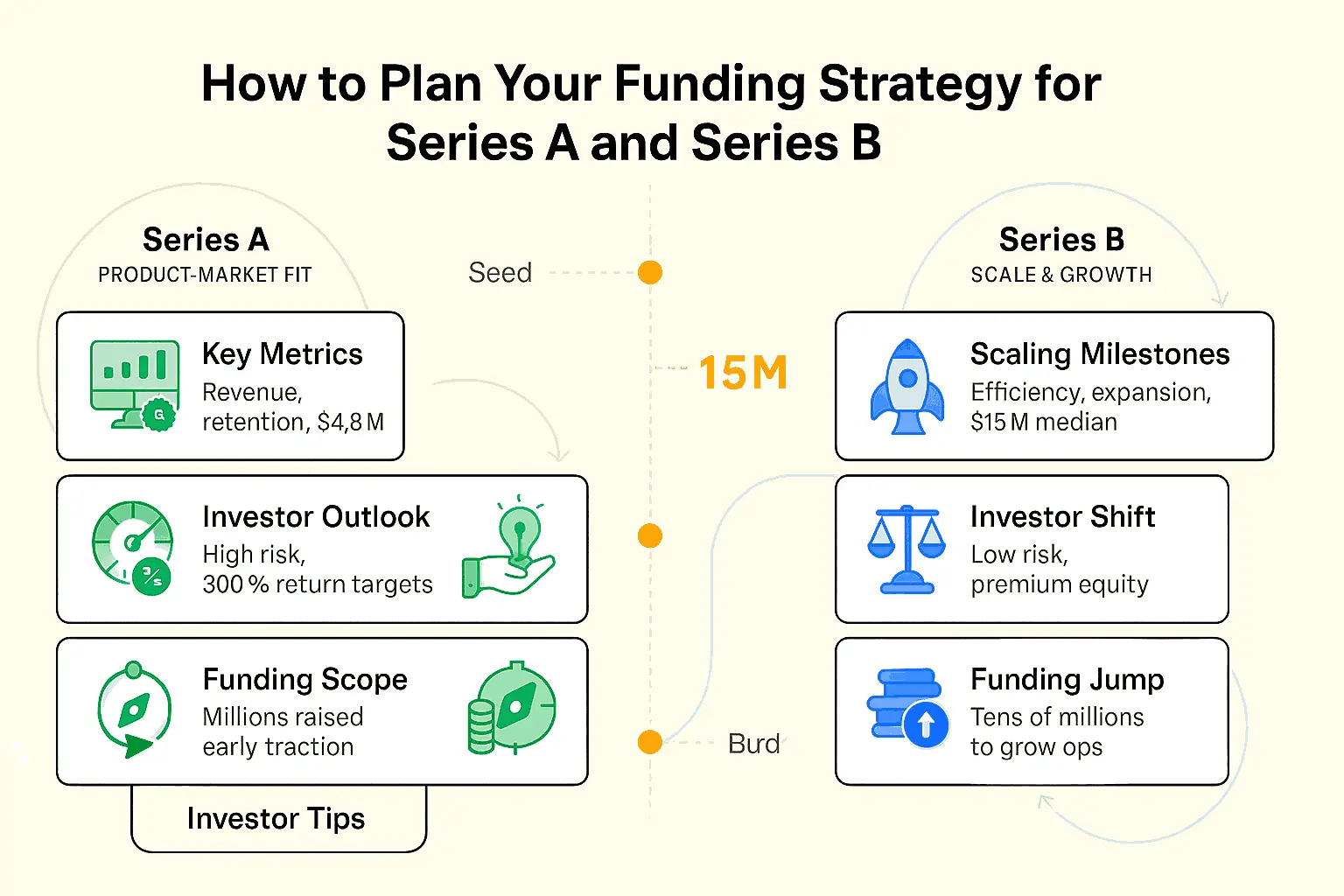

How to Plan Your Funding Strategy for Series A and Series B

Securing startup funding is a critical milestone for entrepreneurs, and understanding the nuances between Series A and Series B rounds can make all the difference. Each funding stage serves distinct purposes, with Series A focusing on proving product-market fit and Series B emphasizing scaling operations. This guide explores the unique characteristics, milestones, and investor expectations of these rounds, equipping you with actionable strategies to manage early-stage funding and growth effectively.

Series A Funding: Establishing Product-Market Fit

Series A funding is the first significant round of venture capital investment, typically aimed at validating your startup’s product-market fit. Investors at this stage are looking for evidence that your product solves a real problem and has a viable market.

1. Key Metrics for Series A Success

To secure Series A funding, startups must demonstrate strong metrics that validate their business model. These include:

- Revenue Growth: Investors expect consistent revenue growth, even if profitability is not yet achieved.

- Customer Acquisition: A proven ability to attract and retain customers is essential.

- Median Valuation: In Q4 2023, Series A median valuation reached $44.8 million, reflecting the growing expectations of venture capitalists.

2. Investor Expectations

Series A investors are willing to accept higher risks in exchange for potentially high returns. They may expect returns as high as 300%, making this stage particularly competitive. Startups must present a compelling narrative backed by data to secure funding.

3. Funding Scope

Series A rounds typically raise amounts in the millions, providing startups with the resources needed to refine their product and expand their market presence. Explore the typical financial scope of Series A by learning more about venture cap firms and their role in early-stage investments.

4. Practical Tips for Attracting Investors

Securing Series A funding requires strategic preparation. Learn how to attract venture capitalists with actionable insights that align with the challenges of this critical funding round.

Series B Funding: Scaling Your Startup

Once product-market fit is established, Series B funding focuses on scaling operations and expanding market reach. This stage involves larger capital injections and a shift in investor expectations.

1. Scaling Milestones

Series B funding is typically secured 28 months after Series A, with startups expected to demonstrate:

- Operational Efficiency: A scalable business model that can handle increased demand.

- Market Expansion: Evidence of successful entry into new markets or verticals.

- Median Round Size: The median Series B round size was $15 million in Q3 2023, highlighting the significant jump in funding compared to Series A.

2. Investor Priorities

Series B investors prioritize stability and scalability over risk. They are willing to pay a premium for equity in a more established company, reflecting the reduced risk compared to earlier rounds.

3. Funding Increase

The progression from Series A to Series B is marked by a significant rise in funding amounts, often reaching tens of millions. This increase enables startups to scale their operations effectively.

Key Difference between Series A and Series B Funding Rounds

Understanding the distinctions between Series A and Series B funding is crucial for startups aiming to scale effectively. Series A focuses on establishing product-market fit and building a foundation for growth, while Series B emphasizes scaling operations and expanding market presence. Recognizing these funding milestones and aligning with investor expectations can significantly impact your startup's trajectory.

| Dimension | Series A | Series B |

|---|---|---|

| Team Size | ~10–30 employees | ~30–100+ employees |

| Profitability Stage | Path to break-even defined; unprofitable | Approaching or achieving profitability |

| Market Segment | Early adopters | Early majority |

| Product Maturity | Core MVP features; frequent pivots | Feature refinement; platform stability |

| Data Infrastructure | Basic analytics (GA, simple dashboards) | Advanced BI (forecasting, anomaly detection) |

| Governance | Informal advisory board | Formal board; independent directors |

| Finance Leadership | Fractional CFO or finance consultant | Dedicated CFO + full finance function |

| Regulatory Readiness | Little to no compliance layer | Established controls (tax, audit, GDPR/CCPA) |

Case Studies: Finance Expertise from Series A to Series B

Canva (2014–2016)

Canva closed a $6 million Series A in April 2015, tapping investors’ confidence to scale its designer-friendly platform. To translate that early capital into growth, the founders brought on a part-time financial advisor who built out unit-economics models—tracking customer acquisition costs, lifetime value, and break-even scenarios month by month. By the time Canva raised its $15 million Series B in September 2016, they had clear, data-driven forecasts to share with growth-stage VCs. A dedicated in-house finance lead then formalized those models into live dashboards, enabling rapid hiring decisions and sharpening their path toward profitability.

Gusto (2014–2015)

After securing $20 million in Series A funding in February 2014, Gusto enlisted a fractional CFO to set up rolling 12-month cash-flow forecasts and standardized board-report templates. This financial framework gave the HR-tech startup the discipline to monitor burn rate in real time and adjust hiring plans on the fly. By its $90 million Series B in December 2015, Gusto had scaled headcount by 300 percent while maintaining clear visibility on unit economics—thanks to the full-time finance team the CFO had recruited and mentored.

Intercom (2013–2014)

Messaging-platform Intercom raised $6 million in its Series A in June 2013 and, within seven months, brought in $23 million in Series B (January 2014). Early on, a lean finance consultant helped capture key metrics—monthly recurring revenue (MRR), churn cohorts, and customer acquisition cost—into an investor-ready dashboard. Once Series B closed, the company transitioned to an internal finance head who established formal month-end close processes and layered on profitability simulations for new product lines, laying the groundwork for sustained, metrics-driven expansion

Conclusion

The leap from Series A to Series B requires more than just fresh capital, it demands a tailored financial playbook that evolves alongside your business. In the early stages, a lean finance partner sharpens your unit-economics and produces the clear, data-driven forecasts investors expect. As you mature, a full-time CFO and finance team build the operational infrastructure—streamlined reporting, real-time KPIs, and robust controls, that unlocks scalable growth and market leadership.

If you're seeking tailored solutions to connect with the right investors, we at Qubit Capital are here to assist. Our Investor Discovery and Mapping service uses AI-driven insights to match startups with best-fit investors. Let’s get started today!

Key Takeaways

- Series A funding is centered on establishing product-market fit with significant early-stage milestones.

- Series B funding is designed for scaling operations with larger capital injections and reduced investment risk.

- Investor expectations shift from high-risk, high-return in Series A to more stable, premium investments in Series B.

- Real-world data highlights a median Series A valuation of $44.8 M and a Series B median round size of $15 M.

- Partnering with finance experts like Accountancy Cloud can streamline your funding journey and boost long-term success.

Frequently asked Questions

What is Series A funding?

Series A funding represents an early-stage investment designed to help startups refine their product-market fit and build upon initial traction. Typically, this funding round involves investments in the millions, enabling businesses to establish a solid foundation for growth.