Ever wondered how venture capital firms turn bold ideas into industry-shaking companies? They run on a clear hierarchy, from analysts spotting emerging trends and associates digging into data, to partners making the final call on which startups to back. Venture capital firms are uniquely positioned to identify high-potential businesses, allocate partners capital effectively, and guide startups toward scalable growth.

Different investor profiles bring unique strategies to the table. Your understanding of venture capital firm operations gains additional context when you consider the analysis in types of investors in startups, which outlines how different investment profiles support startup growth.

This article will delve into the anatomy of venture capital firms, offering insights into their organizational framework, operational strategies, and the key players who drive their success. Let’s jump right in!

Venture Capital Firm Structure: Key Roles and the Investment Process

Venture capital might look like a niche finance niche from the outside, but it’s now a full-blown industry. By the end of 2023, the US alone had 3,417 venture firms, together closing 13,608 deals worth $170.6 billion. Those firms raised $66.9 billion across 474 funds and were sitting on $311.6 billion in dry powder out of $1.21 trillion in assets under management.

The Lifecycle of a Venture Capital Fund

Venture capital firms often focus on industries with exponential growth potential, such as technology or healthcare. Notably, global venture capital funding reached $300 billion in 2023, marking a 15% increase from the previous year. This surge highlights the growing momentum in the VC ecosystem.

Across funds, the basic lifecycle looks similar:

- Fundraising and setup – The VC team raises capital from limited partners (LPs) such as pension funds, endowments, family offices, and wealthy individuals, and locks it into a 10–12 year fund structure.

- Investment period – Over the first few years, the fund deploys capital into a portfolio of startups, reserving a portion for follow-on rounds in the most promising companies.

- Portfolio support – Partners work with founders on hiring, strategy, fundraising, and connections to help grow the companies toward meaningful exits.

- Returns and exits – As startups mature, value is realized mainly through acquisitions and IPOs.

Crucially, VC outcomes follow a power-law distribution: a tiny minority of investments generate the majority of a fund’s returns, while many companies fail or produce modest outcomes. This is why VCs take big swings, accept a high failure rate, and concentrate time and follow-on capital into a small set of apparent winners.

Performance is ultimately judged against venture capital IRR benchmarks across vintages and market cycles, if a fund doesn’t produce top-tier returns relative to peers, it becomes much harder for that firm to raise the next fund. For a deeper breakdown of what “top-tier” looks like at different stages and vintages, see our guide to venture capital IRR benchmarks.

Key Roles in Venture Capital

Every team member in a VC firm, from analysts to partners, plays a role in sourcing deals, conducting due diligence and supporting portfolio companies. Here are few key roles in venture capital which you can study to frame a better strategic approach:

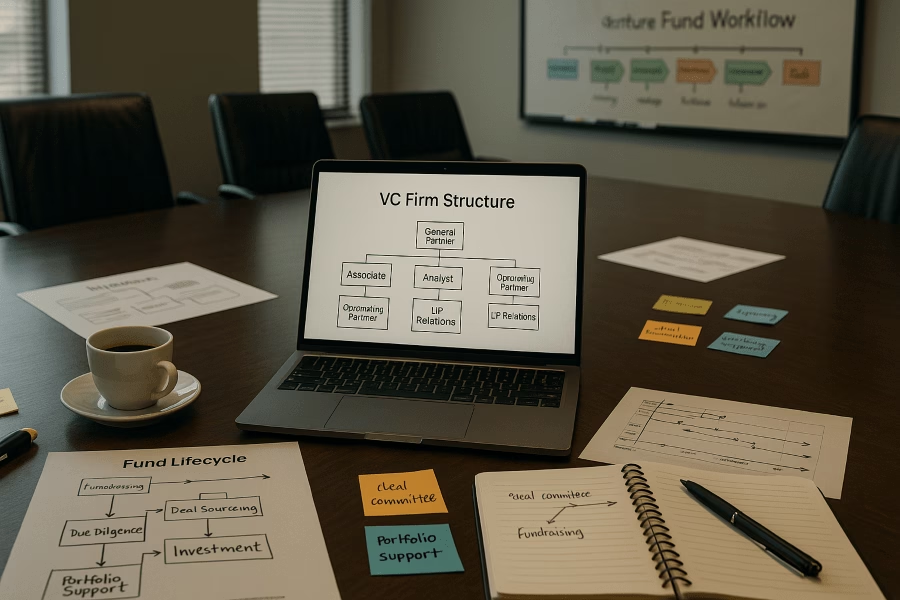

This section covers the venture capital firm structure, detailing fund lifecycle, capital commitments, and key roles like LPs and GPs.

1. Limited Partners (LPs)

LPs are the backbone of venture capital funds, providing the capital that fuels investments. They include entities like pension funds, endowments, and sovereign wealth funds.

2. General Partners (GPs)

GPs manage the fund, making critical decisions about investments, portfolio management, and exits. Beyond financial oversight, GPs often provide hands-on operational support to startups. Marc Andreessen, co-founder of Andreessen Horowitz, emphasizes the importance of this approach, stating, “Operational support is not just a value-add; it’s a necessity for scaling startups effectively.”

Why VCs are picky

To see how structure and operations fit together, imagine a fairly standard $100 million early-stage fund. LPs commit capital for roughly a decade. Over that period, management fees eat about $20 million, leaving $80 million of “investable” capital.

If the GPs decide to reserve 50% for follow-on rounds, that sets aside $50 million for doubling down on the winners. The remaining $30 million is used for first checks. At, say, $1.5 million per initial investment, the fund can back about 20 companies. To hit a 3x net return, that $100 million vehicle needs to come back as roughly $300 million after fees and carry – which usually means two or three breakout companies doing most of the heavy lifting.

The Role of Investment Committees in VC Firms

Beyond individual roles, venture capital firms often rely on investment committees to evaluate deals and guide strategy. These committees bring together partners and senior staff to assess opportunities, ensuring decisions align with fund objectives. Structured review processes help mitigate risks and maintain discipline in capital deployment. Effective committees strengthen governance and support consistent investment outcomes.

Metrics That Matter

Key metrics like fund size, portfolio diversification, and exit multiples are crucial for evaluating a VC fund's performance. For instance, Sequoia Capital’s regional fund structures have enabled a 40% grwth in Asia-Pacific investments, showcasing the impact of strategic fund management on returns.

Breaking Down Venture Capital Firm Structures

Let’s look at some fundamental frameworks that define venture capital firm structure and how these firms function and achieve their goals.

- Identify GP/LP structure

- Review compensation model

- Track fund lifecycle

- Assess post-investment support

Internal Roles: Who Does What?

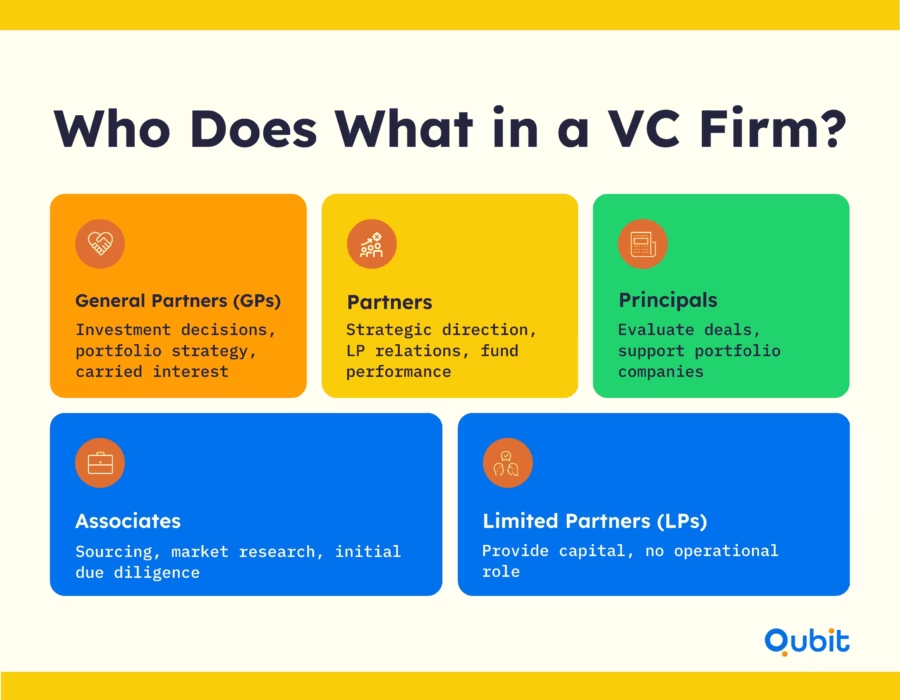

The organizational hierarchy within venture capital firms is built around distinct roles, each contributing to the firm's success.

- General Partners (GPs): These are the decision-makers responsible for managing the fund and making investment choices. GPs also benefit financially through carried interest, typically set at 20% of the fund's profits, once Limited Partners (LPs) recoup their initial investments and returns.

- Limited Partners (LPs): LPs are investors who provide the capital for the fund but have limited involvement in day-to-day operations. Their primary role is financial backing.

- Associates: Associates focus on deal sourcing, market research, and initial due diligence. They often serve as the first point of contact for startups seeking funding.

- Principals: Positioned between Associates and Partners, Principals play a key role in evaluating deals and supporting portfolio companies. They often transition into Partner roles over time.

- Partners: Partners oversee the firm's strategic direction, manage relationships with LPs, and ensure the fund's overall performance aligns with its goals.

Compensation Structures

The financial model of venture capital firms is built around two primary components: management fees and carried interest.

- Management Fees: Typically set at 2% of the fund's total committed capital, these fees cover operational costs, including salaries, office expenses, and administrative functions. This ensures the firm can sustain day-to-day operations effectively.

- Carried Interest: As mentioned earlier, carried interest, usually 20%, is the share of profits allocated to GPs after LPs recover their initial investments and returns. This incentivizes GPs to prioritize high-performing investments.

Diverse Fund Models

Venture capital firms employ various fund structures to adapt to market demands and investment strategies.

- Traditional Funds: These are the most common model, where firms raise capital from LPs and invest in a portfolio of startups. Returns are distributed based on the fund's performance.

- Venture Builders: Unlike traditional funds, venture builders actively create and support startups in-house. They provide resources, mentorship, and operational guidance, ensuring a hands-on approach to growth.

- Special Purpose Vehicles (SPVs): SPVs are single-investment entities created for specific deals. For example, Andreessen Horowitz's dedicated crypto fund, which raised $4.5 billion in 2022, exemplifies how SPVs can address emerging markets like cryptocurrency.

Comparing Traditional VC Funds, Rolling Funds, and DAOs

Regional patterns in VC deal flow illustrate fund model diversity. In Quebec, VC activity saw 85 deals totaling CAD $1.47 billion. Despite a 24% decline in deal count, total funding increased by 14% year-over-year. This highlights how fund specialization enables resilience and strategic opportunity by region.

Post-Investment Monitoring

Once investments are made, venture capital firms focus on monitoring and supporting portfolio companies. This involves regular check-ins, strategic guidance, and operational oversight to ensure startups meet their growth targets. The firm's internal hierarchy plays a crucial role here, with Associates and Principals often handling day-to-day interactions while Partners focus on broader strategic goals.

Clio provides a record-setting illustration. Clio, a BC-based legaltech firm, raised CAD $1.24B in Q3 2024. This accounted for 47% of total quarterly investment and set the mark as Canada's largest software deal. Such results show how focused fund structures can drive outsized, headline-grabbing investment outcomes.

Types of Venture Capital Funding You Should Know

Venture capital firm structure often determines which funding stages a firm specializes in. Below are some major types of VC funding approaches:

1. Seed Funding

Seed funding is the earliest stage of venture capital investment, designed to support startups in their initial development. This funding is typically used for market research, product development, and building a foundational team. Venture capital firms often focus on industries with high growth potential, such as technology or healthcare, during this phase.

2. Early-Stage Funding

Early-stage funding follows seed capital and is aimed at businesses that have a viable product or service but need resources to scale operations. This stage often involves Series A and Series B rounds, where the focus shifts to refining the business model, expanding the customer base, and increasing revenue streams. Venture capital firms strategically invest in companies that align with their sector expertise and geographic focus.

The leap from angel to Series A is substantial. Series A funding generally exceeds $10 million, outweighing standard angel investments. These larger rounds signal investor confidence and enable rapid operational scale. Founders should prepare for complex diligence and heightened growth expectations at this stage.

Snappr exemplifies Series A impact. Snappr raised USD10M in Series A to expand its visual content marketplace. This funding enabled rapid growth and platform development, reflecting how substantial Series A rounds fuel scale for emerging startups.

3. Expansion Funding

Expansion funding, also known as growth-stage funding, is targeted at companies that have established market presence and consistent revenue streams. This stage supports scaling operations, entering new markets, and enhancing product offerings. Venture capital firms at this stage often prioritize businesses with proven scalability and strong leadership teams.

4. Late-Stage Funding

Late-stage funding is designed for mature companies preparing for significant milestones such as IPOs or acquisitions. This stage involves larger investments to solidify market dominance, optimize operations, and prepare for public offerings. Venture capital firms often focus on companies with robust financial performance and clear exit strategies.

5. Acquisition Financing

Acquisition financing is a specialized form of venture capital funding aimed at facilitating mergers or acquisitions. This type of funding helps businesses acquire competitors, expand market share, or diversify their offerings. Strategic focus in this stage often varies based on industry dynamics and geographic opportunities.

Why Diversification Is Critical in VC Investing

Building on the range of funding types, venture capital firms rely on portfolio diversification to manage risk. By investing in multiple startups across sectors and stages, firms reduce the impact of individual failures. This approach increases the likelihood that successful investments offset losses, supporting long-term fund performance. Diversification remains a foundational strategy for navigating the unpredictable nature of startup outcomes.

How Visionary Leaders Shape Venture Capital Success

Spotting transformative opportunities in the fast-paced venture capital ecosystem demands more than just financial acumen, it requires visionary leadership. These leaders excel at identifying emerging market trends and startups with the potential to become unicorns, ensuring their firms remain ahead of the curve. By combining innovative strategies with precise execution, they position venture capital firms to thrive in competitive environments.

Successful exits are another hallmark of effective leadership. When a firm achieves high-profile exits, it not only validates its investment strategy but also enhances its credibility among limited partners (LPs). This credibility becomes a magnet for future investments, creating a cycle of growth and trust.

The ability to choose funding sources wisely can make or break a firm’s trajectory. Carefully weighing the pros and cons of sovereign investments helps leaders decide when patient, state-backed capital will fuel growth and when its oversight or slower decision cycles could slow momentum.

Ultimately, visionary leaders are the driving force behind a venture capital firm's success, blending foresight with action to build reputations, attract capital, and foster innovation. Their ability to anticipate shifts in the market ensures that their firms remain resilient and adaptable in an ever-changing landscape.

Expand Your Reach with Global Networking in the Partner Center

Building meaningful connections is vital for venture capital professionals aiming to enhance operational strategies and industry insights. Platforms like LinkedIn offer access to GoingVC’s professional network, enabling collaboration with seasoned experts. For quick updates and trending topics, Twitter serves as a dynamic space for venture capital insights. Dive deeper into the industry through the GoingVC podcast, featuring interviews with experienced investors.

Additionally, tools like VCStack provide specialized resources and market analytics, while Startup&VC delivers comprehensive news and thought leadership. Explore these platforms to strengthen your network and operational strategies.

Your Essential Glossary of Venture Capital Terms

Understanding venture capital terminology is key to navigating this dynamic industry. Below are concise definitions of critical terms that shape venture capital operations:

- Carry: Often referred to as “carried interest,” this is the share of profits venture capital firms earn from successful investments, typically expressed as a percentage.

- Endowments: These are institutional funds, often from universities or foundations, that invest in venture capital to grow their financial resources over time.

- Family Offices: Private wealth management entities that handle investments for high-net-worth families, frequently participating in venture capital funding.

- IPO (Initial Public Offering): The process by which a private company offers its shares to the public for the first time, often marking a significant milestone for venture-backed firms.

- Limited Partners (LPs): Investors who provide capital to venture capital funds but have limited liability and decision-making power in the fund's operations.

Conclusion

Understanding the structure and operations of venture capital firms is crucial for startups aiming to secure funding and build lasting partnerships. This blog has outlined key strategies, from identifying the right investors to aligning with their investment focus, ensuring your approach is both targeted and effective. By gaining insights into how VC firms operate, entrepreneurs can better position their ventures for success in a competitive market.

At Qubit Capital, we believe in empowering startups to connect with the right investors. If you're ready to refine your venture capital strategy, our Investor Discovery and Mapping service is designed to guide you every step of the way. Let’s unlock your potential and start building meaningful connections today.

Key Takeaways

- VC firms run on layered org charts and niche fund strategies; you must know exactly who sets agendas and why their capital mandates differ.

- Tracing a fund’s lifecycle, from capital calls to final distributions, shows you how LP cash and GP decisions shape outcomes at every turn.

- Bold leadership and headline exits amplify your brand, helping you raise successive vehicles on stronger terms and attract higher-caliber limited partners.

- Seed, Series A, or growth rounds each demand a tuned playbook plus tight operational checks to protect returns and uphold fiduciary trust.

- Success compounds when you build genuine networks and lock in partnerships that open deal flow, share risk, and extend post-deal support.

Frequently asked Questions

What are the main types of venture capital funding?

Main types include seed funding, early-stage, expansion, late-stage, and acquisition financing. Each supports startups at different growth phases.