Despite the strategic focus on innovation, only 6% of executives are satisfied with their innovation performance. With 96% prioritizing innovation, this gap highlights the demand for advanced scouting technologies that translate strategic goals into real results.

This article delves into the top platforms reshaping the scouting process, emphasizing how they address challenges like filtering vast data pools and aligning opportunities with strategic goals. From AI-driven solutions to crowdsourcing tools, we’ll explore how these platforms empower decision-makers to stay ahead in an innovation-driven market.

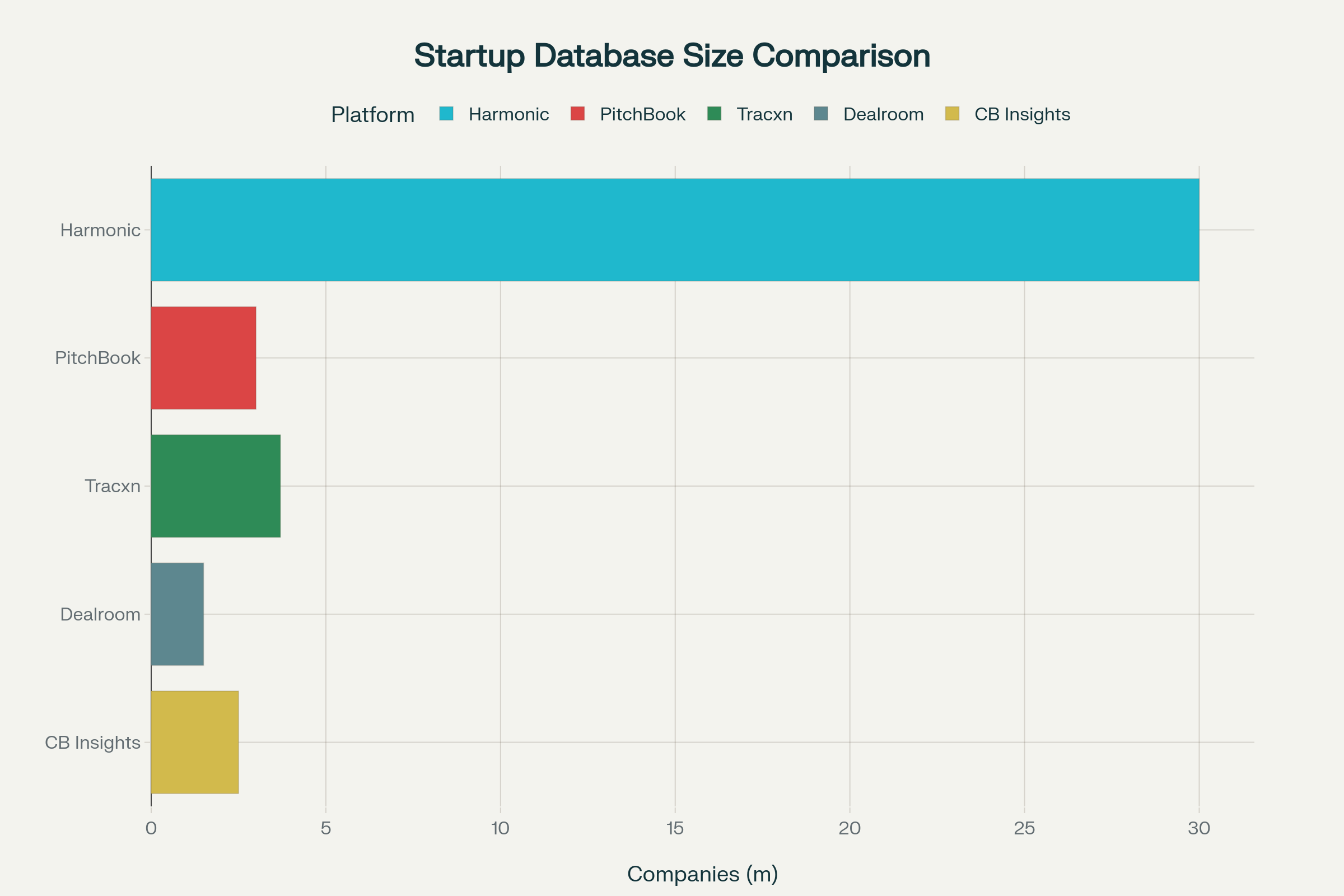

Who Tracks the Most Startups?

The best startup scouting platforms for VCs and corporates (such as Harmonic, PitchBook, Tracxn, Dealroom, and CB Insights) centralize global startup data and provide AI-powered deal sourcing tailored to investment needs.

Today’s global startup databases range widely in both scale and intelligence. In the US, corporate funding reached 12% of all startup investment in 2023. This underscores the role major firms play in fueling innovation and boosts the value of deep-dive platforms for discovery.

- Harmonic.ai is redefining the segment, indexing more than 30 million companies worldwide. Its real-time refresh rate and ability to merge structured and unstructured data help VCs spot nascent ventures. This often happens before they appear on competitors’ radars.

- PitchBook offers full-market coverage of private capital, tracking approximately 3 million companies and 1.6 million deals across VC, PE, and M&A verticals. Known for its deep financing histories and analytic tools, it remains a staple for institutional investors.

- Tracxn tracks over 3.7 million companies and supports advanced market intelligence features, combining AI and human analysts to build sector heatmaps, analyst-rated company lists, and workflows for daily deal sourcing.

- Dealroom.co delivers robust startup and scaleup coverage with more than 1.5 million companies in its database. It leverages powerful growth analytics, European ecosystem focus, and founder strength scoring for tailored investor pipelines.

- CB Insights maintains a database of over 2.5 million startups and growth companies, turbocharged with AI that aggregates news, funding rounds, partnerships, and proprietary mosaic scoring for predictive analysis.

Startup Database Size Comparison (Number of Companies Tracked)

Coverage depth varies widely; Harmonic indexes 30M+ firms while traditional data providers track low–mid single-digit millions. With the rapid evolution of technology, the tools available for startup scouting have transformed, offering unparalleled insights and efficiency. The exploration found in AI startup discovery platforms highlights the mechanisms used to pinpoint emerging startups, thereby complementing the strategic insights offered throughout the guide.

Key Features and Platform Differentiators

1.Harmonic.ai

- Proprietary Aggregation: Pulls data from HR sites, incorporation registries, job boards, personal updates, and social signals. Surfaces pre-stealth and newly registered ventures quickly, often within days of formation.

- Signal Intelligence: Combines external data with internal firm metadata (e.g., CRM [Customer Relationship Management], calendar, and email networks), revealing emergent opportunities via warm intros and private network overlays.

2.PitchBook

- Deal Analytics: Deep funding data and multipronged deal tracking, including exits, valuations, and investor networks. Its proprietary datasets help users run competitive analysis and spot market trends.

- Research-Driven Insights: Diligence workflows leverage executive profiles, cap table simulations, and scenario modeling to inform investment decisions.

3.Tracxn

- Sector Intelligence: Uses AI for founder profiling, market heatmaps, and predictive analytics. Analyst ratings and curated reports support refined deal screening—especially effective for overlooked geographies and verticals.

- Accessible Platform: Deep integration with Excel and customizable screening filters.

4.Dealroom

- Growth Algorithms: Growth signals, rating scores, and robust local data partnerships. Especially strong in mapping European scaleups for governments, ecosystem builders, and VCs.

- Strategic Reports: Provides benchmarking, ecosystem health analytics, and high-frequency alerting for fast-moving tech hubs.

5.CB Insights

- AI-Driven Mosaic Score: Predictive scoring of company health and momentum, streamlining prioritization for both investors and corporates.

- Comprehensive Intelligence: Tracks performance indicators, investor activity, patents, funding rounds, and partnership news. Integrates with enterprise tools and research APIs for real-time coverage.

The Value of Hybrid AI and Human Scouting Models

Building on these platform differentiators, hybrid scouting models combine AI-driven semantic search with human validation to maximize recall and precision. This approach leverages advanced algorithms to surface relevant startups while relying on expert judgment to assess strategic fit and reduce false positives. By integrating both elements, organizations achieve more comprehensive coverage and nuanced evaluation, especially for complex or emerging sectors. Adopting a hybrid model ensures that scouting results align closely with investment or innovation objectives.

Platforms for Specialized Scouting

- Novable: AI-powered scouting with access to 4M+ companies, expert validation, and campaign-driven partnership outreach—ideal for corporates focused on innovation alignment

- StartupBlink & Exploding Topics: Useful for tracking trending and newly launched companies but lack the dedicated financial diligence features of the big five.

- Q-scout by Qmarkets: Offers open innovation scouting and customizable company scoring, especially suited for corporates running thematic searches or crowdsourced briefings.

Steps for Multi-Source Scouting Integration

- Begin by aggregating data from startup databases, patent repositories, and scientific literature to ensure broad innovation coverage.

- Apply AI-powered semantic search to identify relevant technologies and startups across diverse terminology and research domains.

- Validate findings through expert review, focusing on strategic fit and novelty for your organization’s objectives.

Corporates increasingly view partnership with startups as essential. 88% of participants insist that startup collaboration is critical for innovation success, driving demand for platforms tailored to these needs.

Selecting the Right Platform

- CB Insights and PitchBook remain the gold standards for predictive analytics, benchmarking, and broad-market intelligence required for high-confidence deal selection and pipeline management.

- Corporates needing bespoke scouting and campaign-based engagement can blend Novable’s expert-layered reports with the deep deal analytics of PitchBook or Harmonic for maximal visibility.

- VCs prioritizing early deal flow and unrivaled data coverage will find Harmonic.ai and Tracxn invaluable for surfacing pre-seed and stealth startups, while Dealroom shines in Europe-centered portfolio strategies.

Open Innovation Platforms vs. Startup Databases

Case Studies and Success Stories

Real-world examples illustrate the transformative impact of AI-powered scouting platforms on startup collaborations. These success stories showcase how organizations have achieved measurable ROI improvements and fostered innovation through strategic partnerships.

1. Accelerating Product Launches with Generative AI

A leading tech corporation utilized SwitchPitch Gen AI Auto-Scout to streamline its startup scouting process. By identifying and evaluating promising startups, the company successfully launched a new product in record time. This case highlights how generative AI can significantly reduce time-to-market, enabling businesses to stay ahead in competitive industries.

2. Co-Development for Long-Term Innovation

BMW adopted a co-development model to shift from traditional vendor relationships to collaborative partnerships. This approach resulted in valuable technology partnerships that drive sustained innovation. As detailed in BMW’s experience, fostering deeper collaboration with startups can unlock long-term benefits that go beyond immediate project outcomes.

3. Sector-Focused Scouting for Strategic Growth

Leroy Merlin’s success story underscores the importance of specialized scouting. By targeting startups in the housing sector, the company refined its strategic direction through pilot programs. This tailored approach not only aligned with their industry focus but also enhanced their ability to implement innovative solutions effectively.

These examples demonstrate the versatility and effectiveness of AI-powered scouting platforms in addressing diverse business needs. Whether accelerating product development, fostering innovation, or aligning with sector-specific goals, these tools are reshaping how organizations collaborate with startups.

How-to Guides and Best Practices

Implementing generative AI tools effectively can transform startup scouting and evaluation processes. By following structured approaches and adopting proven strategies, organizations can maximize efficiency and accuracy in identifying promising ventures.

1. Define Clear Objectives for AI Integration

Start by identifying the specific challenges in your scouting process that AI can address. Whether it’s automating data collection, analyzing market trends, or evaluating startup potential, having clear goals ensures that AI tools align with your needs. This clarity not only streamlines implementation but also helps in measuring success.

2. Choose the Right AI Tools

AI agents are becoming standard for modern scouting workflows. 96% of businesses plan to increase AI agent use by 2025, with half targeting organization-wide deployment. Selecting the appropriate tools is critical. Focus on platforms that offer advanced capabilities such as predictive analytics, natural language processing, and real-time data insights.

3. Optimize Data Quality and Inputs

AI systems are only as effective as the data they process. Ensure that your data sources are reliable, diverse, and up-to-date. Regularly audit and refine your datasets to eliminate biases and inaccuracies, which can skew AI-driven insights.

4. Establish a Feedback Loop

Continuous improvement is key to maximizing the value of generative AI. Create a feedback loop where team members can evaluate AI-generated insights and provide input for refinement. This iterative process enhances the system’s accuracy and relevance over time.

5. Prioritize Ethical AI Practices

Finally, ensure that your AI implementation adheres to ethical guidelines. Transparency, accountability, and fairness should be at the core of your AI strategy to build trust and credibility in your scouting processes.

By adopting these best practices, startups and organizations can unlock the full potential of generative AI, driving smarter and faster decision-making.

Market Trends and Future Outlook

The startup discovery process is undergoing a profound transformation, driven by advancements in artificial intelligence (AI) and cutting-edge scouting tools. These innovations are not only accelerating how startups are identified but are also reshaping the broader market dynamics.

1. The Growth of Technology Scouting Software

The Technology Scouting Software Market is experiencing remarkable growth, with projections indicating an increase from USD 150.17 million in 2023 to USD 646.17 million by 2032. This surge highlights the growing reliance on sophisticated tools to streamline the identification of emerging startups and technologies. As businesses seek to stay ahead, these tools are becoming indispensable for uncovering opportunities that align with strategic goals.

2. AI’s Role in Startup Discovery

AI tools are revolutionizing the startup ecosystem by enabling faster and more accurate analysis of market trends. From predictive analytics to automated data processing, AI is empowering investors and organizations to make informed decisions with unprecedented efficiency. A detailed review in AI tools for fundraising establishes a broader context for understanding how AI transforms financial processes across the startup ecosystem, linking directly to the specialized scouting strategies discussed here.

Future Implications

As AI continues to evolve, the future of startup discovery will likely be defined by even greater precision and personalization. Investors and organizations will benefit from tools that not only identify promising startups but also predict their potential for success based on real-time data and historical trends. This shift underscores the importance of staying updated on technological advancements to remain competitive in a rapidly changing market.

By embracing these trends, businesses can position themselves to capitalize on emerging opportunities while fostering innovation within their industries.

Conclusion

The strategies outlined in this blog emphasize the importance of adopting AI-driven tools for startup scouting. By implementing these approaches, businesses can streamline their processes, uncover hidden opportunities, and stay ahead in the competitive startup ecosystem. The evolving platform landscape highlights the need for adaptability and innovation, ensuring that scouting efforts align with emerging trends and technologies.

To optimize your startup scouting process, consider taking actionable steps today. Whether it's refining your criteria, exploring AI-powered platforms, or collaborating with experts, every improvement can yield significant results.

Explore how our services can elevate your scouting efforts by visiting Startup Matchmaking. Let us help you discover the startups that align with your vision and drive your success forward.

Key Takeaways

- Comprehensive review of leading startup scouting platforms and their unique features.

- AI-driven and generative AI tools substantially enhance scouting efficiency.

- Real-world case studies validate the effectiveness of these platforms.

- Actionable best practices guide optimal technology adoption and evaluation.

- Future trends indicate expanded use of AI in startup scouting across industries.

Frequently asked Questions

What is a startup scouting platform?

A startup scouting platform is a digital tool for investors and corporations to find promising startups. It uses data analytics and AI to streamline discovery. This helps users identify innovative startups that match their goals quickly and efficiently.