Cold outreach has transformed from a simple tactic into a powerful strategy for startups seeking investor attention. With an average open rate of 27.7%, cold campaigns demonstrate their potential to spark meaningful connections. Success stories like Box, which secured funding through a cold email, highlight the effectiveness of personalized outreach. Investors are increasingly receptive to tailored approaches, making personalization a critical factor in standing out.

Our blog dives into advanced strategies for investor outreach, offering actionable tips, personalization techniques, and real-world examples. To enhance your fundraising efforts, explore how contemporary tools, such as AI tools for fundraising, can streamline the process and maximize results.

Understanding Cold Outreach and Investor Relations

Cold outreach has become a pivotal strategy for startups aiming to connect with investors and validate their business ideas. By initiating direct communication, startups can gain valuable feedback and spark early interest, creating opportunities for meaningful investor relations.

This approach mirrors the structure of a B2B enterprise sales process, where targeted outreach is used to move prospects through a funnel. For startups, this means crafting personalized messages that resonate with investors, much like tailoring pitches to potential clients in a sales scenario.

The Power of Personalization in Cold Outreach

Highly personalized campaigns are key to achieving success in cold outreach. Research shows that reply rates can exceed 18% when outreach efforts are tailored to the recipient’s interests and needs.

This level of engagement not only opens doors to investor conversations but also provides startups with actionable insights to refine their value propositions. For example, feedback gathered through cold outreach can help startups identify gaps in their messaging and improve their pitch.

AI Personalization and the Evolution of Outreach

The landscape of cold outreach is evolving rapidly, thanks to advancements in AI-driven personalization and multichannel engagement. AI tools enable startups to craft hyper-targeted messages, analyze response patterns, and optimize outreach strategies across multiple platforms.

This evolution allows startups to scale their efforts while maintaining the personal touch that drives investor interest. Incorporating multi-touch approaches, such as combining email outreach with LinkedIn messaging, can further enhance engagement rates.

To maximize the impact of cold outreach, startups can benefit from creating a systematic approach to organizing investor data. Learn how to build investor map to streamline your outreach efforts and ensure you’re targeting the right investors with the right messages. how to build investor map.

Investor Outreach Strategies & Best Practices

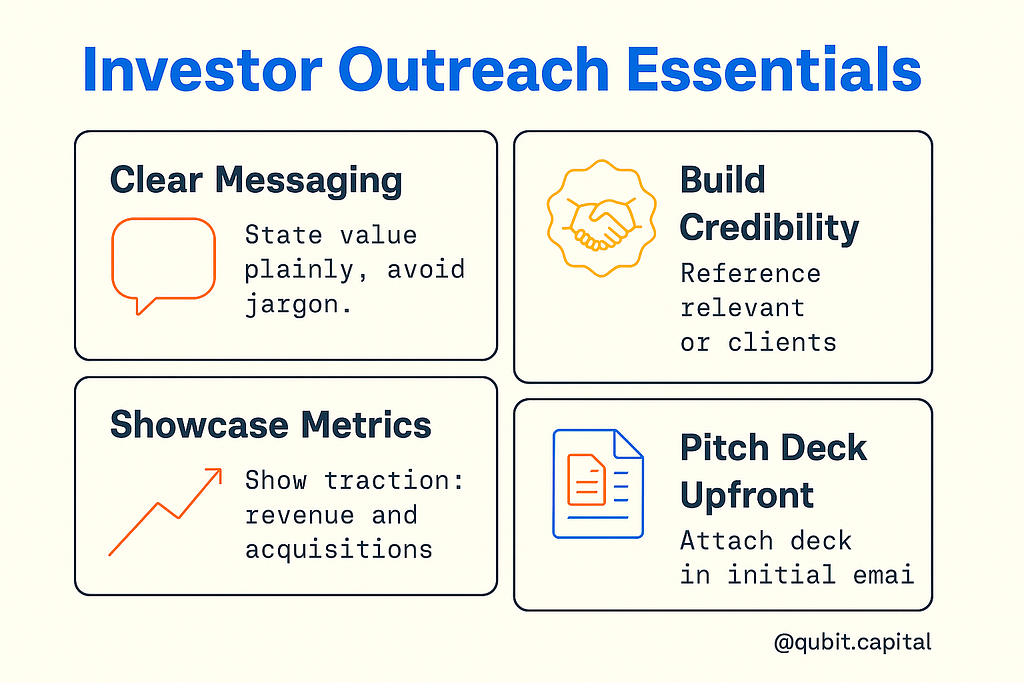

Connecting with investors requires a thoughtful approach that balances clarity, credibility, and accessibility. Effective investor outreach strategies not only capture attention but also build trust, paving the way for meaningful conversations. Below, we outline actionable practices to enhance your outreach efforts and maximize engagement.

1. Craft Clear and Compelling Messaging

The foundation of any successful outreach is a well-defined message. Investors are inundated with proposals, so your communication must stand out. Focus on articulating your value proposition in a concise, impactful manner. Avoid jargon and ensure your message answers key questions: What problem are you solving? Why is your solution unique? How will it generate returns?

2. Build Credibility Through Strategic Name-Dropping

Credibility can make or break an investor’s interest. Mentioning partnerships, high-profile clients, or endorsements from industry leaders can establish trust quickly. For instance, referencing a collaboration with a well-known brand or a testimonial from a respected figure in your industry signals reliability and potential. However, ensure that any name-dropping is relevant and verifiable to avoid appearing disingenuous.

3. Showcase Key Performance Metrics

Investors are driven by data, so presenting your performance metrics upfront is essential. Highlight figures that demonstrate traction, such as revenue growth, customer acquisition rates, or market share. These metrics provide tangible proof of your business’s potential and help investors assess the opportunity objectively.

4. Use Clear and Professional Email Formatting

The way you structure your email can significantly impact its readability. Use short paragraphs, bullet points, and bolded text to emphasize critical information. A well-organized email not only looks professional but also makes it easier for investors to grasp your message quickly.

5. Include the Pitch Deck Upfront

Lowering engagement barriers is crucial in the early stages of outreach. Attaching your pitch deck to the initial email ensures investors have immediate access to detailed information about your business. This proactive step saves time and demonstrates confidence in your proposal.

Bonus Tip: Segment Your Investor List

Tailoring your outreach to specific investor personas can further enhance your success rate. Your exploration of targeted outreach is complemented by investor segmentation tools, providing an overview of methods to differentiate investor personas effectively. By identifying the right audience for your pitch, you can craft messages that resonate more deeply.

Cold Outreach Tools for Investor Outreach

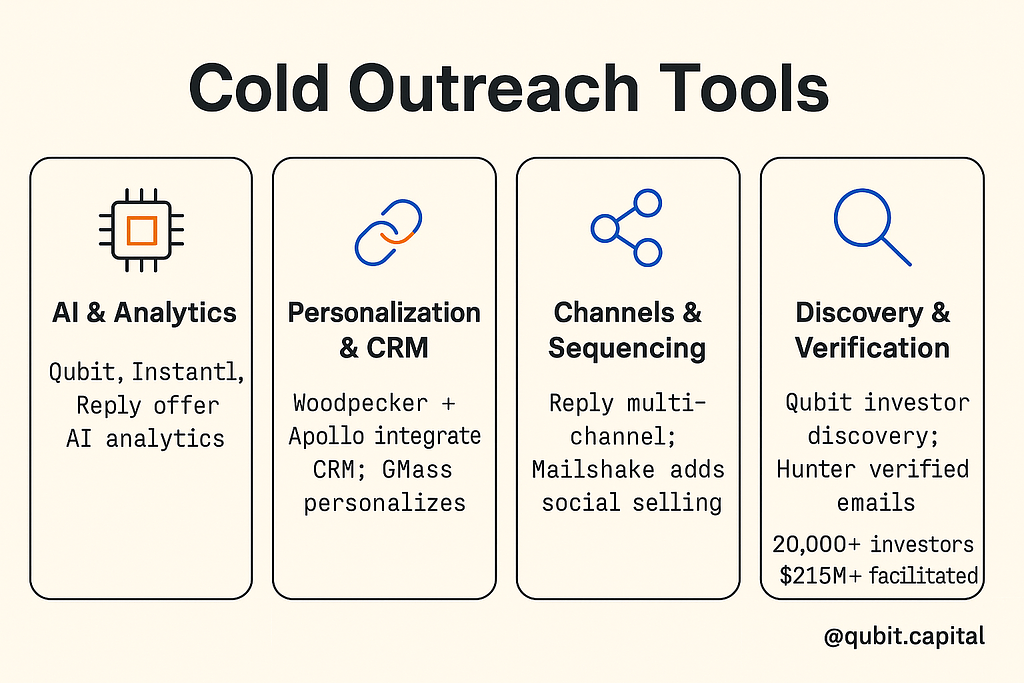

Reaching out to investors requires precision, personalization, and the right tools to streamline the process. Cold outreach tools are designed to simplify investor engagement by automating repetitive tasks, enabling bulk communication, and ensuring follow-ups are timely and tailored. Below, we compare ten specialized tools that can elevate your investor outreach strategy.

1. Qubit Capital

Qubit Capital pairs AI-powered investor discovery with precision matchmaking to help founders reach the right funds faster. Its algorithms assess investor theses, portfolios, stage, and geography to generate a ranked investor map with relevancy scores, while in-house strategists validate matches and streamline outreach.

The platform adds fundraising essentials, pitch deck and financial model support plus real-time analytics on response patterns, so teams can iterate quickly and maintain momentum. Backed by a 20,000+ investor network and $215M+ facilitated for 64+ startups, it’s ideal for seed to Series B companies seeking targeted, data-driven fundraising.

2. Instantly

Instantly stands out for its AI-driven automation, which allows users to craft personalized email campaigns at scale. Its advanced analytics provide insights into open rates, click-through rates, and response patterns, helping you refine your outreach strategy. The platform also supports A/B testing, enabling you to identify the most effective messaging for investor engagement.

3. Woodpecker

Woodpecker is ideal for those who prioritize personalization. It offers robust CRM integration, ensuring that your investor data is always up-to-date. The tool also excels in automating follow-ups, sending reminders based on recipient behavior, and maintaining a human-like tone in communications.

4. Mailshake

Mailshake is a versatile tool that combines email outreach with social selling. Its user-friendly interface allows you to create and manage campaigns effortlessly. The platform’s analytics dashboard provides actionable insights, while its automated follow-up feature ensures no potential investor falls through the cracks.

5. GMass

GMass integrates seamlessly with Gmail, making it a popular choice for startups and small businesses. Its bulk email capabilities are complemented by features like mail merge personalization and automated follow-ups. GMass also tracks email performance, giving you a clear picture of your outreach effectiveness.

6. Hunter.io

Hunter.io is best known for its email-finding capabilities. It helps you locate verified email addresses of potential investors, ensuring your outreach efforts are directed at the right contacts. The platform also offers email templates and campaign management features, making it a comprehensive tool for investor outreach.

7. Reply.io

Reply.io combines email automation with multi-channel outreach, including LinkedIn and phone calls. Its AI-powered algorithms suggest optimal times for sending emails, increasing the likelihood of engagement. The platform also provides detailed analytics to help you measure the success of your campaigns.

8. Apollo.io

Apollo.io is a robust sales engagement platform that includes features like email sequencing, contact enrichment, and CRM integration. Its advanced targeting options allow you to segment your investor list based on criteria like industry, location, and funding stage, ensuring your messages resonate with the audience.

9. Saleshandy

Saleshandy focuses on email tracking and scheduling, making it easier to manage large-scale outreach campaigns. Its automated follow-up feature ensures consistent communication, while its analytics help you identify which messages are driving the most engagement.

10. Lemlist

Lemlist is known for its unique personalization features, such as adding dynamic images and videos to emails. This tool helps you stand out in crowded inboxes, making it particularly effective for investor outreach. Lemlist also offers detailed analytics and A/B testing capabilities.

For a structured approach to managing your investor communications, consider using investor tracking templates. These templates provide a clear framework for monitoring interactions and ensuring no opportunity is missed.

By integrating one or more of these tools into your outreach strategy, you can enhance your efficiency and improve your chances of securing investor interest.

Conclusion

Mastering investor outreach requires a thoughtful approach. By recognizing the benefits of cold outreach, adopting proven strategies, and utilizing specialized tools, startups can significantly improve their chances of success. Personalization, backed by data, and clear, concise communication are essential elements that can make your outreach stand out and boost response rates.

We encourage startups to put these strategies into action to refine their investor engagement efforts. If you're looking to align your outreach with the right investors, consider exploring our Investor Discovery and Mapping service. This tailored solution can help you identify and connect with investors who align with your vision, ensuring a more targeted and effective approach.

Key Takeaways

- Effective personalization in cold outreach can significantly improve open and reply rates.

- Clear, concise emails and actionable metrics are essential for investor engagement.

- Specialized tools like Instantly, Woodpecker, and Mailshake offer distinct advantages in automation and CRM integration.

- Data-driven strategies empower startups to optimize investor outreach and secure better funding outcomes.

- Timely follow-ups and upfront pitch deck sharing reduce barriers to investor evaluation.

Frequently asked Questions

What are the best tools for cold outreach to investors?

Several tools can streamline your cold outreach efforts. Platforms like Instantly, Woodpecker, and Mailshake offer automation features to help scale your campaigns. GMass is another excellent option for Gmail users, while Hunter.io simplifies finding verified email addresses. For those seeking CRM integration, Reply.io stands out. Each tool brings unique features, such as AI-powered automation, analytics, and personalization capabilities, making them invaluable for investor outreach.

Back

Back