Acquiring startups has become a strategic priority for investors and corporations aiming to stay competitive in fast-evolving markets. With the rise of AI-driven tools and platforms, identifying promising startup opportunities has never been more efficient. These platforms not only streamline the sourcing process but also provide valuable insights to help investors make informed decisions. Your examination benefits from the perspective offered by AI tools for startup acquisition, where detailed observations reveal how automated analyses are applied to evaluate potential startup deals.

This article aims to guide you through the leading deal sourcing platforms of 2025, offering a detailed comparison of their features, benefits, and use cases. Let's jump right in!

Leading AI-Powered Deal Sourcing Platforms

SourceCo: AI-Driven Off-Market Discovery

Artificial intelligence is reshaping how businesses uncover acquisition opportunities, and SourceCo is leading the charge. This AI-powered platform specializes in identifying off-market startup acquisition targets, offering unparalleled efficiency in deal discovery. With advanced natural language processing (NLP) technologies, SourceCo scans extensive SMB data to pinpoint tailored opportunities for buyers.

The platform's success is evident in its impressive metrics. SourceCo has facilitated deals totaling over $280 million, with $90 million closed just last month. These figures highlight its ability to deliver rapid, actionable insights that drive meaningful transactions.

Users like Daniel Florian have shared glowing testimonials about SourceCo's effectiveness. Daniel praised the platform for its ability to provide quick, actionable opportunities, which can be explored further through his LinkedIn profile.

SourceCo's tailored search capabilities cover over 200 million SMB mid-market companies, ensuring buyers access a vast pool of potential targets. Whether you're seeking efficiency or scalability, SourceCo's AI-driven approach is transforming the acquisition process for startups.

Qubit Capital: Hybrid AI and Human Expertise

Qubit Capital streamlines fundraising and strategic deal discovery by pairing startups with the right investors through a hybrid of AI and human expertise. Its network of 20,000+ venture, private equity, and corporate investors powers targeted introductions across geographies and sectors. Since 2020, the platform has facilitated over $215 million in funding for 64+ startups—evidence of a model built for precision, speed, and scale.

Under the hood, Qubit Capital analyzes investor theses, portfolio histories, check sizes, stages, sectors, and geographies to generate relevancy-scored matches. Live data mining and learning loops continuously refine results, while automated yet personalized outreach, scheduling, and follow-ups keep pipelines moving. The result is measurable throughput—more than 3,000 startup–investor meetings to date—without the manual drag typical of traditional processes.

Best suited for: Seed to Series B raises ($150K–$30M), the platform also serves corporate investors scouting partnerships, minority stakes, or acquisition pathways. Founders highlight rapid access to high-fit angels and institutional funds, plus pricing that works for bootstrapped teams, backed by hands-on support that goes beyond introductions.

Grata: Advanced AI Search Capabilities

Grata transforms deal sourcing with its cutting-edge AI search capabilities, offering unparalleled efficiency for acquisition teams. By analyzing over 16 million company profiles and 1.2 billion web pages, Grata provides users with early access to opportunities that might otherwise remain hidden.

This AI-powered platform enables a 2–6× increase in productivity, streamlining the process of identifying and evaluating potential acquisitions. Users report a 30% improvement in sourcing efficiency, while capturing 70% of first-to-deal opportunities, giving them a significant competitive edge.

Grata's advanced search tools are designed to optimize acquisition pipelines, ensuring that users can focus on high-value opportunities without wasting time on manual research. Whether you're targeting niche markets or broad industries, Grata's AI-driven insights make deal sourcing faster and more precise.

Comprehensive Data and Research Platforms

SourceScrub: Private Company Mapping

SourceScrub offers an unparalleled solution for mapping private companies, providing access to real-time data that empowers businesses to make informed acquisition decisions. With a database of over 15 million company profiles, this platform ensures users can identify potential targets with precision and efficiency.

The platform's detailed mapping capabilities go beyond surface-level information, offering insights into company performance, industry trends, and growth potential. This comprehensive approach helps businesses uncover hidden opportunities in the private market, enabling strategic moves that align with their goals.

Whether you're seeking acquisition targets or exploring partnerships, SourceScrub's up-to-date data ensures you stay ahead in a competitive landscape. Its robust features make it an essential tool for businesses aiming to expand their reach and optimize decision-making processes.

Tracxn: Global Startup Database

Tracxn stands out as a comprehensive platform for exploring the global startup ecosystem. With its extensive database covering over 100 countries, it has become an indispensable tool for investors and businesses seeking insights into emerging markets.

What sets Tracxn apart is its integration of advanced deal discovery tools. These features enable users to identify promising startups and track industry trends with precision. By combining data analytics with market intelligence, the platform ensures that users can make informed decisions efficiently.

Whether you're an investor scouting for opportunities or a business exploring partnerships, Tracxn offers a streamlined approach to understanding the ever-evolving startup landscape. Its global reach and robust tools make it a go-to resource for staying ahead in competitive markets.

Cyndx: Capital Trends Intelligence

Understanding the dynamics of private companies and capital trends is crucial for investors seeking market opportunities. Cyndx stands out as a platform that delivers comprehensive insights into these areas, enabling users to make informed decisions. By analyzing vast datasets, Cyndx uncovers patterns in capital-raising activities and private company performance, offering a global perspective on market movements.

Investors benefit from Cyndx's ability to identify emerging trends and pinpoint opportunities across industries. Its data-driven approach ensures accuracy and relevance, making it a valuable resource for assessing market potential. Whether tracking funding rounds or evaluating company growth trajectories, Cyndx provides actionable intelligence tailored to the needs of its users.

Specialized Regional and Niche Platforms

DealSuite: European Cross-Border M&A

Facilitating mergers and acquisitions across borders requires a platform that prioritizes both efficiency and security. DealSuite excels as a trusted matchmaking solution for European cross-border M&A transactions. Its advanced technology ensures that businesses can connect seamlessly while maintaining strict privacy controls.

As an online matchmaking platform focusing on European cross-border deals, DealSuite combines smart algorithms with user-friendly features to simplify the acquisition process. This makes it an ideal choice for businesses seeking opportunities in Europe's dynamic market.

What sets DealSuite apart is its commitment to secure deal management. By integrating robust privacy measures, the platform ensures that sensitive information remains protected throughout the transaction process. This focus on security, paired with its specialized European market expertise, makes it a standout option for companies navigating the complexities of international M&A.

PrivSource: Exclusive Off-Market Network

PrivSource stands out as a unique platform designed for those seeking rare acquisition opportunities. Its invitation-only model ensures exclusivity, granting members access to off-market deals that are often inaccessible through traditional channels.

This network caters to professionals who value discretion and exclusivity, offering a curated selection of opportunities that align with their investment goals. By focusing on off-market transactions, PrivSource eliminates the noise of public listings, allowing users to discover hidden gems in the deal flow landscape.

Mergr: Middle-Market M&A Research

Mergr stands out as a comprehensive resource for middle-market investors, offering detailed insights into historical mergers and acquisitions. Its database is tailored to uncover patterns and trends in past transactions, making it an essential tool for professionals aiming to understand the intricacies of deal-making within this segment.

By focusing on granular data, Mergr enables users to analyze transaction histories, identify key players, and evaluate market dynamics effectively. This level of detail is particularly valuable for investors and analysts seeking to make informed decisions in the competitive middle-market space.

Advanced Analytics and Integration Tools

Beauhurst: Comprehensive Deal Analytics

Beauhurst offers a comprehensive platform for deal sourcing, combining robust data analytics with user-friendly tools. Its standout feature lies in presenting a balanced perspective—highlighting both the advantages and limitations of its services. Users can explore detailed insights into private company investments, track market trends, and identify high-growth businesses.

However, Beauhurst's pricing structure may require careful consideration, as it is tailored to the depth of data and features accessed. While the platform delivers significant value for professionals in venture capital, private equity, and corporate innovation, its cost may not suit smaller firms or individual users.

Kumo: Real-Time Deal Tracking

Tracking deals with precision has never been more critical for investors. Kumo stands out by integrating multiple data sources to deliver accurate, real-time insights. This advanced AI-powered platform ensures that every piece of information is timely and relevant, giving investors the edge they need in fast-paced markets.

Kumo's ability to consolidate and analyze data from diverse sources empowers users to make informed decisions with confidence. By providing a clear, up-to-the-minute view of deal progress, it eliminates guesswork and enhances decision-making efficiency.

Affinity: Intelligent Deal Discovery

Streamlining deal discovery is essential for investors aiming to stay ahead in competitive markets. Affinity combines automated analytics with seamless integration capabilities to redefine efficiency in deal sourcing. Its intelligent platform analyzes vast datasets, uncovering valuable insights that would otherwise remain hidden.

Beyond analytics, Affinity excels in integration. The platform connects effortlessly with popular tools, creating a unified ecosystem that simplifies workflows. This interconnected approach ensures that users can manage data, track opportunities, and collaborate without switching between multiple systems.

4Degrees: Relationship Intelligence

Managing intricate deal pipelines becomes significantly more efficient with 4Degrees. This platform transforms the way professionals handle acquisition workflows by introducing advanced relationship intelligence and seamless integration capabilities.

4Degrees excels at identifying and nurturing key connections, ensuring that no opportunity slips through the cracks. By integrating with popular tools and platforms, it creates a unified workspace that simplifies collaboration and streamlines processes.

HubSpot: Centralized Deal Management

HubSpot transforms deal management by centralizing processes and delivering actionable insights through its advanced CRM capabilities. Businesses utilizing HubSpot's CRM integrations experience remarkable financial benefits, with real-world data showing a return of $8.71 for every dollar spent on CRM upgrades.

This centralized approach eliminates inefficiencies, enabling teams to focus on closing deals faster and with greater accuracy. By consolidating data and automating workflows, HubSpot empowers organizations to make informed decisions that drive measurable ROI.

MicroAcquire: Premium Deal Flow Analytics

MicroAcquire's emphasis on premium deal flow metrics offers investors a unique lens to evaluate market trends and secure high-value opportunities. By prioritizing detailed insights, the platform enables users to assess deal performance with precision, ensuring informed decision-making and enhanced protection against market volatility.

This focus on premium metrics not only highlights the platform's commitment to transparency but also underscores its role in shaping the broader acquisition landscape. Investors benefit from access to curated data that aligns with real-world success metrics, fostering confidence in deal outcomes and market positioning.

Traditional Advisory and Network Solutions

Buy-Side Deal Sourcing Firms

Buy-side firms excel at identifying acquisition opportunities by tapping into exclusive networks and proprietary deal flows. This strategic approach allows them to uncover unique targets that are often unavailable through traditional channels.

By cultivating long-standing relationships with industry insiders, these firms gain access to off-market deals that provide a distinct competitive edge. Proprietary databases and established connections with intermediaries, such as SourceCo, Captarget, Blue River, and Copper Run, play a pivotal role in streamlining the sourcing process.

Leading buy-side advisory firms, including Harvey & Co and Dinan & Company, have mastered the art of utilizing proprietary resources to discover hidden opportunities. Their expertise highlights the importance of combining data-driven insights with trusted relationships to secure the best possible outcomes in the acquisition landscape.

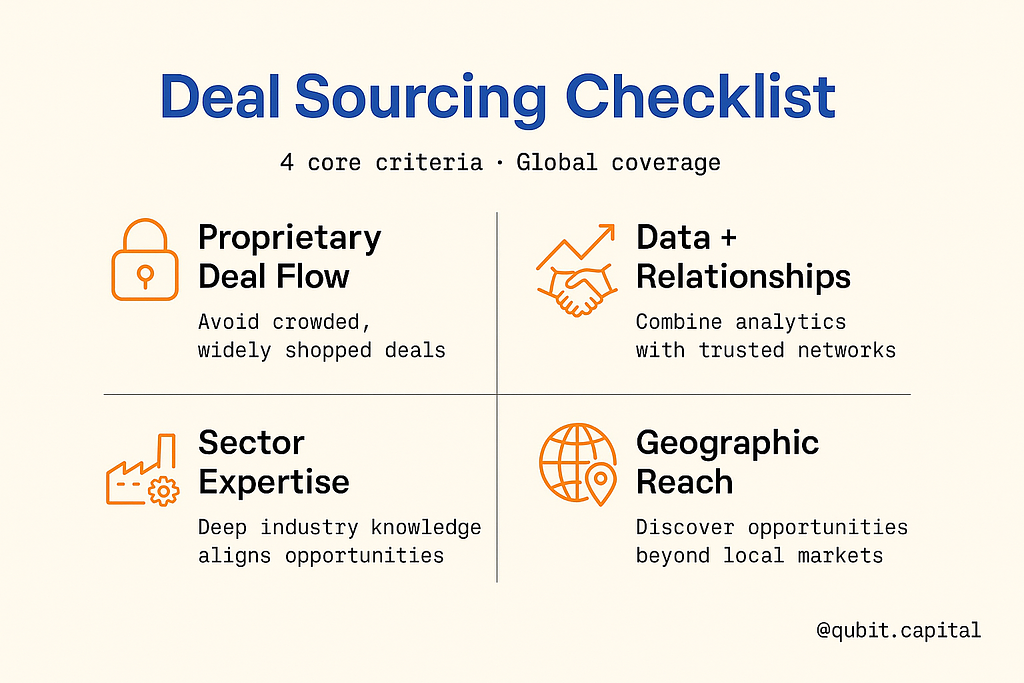

Selection Criteria Checklist

Choosing the right deal sourcing provider requires a structured approach to ensure alignment with your acquisition goals. A comprehensive checklist can simplify this process and highlight key factors that distinguish an ideal platform.

1. Access to Proprietary Deal Flow

The ability to access exclusive opportunities is crucial. Providers offering proprietary deal flow ensure that startups are not competing for widely available deals, giving them a competitive edge in acquisitions.

2. Balancing Relationship-Driven and Data-Driven Approaches

An effective provider combines strong industry relationships with robust data analytics. This balance ensures that acquisitions are both strategically sound and backed by actionable insights.

3. Sector-Specific Expertise

Providers with deep knowledge of specific industries can identify opportunities that align with your business model. Their expertise ensures that acquisitions are relevant and valuable.

4. Geographic Reach

Global reach is essential for startups aiming to expand into new markets. Providers with extensive geographic coverage can uncover opportunities beyond local boundaries.

5. Cost vs. Value Alignment

Evaluating the cost of services against the value delivered is vital. The ideal provider offers transparent pricing and measurable results, ensuring your investment is worthwhile.

Platform Features and Pricing Analysis

Selecting the right platform often hinges on understanding how its features align with your organization's needs and budget. Each platform is designed with specific strengths, catering to varying business sizes and market focuses. For smaller organizations, affordability and ease of use may take precedence, while enterprise-level solutions prioritize scalability and advanced integrations.

Balancing subscription costs with return on investment (ROI) is a critical consideration. Platforms targeting mid-market businesses often offer specialized tools that bridge the gap between affordability and functionality. On the other hand, enterprise solutions frequently include robust integration capabilities, enabling seamless workflows across multiple systems.

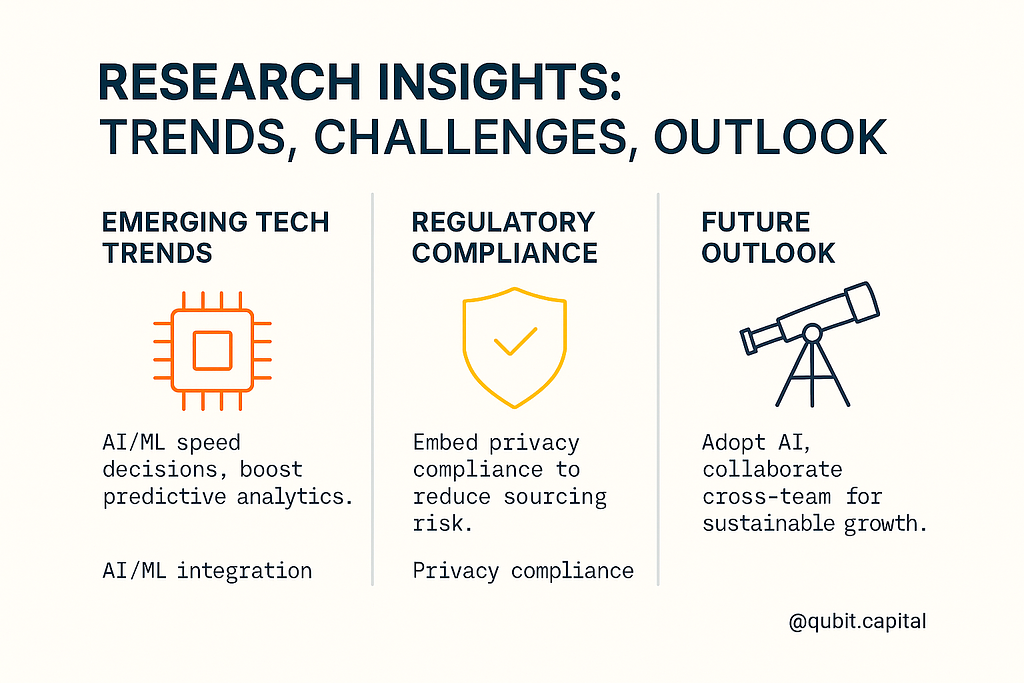

Comprehensive Research Insights: Trends, Challenges, and Future Outlook

The dynamic world of deal sourcing is shaped by a convergence of market data, technological advancements, and evolving regulations. By analyzing these elements, businesses can uncover actionable strategies to optimize their operations. This section synthesizes key insights from diverse sources to provide a clear picture of current trends and challenges while offering a glimpse into the future of deal sourcing.

Emerging Technology Trends in Deal Sourcing

Technology continues to redefine how businesses identify and secure opportunities. Platforms powered by artificial intelligence (AI) and machine learning are transforming the deal sourcing process, enabling faster and more accurate decision-making. The discussion is enriched by insights from AI tools for fundraising, which illustrate how data-driven strategies underpin both funding initiatives and acquisition planning. These tools not only streamline workflows but also enhance predictive analytics, helping businesses anticipate market shifts.

Regulatory Challenges and Compliance

As regulations evolve, businesses face increasing pressure to maintain compliance while pursuing growth. From data privacy laws to industry-specific mandates, staying ahead of these requirements is critical. Companies that integrate compliance into their sourcing strategies can mitigate risks and build trust with stakeholders.

Future Outlook and Best Practices

Looking ahead, the integration of AI and machine learning will play an even greater role in deal sourcing. Successful case studies highlight the importance of adopting technology-driven platforms and fostering collaboration across teams. By embracing innovation and prioritizing compliance, businesses can position themselves for sustainable growth in a competitive market.

Conclusion

AI-enhanced deal sourcing and platform evaluation have emerged as transformative strategies in acquisition decision-making. By integrating advanced tools and methodologies, businesses can identify opportunities with greater precision and assess platforms more effectively. Throughout this blog, we’ve explored actionable insights that emphasize the importance of data-driven approaches. These strategies not only streamline the acquisition process but also empower decision-makers to act with confidence.

Relying on intuition alone is no longer sufficient in a competitive market. Harnessing data-backed insights ensures that every decision is informed, strategic, and aligned with long-term goals. At Qubit Capital, we specialize in guiding investors through the complexities of strategic acquisitions. Let us help you make informed, impactful decisions with our tailored services. Strategic Acquisition services can support your next move.

Key takeaways

- AI-driven deal sourcing platforms significantly reduce research time and improve efficiency.

- Platforms like SourceCo and Grata provide real-world success metrics and impressive transaction volumes.

- A thorough checklist including proprietary data, geographic reach, and cost alignment is essential for selecting the right platform.

- Informed acquisitions require both advanced analytics and a relationship-driven approach

Frequently asked Questions

What are deal sourcing platforms?

Deal sourcing platforms are specialized tools that use a combination of AI-powered analytics and extensive databases to identify off-market and under-the-radar acquisition targets. They help investors streamline due diligence and accelerate deal flow.

Back

Back