While venture capital remains essential for scaling AI startups, the current environment increasingly favors capital efficiency over growth-at-all-costs mentalities. Rising interest rates, economic volatility, and heightened investor scrutiny have created new challenges for AI founders seeking traditional equity funding.

This transformation has elevated non-dilutive capital as a strategic imperative rather than a supplementary option. For AI startups, which often require substantial upfront investment in compute resources, talent acquisition, and regulatory compliance, preserving equity while accessing growth capital can determine long-term success.

For AI startups, this evolving funding environment underscores the importance of exploring diverse financing options. Non-dilutive capital, such as grants and accelerator funding, is gaining traction as a strategic choice. The discussion in "how to raise money for AI startup" provides a broader framework that contextualizes non-dilutive funding within wider fundraising trends, enhancing your overall perspective.

Government Grant Programs: Federal AI Funding

SBIR and STTR Programs

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs represent the largest source of non-dilutive funding for AI startups in the United States. With over $4 billion distributed annually across federal agencies, these programs specifically target innovative technologies with commercial potential.

Phase I funding typically provides $50,000 to $500,000 over six to twelve months for feasibility studies and proof-of-concept development. AI startups can use these funds for algorithm development, initial testing, and market validation. The application process requires demonstrating technical innovation, commercial potential, and team capability to execute the proposed research.

Phase II awards extend successful Phase I projects with $750,000 to $1.5 million over two years for prototype development and market preparation. AI companies often use Phase II funding for product development, customer pilot programs, and regulatory compliance preparation. The selection rate for Phase II typically ranges from 40-60% for companies that successfully complete Phase I.

Phase III funding provides unlimited non-SBIR funds for commercialization, often through direct government contracts or private investment. Many successful AI companies have leveraged Phase III opportunities to scale operations while maintaining government relationships that provide ongoing revenue streams.

Key federal agencies offering AI-focused SBIR opportunities include the Department of Defense (DoD), National Science Foundation (NSF), Department of Energy (DOE), and National Institutes of Health (NIH). Each agency maintains specific AI priorities, from autonomous systems and cybersecurity to healthcare applications and energy optimization.

National Science Foundation AI Research Grants

The NSF operates several grant programs specifically designed for AI research and commercialization. The Partnerships for Innovation (PFI) program provides up to $1 million for university-industry collaborations developing AI technologies with clear commercial pathways. AI startups can partner with academic institutions to access these funds while gaining research expertise and student talent.

The Smart and Connected Communities (SCC) program offers grants up to $1.5 million for AI solutions addressing urban challenges, including transportation, energy, and public safety. This program particularly favors AI applications with measurable social impact and municipal partnership potential.

NSF I-Corps provides $50,000 grants for customer discovery and market validation, essential for AI startups transitioning from research to commercial applications. The program includes intensive mentorship and requires systematic customer development activities that often prove invaluable for refining product-market fit.

Department of Energy AI Innovation Programs

The DOE's Advanced Research Projects Agency-Energy (ARPA-E) funds breakthrough AI technologies for energy applications, with typical awards ranging from $1 million to $10 million over three years. Recent focus areas include AI for grid optimization, renewable energy forecasting, and carbon capture technologies.

The Small Business Vouchers (SBV) program provides $50,000 to $300,000 for AI startups to collaborate with national laboratories, accessing world-class research facilities and expertise. This program works particularly well for AI companies developing hardware-software integrated solutions requiring specialized testing environments.

National Institutes of Health AI Research Opportunities

NIH offers substantial funding for healthcare AI applications through multiple mechanisms. The Small Business Innovation Research for Healthcare specifically targets AI solutions for medical diagnosis, drug discovery, and clinical decision support, with awards typically ranging from $500,000 to $2 million.

The BRAIN Initiative provides grants up to $1.5 million for AI technologies advancing neuroscience research, including brain-computer interfaces, neural data analysis, and cognitive enhancement applications. This program particularly values interdisciplinary approaches combining AI with neuroscience, psychology, and engineering.

Startup Success Stories

Real-world examples bring these statistics to life.

- Cali’s Books SBIR Grant Success: Cali’s Books, a startup specializing in interactive children’s books, secured funding through the Small Business Innovation Research (SBIR) grant program. This non-dilutive capital enabled them to expand their product line and reach new markets without giving up equity.

- Dollaride’s Electric Transit Expansion: Dollaride, a transportation startup, utilized non-dilutive funding to launch its electric transit initiative. This funding allowed them to innovate in the sustainable mobility space while maintaining full control of their business operations.

For startups exploring various funding paths, insights from AI startup funding options expand your view by detailing various financial avenues, thereby complementing the focus on non-dilutive capital strategies.

Accelerator Programs: Equity-Free Growth Resources

Technology Giants' AI Accelerator Programs

Google AI First operates as a global, equity-free accelerator providing selected AI startups with up to $350,000 in Google Cloud credits, technical mentorship from Google AI researchers, and go-to-market support. The program runs twice annually with highly competitive selection processes focusing on technical innovation and scalable business models.

Microsoft for Startups offers AI companies up to $350,000 in Azure credits plus access to Microsoft's technical advisory network and customer introduction programs. The program particularly benefits AI startups building enterprise solutions compatible with Microsoft's ecosystem. Recent graduates include companies developing conversational AI, computer vision, and automation platforms.

AWS Generative AI Accelerator provides up to $300,000 in AWS credits specifically for startups developing generative AI applications. The program includes technical workshops, architecture reviews, and customer connection opportunities through AWS's extensive enterprise network.

NVIDIA Inception serves AI startups with free access to NVIDIA's technical expertise, hardware discounts, and marketing support. While not providing direct cash funding, the program offers substantial value through GPU credits, technical training, and venture capital introductions. Many AI hardware and autonomous systems companies credit NVIDIA Inception with accelerating their development timelines.

Corporate Innovation Labs and Accelerators

Intel AI Academy combines funding opportunities with technical education, providing AI startups access to Intel's hardware optimization expertise and edge computing resources. The program particularly benefits companies developing AI applications for IoT, autonomous vehicles, and industrial automation.

IBM AI Accelerator focuses on enterprise AI solutions, providing selected startups with access to Watson AI services, technical mentorship, and customer pilot opportunities. The program's strength lies in enterprise sales support and regulatory compliance guidance for AI applications in highly regulated industries.

Qualcomm AI Accelerator specializes in mobile and edge AI applications, offering hardware development kits, technical support, and market access through Qualcomm's extensive OEM network. This program proves particularly valuable for AI startups developing consumer applications requiring on-device processing.

University-Based AI Accelerators

Stanford AI Accelerator leverages Stanford's AI research leadership to support early-stage companies with funding, mentorship, and talent recruitment. The program provides access to Stanford's extensive alumni network in Silicon Valley while maintaining close connections to cutting-edge AI research.

MIT Sandbox offers equity-free funding up to $25,000 for MIT-affiliated AI projects, combined with mentorship from faculty and industry experts. The program's strength lies in technical rigor and connections to MIT's research labs, often leading to licensing opportunities for breakthrough AI technologies.

Carnegie Mellon AI Startup Studio focuses on commercializing AI research from one of the world's leading AI programs. Participants gain access to CMU's extensive AI faculty, research facilities, and industry partnerships while receiving seed funding and intensive entrepreneurship training.

Alternative Non-Dilutive Funding Mechanisms

Revenue-Based Financing for AI Startups

Revenue-based financing has emerged as a viable option for AI companies generating recurring revenue. Companies like Lighter Capital, Clearbanc, and Pipe provide $100,000 to $4 million in growth capital in exchange for a percentage of future revenues, typically 2-10% of monthly sales until a predetermined multiple is repaid.

This funding model works particularly well for AI-as-a-Service companies, enterprise software with embedded AI, and consumer AI applications with subscription models. The qualification criteria typically include $200,000+ in annual recurring revenue, consistent growth rates, and predictable customer retention metrics.

Advantages include faster approval processes compared to traditional loans, flexible repayment tied to business performance, and preservation of equity for future rounds. Limitations include revenue requirements that exclude pre-revenue startups and cost of capital that can exceed traditional debt for high-growth companies.

Customer-Funded Development Programs

Many large enterprises offer pilot programs and proof-of-concept funding for AI startups developing solutions for their specific needs. Microsoft's AI Innovation Challenge provides $100,000 to $500,000 for startups building AI solutions for Microsoft's enterprise customers, often leading to commercial contracts worth millions.

IBM's AI Pilot Program funds AI startups developing solutions for IBM's client base, particularly in healthcare, financial services, and manufacturing. Successful pilots often transition to multi-year commercial relationships providing sustainable revenue growth.

Amazon's Alexa Fund invests in voice AI startups while providing access to Amazon's ecosystem and customer base. Although technically equity investment, the fund often structures deals to minimize dilution while maximizing strategic value.

Competition and Prize-Based Funding

- XPRIZE regularly offers multi-million dollar competitions for breakthrough AI applications addressing global challenges. Recent competitions have focused on AI for education, healthcare diagnosis, and environmental monitoring. Winners receive substantial prize money without equity requirements while gaining significant media exposure and investor attention.

- Government innovation challenges at federal, state, and local levels offer prizes ranging from $50,000 to $1 million for AI solutions addressing specific public sector needs. The U.S. Department of Transportation's Inclusive Design Challenge recently awarded $500,000 to AI startups developing accessible transportation solutions.

- Corporate innovation challenges from companies like GE, Shell, and Procter & Gamble offer substantial prizes for AI solutions relevant to their industries. These competitions often lead to strategic partnerships, licensing agreements, and customer relationships beyond the initial prize money.

Application Strategy and Timeline Planning

Grant Application Best Practices

Successful grant applications require months of preparation and strategic planning. Research and preparation should begin 6-9 months before application deadlines, including thorough analysis of funding agency priorities, evaluation criteria, and reviewer backgrounds.

- Technical narrative development must clearly articulate the innovation's technical approach, anticipated challenges, and proposed solutions. Reviewers often include subject matter experts who can identify weaknesses in technical approaches or unrealistic timelines. Include preliminary data, algorithm performance metrics, and clear development milestones.

- Commercial potential demonstration requires market analysis, competitive landscape assessment, and clear path-to-market strategies. Many AI grants specifically evaluate commercial viability, requiring detailed business models, customer validation, and revenue projections.

- Team qualifications play a crucial role in evaluation. Highlight relevant technical expertise, previous commercialization experience, and advisory board strength. For university-industry collaborations, demonstrate clear roles and intellectual property arrangements.

Application Timeline Management

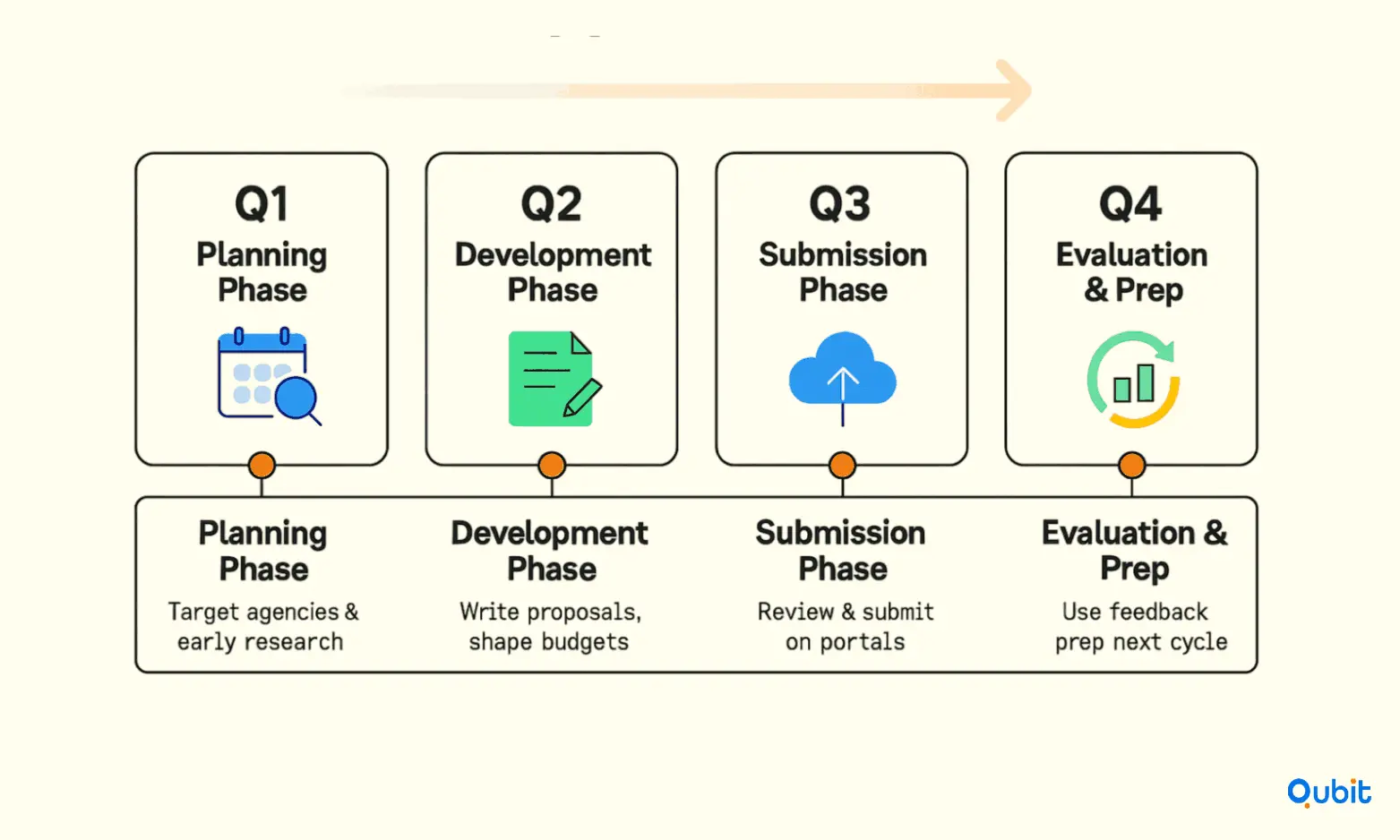

- Q1 Planning Phase should focus on identifying target opportunities, assembling application teams, and beginning preliminary research. Many federal agencies announce annual priorities during this period, allowing strategic alignment with funding objectives.

- Q2 Development Phase involves intensive proposal writing, technical approach refinement, and budget development. Most competitive grants require 40-60 hours of preparation time, making early starts essential for quality submissions.

- Q3 Submission Phase includes final reviews, compliance checking, and submission through required portals. Many agencies require institutional approvals and certifications that can take weeks to obtain.

- Q4 Evaluation and Planning covers the review period and planning for next year's opportunities. Use reviewer feedback to improve future applications and begin preparing for potential follow-on funding.

Success Rate Realities

- Federal grant programs typically have acceptance rates ranging from 10-25%, making them highly competitive. SBIR Phase I success rates average 20% across agencies, while Phase II success rates improve to 40-60% for successful Phase I companies.

- Accelerator programs often have acceptance rates below 5% for prestigious programs like Y Combinator or Techstars. Corporate accelerators may have higher acceptance rates but provide less flexibility and networking value.

- International grants vary significantly by program and country, with EU programs typically achieving 15-30% success rates depending on the specific call and competition level.

Conclusion

Non-dilutive capital offers startups a powerful way to secure funding while preserving equity, ensuring founders maintain control over their vision. This approach not only safeguards ownership but also supports long-term growth without compromising future opportunities. Transparent application processes, strategic partnerships, and real-world success stories further highlight the value of this funding model.

If you're ready to explore how non-dilutive capital can elevate your startup, we’re here to help. At Qubit Capital, our Fundraising Assistance service is designed to guide you through this journey. Let us help you secure the resources you need without sacrificing equity. Reach out to us today!

Key Takeaways

- Non-dilutive capital preserves equity while fueling sustainable growth.

- Strategic partnerships like those with ECL provide fast, flexible funding solutions.

- Data-driven case studies demonstrate the tangible benefits of alternative funding.

- A clear application process through LvlUp Growth Financing streamlines access to grants and accelerators.

- AI startup founders gain a competitive edge with founder-friendly, non-dilutive funding options.

Frequently asked Questions

What is non-dilutive funding?

Non-dilutive funding refers to financial resources provided to startups without requiring them to give up equity. Examples include grants, accelerator programs, and other initiatives that allow founders to retain ownership while securing capital for growth.

Back

Back