Growth capital in Agri/FoodTech isn’t just growing, it’s shifting and concentrating. A big part of that capital is now moving into developing markets, where agrifoodtech funding climbed to $3.7 billion in 2024, up 63% year-on-year and now accounting for 23% of global funding.

Even more important for scale-ups: the money is clearly clustering in later rounds. Late-stage deals raised 133% more capital year-on-year, growth-stage rounds were up 54%, while seed/Series A barely moved at 1%, a clear signal that the real firepower sits in funds that want to write bigger cheques into proven models.

For Agri/FoodTech founders, that changes the game. Growth capital is increasingly reserved for startups that can show real traction: repeatable revenue, strong unit economics, defensible technology, and clear impact on food systems or climate resilience.

In this guide, we’ll look at how to position your Agri/FoodTech startup for these larger rounds—using crowdfunding, strategic investors, and partnerships to graduate from “promising idea” to “scalable growth story” that late-stage capital is actively hunting for.

Let’s jump right in!

Growth Capital Strategies for Scaling AgriTech & FoodTech Startups

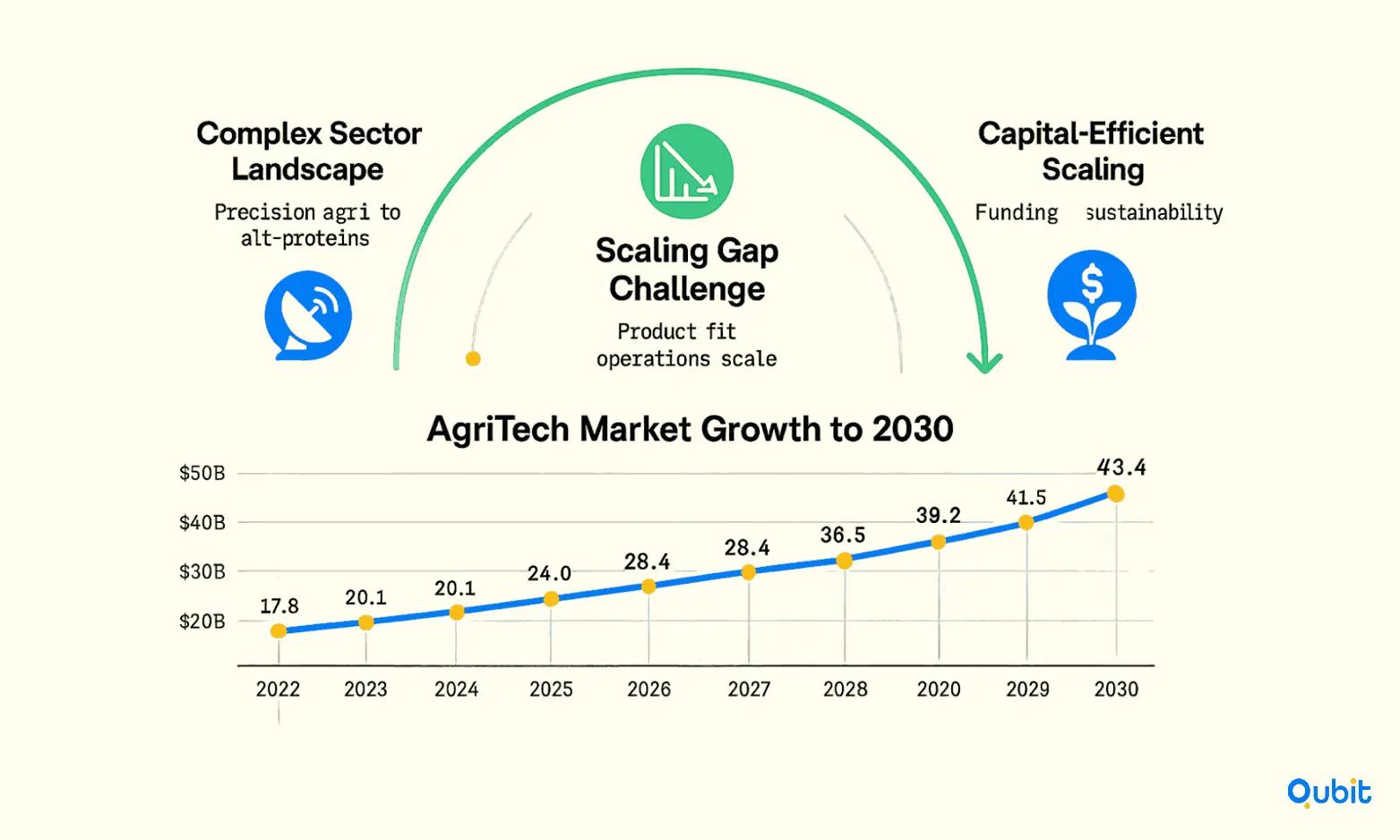

AgriTech and FoodTech innovation spans precision agriculture, digital farming, alternative proteins, sustainable packaging, supply chain optimization, and biotech-driven food production.

Despite high growth potential, projected global agritech market value surpassing $43 billion by 2030, many ventures encounter “growth valleys,” where product-market fit and technical milestones must convert into scalable, profitable operations. The challenge: not just raising funds, but building sustainable, capital-efficient pathways to scale. Meeting these needs requires transformative business models and robust capital strategies.

Example Scenario: Tech vs. Hardware Funding Strategies

For example, a hardware-focused AgriTech startup may prioritize capital for factory setup and inventory, often seeking large debt or grant support, while a SaaS platform can scale with smaller rounds and more flexible capital stack options. This difference shapes investor selection and the speed of scaling.

From understanding investor expectations to identifying the right funding sources, we’ll cover it all. For a deeper dive into early-stage funding, check out our guide on agritech startup funding.

Understanding the Growth Capital Continuum

Growth capital is funding aimed at scaling operations, accelerating market penetration, or expanding technology platforms for AgriTech and FoodTech startups that have demonstrated initial validation and revenue generation. Unlike seed or early-stage funding focused on proving concept, growth capital supports operational scale, geographical expansion, M&A, and entry into new value chain segments

Types of Growth Capital for Agri/FoodTech

Effective growth capital strategies involve selecting the right instruments for scaling Agri/FoodTech ventures.

Securing Series A funding in the Agri/FoodTech sector requires a deep understanding of the industry’s current dynamics. This includes evaluating the funding environment, market size, growth trends, and regulatory factors that influence investor decisions.

Recent Trends in Agri/FoodTech Funding

Global Agri/FoodTech funding has shifted sharply in the past few years. After strong growth from 2017–2021, investments contracted by over 70%, falling from $61.2 billion in 2021 to $16.1 billion in 2024. Deal numbers and sizes have changed too, with larger, later-stage rounds becoming more prominent even in a slower funding environment.

Regional markets are seeing even steeper corrections. In 2025, agritech startups in Africa, South Asia, and Southeast Asia raised $303 million across 65 Series A deals, down 46% from $564 million in 2023. This rapid drop signals changing investor sentiment and rising capital scarcity, especially in emerging economies. Founders need to recalibrate their funding strategies and value propositions for a more selective, risk-aware market.

Against this backdrop, capital is being allocated more selectively. Investors increasingly favor companies with:

- Clear technological differentiation

- Scalable business models

- Robust unit economics

Deeptech and downstream business models attract different risk profiles and investor appetites, shaping who gets funded and on what terms.

At the same time, strategic and diversified capital is becoming more important. In response to capital scarcity, companies are moving beyond traditional VC dependence and increasingly blending:

- Debt

- Grants

- Corporate or strategic partnerships

This mix of funding sources is emerging as a key strategy for Agri/FoodTech companies looking to scale in a tougher, more disciplined funding cycle.

Key Growth Capital Strategies

Agri/FoodTech scale-ups rarely grow on just one type of capital. The most resilient companies blend equity, debt, and grants to match different stages and needs.

- Equity capital

Still sits at the core of most growth stories—especially when it comes from sector-focused VCs like Omnivore, Accel, PeakBridge, or Zintinus. These investors bring more than money: they help with pilots, hiring, partnerships, and expansion. For example, Omnivore has backed over 90 Indian AgriTech startups, supporting them from pilot through growth stages. - Venture debt and asset-backed lending

Useful for funding equipment, processing facilities, inventory, and working capital without giving up additional ownership. This type of capital suits more mature operations with predictable revenues and assets that can be financed or used as collateral. - Grants and innovation competitions

Offered by governments, multilaterals, and NGOs, these can fund research, pilots, and sustainability-focused projects. Grants reduce R&D and impact risk, helping startups prove concepts and outcomes before layering on larger rounds of commercial capital.

Debt and structured capital are becoming realistic options much earlier than before. Specialist investors report a rising pipeline of AgTech and FoodTech companies taking on growth debt, especially where there is recurring revenue or contracted offtake.

In markets like India, the broader PE-VC ecosystem rebounded to $43 billion in 2024, up 9%, with growth-stage deals driving the recovery, creating more lenders and funds comfortable with non-dilutive instruments such as venture debt and equipment finance for agrifood businesses.

Capital Stack Table

| Stage | Funding Source | Example Use Case |

|---|---|---|

| Early/Seed | VC, Angel, Incubator Grant | MVP, pilot runs, initial staffing |

| Growth | Growth VC, Debt, CVC | New facility, product expansion, customer acquisition |

| Expansion | Corporate alliances, M&A | Entering new geography, vertical integration |

Strategic Partnerships and Corporate Collaborations

- Corporate-Startup Partnerships: FoodTech and AgriTech scale through alignments with large food corporations or agri-input companies, who provide not only capital but also market access, supply chain integration, and validation.

- Joint Ventures and Alliances: Cross-border or supply chain JVs can blend local expertise, technology, and distribution capabilities. For example, Wageningen’s Revvye and agriculture cooperative Royal Cosun formed a partnership to bring food ingredient innovation to scale.

- Accelerators and Incubators: Specialized programs offer funding, networking, mentoring, and pilot opportunities. In markets like India, tailored AgriTech accelerators connect foreign startups to government support and ecosystem engagement.

Monetization and Business Model Innovation

Innovative Monetization Models:

- Subscription/SaaS for farm management platforms, leveraging AI, IoT, and blockchain for data-driven advisory and logistics.

- “Farm-to-fork” direct distribution and supply chain efficiency models.

- Input/output marketplaces, linking smallholders to markets and services (e.g., DeHaat in India raised $224M through innovative scale-up).

Optimizing Unit Economics:

- Prioritize margin improvement and technology cost curve reduction at each growth stage.

- Unit economics (the specific financial outcomes per product or customer) are key to scaling.

- Prove positive gross margins and operational expense scalability before pursuing capital-intensive scale-ups (e.g., vertical farming, cultivated meat).

- Pilot with co-manufacturing or asset-light models before heavy Capex commitments.

Market Expansion Strategies

- Emerging Markets Focus: Markets such as India—where demand, supportive policy, and digital adoption converge—offer high-growth opportunities.

- Localization: Successful scaling often requires product/service adaptation to local agronomic, regulatory, and economic contexts, especially for smallholder-dominated landscapes.

- Pilot, Prove, Scale: Run pilot projects in target regions, validate results, then use data to unlock growth funding and strategic customers.

Technology and Digital Infrastructure

- SaaS and Digital Platforms: SaaS solutions allow rapid scaling of software-driven services (farm management, traceability, distribution) without high infrastructure cost.

- Integration of AI, IoT, and Data Analytics: Enhances product performance and offer differentiation, helping attract capital and scale user adoption.

- Blockchain and Traceability: Increasingly critical in food supply chain transparency, reducing fraud, and optimizing operations.

Scaling Challenges and Solutions

Overcoming scaling barriers often depends on implementing targeted growth capital strategies for Capex-intensive business models.

A. Operational and Market Barriers

- Fragmented supply chains and diverse local requirements impede fast scaling, especially when serving millions of smallholders or multiple regulatory regimes.

- High Capex business models (e.g., bioprocessing plants, alt-protein fermentation) require careful Capex phasing and de-risking strategies prior to major fundraising.

- “Catch-22” of needing scale to reduce cost and raise capital, yet requiring capital to achieve scale. Resolved by co-manufacturing, off-take agreements, and creative staging.

B. Pathways to Surmount Key Hurdles

- Unit Economics First: Relentlessly validate that scale will yield operational efficiency and improved margins—a precondition for major growth capital rounds.

- Realistic Valuations: Reset valuation expectations based on current market conditions rather than hype cycles or peak-era deal terms.

- Focus on Impact and ESG: Demonstrated social, environmental, and governance impact helps unlock impact investing and ESG-aligned funds.

Case Studies: Growth Capital in Action

| Company | Sector | Key Growth Strategy | Capital Raised | Scaling Outcome |

|---|---|---|---|---|

| DeHaat | Indian AgriTech | Digital platform, marketplace | $224M (Series E) | Market leader empowering smallholders, robust revenue growth |

| Ninjacart | Supply chain | Tech-enabled logistics | $10M (late-stage) | Efficient last-mile delivery, expanded network |

| Revvye | Alternative Protein | Strategic partnership | — | Scaled ingredient via JV with major agri-cooperative |

| Vow | Cultured meat | Niche, high-value intro | — | Launched novel species, scaling to broader categories |

| Licious | FoodTech | VC-led growth, branding | Mult. rounds | Pan-India presence, market leadership |

The Role of Emerging Models: Circular Economy and Wave 3.0

- Modern FoodTech is shifting from simple digitization toward “Wave 3.0”: a holistic, circular, and systemic innovation approach.

- Focus is moving from single-point solutions (e.g., delivery apps) to full value-chain transformation (waste reduction, valorization of byproducts, biotech across the cycle).

- Growth capital now seeks out business models that create value environmentally, economically, and for health, rewarding those who deliver impact at scale.

Policy and Ecosystem Enablers

- Public-Private Partnerships: Joint initiatives on R&D, infrastructure, and tech adoption expand addressable opportunities and de-risk private capital.

- Supportive Regulation: Adaptive regulatory frameworks accelerate the adoption of circular, biotech, and sustainable food solutions.

- Ecosystem Building: Clusters, tech parks, and agrifood innovation centers spark cross-pollination and growth, often attracting both public and corporate co-investment.

For startups in sectors like agritech, exploring alternative funding options such as agritech debt financing can complement efforts. Debt financing offers non-dilutive capital, allowing founders to retain equity while scaling operations.

Conclusion

For Agri/FoodTech founders, the funding landscape is tougher, but also clearer. Capital is concentrating in later stages and developing markets, and investors are backing fewer, stronger bets. That means you can’t scale on pitch decks and buzzwords; you need proof: repeatable revenue, solid unit economics, defensible tech, and real impact on farmers, consumers, and climate.

Growth capital is increasingly going to teams that blend instruments, equity, debt, grants, and strategic partnerships, into a disciplined, staged capital stack. If you can show that every dollar of scale drives margin, impact, and market share, you stop “chasing rounds” and start choosing them. In this cycle, the best Agri/FoodTech companies won’t just survive the reset; they’ll use it to build durable category leadership.

If you're ready to elevate your startup's funding journey, we invite you to explore our Fundraising Assistance service to help secure the capital you need.

Key Takeaways

- Growth capital is concentrating in later, larger rounds.

- Developing markets now command a growing share of funding.

- Investors expect traction: revenue, margins, and defensible tech.

- Blended capital stacks (equity, debt, grants) reduce risk.

- Strategic partnerships unlock markets, distribution, and validation.

- Strong unit economics beat hype in today’s environment.

- Impact on food systems and climate is now a core filter.

Frequently asked Questions

What is growth capital and why is it crucial for AgriTech startups?

Growth capital refers to funding used to expand operations and scale validated AgriTech startups. It accelerates market entry and boosts technology adoption.