E-commerce businesses often face unique challenges when scaling operations, particularly when it comes to financing inventory and purchase orders. Global industry expansion redefines the potential of ecommerce startups. By 2030, ecommerce market size will reach $47.7 trillion. This trajectory underscores demand for scalable financing solutions. Entrepreneurs must seize inventory support to capture this growth.

This blog explores non-dilutive inventory funding. These solutions help entrepreneurs maintain control of their ventures. From actionable steps to real-world case studies, this guide provides insights into alternative financing strategies tailored for e-commerce businesses.

Let’s jump right in!

What is Inventory Financing for ECommerce?

ECommerce inventory financing is a specialized loan program designed to help online businesses procure goods and maintain optimal inventory levels. This financial solution addresses the common cash flow challenges faced by ECommerce businesses, enabling them to invest in inventory without disrupting other operational expenses.

Create specifically for online retailers, inventory financing supports growth strategies such as expanding product lines and scaling inventory efficiently. It plays a vital role during high-demand periods, ensuring businesses can meet market needs without delays or stock shortages. By bridging the gap between purchasing inventory and generating revenue, this financing option empowers businesses to focus on scaling sustainably.

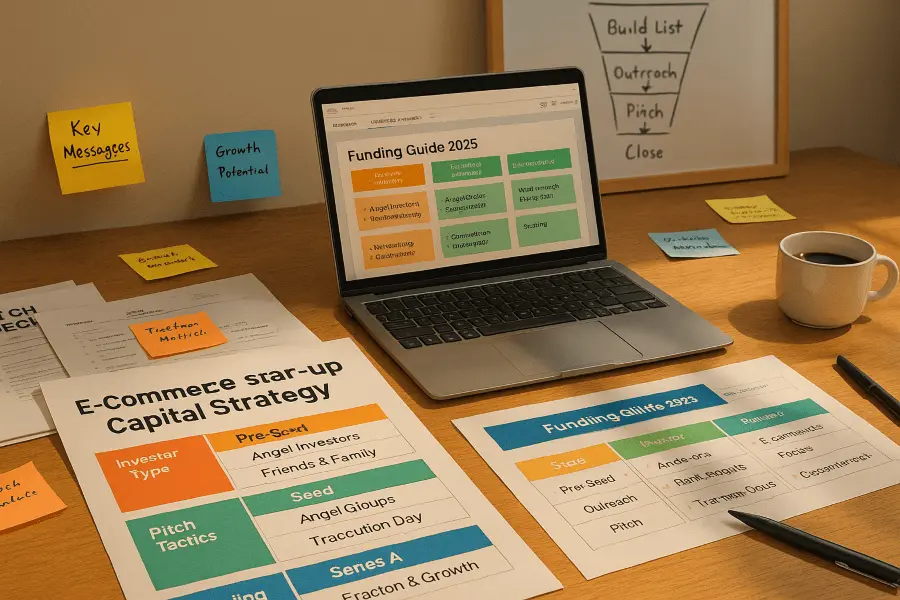

Your examination of ecommerce startup fundraising strategies broadens your perspective on diverse funding methodologies that naturally frame the discussion of inventory financing options.

How Does Inventory Financing Work?

Inventory financing provides businesses with the capital needed to purchase stock, ensuring they can meet customer demand without straining cash flow. This process involves assessing inventory needs, applying for funding, and managing repayment effectively.

1. Assessing Inventory Needs

The first step is understanding your inventory requirements. Tools like the Sales Forecasting Tool can help businesses plan their stock purchases by predicting future sales trends accurately. This ensures that the financing aligns with actual inventory demands, minimizing the risk of overstocking or understocking.

2. Application Process

Applying for inventory financing is straightforward, especially with modern online platforms. Businesses typically create an account, submit necessary documentation, and specify the amount required. Many lenders offer rapid funding, with approvals sometimes completed within minutes, allowing businesses to act quickly on purchasing opportunities.

3. Repayment Management

Financing typically covers between 50-80% of inventory value. Some lenders may offer up to 100% financing, depending on the agreement. Inventory financing is a practical solution for businesses looking to scale operations or manage seasonal demand. It combines flexibility with speed, ensuring companies can maintain optimal inventory levels without compromising their financial stability.

For example, a fashion retailer used purchase order financing to fulfill a large holiday order from Amazon, resulting in 40% quarterly growth.

Inventory Financing Options & Types

E-commerce businesses often face challenges in maintaining sufficient inventory levels, especially during peak seasons or rapid scaling phases. Inventory financing provides a solution by offering various funding options tailored to meet these demands.

Understanding inventory financing options helps businesses choose the best fit for their needs.

Traditional Financing Methods

Business Term Loans

Business term loans are a common choice for inventory financing. These loans provide a lump sum amount that can be used to purchase inventory upfront. Repayment terms are typically fixed, making it easier for businesses to plan their finances.Revolving Lines of Credit

Revolving lines of credit offer flexibility, allowing businesses to borrow funds as needed up to a predetermined limit. This option is particularly useful for managing fluctuating inventory needs without committing to a fixed loan amount.

Alternative Financing Methods

Merchant Cash Advances

Merchant cash advances provide immediate funding based on future sales. This option is ideal for e-commerce businesses with consistent revenue streams, as repayments are tied to daily or weekly sales percentages.Peer-to-Peer Lending

Peer-to-peer lending platforms connect businesses directly with individual investors. This method often features competitive interest rates and faster approval processes, making it a viable option for businesses seeking quick access to funds.

Alternative sources are not just niche. By 2033, revenue-based financing will expand to $178.3 billion. This rapid growth reflects startups’ shift to non-traditional capital for scaling inventory.

Integrating Financing with Inventory Management Solutions

Building on emerging trends, integrating inventory financing with inventory management and logistics solutions can significantly enhance supply chain efficiency. This approach allows businesses to synchronize capital access with real-time inventory tracking, reducing the risk of stockouts or overstocking.

By aligning financing with operational systems, companies can streamline purchasing, fulfillment, and cash flow management. This integration supports sustainable growth and positions e-commerce businesses to respond quickly to market changes.

Comparing Inventory Financing Options

| Feature | Traditional Loans | Revenue-Based Financing | Ecommerce-Specific Platforms |

|---|---|---|---|

| Approval Speed | Several days to weeks | Within a few days | Rapid, often same-day |

| Repayment Structure | Fixed monthly payments | Percentage of sales revenue | Flexible, revenue-aligned |

| Collateral Requirement | Usually required | May require inventory as collateral | Often inventory-based, less stringent |

| Best For | Established businesses | High-growth, variable sales | Online sellers needing agility |

Emerging Trends in Inventory Financing

The global inventory financing market was valued at $205.7 billion in 2023, highlighting its growing importance for businesses worldwide. Additionally, Purchase order financing, where a financier advances payment to suppliers so businesses can fulfill large orders, the market projected to reach $12.9 billion globally by 2033.These trends underscore the increasing demand for innovative financing solutions tailored to the e-commerce sector.

For insights into how managing supply chain uncertainties can influence financing strategies, explore this logistics risk ecommerce investors resource.

Who Should Apply for Inventory Financing?

Direct-to-consumer models now shape eligibility profiles for inventory lending. In 2025, D2C ecommerce sales exceeded $187 billion for established brands. This volume positions D2C startups as prime candidates for funding.

Businesses seeking inventory financing often share specific characteristics that make them ideal candidates for this type of funding. A strong sales history, coupled with reliable forecasted sales data, is one of the primary eligibility criteria. Lenders look for companies that demonstrate consistent revenue generation. Accurate sales forecasts also help prove repayment ability.

High inventory turnover is another critical factor. Companies that frequently replenish stock due to steady or increasing demand are better positioned to benefit from inventory financing. This is particularly true for businesses in industries with seasonal demand fluctuations, such as retail or e-commerce. By securing funding, these businesses can prepare for peak seasons without straining their cash flow.

Effective cash flow management is equally important. Businesses must show they can handle the repayment terms without compromising daily operations. For example, maintaining a balance between incoming revenue and outgoing expenses is essential to avoid financial bottlenecks.

Additionally, compliance with regulatory standards can impact eligibility. Your consideration of ecommerce data privacy compliance investors brings clarity to how regulatory factors intersect with inventory financing, grounding the discussion in compliance and operational accountability.

How to Apply for Inventory Financing?

Securing inventory financing can be a straightforward process when approached systematically. Whether you're a small business owner or an e-commerce entrepreneur, understanding the steps involved can help you access the funds you need to grow your operations. Below is a step-by-step guide to applying for inventory financing.

- Research and compare offers

- Create online account

- Submit documentation

- Verify sales

1. Research and Compare Financing Offers

Begin by exploring various inventory financing options available in the market. Look for platforms that specialize in funding inventory costs, such as the Kickfurther Funding Platform, which offers up to 100% funding with flexible payment terms. Compare interest rates, repayment schedules, and eligibility criteria to identify the most favorable terms for your business. Negotiating terms can also help secure a deal that aligns with your financial goals.

2. Create an Online Account

Once you've chosen a financing provider, the next step is to create an online account on their platform. This account will serve as your hub for submitting applications, tracking progress, and managing repayments.

3. Submit Financial Documentation

Prepare and upload the necessary financial documents to demonstrate your business's stability and repayment capacity. These typically include balance sheets, income statements, and cash flow reports. Ensure that your documentation is accurate and up-to-date, as this will play a crucial role in the approval process.

Financial Documentation Checklist for Inventory Financing

- Gather recent financial statements, including balance sheets and income statements, to demonstrate business stability and cash flow.

- Prepare detailed sales records and inventory reports that show consistent demand and effective stock management practices.

- Include a clear business plan outlining growth strategies, use of funds, and repayment approach for lender review.

4. Verify Sales Performance

Most inventory financing providers require proof of sales performance to assess your ability to sell the financed inventory. This may involve submitting sales records or integrating your e-commerce platform with the financing provider’s system. Accurate sales data can significantly improve your chances of approval.

Step 5: Await Approval and Finalize Funding

You've submitted your application, pitched your business, and answered follow-up questions. Now comes the hardest part: waiting while investors complete diligence and make their final decision.

This phase isn't passive. Investors are stress-testing your assumptions, validating claims, and comparing your opportunity against other deals competing for the same capital. How you respond during this period, providing requested data quickly, addressing concerns transparently, maintaining momentum, often determines whether you get a term sheet or a polite pass.

Before you blame “market conditions,” skim common fundraising hurdles for ecommerce founders for practical fixes. It covers how to separate ad-driven bumps from real retention, tighten unit economics, and show inventory turns like a pro.

Benefits of Inventory Financing

Inventory financing offers businesses a practical solution to address cash flow challenges while maintaining operational efficiency. The benefits of inventory financing are especially valuable for e-commerce companies.

1. Faster Access to Funds

Unlike conventional loans, inventory financing provides quicker access to capital. Businesses can secure funding based on the value of their inventory, enabling them to meet immediate financial needs without lengthy approval processes. This speed is crucial for companies facing seasonal demand spikes or unexpected expenses.

2. No Personal Guarantees Required

One standout advantage of inventory financing is the elimination of personal guarantees. Business owners can protect their personal assets while still obtaining the funds necessary to grow their operations. This feature reduces financial risk and fosters confidence in pursuing expansion opportunities.

3. Support for Businesses with Imperfect Credit

Inventory financing is accessible to businesses with less-than-perfect credit histories. By focusing on the value of inventory rather than credit scores, this option opens doors for companies that might struggle to qualify for traditional loans. It empowers businesses to achieve growth without diluting ownership or sacrificing operational flexibility.

4. Non-Dilutive Growth Opportunities

For companies aiming to scale, inventory financing provides a non-dilutive funding option. Owners retain full control of their business while accessing the capital needed to invest in inventory, meet customer demands, and drive revenue growth.

Inventory financing is a versatile tool that aligns with the needs of businesses across industries, offering speed, accessibility, and flexibility.

Alternative Financing Solutions

Exploring funding options beyond traditional loans can open doors to innovative growth strategies. Two standout solutions, 8fig Growth Plans and Kickfurther’s funding models, offer businesses the flexibility to scale without the constraints of conventional financing.

8fig Growth Plans: Tailored for Expansion

8fig Growth Plans provide a dynamic approach to financing by aligning repayments with your business’s revenue cycle. This model eliminates upfront payments, allowing businesses to focus on growth while managing cash flow effectively. With tailored strategies designed to meet specific needs, 8fig ensures that funding aligns with operational goals, making it an ideal choice for scaling eCommerce ventures.

Kickfurther’s Unique Funding Model

Kickfurther introduces a community-driven funding platform that connects businesses with backers who support inventory purchases. This innovative model offers flexible repayment schedules based on sales performance, ensuring businesses only pay when revenue is generated. By removing the pressure of fixed repayment terms, Kickfurther empowers businesses to grow sustainably while maintaining financial stability.

Both 8fig and Kickfurther redefine how businesses approach financing, emphasizing adaptability and growth-focused strategies. These alternatives demonstrate that funding can be as dynamic as the businesses it supports.

Conclusion

Securing funding is often a pivotal step in scaling e-commerce businesses, and this blog has highlighted key strategies to make that process effective and sustainable. From exploring non-dilutive financing options to crafting compelling, narrative-driven proposals, the insights shared here underscore the importance of strategic planning in achieving growth without sacrificing equity.

Non-dilutive financing stands out as a powerful tool for entrepreneurs aiming to retain control while accessing the capital needed to expand. By focusing on clear, persuasive storytelling, businesses can build trust with investors and unlock opportunities that align with their vision.

If you're ready to explore tailored financing solutions, we at Qubit Capital can help connect you with the right investors through our ecommerce fundraising assistance. Let us guide you toward securing funding that empowers your growth without dilution.

Key Takeaways

- Non-dilutive inventory financing offers rapid, flexible funding solutions.

- Supports both traditional and alternative financing models to aid e-commerce growth.

- Eligibility requires a strong sales history and effective cash flow management.

- Streamlined application processes and fast funding are major benefits.

- Innovative approaches like Kickfurther have transformed inventory financing strategies.

Frequently asked Questions

What is inventory financing in ecommerce?

Inventory financing is a loan based on the value of a retailer’s stock. It helps e-commerce businesses buy or hold inventory without upfront capital. Asset-based loans and inventory credit lines use your goods as collateral. This type of financing supports growth and smooths cash flow.