In 2025, multiple sources point to renewed momentum in e-commerce VC. Funding is rebounding after a brief post-2021 cooldown, and shifting toward infrastructure and enablement plays.

That’s good news, but it also raises the bar. Investors expect faster, cleaner growth, and founders still want to protect ownership. Scaling an e-commerce business now takes a sharper financing plan, especially when you are balancing growth with equity preservation.

Venture debt has emerged as a strong option for startups that want non-dilutive capital. It can help you fund inventory, marketing, logistics, or tech upgrades without giving up significant control. Let’s dive into how venture debt can fuel your e-commerce growth, and where it fits alongside equity.

This guide is for e-commerce founders, DTC operators, marketplace leaders, and finance teams who want growth capital without heavy dilution.

Let’s dive deeper into how venture debt can fuel your e-commerce growth.

Venture Debt Financing for Startups

Venture debt financing offers startups a unique opportunity to extend their runway without diluting founder equity. This approach can be particularly valuable for companies seeking to bridge funding gaps between equity rounds. It also helps manage unforeseen expenses.

By integrating debt into their financial strategy, startups can maintain operational momentum while preparing for future growth.

Extending Runway Beyond Equity Rounds

Most Series A or B companies raise roughly 18 months of cash, which often limits their ability to scale during unforeseen challenges or market shifts. Venture debt can help extend this runway further, providing startups with additional time to achieve milestones or improve their valuation before the next equity round. This financial cushion can be a game-changer for startups navigating competitive industries.

Many startups face a tight funding time frame. According to research, 21.5% of businesses fail within their first year. This data emphasizes how extending runway using venture debt can help companies survive key early milestones and build valuation for subsequent equity rounds.

Bridging Funding Gaps Strategically

For startups experiencing delays in equity funding or seeking to avoid premature dilution, venture debt serves as a strategic bridge. It allows companies to maintain operational continuity while waiting for favorable market conditions or investor interest. This flexibility can be pivotal in achieving long-term success without compromising short-term stability.

Timing Your Venture Debt Raise for Maximum Advantage

Building on these strategic considerations, founders should time their venture debt raise soon after closing an equity round. This approach leverages the company’s strengthened financial position and recent investor validation, increasing lender confidence. As a result, startups can negotiate more favorable terms, including lower interest rates and flexible covenants. Proper timing also ensures that debt complements, rather than replaces, equity funding in the overall capital strategy.

Venture debt financing is not just about securing funds; it’s about preserving equity, extending growth opportunities, and strategically positioning a startup for future success.

Risks of Overreliance on Venture Debt

While venture debt can support growth, excessive reliance may signal financial weakness to potential investors. Overuse can strain cash flow due to fixed repayment obligations, especially if revenue targets are missed. This risk may deter future equity investors and limit fundraising options. Founders should carefully balance debt with other funding sources to maintain long-term financial health.

Addressing Balloon Payments and Cash Flow Forecasting

One of the challenges associated with venture debt is managing balloon payments (large lump-sum payments due at the end of a loan term), which can strain cash flow if not properly planned.

To mitigate this, startups must prioritize accurate forecasting and maintain a clear understanding of their financial health. Regularly updating cash flow projections ensures that debt obligations align with revenue expectations, reducing the risk of financial bottlenecks.

If revenue projections fall short, startups risk defaulting on balloon payments, highlighting the need for contingency planning.

Best Practices for Managing Venture Debt Covenants

- Model the financial impact of covenants before signing to ensure your business can consistently meet requirements.

- Negotiate for operational flexibility, such as reasonable revenue targets and minimum cash balances, during term sheet discussions.

- Establish regular internal reviews to monitor compliance and identify potential covenant breaches early.

- Maintain open communication with lenders to address issues proactively and seek waivers if challenges arise.

- Document all covenant-related processes and assign clear ownership within your finance team for accountability.

Due Diligence: A Critical Step

Securing venture debt requires thorough due diligence, both from the lender and the startup. Lenders typically assess the company’s financial stability, growth potential, and ability to repay the debt. On the other hand, startups must evaluate the terms of the loan, including interest rates, repayment schedules, and any associated covenants. This mutual diligence ensures that both parties enter into a sustainable and beneficial agreement.

Your exploration of venture debt is enriched by insights from the article on ecommerce startup fundraising strategies, which lays a baseline by detailing various funding models for e-commerce start-ups.

E-commerce Funding and Venture Debt Options

E-commerce business performance is measurable and impactful. A recent study found that e-commerce companies achieved a composite efficiency score of 5.66 and a 54.3 percent profitability rate. These metrics are instrumental to lenders and investors when assessing suitability for venture debt or equity funding.

Venture debt has emerged as a compelling option for founders seeking to minimize equity dilution while accessing capital to scale. This section explores how venture debt integrates with other financing methods, the role of data-driven lending, and the importance of key performance metrics in funding decisions.

- Equity: Dilutes ownership, provides large capital

- Debt: No dilution, requires repayments

The Role of Venture Debt in E-commerce Financing

Venture debt offers e-commerce businesses a unique advantage by providing capital without requiring significant equity stakes. Unlike traditional equity financing, which often demands substantial ownership, venture debt allows founders to retain control while fueling growth. This is particularly beneficial for businesses with predictable revenue streams and strong performance metrics.

For direct-to-consumer (DTC) brands, venture debt can complement other funding methods, such as revenue-based financing. A balanced view emerges when you encounter the discussion on revenue based financing ecommerce, which contrasts alternative funding structures alongside venture debt considerations. By combining these approaches, businesses can diversify their funding sources while maintaining operational flexibility.

Data-Driven Lending: A Game-Changer

Modern e-commerce funding relies heavily on data-driven lending models. These models assess a business's financial health and growth potential by analyzing metrics such as customer acquisition costs (CAC), lifetime value (LTV), and monthly recurring revenue (MRR). By leveraging these insights, lenders can offer tailored financing solutions that align with the business's specific needs.

For example, a DTC brand with high LTV and low CAC may qualify for more favorable terms, as these metrics indicate strong profitability and efficient customer acquisition strategies. This data-centric approach ensures that funding decisions are grounded in measurable performance rather than speculative projections.

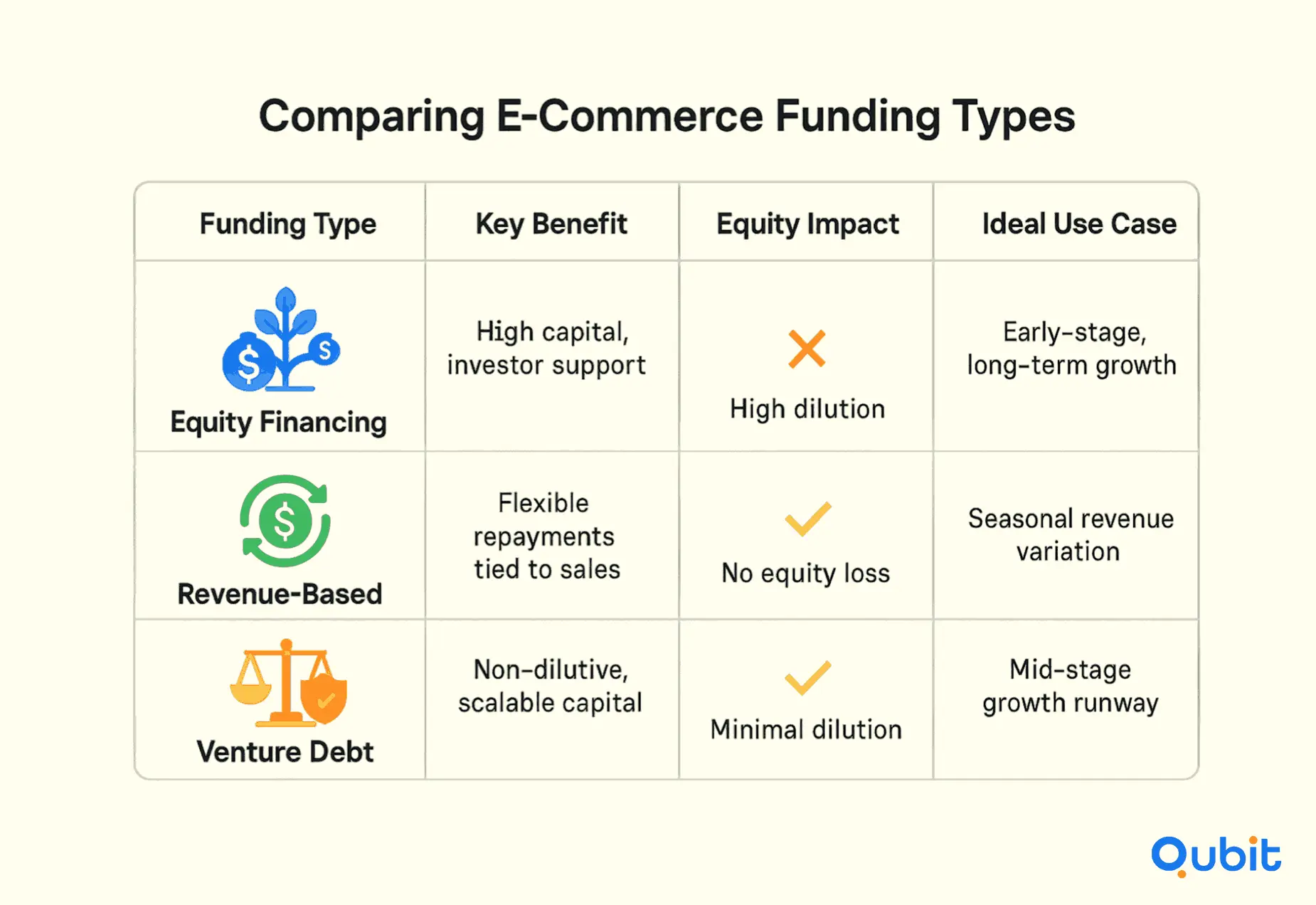

Comparing Funding Types

- Equity Financing: Provides substantial capital but often requires founders to give up significant ownership.

- Revenue-Based Financing: Offers flexible repayment terms based on revenue performance, making it ideal for businesses with fluctuating cash flows.

- Venture Debt: Combines the benefits of debt financing with minimal equity dilution, making it a preferred choice for scaling businesses.

By understanding the nuances of each funding type, e-commerce founders can make informed decisions that align with their growth objectives and long-term vision. Planning a seasonal push? funding options for ecommerce founders shows how to stack tools, inventory finance for bulk buys, RBF for marketing, and short-term credit for gaps. It also flags red lines on covenants and collateral.

Why Metrics Matter

Key performance metrics play a pivotal role in determining the suitability of funding options. Metrics such as gross margin, churn rate, and average order value (AOV) provide insights into a business's operational efficiency and profitability. Lenders and investors often prioritize these metrics to assess risk and potential returns.

For founders, maintaining strong metrics not only improves funding prospects but also enhances overall business performance. Regularly tracking and optimizing these metrics can create a solid foundation for sustainable growth.

Emerging E-commerce Funding Trends

The e-commerce sector is witnessing a transformative shift in how startups secure funding. From innovative lending models to non-dilutive financing options, these trends are reshaping the financial strategies of entrepreneurs in capital-intensive industries.

Venture capital activity underpins this transformation. According to industry projections, global venture capital investments are projected to reach $400 billion by end of 2025, up from $300 billion in 2021. This surge highlights the intensified investor interest in scaling e-commerce and startup innovation.

Data-Driven Lending Models

One of the most significant advancements in e-commerce funding is the rise of data-driven lending models. These systems utilize sophisticated algorithms and real-time analytics to assess a business's financial health and growth potential. Unlike traditional lending, which often relies on static credit scores, data-driven models evaluate dynamic metrics such as sales performance, customer retention rates, and inventory turnover. This approach enables lenders to offer tailored financing solutions that align with the unique needs of e-commerce businesses.

For startups, this means faster access to capital without the lengthy approval processes associated with conventional loans. Additionally, the precision of these models reduces the risk of overborrowing, ensuring that businesses receive funding proportional to their operational requirements.

Venture Debt in Capital-Intensive Sectors

Venture debt is gaining traction as a preferred funding option for e-commerce founders. This form of financing offers non-dilutive capital, allowing entrepreneurs to retain equity while securing the resources needed for growth. Founders in sectors like e-commerce can tap into growing venture debt markets as investors demonstrate ongoing interest in non-dilutive funding.

The appeal of venture debt lies in its flexibility. Unlike equity financing, which often comes with stringent oversight, venture debt allows startups to maintain control over their operations. This is particularly advantageous for businesses in capital-intensive sectors, where scaling requires substantial upfront investment in technology, logistics, and marketing.

To complement venture debt strategies, businesses can explore alternative funding avenues through strategic partnership marketplace funding ecommerce. An examination of strategic partnership marketplace funding ecommerce introduces you to alternative growth capital avenues, complementing the focus on venture debt with insights on collaborative financial strategies.

The Role of Financial Technologies

Emerging financial technologies are playing a pivotal role in reshaping the e-commerce funding landscape. From AI-driven risk assessments to blockchain-based transaction tracking, these innovations are enhancing transparency and efficiency in the funding process. For startups, adopting these technologies can streamline operations and improve their appeal to investors.

As e-commerce continues to evolve, staying ahead of funding trends is crucial for long-term success. By embracing data-driven models, venture debt, and cutting-edge financial technologies, businesses can unlock new opportunities for growth and sustainability.

Conclusion

Securing venture debt can be transformative for e-commerce startups aiming to scale efficiently. By prioritizing non-dilutive funding options, managing balloon payments with foresight, and conducting thorough due diligence, businesses can mitigate risks while unlocking growth opportunities. These strategies empower founders to retain equity while accessing the capital needed to expand operations and enhance market presence.

Venture debt serves as a powerful tool for startups seeking to grow without compromising ownership. When approached strategically, it bridges the gap between funding needs and equity preservation, making it an essential consideration for scaling businesses.

If you're looking to secure the right investor connections while preserving your equity, we offer our ecommerce fundraising assistance to help guide your venture debt journey. Let us support your startup in achieving sustainable growth while keeping your vision intact.

Key Takeaways

- Venture debt offers a non-dilutive financing option crucial for scaling e-commerce businesses.

- Managing balloon payments is essential to maintain healthy cash flow.

- Proper asset matching and thorough due diligence can secure favorable loan terms.

- A diversified funding mix including debt, equity, and alternative options strengthens financial resilience.

- Emerging trends highlight a shift towards data-driven funding models in the e-commerce sector.

Frequently asked Questions

How does data-driven lending benefit ecommerce startups?

Data-driven lending uses real-time metrics like LTV, CAC, and MRR to assess risk more accurately. This helps ecommerce startups secure better funding terms and optimize growth.