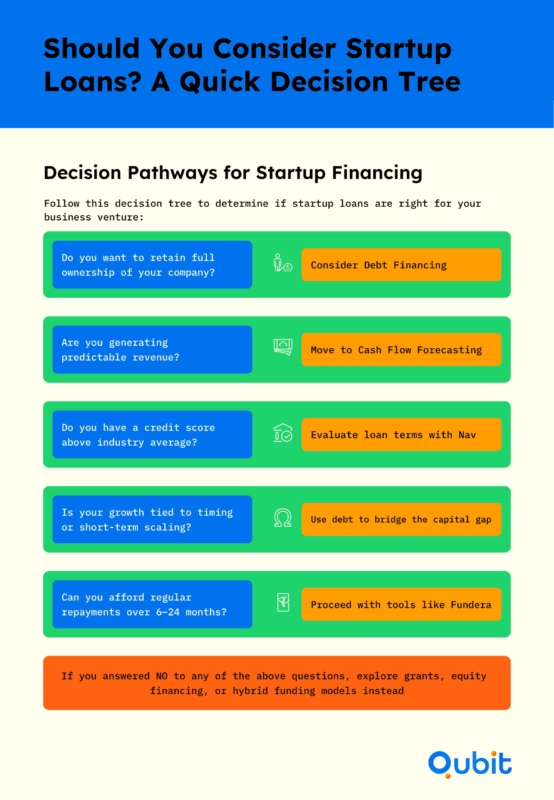

Starting a business often requires more than just a great idea—it demands capital. For many early-stage entrepreneurs, startup business loans can provide the financial boost needed to turn concepts into reality. Whether you're looking to fund product development, hire a team, or scale operations, understanding when to explore debt options is crucial.

Debt financing offers distinct advantages over equity, such as retaining full ownership of your company. However, it’s not the only funding route available. An exploration of how to find grants for startups offers complementary insights into non-repayable funding avenues, illustrating an alternative to debt financing.

Explore Debt Financing Trends Through Real-World Examples

Debt financing is evolving rapidly, driven by technological advancements and shifting workplace dynamics. For startups seeking effective startup business loans, understanding these trends is crucial to making informed financial decisions. This section delves into emerging patterns in debt financing, supported by real-world examples that highlight innovative loan strategies.

The Role of Market Growth in Debt Financing

The rising interest in debt financing reflects startups’ need for non-dilutive capital in an increasingly competitive market. A notable example is Fetch Rewards, which secured $50M in private credit from Morgan Stanley after reaching profitability. The deal illustrates how startups are capitalizing on market momentum to access flexible debt solutions that fuel growth—without sacrificing equity.

Case Studies: Practical Applications of Debt Financing

1. Efficient Debt Utilization with AI Tools

Company A serves as a compelling example of how startups can optimize debt financing through technology. By adopting Kabbage’s AI-driven lending platform, the company streamlined its loan management processes, ensuring efficient allocation of funds. This approach not only reduced operational costs but also allowed the business to focus on scaling its core operations.

2. Adapting to Market Trends for Rapid Scaling

Company B illustrates how aligning debt strategies with market trends can drive growth. By capitalizing on the shift towards remote work, the company invested in scalable solutions that supported its expansion. This strategic use of debt financing enabled the business to meet rising demand while maintaining financial stability

Emerging Trends Shaping Debt Financing

Increased Adoption of AI Tools

The integration of AI in business operations is reshaping how startups approach debt financing. AI tools can streamline processes like loan underwriting and fund allocation, making it easier for startups to secure and utilize loans effectively. This trend is particularly relevant for startups aiming to optimize their startup business funding strategies.

The Shift Towards Remote Work

The growing emphasis on remote work has influenced the types of solutions startups prioritize. Many businesses are now channeling debt-financed expenditures into technologies and platforms that support distributed teams. This shift not only reflects changing workplace norms but also highlights the adaptability of debt financing in meeting evolving business needs.

Must-Have Tools and Resources for Analyzing Loans

Evaluating loan options can be a daunting task for startup founders, especially when juggling multiple financial priorities. Fortunately, there are specialized tools and resources designed to simplify this process, ensuring you make informed decisions that align with your business goals. From simulation software to credit assessment utilities, these solutions provide actionable insights to optimize your loan strategy.

Comparative Loan Simulations

Understanding how different loan structures impact your startup’s finances is crucial. Fundera’s Business Loan Comparison Tool is an excellent resource for this purpose. It allows you to run comparative loan simulations and analyze various borrowing scenarios. By inputting details such as interest rates, repayment terms, and loan amounts, you can visualize how each option affects your cash flow and long-term financial health.

For example, if you're considering an SBA startup loan, Fundera’s tool can help you compare government-backed financing with traditional loans, highlighting differences in interest rates and repayment flexibility. This clarity enables you to choose the most cost-effective option for your startup.Cash Flow Forecasting

Maintaining a healthy cash flow is essential for timely debt repayments. Float specializes in predicting future cash needs, ensuring you’re prepared for upcoming financial obligations. By analyzing historical data and projecting future revenue, Float helps you identify potential gaps in your cash flow, allowing you to adjust your repayment schedule or loan terms accordingly.

For startups exploring loans for growth, this tool is invaluable—it ensures your borrowing aligns with your ability to repay, reducing the risk of financial strain.Creditworthiness Assessment

This platform allows you to access up to six personal and business credit reports in one place, including data from major bureaus like Equifax, Experian, and Dun & Bradstreet. Key factors influencing your business credit score include payment history, credit utilization, age of credit, and industry risk. By monitoring these elements, you can identify areas for improvement and enhance your credit profile, increasing your chances of securing favorable loan terms.

Before applying for a loan, understanding your startup’s creditworthiness can save time and effort. Nav offers a comprehensive evaluation of your credit profile, providing insights into factors lenders consider when approving loans.External Resources for Loan Analysis

The U.S. Small Business Administration’s Lender Match tool connects entrepreneurs with SBA-approved lenders, offering insights into loan terms and conditions. Additionally, Bankrate’s Small Business Loan Rates dashboard provides up-to-date information on interest rates, aiding startups in making informed financing decisions. Staying informed about market trends ensures you’re prepared to adapt your loan strategy as needed.

Balancing Debt Financing with Other Funding Options

While loans are a popular choice for startup financing, it’s worth exploring alternative funding methods. For instance, real-world examples featuring startups funded by grants provide contrasting scenarios to debt financing, enriching your understanding of varied funding approaches. Grants can offer non-repayable capital, reducing financial pressure compared to loans.

By combining insights from tools like Tool X, Tool Y, and Tool Z with external resources, you can create a well-rounded strategy for evaluating loans and other funding options.

Conclusion

Debt financing can be a powerful tool for small businesses seeking growth, but it requires careful planning and alignment with long-term goals. Throughout this blog, we’ve explored strategies to manage debt effectively, highlighted trends in financing, and emphasized the importance of choosing loan options that support sustainable development. From actionable insights derived from case studies to recommended tools, the key takeaway is that informed decision-making is crucial to overcoming challenges and achieving small business debt relief.

If you're ready to connect with the right investors, we at Qubit Capital can help with our Investor Discovery and Mapping service. Let’s work together to unlock your business’s potential.

Key Takeaways

Debt financing offers startups a way to access capital through structured repayment plans, allowing them to retain ownership and minimize equity dilution while funding operations or growth.

Emerging trends, such as the rise of AI-driven credit assessment and the shift toward remote-first business models, are reshaping how startups approach and qualify for loans.

Case studies from real-world startups demonstrate how well-structured debt strategies can support everything from working capital needs to scaling initiatives without overleveraging the business.

Leveraging specialized tools and platforms can enhance loan analysis, helping founders assess risk, forecast repayments, and make informed financing decisions.

Ultimately, selecting the right financing approach means aligning your capital strategy with long-term goals, ensuring that funding fuels sustainable growth without compromising flexibility or control.

Frequently asked Questions

Can startups get debt financing?

Yes, startups can access debt financing, especially if they have a viable revenue model, a decent credit profile, or collateral to offer. Unlike equity financing, this option allows founders to retain ownership while repaying the borrowed amount over time. It’s ideal for businesses looking for capital without giving up a stake in their company.