Securing capital is the lifeblood of any startup. Without adequate resources, even the most groundbreaking ideas may never reach their full potential.

For many founders, startup financing can feel overwhelming, and filled with challenges. From deciphering funding stages to crafting a compelling pitch that resonates with investors, the hurdles are numerous and often intricate.

Amid current challenges, simply having a great idea isn’t enough. Founders must equip themselves with advanced strategies and unique insights to stand out in the crowded field of entrepreneurs vying for attention.

This comprehensive guide aims to demystify the process of how to secure funding for a startup, offering actionable advice to help entrepreneurs obtain the capital they need to grow and flourish.

(For a deeper understanding of the essentials, explore our article on fundraising fundamentals.)

Understanding the Startup Funding Game

The Different Stages of Startup Funding

Every startup’s journey is unique, but most follow a similar path when it comes to funding stages.

Recognizing these stages helps founders align their funding strategies for startups with their company’s growth trajectory, ensuring they approach the right investors at the right time.

- Pre-seed Stage: This is the initial phase where founders typically use personal savings or funds from friends and family. It’s about turning an idea into a prototype or minimum viable product (MVP).

- Seed Stage: At this point, startups seek external capital to further develop their product and validate their business model. Funding often comes from angel investors or seed-stage venture capitalists.

- Series A: Focuses on optimizing product-market fit and scaling the user base. Investors look for evidence of traction and a clear plan for growth.

- Series B, C, and Beyond: Each subsequent round aims at scaling the business further, expanding into new markets, or developing new product lines. Investors at these stages are typically larger venture capital firms and institutional investors.

Startups benefit from aligning their funding strategy with the appropriate stage. Targeting the right investors who are interested in businesses at your level of development increases your chances of obtaining capital.

Types of Investors and Funding Options

If you grasp the different types of investors and funding sources, a more tailored approach follows:

- Angel Investors: High-net-worth individuals who provide capital in exchange for equity or convertible debt. They often offer mentorship and industry connections.

- Venture Capitalists (VCs): Firms that invest in startups with high growth potential. They typically provide larger amounts of capital than angel investors and may take an active role in company decisions.

- Institutional Investors: Organizations like banks, insurance companies, and pension funds that invest substantial sums, usually in later funding rounds.

Alternative Funding Options:

- Venture Debt: Loans offered to startups with venture capital backing. It provides capital without immediate equity dilution but requires repayment with interest.

- Equity Crowdfunding: Raising small amounts of capital from a large number of investors, typically through online platforms.

- Grants and Government Programs: Non-dilutive funding options provided by government agencies or foundations to support innovation and entrepreneurship.

For a comprehensive exploration of these options, refer to our article on fundraising fundamentals and proven methods.

Effective Fundraising Strategies for Startups

Assessing Your Funding Needs

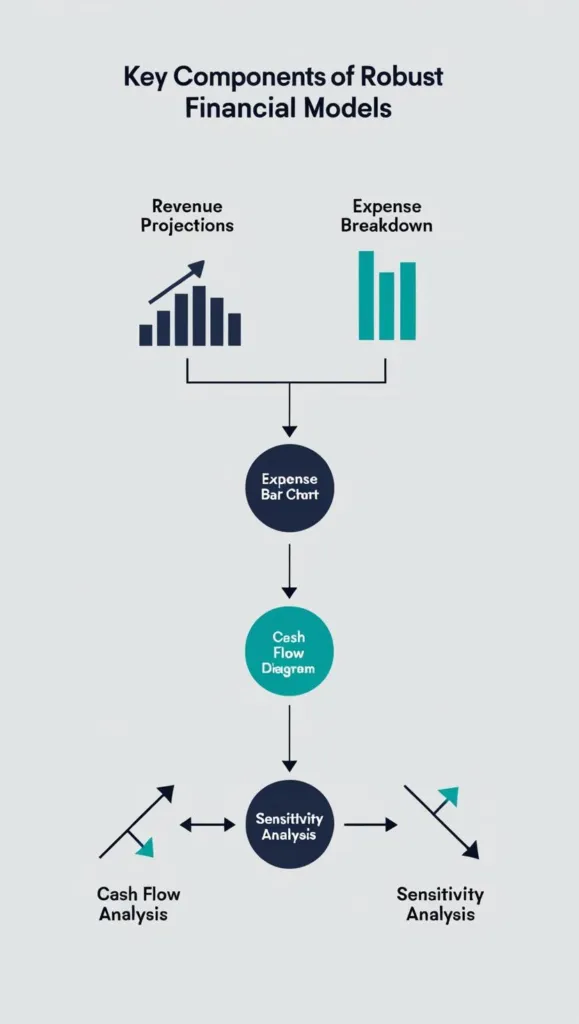

Before approaching investors, it’s critical to evaluate how much capital you need and when you’ll need it. This involves a thorough analysis of your startup’s financial requirements and growth plans.

- Projecting Expenses: Estimate costs for product development, operations, marketing, hiring, and other key areas. Be realistic and account for contingencies.

- Setting Milestones: Define clear objectives that funding will help you achieve, such as launching a product, reaching revenue targets, or entering new markets.

- Understanding Burn Rate: Calculate how quickly you’ll spend funds to maintain operations, which helps determine how much you need and when you’ll need additional capital.

Checklist: Download our funding needs assessment checklist to organize and quantify your financial requirements effectively.

Crafting a Compelling Pitch Deck

Your pitch deck is often the first impression investors have of your startup. It’s a visual summary of your business plan designed to engage and persuade potential investors.

Key Elements of a Successful Pitch Deck:

- Introduction: Briefly introduce your company, mission, and what makes it unique.

- Problem Statement: Clearly articulate the problem your product or service addresses.

- Solution: Present your offering and explain how it solves the problem effectively.

- Market Opportunity: Highlight the size of the market and potential for growth.

- Business Model: Explain how you will generate revenue and achieve profitability.

- Traction: Showcase any milestones, sales figures, user growth, or partnerships that demonstrate momentum.

- Team: Introduce your team members, emphasizing their expertise and relevance to the business.

- Financial Projections: Provide realistic forecasts and key financial metrics.

- Competition: Analyze competitors and explain your competitive advantage.

- Investment Ask: Specify how much funding you’re seeking and how it will be used.

Storytelling Techniques:

- Engage Emotionally: Use narratives to connect with investors on a personal level.

- Visual Aids: Incorporate charts, infographics, and images to illustrate points effectively.

- Clarity and Brevity: Keep slides concise, focusing on essential information.

Templates: Access our selection of professional pitch deck templates to craft a compelling presentation.

(For more on creating impactful pitch decks, read our guide on the art of storytelling for investors.)

Developing a Personalized Outreach Strategy

Investors receive numerous pitches daily. Personalization can make yours stand out and increase the likelihood of engagement.

Steps to Personalize Your Approach:

- Research Investors: Understand their investment focus, preferred industries, typical deal sizes, and portfolio companies.

- Align Interests: Highlight how your startup fits within their investment thesis or complements their existing portfolio.

- Customized Communication: Personalize emails and presentations to address specific investor concerns or interests.

- Leverage Mutual Connections: If possible, seek introductions through shared contacts, which can add credibility.

Using Data and Tools:

- CRM Systems: Utilize customer relationship management tools to track interactions and schedule follow-ups.

- Analytics: Monitor engagement with your communications to gauge interest and tailor subsequent outreach.

Building Relationships with Potential Investors

Networking is a powerful tool in fundraising. Entrepreneurs need to build genuine relationships to access funding opportunities and valuable advice.

Networking Strategies:

- Attend Industry Events: Participate in conferences, seminars, and workshops relevant to your sector.

- Online Platforms: Engage with investors on platforms like LinkedIn, AngelList, and startup communities.

- Join Incubators and Accelerators: These programs offer mentorship, resources, and connections to investors.

- Host or Participate in Webinars: Position yourself as a thought leader and connect with like-minded professionals.

Best Practices:

- Be Authentic: Build relationships based on mutual interests and respect.

- Follow-Up: After initial contact, maintain communication without being overly persistent.

- Provide Value: Share insights, updates, or opportunities that may interest your connections.

(Discover more networking tips in our investor engagement guide.)

Exploring Alternative Funding Options

Exploring non-traditional funding sources can diversify your capital base and potentially offer more favorable terms.

Venture Debt

- Definition: A form of debt financing provided to startups with venture capital backing.

- Pros:

- No immediate equity dilution.

- Can extend runway without altering ownership structure.

- Interest payments may be tax-deductible.

- Cons:

- Requires regular repayments, which can impact cash flow.

- May include warrants, giving lenders rights to purchase equity in the future.

- Default risk if unable to meet repayment terms.

Equity Crowdfunding

- Definition: Raising capital through small contributions from a large number of investors via online platforms.

- Pros:

- Access to a broad investor base.

- Marketing benefits by increasing public awareness.

- Retain more control compared to traditional VC funding.

- Cons:

- Regulatory compliance can be complex.

- Public disclosure of business information.

- Managing a large number of small investors.

Grants and Government Programs

- Definition: Non-repayable funds provided by government agencies or foundations to support specific initiatives.

- Pros:

- No equity dilution or repayment.

- Validation and credibility from reputable sources.

- Can be significant amounts depending on the program.

- Cons:

- Highly competitive application processes.

- Specific requirements and restrictions on fund usage.

- Lengthy approval timelines.

Evaluating Options:

Consider your startup’s stage, industry, capital needs, and long-term goals when choosing funding sources. A mix of traditional and alternative funding can provide flexibility and stability.

Legal Considerations and Compliance

A solid understanding of legal requirements leads to a safer path for your startup’s future.

Key Areas to Focus On:

- Regulatory Compliance: Understand securities laws relevant to fundraising, such as Regulation D in the U.S.

- Documentation: Prepare clear and comprehensive legal documents, including term sheets, shareholder agreements, and disclosure statements.

- Intellectual Property Protection: Secure patents, trademarks, and copyrights to protect your innovations.

- Due Diligence Preparation: Organize financial records, contracts, and corporate documents for investor review.

Engaging Legal Counsel

Hiring an attorney experienced in startup law can:

- Ensure Compliance: Help you navigate complex regulations.

- Prevent Mistakes: Identify potential issues before they become problems.

- Negotiate Terms: Assist in securing favorable investment agreements.

(For advanced legal strategies, explore our article on startup legal considerations.)

Advanced Fundraising Techniques

Understanding Investor Psychology

Investors are driven by a combination of logical analysis and emotional response. Founders who understand investors’ motivations can create more compelling pitches.

Key Psychological Factors:

- Risk Versus Reward: Investors assess the potential return on investment relative to the risks involved.

- Fear of Missing Out (FOMO): Creating a sense of urgency or exclusivity can motivate investors to act quickly.

- Value Alignment: Investors are more inclined to support startups that align with their values or investment philosophies.

- Confidence in the Team: Investors look for passionate, knowledgeable, and committed founders.

Strategies to Align Your Pitch:

- Highlight Traction: Demonstrate momentum with user growth, revenue, or partnerships.

- Showcase Unique Value: Emphasize what sets your startup apart from competitors.

- Build Credibility: Present endorsements, testimonials, or industry awards.

- Address Risks Proactively: Acknowledge potential challenges and outline mitigation plans.

(Learn more in our investor engagement guide.)

Personalization Techniques to Stand Out

In a crowded market, personalization can make a significant difference in capturing investor attention.

Techniques:

- Customized Pitch Decks: Tailor presentations to address specific investor interests or concerns.

- Personalized Communication: Reference previous interactions, mutual connections, or recent investor activities.

- Data-Driven Approaches: Use analytics to segment investors and tailor outreach strategies.

- Interactive Presentations: Incorporate Q&A sessions or live demos to engage investors actively.

Tools for Personalization:

- Email Marketing Platforms: Use segmentation and personalization features to customize messages.

- Customer Relationship Management (CRM) Systems: Track investor interactions and preferences.

- Analytics Software: Monitor engagement metrics to refine your approach.

Cultural Considerations in International Fundraising

Expanding your investor base internationally requires cultural sensitivity and adaptability.

Strategies:

- Research Cultural Norms: Understand communication styles, negotiation tactics, and business protocols in different countries.

- Language Considerations: Provide materials in the investor’s preferred language or use professional translators.

- Adapt Business Practices: Be flexible in meeting formats, decision-making processes, and timelines.

- Local Partnerships: Collaborate with local firms or advisors who understand the market.

Challenges and Solutions:

- Legal and Regulatory Differences: Consult with international legal experts to ensure compliance.

- Currency Risks: Consider hedging strategies or financial instruments to mitigate exchange rate fluctuations.

(Explore in-depth strategies in our global fundraising guide.)

Using Media and PR

Your startup needs to develop a strong public profile to attract investors and boost its reputation.

Strategies:

- Press Releases: Announce significant milestones, funding rounds, or product launches.

- Media Outreach: Cultivate relationships with journalists and influencers in your industry.

- Content Marketing: Publish thought leadership articles, whitepapers, or blogs showcasing your expertise.

- Social Media Engagement: Maintain active profiles on platforms relevant to your audience.

Benefits:

- Increased Visibility: Broaden awareness of your startup among potential investors and customers.

- Credibility and Trust: Third-party endorsements can enhance your reputation.

- Investor Attraction: Positive media coverage can draw inbound interest from investors.

Attracting Socially Responsible Investors

Impact investing focuses on generating positive social or environmental outcomes alongside financial returns.

Steps to Attract Impact Investors:

- Define Your Impact: Clearly articulate how your startup contributes to social or environmental goals.

- Align with ESG Criteria: Incorporate Environmental, Social, and Governance principles into your operations.

- Measure and Report: Provide transparent reporting on impact metrics and outcomes.

- Engage with Relevant Networks: Join forums, conferences, and organizations focused on impact investing.

Advantages:

- Access to Dedicated Capital Pools: Impact investors may offer funding not accessible through traditional channels.

- Enhanced Brand Image: Commitment to social responsibility can attract customers and employees.

- Long-Term Partnerships: Impact investors often focus on sustainable growth and may offer additional support.

Sample Case Studies

- EcoTech Innovations: By emphasizing their commitment to reducing carbon emissions, EcoTech attracted funding from a leading impact investment firm. They showcased measurable environmental impacts and aligned their business model with global sustainability goals.

- GlobalConnect: Successfully secured investment from an overseas venture capital firm by adapting their pitch to accommodate cultural preferences. They highlighted market opportunities relevant to the investor’s region and demonstrated cultural understanding, building trust and rapport.

(For strategies on overcoming challenges, see our article on overcoming fundraising challenges.)

Overcoming Fundraising Challenges

Common Obstacles and How to Overcome Them

Founders often encounter hurdles during the fundraising process. Identifying and addressing these challenges proactively can improve your chances of success.

Obstacles:

- Market Saturation: Difficulty standing out in a crowded industry.

- Solution: Highlight unique features, innovative technology, or niche markets. Demonstrate a clear competitive advantage.

- Economic Conditions: Fundraising during economic downturns or uncertain markets.

- Solution: Emphasize the resilience of your business model. Showcase strong financial management and adaptability.

- Limited Network: Lack of access to investors or key industry players.

- Solution: Leverage online platforms, attend networking events, and seek introductions through advisors or mentors.

- Insufficient Traction: Early-stage startups may struggle to demonstrate progress.

- Solution: Focus on prototypes, early user feedback, or pilot programs to illustrate potential.

Strategies to Overcome Rejection

Rejection is a natural part of fundraising. To strengthen your approach, you must learn from each experience.

Techniques:

- Seek Constructive Feedback: Politely ask investors for reasons behind their decision.

- Iterate Your Pitch: Incorporate feedback to refine your messaging and presentation.

- Broaden Your Investor List: Diversify the types of investors you approach, considering angels, VCs, and alternative sources.

- Maintain Professionalism: Respond graciously to rejection, maintaining relationships for future opportunities.

Overcoming Economic Downturns

Economic challenges require strategic adjustments to your fundraising approach.

Strategies:

- Adjust Valuations: Be flexible with terms and valuations to attract cautious investors.

- Focus on Essentials: Prioritize core aspects of your business that offer immediate value.

- Demonstrate Resilience: Provide evidence of cost-saving measures, efficient operations, and a clear path to profitability.

- Explore Government Programs: Take advantage of grants, loans, or relief programs designed to support businesses during downturns.

Legal Compliance and Avoiding Pitfalls

Common legal mistakes can derail fundraising efforts. Prevent issues by:

- Ensuring Accurate Disclosures: Provide truthful and complete information to investors.

- Protecting Confidential Information: Use non-disclosure agreements (NDAs) when appropriate.

- Understanding Investor Rights: Be clear on terms related to equity, voting rights, and exit options.

- Consulting Legal Professionals: Engage experts to review agreements and advise on regulatory compliance.

Sample Success Stories

- HealthTech Solutions: Faced with multiple rejections, they sought detailed feedback from investors. By addressing concerns about scalability and strengthening their team, they refined their pitch and secured significant venture capital funding.

- Green Energy Co.: During an economic downturn, they pivoted to emphasize the cost-saving aspects of their product. This approach attracted investors looking for recession-resistant opportunities, leading to a successful funding round.

(For operational strategies during growth phases, refer to our guide on startup operations strategy.)

Maintaining Investor Relations Post-Funding

Importance of Ongoing Communication

Securing investment is the beginning of a long-term relationship. Effective communication keeps investors informed and engaged.

Best Practices:

- Regular Updates: Send quarterly reports highlighting achievements, challenges, and financial performance.

- Transparency: Be honest about setbacks and outline plans to address them.

- Accessible Communication: Provide channels for investors to ask questions and offer input.

- Celebrating Milestones: Share successes to reinforce confidence in your leadership.

Building Long-Term Relationships

It’s important for founders to cultivate strong investor relationships to open doors to more opportunities.

Deploying Relationships:

- Strategic Advice: Tap into investors’ expertise and networks for guidance.

- Future Funding: Secure follow-on investments or introductions to new investors.

- Partnership Opportunities: Collaborate on initiatives that align with mutual interests.

Cultivating Trust:

- Consistency: Deliver on promises and meet agreed-upon deadlines.

- Professionalism: Respect investors’ time and perspectives.

- Mutual Respect: Acknowledge the contributions investors make to your startup’s success.

For more on nurturing investor relationships, see maintaining strong investor relations.

Scaling Operations Post-Fundraising

Strategic Growth Planning

With new capital, strategic planning ensures that funds are utilized effectively to drive growth.

Steps:

- Define Clear Objectives: Align spending with specific goals, such as expanding into new markets or launching products.

- Prioritize Initiatives: Focus on projects with the highest potential return on investment.

- Resource Allocation: Determine the necessary budget, personnel, and timeframe for each initiative.

Scaling Teams and Operations

Expanding your team and operational capacity enables you to manage growth successfully.

Considerations:

- Hiring Strategically: Identify key roles that will have the most impact and prioritize filling them.

- Maintaining Culture: As the team grows, preserve the core values and mission of your startup.

- Process Implementation: Develop systems and procedures to support efficiency and consistency.

Monitoring and Adjusting

Continuous evaluation allows you to adapt to changes and optimize performance.

Actions:

- Set KPIs: Establish key performance indicators aligned with your objectives.

- Regular Reviews: Schedule periodic assessments to track progress and identify areas for improvement.

- Flexibility: Be prepared to pivot strategies based on data and market feedback.

- Stakeholder Involvement: Keep investors and key team members informed and involved in decision-making processes.

(Learn more in our guide on scaling operations post-fundraising.)

Conclusion

Securing capital for your startup is a multifaceted journey that requires preparation, strategy, and resilience. Your startup needs to understand funding, craft a strong pitch, and use advanced techniques to succeed.

Remember to personalize your approach, build strong relationships, and stay adaptable in the face of challenges.

Now is the time to implement these strategies and elevate your startup to the next level. Contact Qubit Capital and find out how we can assist you in your fundraising journey, providing the expertise, resources, and global perspective to help you secure the capital you need.

(Learn more about our services and how we support entrepreneurs by visiting our startup success hub.)

Frequently Asked Questions (FAQ)

How Can I Raise Money for My Startup?

- Assess Funding Needs: Determine how much capital you need and for what purposes.

- Identify Potential Investors: Research investors that align with your industry and goals.

- Craft a Compelling Pitch Deck: Highlight your value proposition and market potential.

- Develop Outreach Strategies: Personalize your approach for different investors.

- Network Actively: Leverage events, platforms, and connections.

- Explore Alternative Funding: Consider crowdfunding, grants, or venture debt.

(For detailed guidance, read our article on how to raise capital for your startup.)

How Can I Fund a Startup with No Money?

- Bootstrapping: Utilize personal resources and reinvest revenues.

- Crowdfunding: Launch a campaign on platforms like Kickstarter or Indiegogo.

- Grants and Competitions: Apply for grants or enter startup competitions offering cash prizes.

- Strategic Partnerships: Collaborate with businesses or organizations for mutual benefit.

- Incubators and Accelerators: Join programs that provide resources, mentorship, and sometimes initial funding.

How Do Small Startups Obtain Funding?

- Angel Investors: Seek individuals interested in investing in early-stage companies.

- Micro-VCs: Approach venture capital firms that specialize in smaller investments.

- Crowdfunding Platforms: Use equity or reward-based crowdfunding to raise capital.

- Friends and Family: Consider loans or investments from personal networks.

Which Funding Is Best for Startups?

| Funding Type | Equity Dilution | Control Retained | Repayment Terms | Risk Level |

| Angel Investors | Moderate | Less | None | Medium |

| Venture Capital | High | Less | None | High |

| Crowdfunding | Low to None | More | None | Low |

| Venture Debt | None | More | Yes | Medium |

| Grants | None | More | None | Low |

Considerations:

- Equity Dilution: How much ownership you’re willing to give up.

- Level of Control: Impact on your decision-making authority.

- Repayment Obligations: Whether funds require repayment and under what terms.

Choosing the best funding option depends on your startup’s needs, stage, and goals. Evaluate each option carefully to determine which aligns best with your vision and operational requirements.

(Explore more in our comprehensive guide on startup funding strategies.)

Key Takeaways

- Understand Your Funding Needs: Clearly define how much capital you need, why, and by when.

- Craft a Compelling Story: Use storytelling to engage investors emotionally and logically.

- Personalize Your Approach: Tailor outreach and presentations to align with investor interests.

- Leverage Alternative Funding: Explore options beyond traditional equity financing to diversify capital sources.

- Build Strong Relationships: Networking and effective communication are vital throughout the fundraising process.

- Stay Resilient: View challenges and rejections as learning opportunities to refine your approach.

- Plan for Growth: Strategically allocate funds post-funding to scale operations effectively.

Back

Back